Elsa AI: The Future Interface of Web3

a deep-dive into crypto's premier copilot

M31 Capital recently led Elsa's $3m Seed round:

“One of our highest conviction bets in Web3 AI is the potential for copilots to transform UI/UX through tech abstraction. We tried every solution on the market and strongly believe Elsa’s product and AI development team is in a league of its own."

The next wave of Web3 adoption won’t come through wallets, it will come through AI agents that abstract away complexity and deliver intent-driven UX.

Elsa AI is one of the first teams building a full-stack architecture for this future: multi-agent orchestration, risk-aware execution, and community extensibility. They aren’t just building a trading bot or a chat UX, they’re building an agent OS for Web3.

We believe in their approach: deliberate sequencing (no token-first), deep data flywheel, and open ecosystem design, gives them a path to durable leadership in this emerging category.

Investment Thesis

The market for autonomous agents as the default Web3 UX is early, but inevitable. Every meaningful Web3 interaction is multi-step, cross-surface, and risk-bound.

Today, users either:

Manually sequence complex transactions across fragmented apps, or

Rely on opaque bots with little composability or explainability.

Elsa’s thesis is simple: intent-first, risk-aware agents will become the primary interface layer for the next wave of users, and those agents need:

Deep chain composability

Robust execution & safety models

Personalization & data flywheel advantages

Distribution leverage through wallet/messaging integrations

Elsa is one of the first teams building this stack holistically:

Multi-agent architecture with community extensibility (DAO scripts flywheel)

Cross-chain support from day one (Base + Solana)

Integrated with wallet & messaging layers (Coinbase, XMTP)

Voice-first UX exploration, critical for onboarding non-core crypto users

Critically, Elsa is sequencing correctly → product traction first, token economy second, which positions it for sustainable value capture, not mercenary TVL or hype cycles.

Despite limited marketing spend, the product was able to catch the attention of the Coinbase Wallet & Base ecosystem teams, leading to deep platform integrations, organic promotions, and participation in Elsa’s recent Seed round.

If agents are the next dominant UX layer for Web3, the market opportunity is immense, and we believe Elsa is one of the best-positioned teams to own a key part of this emerging stack.

Protocol Overview

Elsa AI is building a multi-agent intent protocol designed to abstract Web3 complexity and enable users to interact with blockchains through natural language and intent-first UX.

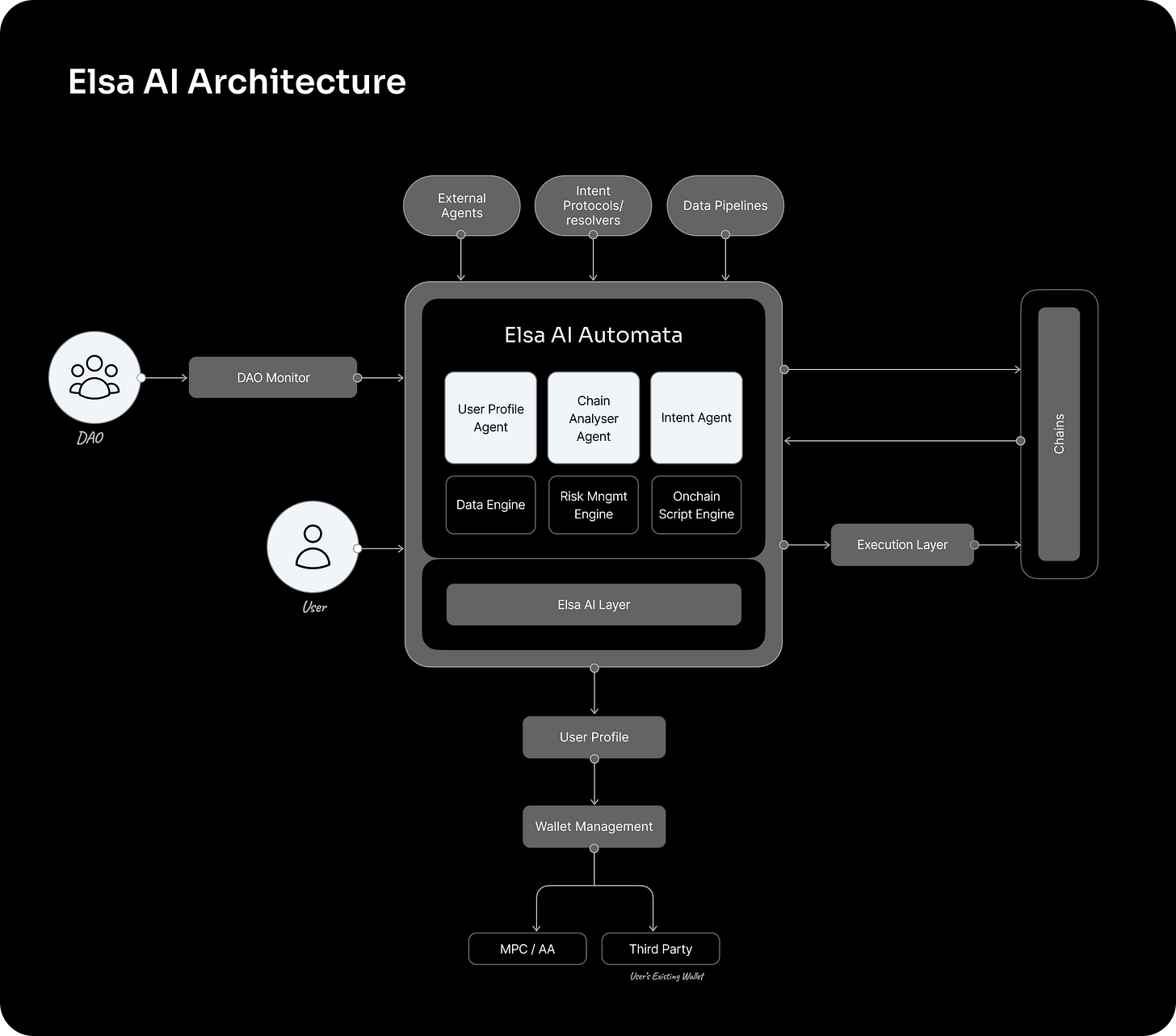

At its core, Elsa operates a layered architecture:

Intent agent → parses user intent and sequences necessary chain interactions.

Chain analyzer agent → continuously monitors onchain data to surface opportunities, risks, and events.

Risk engine → enforces personalized risk preferences and portfolio protection.

Onchain script engine → enables community-created workflows to be composed and reused.

Execution layer → manages actual multi-chain transaction execution, optimized for gas efficiency and latency.

Unlike most agent projects that are UI-only or narrowly focused (trading, DeFi), Elsa is building an agent OS layer:

Open for developers via SDKs & DAO script marketplace.

Embedded across wallet & messaging surfaces.

Architected for both EVM and Solana ecosystems from day one.

Elsa is positioned not as “another bot”, but as an intent-routing fabric for how the next wave of users and agents will interact with Web3.

Target Markets & Use Cases

Elsa’s target market is broader than typical DeFi agent tools, spanning consumer, prosumer, and developer segments:

1️⃣ Retail & prosumer users

DeFi trading & yield farming: “Rebalance my portfolio if market volatility exceeds X”

NFT automation: “Buy a Pudgy Penguin below 25 ETH; monitor floor price”

Portfolio risk management: “Trigger stop-loss if ETH drops 10% within an hour”

2️⃣ Builders & developers

Composable agents via the DAO marketplace

Agent SDK allows developers to build specialized agents on top of Elsa Automata (e.g. Solana gaming agents, Telegram-native bots, onchain data monitoring agents)

3️⃣ Power wallets & ecosystems

Wallets & exchanges (e.g. Coinbase Smart Wallet) can embed/white label Elsa agents to offer richer UX.

Messaging layers (XMTP, Telegram bots) can use Elsa to power agent-first interaction flows.

4️⃣ Emerging verticals

RWA protocols: agents managing asset monitoring and rebalancing.

Cross-chain governance: agents facilitating delegation, voting, proposal monitoring.

Agent marketplaces: 3rd party agents using Elsa Automata as their routing & execution backend.

In short: wherever users will want to interact with Web3 through agents rather than apps, Elsa aims to be the underlying coordination and execution layer.

Elsa in Action

In collaboration with XMTP & Coinbase, Elsa allows you to go onchain: swap, bridge, stake, just by sending a message.

Collaboration with Enso allows users to zap into DeFi positions from any token in just one transaction; no approvals, no mints, no deposits, just one shortcut to your destination.

Zerion integration fetches your portfolio in seconds. Just type: “Show my portfolio, with total balance” Works with all major wallets. No waiting. No tabs. Just ask.

Swap on Solana effortlessly.

Lend USDC on Base seamlessly.

Multiple swaps in one go.

Technical Capabilities & Architectural Design

Elsa’s architecture consists of two core components: Elsa AI Automata and the Elsa AI Layer, working in tandem to automate complex blockchain interactions through a user-friendly, natural language interface.

Inside Elsa AI Automata: How Agents Will Navigate Web3 For You

At its core, Web3 is supposed to be open, permissionless, and programmable, yet for most users, interacting with blockchains still feels like flying a plane with no instruments. Every action: swapping tokens, yield farming, buying an NFT, requires navigating fragmented apps and opaque risks.

Elsa AI Automata aims to flip that experience on its head: from manual execution to intent-driven automation. You tell the system what you want, and the agents handle the rest. Here's how it works under the hood:

The Architecture

Think of Elsa as a layered stack of intelligence, designed to bridge the user → AI → chain gap:

User interface: natural language (text or voice). No wallet UX required.

AI agents: continuously scanning chains, modeling your preferences, assessing risk.

Execution layer: batching and routing transactions across chains in the background.

But the magic lies in how the agents cooperate.

The Agents in Action

1️⃣ User Profile Agent

Your preferences, risk tolerance, and behavioral patterns, all stored, updated, and used to drive intelligent suggestions. Example:

“Deposit $100 in Aave at best yield.”

“Yield farm stablecoins on Solana with auto-optimization.”

As you interact, your profile evolves. The more you use Elsa, the smarter it gets.

2️⃣ Chain Analyzer Agent

A tireless sentinel monitoring chain activity in real time. New opportunities are surfaced proactively:

“Disney just launched a new NFT drop, want to mint?”

“Top memecoins trending right now, with $5M+ in volume.”

“New token listed, 10x increase in onchain mentions.”

The goal: filter signal from noise, and bring you only what matters.

3️⃣ Intent Agent

Here’s where automation kicks in. You state an outcome, the agent figures out how to get there:

“Buy a Pudgy Penguin if it dips below 25 ETH.”

“Deploy $100 across the top 10 new Solana memecoins.”

Behind the scenes, the agent sequences transactions, manages slippage, and optimizes execution, removing friction from multi-step blockchain interactions.

4️⃣ Risk Management Engine

No more passive exposure. Elsa actively monitors your portfolio and enforces risk rules:

“Trigger stop-loss if BTC drops 10% in an hour.”

“Cap exposure to volatile assets at 20%.”

Risk models evolve dynamically as your behavior changes, no static dashboards required.

5️⃣ Onchain Script Engine

Users and the DAO can author reusable scripts, turning complex actions into one-click automations:

“Stake $100 across top Cosmos networks.”

“Airdrop farm across ZKSync protocols.”

Approved scripts can then be invoked by users or agents, multiplying what you can do with a single intent.

6️⃣ Execution Layer

Transactions are intelligently managed:

Batch where possible to save gas.

Delay non-urgent txs if chains are congested.

Simulate outcomes pre-execution and suggest optimizations.

Data & External Intelligence

Elsa AI Automata thrives on data. To feed its agents:

Chain Data: Token Terminal, Dune, Nansen, Arkham, CoinGecko, DeFiLlama, and SQD Network (🔜).

Oracles: Chainlink, Pyth, DIA.

Offchain Data: Twitter, Discord, Telegram, web scraping.

RAG-enhanced LLMs sit at the heart of the system, blending real-time retrieval with conversational AI. The result? Contextual answers and actionable insights that feel fluid and personalized.

Example:

User: “Should I ape into the new Solana meme coin?”

Elsa: “Based on onchain activity and community sentiment, risk is high but momentum is strong. If you proceed, consider limiting exposure to 2% of portfolio.”

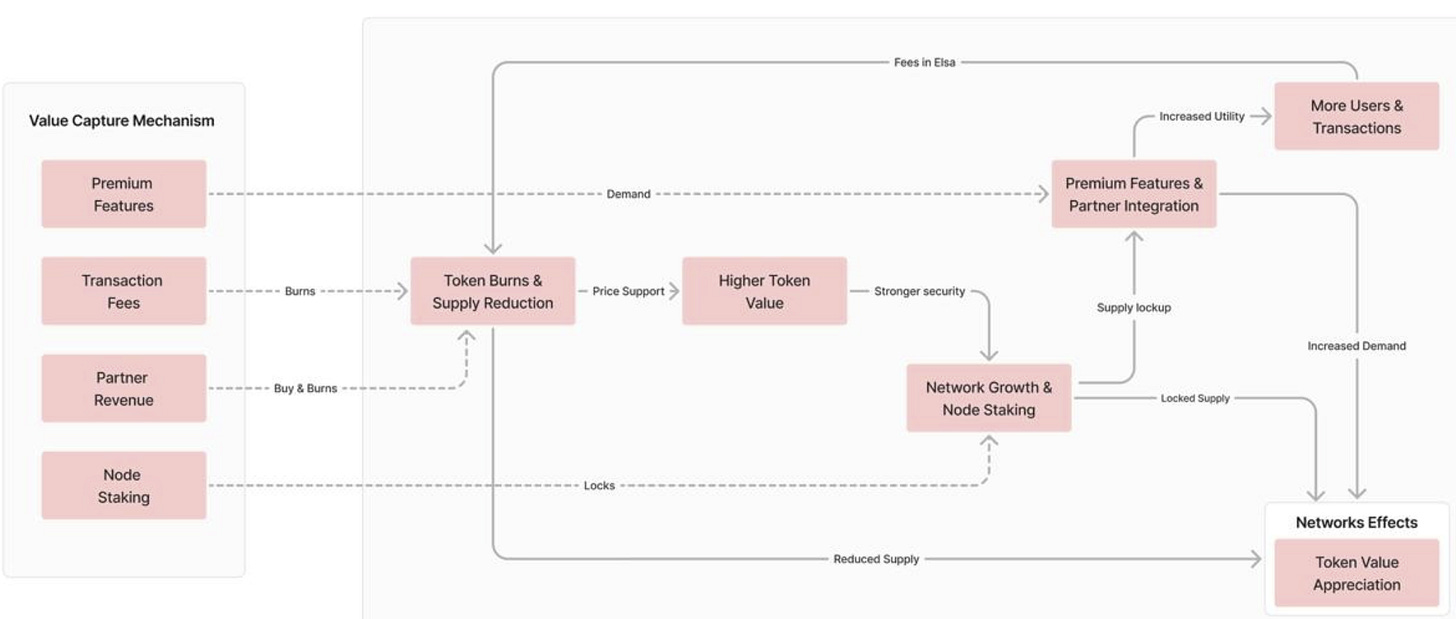

Business Model (Value Accrual)

Elsa is sequencing its monetization strategy in a disciplined way: build core usage and agent flywheel first, layer in value capture second.

The opportunity: agents that become the default interface layer for Web3 users will sit in a structurally advantaged position to capture value across multiple surfaces: execution, curation, personalization.

Elsa’s planned revenue model has three primary layers:

1️⃣ Agent execution fees

Agents executing onchain actions (trades, staking, bridging, etc.) will generate protocol-level fees, similar to how routers and aggregators monetize today.

Elsa agents will selectively integrate with existing DeFi protocols and liquidity layers (Enso, Uniswap, Solana AMMs), but will take a cut of value routed through agents.

Crucially, this fee layer will scale with agent adoption, a volume-driven revenue flywheel.

2️⃣ DAO marketplace revenue share

The onchain script / agent marketplace will allow developers to submit reusable agent scripts.

Elsa DAO will take a protocol fee / rev share on marketplace activity (think: App Store model).

Over time, this can drive highly recurring, defensible revenue from a long-tail of niche, composable agent behaviors, increasing lock-in.

3️⃣ Personalization & premium UX

Elsa is building a behavioral + risk profile data flywheel, enabling deeply personalized agent recommendations.

Over time, Elsa can introduce premium agent services:

Custom risk models

Advanced trading signals

AI-driven portfolio optimization

Priority execution / MEV protection

These features can be offered on a subscription or usage-based model (think: Shopify Plus for agent UX).

Future Token Role

Elsa’s team is taking a disciplined approach:

No token launched yet, building usage-first.

Over time, the $ELSA token will be introduced as the central unit of protocol economics:

Staking for revenue share, governance, and script curation.

Utility within agent execution and marketplace flows.

Potential fee rebates and premium UX unlocks.

Importantly: Elsa’s focus is on building usage-driven token demand, not speculative inflation.

Elsa is positioned to build a multi-surface, multi-revenue stream protocol:

Execution layer monetization

DAO marketplace rev share

Premium personalization services

Usage-driven token economy

If Elsa succeeds in becoming a dominant agent OS layer for Web3, this model offers both:

Strong base revenue scaling with agent usage.

Recurring, high-margin revenue from personalization & premium features.

Platform Integrations & Traction

Integrations & Strategic Partnerships

One of Elsa’s most underappreciated strengths is the depth and breadth of its early ecosystem integrations. While many agent projects remain isolated UX experiments, Elsa is building the connective tissue to embed its agents across the wallets, messaging layers, and chains where real users live.

Current key integrations:

Coinbase Smart Wallet

Non-custodial Account Abstraction (AA) integration: enables Elsa agents to execute transactions seamlessly across EVM chains, with built-in MPC security.Coinbase Onramp

Fiat onramp baked into agent workflows: critical for onboarding non-core crypto users and enabling “buy → execute” flows inside Elsa.XMTP

Messaging layer integration: agents can proactively surface opportunities, risk alerts, and intent confirmations via secure wallet-based messaging.Enso Finance

Partnering on composable DeFi strategies: Elsa agents can leverage Enso’s aggregation and social trading primitives to construct complex execution pipelines.Anoma

Effortless DeFi execution: Elsa’s architecture taps Anoma’s intent-based execution layer to make multi-chain DeFi feel invisible, letting agents translate user goals into seamless onchain actions without the usual fragmentation or friction.

Hyperlane

Early partner on cross-chain messaging: foundational for Elsa’s roadmap of multi-chain intent chaining.Base ecosystem

Deep alignment with Base chain: Elsa is positioned as one of the lead AI-agent experiences designed for Base users and Coinbase’s onchain distribution.

Emerging partnerships (in development):

Work underway with Solana-native wallet providers to extend Elsa UX into mobile-first Solana flows.

Early discussions with Telegram-native trading bot platforms to integrate Elsa agents into existing retail workflows where a large % of retail order flow already lives.

Customer Traction

Elsa’s traction is early but material, and importantly, driven by real, organic usage (not mercenary incentives and with minimal marketing spend):

150K+ MAUs: Primarily through web + chat UX; now expanding to voice-first.

5K–8K DAUs: Consistent daily active usage, driven by a core cohort of agent-first traders, DeFi users, and NFT participants.

$15M+ onchain transaction volume executed via Elsa agents: Not just intent surfacing, actual agent-driven execution, a key proof point.

DAO scripts growing: 50 unique onchain scripts submitted / approved: early signs of flywheel around community-driven agent behaviors.

Elsa is building the pipes that will let agents move from UX experiment → embedded execution layer inside real wallets and messaging environments.

That positioning, especially given Coinbase and XMTP alignment, gives Elsa a path to distribution leverage that most agent projects simply won’t be able to match.

And critically: their traction is usage-first, not token-farmed.

That’s the foundation you want before introducing a token-driven flywheel, and it makes Elsa one of the few teams in this category that is building for sustainable defensibility.

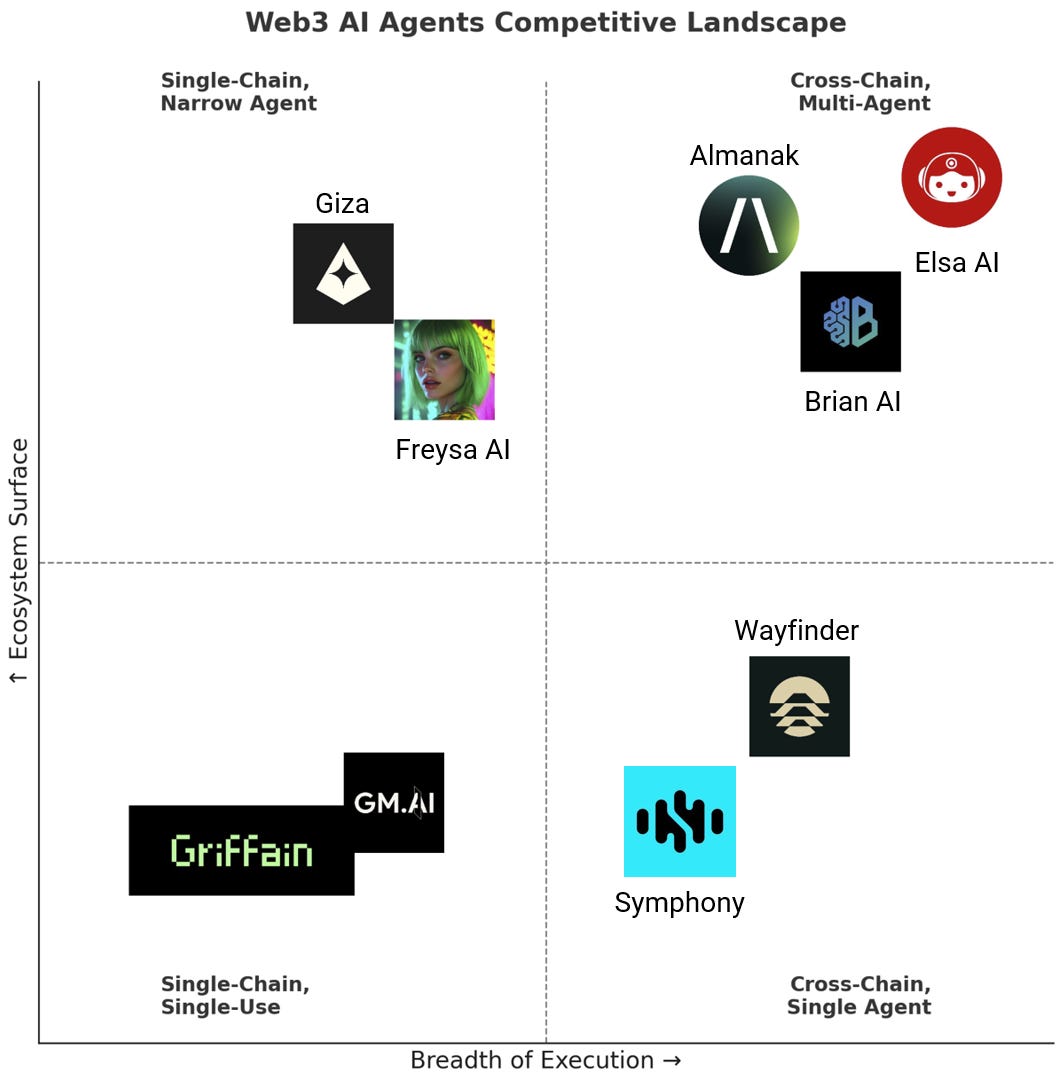

Competitive Landscape

We are witnessing the emergence of an entirely new stack: AI agents that navigate Web3. From trading flows to cross-chain UX to DeFi strategy automation, the core idea is the same: abstract blockchain complexity behind natural language and intent-based agents.

Elsa AI competes in a space with early but fast-evolving players:

How Elsa Differentiates

In a market this noisy, differentiation will hinge on two things: breadth of utility and quality of agent orchestration. Here’s where Elsa stands out:

✅ Intent-first UX: Elsa offers what most players only hint at: true intent-driven workflows, not just agent pipes. Users can say

"Stake 3% of my portfolio into blue-chip DeFi if market volatility exceeds X" and Elsa’s agents will compose, risk-manage, and execute this.

✅ Full-stack agent architecture: While most players focus on one layer (execution agents, LLM interfaces, chain abstraction), Elsa’s architecture runs deep:

Chain Analyzer agent surfaces onchain opportunities.

Intent agent abstracts complex interactions.

Risk engine continuously monitors and mitigates.

Onchain script engine gives advanced users composability.

✅ Multi-chain, multi-surface: Many competitors are Solana-native or EVM-only. Elsa works across:

Base, Optimism, Arbitrum, Polygon, Solana, Hyperlane, Hyperliquid, Berachain, Ink , with a roadmap toward broader modular interoperability.

Voice-first UX (rare in this space), web app, chat interfaces.

✅ DAO-governed extensibility: Elsa allows the community to submit and approve onchain scripts and automations, enabling a growing ecosystem of community-built agent capabilities. This creates a compounding flywheel.

✅ No-token-first discipline: Many players (Wayfinder, Griffain, Giza, etc.) are leading with token incentives. Elsa is building usage first, monetization second, a smarter sequencing given market cycles.

Defensibility / Moat Potential

Here’s the key question: in an open agent world, how does Elsa defend its edge?

🟢 Data flywheel: As agents interact and learn, user-specific behavioral/risk profiles become richer. Over time, Elsa’s ability to offer personalized and risk-aware agent recommendations compounds, a deep data moat competitors can’t fast-follow.

🟢 Community-driven extensibility: By letting its DAO submit and approve new agent scripts, Elsa builds an open ecosystem of long-tail automations. Think "App Store for agent workflows", once built out, this becomes a major lock-in layer.

🟢 Cross-surface UX: Most players are chat or UI-only. Elsa’s bet on voice + web + chat makes it more accessible to non-core crypto audiences, optimizing its TAM.

🟢 Partnership and integration depth: Early partnerships with Coinbase Smart Wallet, XMTP, Enso, Hyperlane show that Elsa is stitching itself into real wallet and messaging layers, reducing switching friction.

In a space where many teams are building tools for advanced users (traders, DeFi power users), Elsa is going after the broader goal: AI agents as the interface for all Web3 users; intent in, execution out.

Its ability to combine:

deep agent architecture,

multi-chain reach,

risk-aware UX, and

community extensibility

positions it as one of the few teams building not just another DeFi agent, but a potential agent OS for Web3.

If Elsa executes well on this roadmap, its moat will come not from AI model IP (which will be increasingly commoditized), but from:

behavioral & risk data loops

community flywheel of agent scripts

deep integrations with wallet/messaging/infra layers.

Very defendable positioning in this fast-forming category.

🧑💻 Leadership Team

Elsa’s leadership team brings an uncommon blend of deep Web3 product DNA, AI/blockchain engineering strength, and fintech execution experience, exactly the profile needed to build agents that operate at both user and protocol layers.

Dhawal Shah — Co-Founder & CEO

Web3 and fintech veteran with strong DeFi ecosystem connections. Previously led product at Frontier (exited) and co-founded Woodstock Fund, giving him unique insight into both agent UX demand from the DeFi ecosystem and how to navigate early token and distribution design.Vetrichelvan Jeyapalpandy — Co-Founder & CTO

Seasoned Web3 engineer and systems architect with deep experience in scalable data infrastructure, cross-chain protocols, and onchain execution frameworks. Prior to Elsa, Vetri led engineering teams at Unmarshal, building one of the ecosystem’s earliest blockchain data indexing networks, and contributed to open-source DeFi and agent frameworks across EVM and non-EVM chains. Now driving Elsa’s core agent and protocol architecture, with a focus on making decentralized AI systems composable, performant, and verifiable.

Kunal Gandhi — Head of Marketing

Brings experience in scaling crypto products and consumer-first Web3 experiences. Previously led growth for Wildcard (#1 Farcaster client) and helped grow Ellicium Solutions (now Emergys) (Big Data & AI, acquired). His background across product, marketing, and community helps Elsa craft an agentic UX for both crypto-native and consumer users.

Most “AI agent” projects in crypto are either AI-first teams learning Web3, or DeFi-first teams wrapping simple LLM flows. Elsa is one of the few teams building with:

native crypto product intuition,

serious AI + blockchain engineering depth, and

consumer UX understanding all in one stack.

Product & GTM Roadmap

Q2 2025

Pre-TGE points campaign: Just launched a few days ago, users can earn points by trying out different functionality on Elsa.

Q3 2025

Full rollout of Intent Agent 2.0: multi-intent chaining and advanced risk modeling

First DAO-governed agent script marketplace: allowing users/devs to submit and monetize reusable agent flows (early App Store dynamic)

Partnership deepening: ongoing integrations with Base, Coinbase Smart Wallet, XMTP

Q4 2025

Expansion to additional chains: zkSync, Starknet, Cosmos SDK ecosystems

Voice-first UX beta: voice-to-agent-to-chain flow, bringing non-core crypto users into Web3 agent UX

Release of Elsa SDK for developers building custom agents atop Elsa Automata

2026

Monetization flywheel: progressive rollout of Elsa Token Economy, centered on real usage-driven value capture, no premature token pumping

Personalization loop: leveraging behavioral + risk data flywheel to make agent recommendations fully adaptive and user-specific

Expansion of DAO-governed agent marketplace into cross-ecosystem agent interoperability (think: agents chaining flows across EVM + Solana + Cosmos)

In a space where many players are betting on chatbots or AI wrappers around DeFi scripts, Elsa is pursuing the harder but more durable path: building a true intent-first, risk-aware, multi-agent stack, with a community-driven extensibility model and broad UX surface.

Key Execution Challenges

UX Scalability: Voice + NLP + agents sounds magical, but consumer UX quality is notoriously hard to get right. Elsa must prove that their agent UX works across device types and user sophistication levels.

Latency + Reliability: Multi-agent execution across chains is complex. Slow or buggy agent behavior will quickly kill trust. Engineering the execution layer for latency and safety is critical.

DAO Incentive Alignment: Community-driven agent script marketplaces are powerful, but incentive alignment will be hard. Without curation, the ecosystem could bloat with low-value scripts or even malicious agents.

Distribution: Partnerships with Coinbase and wallet providers help, but Elsa will need to solve the "agent onboarding" problem: how do you get mainstream users comfortable handing over execution to AI agents?

The Broader Vision

Elsa isn’t just a trading tool; it’s an architecture for AI-mediated interaction with Web3. Where most wallets and apps today force users to click through complex interfaces, Elsa offers a goal-driven UX, abstracting away the pipes and contracts beneath.

In a world of proliferating chains, faster-moving markets, and AI-native users, architectures like Elsa AI Automata represent the future direction of onchain interaction:

Agents that understand your goals.

Agents that manage execution and risk.

Agents that learn and adapt over time.

The more data it consumes, and the more composable workflows it supports, the more powerful the system becomes.

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies that support individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital

good write up, thanks

Vetri is an exceptional tech mind behind HeyElsa, and Dhawal is a great executive to lead! I am super excited for the successive league of their journey, power to both.