ESG = CCP

The climate-conscious prefer USD (aka the "PETROLdollar"), a tree-killing paper version of money backed by cruise missiles and ~10,000x the carbon footprint of BTC

When email started gaining real traction, it represented a new technology that obviated the need for a longstanding incumbent, the U.S. Postal Service.

By dematerializing mail, this seemingly magical new technology could teleport messages from one end of the planet to the other instantly, a huge leap vs. the T+7 promised by the snail-mail Postmaster General.

…this story sounding familiar?

As you would expect, the Postal Service fought the adoption of email (or "bitmail", if you will) every step of the way, even going so far as to lobby Congress for a digital stamp tax of 5-cents per email!

The always-helpful United Nations chimed in as well, recommending government coordination around a global tax on email...

And what was the primary argument they used to try and kill email? wait for it...

"It's bad for the environment!"

"E-mail uses too much energy!", critics claimed, "it should be banned!". It MUST be bad for the planet - just look at all those servers!

Similarly, Bitcoin is a new technology that obviates the need for the longstanding incumbent. By dematerializing money, this seemingly magical new technology can teleport value from one end of the planet to the other instantly, a huge leap vs. the T+7 promised by the snail-mail Commercial Banks.

Which is why Bitcoin now, like email then, is getting attacked in exactly the same way:

You read that right. Bitcoin will use 100% of the world's energy by... *checks notes*... two years ago!

Besides their perfect track record of being wrong, these ESG critiques also invariably fail to account for the costs of the technology being replaced.

Summing up the collective impact of all the gas-guzzling USPS trucks, upstream coal-powered postage stamp manufacturing facilities, the deforestation impact from envelope demand, etc., would have shown the U.S. Postal Service used egregiously more energy and was magnitudes of order worse for the environment than email.

The ESG impact is just more diffuse and cumbersome to calculate than email servers in a warehouse.

Similarly, it's a lot easier to calculate Bitcoin mining's energy use than the energy use of its alternative, the U.S. Dollar:

Bitcoin mining uses 220 TWh/yr of the world's total energy consumption of 160,000 TWh/yr. That's 0.14% or 1/7th of 1%. Over 60% of that is clean & renewable energy (~2-3x more than other major industries), mostly coming from sources that are currently going to waste. On top, it is incentivizing innovations in sustainable energy and energy capture like nothing else.

USD uses an unknown amount of energy. You'd need to sum the collective impact of every bank branch on every street in the world plus every one of their computers used to send & receive USD (the literal "PETROLdollar"). A currency whose value is backstopped by cruise missiles, aircraft carriers, guns, tanks, and drones which are quickly pointed in the direction of any country who dares de-Dollarize. Not to mention the costs of war and the human lives lost...

All of this in order to send a tree-killing paper version of money around the world more slowly and cost-inefficiently than BTC.

GSE-Friendly

Bitcoin wins when it comes to Environmental impact, no question. But why does such little attention get paid to the 'S' or 'G'?

Governance: The 'G' focuses on enforcing accountability and transparency (what's better than 100% transparency?), preventing "anti-competitive practices" (Bitcoin is open source!), and ownership & control (no one has more control over the Bitcoin network than anyone else).

Even with regard to equitable employee compensation, nothing is more equitable than Proof of Work where everyone's salary is the same: 6.25 BTC per block.

Social: The concerns of the 'S' focus on "Diversity & Inclusion" and human rights. Bitcoin is not only inclusive, it is provably inclusive. Unlike every other company, industry, or entity on the planet, it is programmatically & mathematically impossible for Bitcoin to discriminate. Pure code neither knows nor cares about the race, gender, age, or sexual orientation of the sender, receiver, miner, or holder.

On the human rights front, Bitcoin not only allows anyone to participate but it also forces no one. Unlike the mining of certain other shiny Store-of-Value assets, there is zero coercion involved in the manufacturing of BTC. Bitcoin mining and maintenance is 100% voluntary.

The Gerontocracy

Bitcoin, like email, is a better product than what it replaces. It is better for the consumer, better for the planet, more fair, inclusive, open, etc.

"So", asked Peter Thiel during his Bitcoin 2022 keynote, "Why isn't BTC already a $10T market cap?"

In his view, the weaponization of the ESG term by America's finance gerontocracy is no different than the narrative control tactics employed by the CCP, and is the single largest thing holding BTC from reaching a market cap of $10 Trillion or more.

ESG is a "hate factory for naming enemies", according to Thiel.

If that sounds a little extreme, consider what they call us! A "scientific" study published last month concluded - using science! - that Bitcoiners are psychopaths.

Did I mention they used SCIENCE to come to this conclusion?? And as we know from the last 2 years, Science Is Never Wrong.

If you disagree, I have a scientific study that will prove you're a psychopath too.

It would be funny if it weren't so deranged. But the idea that attempting to flee a corrupt financial system makes you a psychopath is exactly backwards.

Just ask any of the 29,266,991 Venezuelans buying BTC to survive hyperinflation.

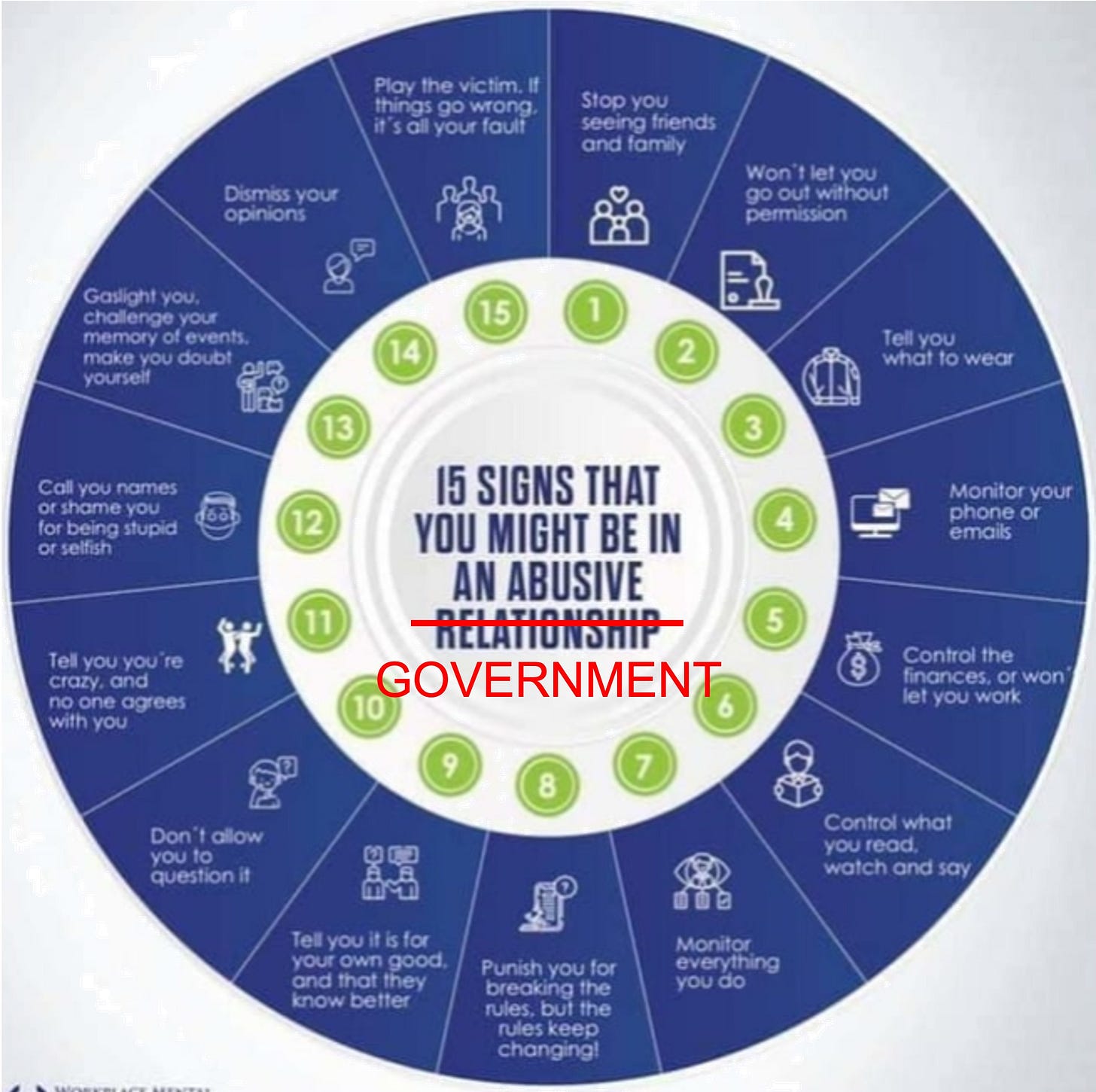

In fact, repeatedly abusing your citizens and then gaslighting them when they try to leave is textbook toxic relationship...

Conclusion

ESG in the West, much like the narrative control tactics and social credit scoring practices of the CCP in the East, has become a tool for exerting power and control over disruptive industries.

This narrative control tactic is now being focused on Bitcoin because it makes every other industry look terrible by comparison:

Environment (A+): Bitcoin's high renewable energy composition highlights the environmental exploitation of the petroldollar system

Social (A+): Bitcoin's provable fairness highlights the discrimination & coercion inherent to the mega-corps

Governance (A+): Bitcoin's success as an open monetary system highlights the absurdity of an opaque & Cantillon monetary system

Bitcoin is an unbelievable net positive for the environment and more importantly humanity. However, the point here is not to make the case that Bitcoin is ESG-friendly, but rather to show that efforts to comply with the ESG narrative are made in vain, since an industry will never be ESG compliant if it does not support The Current Thing.

The ESG critique of BTC is the primary thing standing in the way of a $10T market cap. Addressing its hypocrisy will unlock that $10T of human progress which has always been the result of a hard money standard.

What We’re Reading

The War on Woke Capitalism has begun (Mark E. Jeftovic)

Letter to the U.S. EPA (Bitcoin Mining Council)

The UnCommunist Manifesto (Aleks Svetski & Mark Moss)

Everything Divided by 21M (Knut Svanholm)

The Faith of a Futurist (George Gilder)

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies that support individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital