2022 was quite an eventful year for crypto…to say the least.

The industry was hit by a perfect storm of deteriorating macro conditions, company fraud/mismanagement, doomsayer media headlines, and negative sentiment in DC, causing token prices to fall 70-90% across the board. Given the current market conditions, its easy to get distracted and/or disillusioned by all the noise.

Even those of us heavily involved in the industry often get too caught up in the minutiae and lose perspective on what will actually move the needle long-term. We argue about optimal programming languages, consensus mechanisms, composability, throughput, decentralization, interoperability, value capture, etc. We obsess over esoteric functionality like concentrated liquidity, MEV capture, fractionalization, shared security, liquid staking, etc.

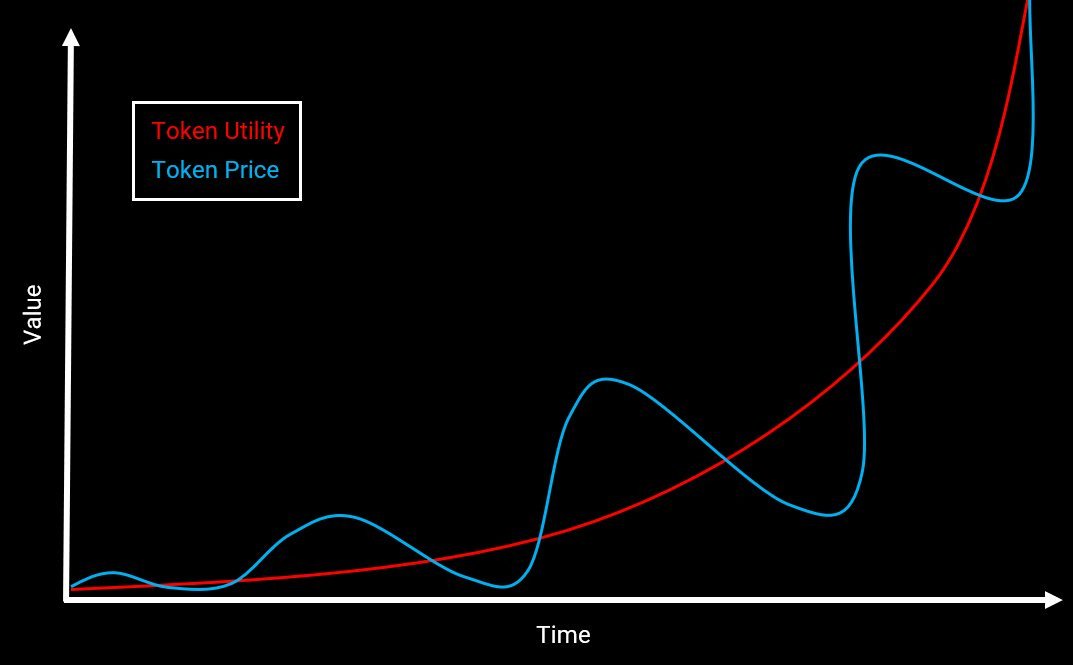

Yes, these details matter (to varying degrees), but if we zoom out and abstract away all this noise — what actually gives tokens inherent value?

Utility.

Utility can either be a service (financial, gaming, media, etc.) or economic (stablecoin yielding assets, etc.). Utility drives demand — which drives value.

Price tends to oscillate along the utility curve, alternating between over and undervalued (relative to inherent value). Early stage tech, like crypto, is especially volatile because its future utility is particularly hard to forecast. Instead of timing cycles, investors are much better off focusing on the utility curve instead, since it eventually converges with price over time.

Admittedly, most utility today is limited to niche, crypto-native use-cases within DeFi (blue stars) & NFT collectibles (red stars).

(top dApps by users and fees; token terminal as of 12/31/22)

Users are mostly crypto-natives with relatively high risk tolerance and some level of understanding/trust in the underlying tech. So how does crypto expand to more mainstream users? (It helps to zoom out and keep it simple)

1) more relevant products, 2) easier to use dApps, and 3) legal clarity.

The vast majority of on-chain assets today are crypto-native — we need more real-world value on-chain for products to actually be relevant for most consumers and institutions.

dApps are way too hard to use — we need more tech abstraction & automation.

Legal ambiguity & lack of consumer protection keeps many on the sidelines — comprehensive regulatory reform is needed to enhance user confidence & safety.

Through this lens, I believe the most significant developments to watch over the next 12 months are:

Onboarding real-world assets (RWAs)

Improving UI/UX through Account Abstraction (AA)

Regulatory clarity/reform for a) stablecoins, b) market structure, and c) consumer protection

Onboarding real-world assets (RWAs)

The problem: Since DeFi exploded onto the scene in 2020, there has been continued progress in application functionality and underlying infrastructure performance. The technology has opened up novel functionality (flash loans, brokerless money markets and exchanges, near-instant transaction finality, seamless cross-application/asset interoperability, etc.) not possible in the siloed & archaic world of web2/TradFi.

However, DeFi is still highly reflexive: most transaction activity is centered around tokens whose value is derived from said activity (or speculation on future activity). Since assets are mainly crypto-native, DeFi’s functionality isn’t relevant for most consumers & institutions. Despite the exciting innovation, without integration of RWAs, utility will always be limited to niche, crypto-native use-cases.

Out of the nearly $1T in total crypto market cap today, only ~$130B represents real world value, the vast majority of which is fiat-backed stablecoins. More complicated asset classes, like private debt (below), have just barely scratched the surface (~$350M today).

(rwa.xyz)

The solution: On-chain RWAs are digital representations (either fungible or non-fungible) of assets that rely on legal enforcement, including fiat, real estate, commodities, securities, and other physical assets. Combining the advantages of DeFi (below) with the breadth and relevancy of traditional financial assets, RWAs are the key to more mainstream DeFi adoption.

DeFi’s RWA opportunity:

Structural cost efficiencies vs. TradFi will improve over time, decreasing the cost of capital and increasing capital efficiency.

(frigg.eco whitepaper)

(IMF’s global stability report)

(an unreal primer on real world assets — highly recommend for a deeper dive on the subject)

On-chain fiat (stablecoins) has proven PMF with ~$130B in value. But total TAM = $95T!

(fiat-backed stablecoins; defillama as of 12/31/22)

(visual capitalist)

Other RWAs represent an even larger TAM and are likely the only way to meaningfully onboard institutions.

(chainlink 2022)

(visual capitalist)

What to watch: I’m an optimist and perma-bull, but I’m also a realist — RWAs have significant hurdles to reaching mass adoption on-chain. Major pain-points include navigating regional underwriting, trading/settlement/clearing, compliance, custody, and ownership laws, as well as reaching an industry-wide agreement on technology standards.

Admittedly, it will be a long and arduous road — but the progress being made to-date is encouraging. Besides fiat, first-movers include heavily liquid assets with high on-chain demand (t-bills), as well as long-tail assets that are underserved by TradFi (trade finance assets, emerging market credit, revenue-backed financing). Like all disruptive technology, use-cases will start niche, and move up market as utility increases and costs fall.

(wikipedia)

Given the recent momentum in RWA adoption illustrated below, I believe 2023 could be the first real breakout year for the category.

(an unreal primer on real world assets — again highly recommend)

Improving UI/UX through account abstraction (AA)

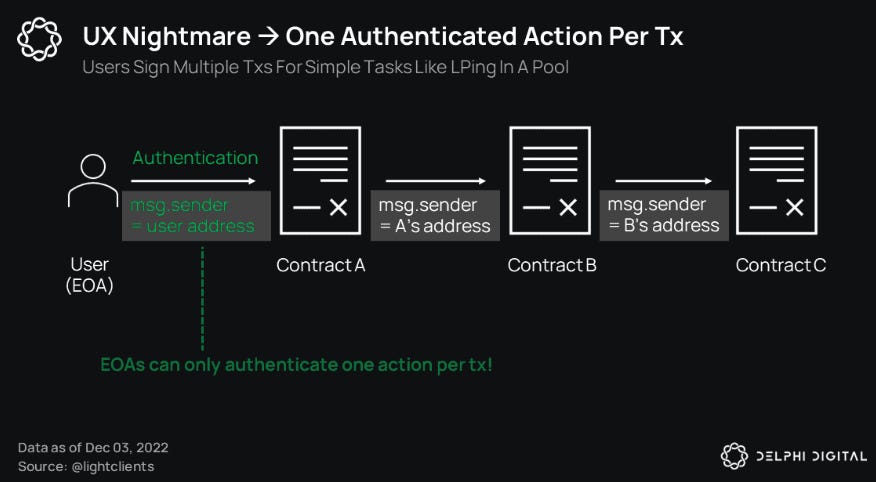

The problem: Self-custody wallets are the main interface connecting users with blockchain applications — and yet, entering 2023, the user experience is still pretty terrible. Even for the most tech-savvy, crypto-native users, wallets are clunky and always an adventure to use. Without going too deep into the tech, the functionality handicap is mostly a result of the two account structure: externally owned accounts (EOA) & smart contract accounts.

Instead of simply “using an app”, like in web2, web3 users must figure out which blockchain the app is on, download a chain-specific wallet, acquire chain/app specific tokens, and take full responsibility for asset custody. This design has created an inefficient and frustrating user-experience, unquestionably hindering crypto adoption.

Each on-chain interaction requires a new transaction (manual user signature), which can be extremely tedious and expensive.

Seed-phrase security design creates a single-point of failure.

Limited on-chain privacy.

The solution: Account Abstraction (AA) effectively combines the two accounts into one (“abstracting” away the technical complexities), enabling a more programmable, automated user-experience like we’re used to in web2. Upgraded features include:

Multicall: Bundle multiple transactions into one, and execute the sequence of operations in one atomic transaction.

Session keys: Pre-approve the rules for interacting with a dApp so you can use it as much as you want within those rules without having to sign every single transaction. (effectively enabling web3 subscription & metered services)

Reducing / eliminating the need for users to hold specific tokens (a major point of friction today)

Token abstraction: Users can pay fees in any token; the exchange for the necessary token is automated in the background.

Reverse gas model: dApps pay user gas fees, potentially eliminating the need for users to have tokens at all. This is similar to web2 model where companies directly pay for cloud services and generate revenue through ads or customer subscriptions.

Social recovery: If users lose their private key they can authorize a new key as the legitimate wallet owner (based on trusted contacts, hardware wallets, or third party services).

Multifactor authentication: Accounts that require signatures from multiple keys, with a transaction only going ahead if certain conditions are met.

Plugins: Enable developers to create new capabilities for wallets to leverage.

What to watch: While the idea of AA has been around since 2015, there are many risks and challenges to retrofitting current dApps/L1s for the tech. Fortunately, newly launched L2s are much better suited for AA (StarkNet, zkSync, Fuel deploying natively), with wallets Argent (link) and Cartidge (link) currently leading the charge. Developers are now integrating AA functionality directly into dApps, and as L2s continue to gain share, these capabilities should become more broadly available as 2023 progresses.

Regulatory Clarity

The problem: Contrary to popular belief, crypto is regulated in the US — its just extremely unclear which laws and regulators have jurisdiction over different tokens, decentralized networks, and centralized companies in the space. A recent Eurex survey of 4,000 institutional investors (link) revealed ~75% cite “lack of regulatory clarity” as their main concern with crypto.

Most consumers, and nearly all institutions, will never meaningfully adopt crypto without more legal assurance. “Crypto regulation” is a broad and nuanced topic, but I see three distinct issues hindering adoption the most: 1) stablecoins, 2) market structure, and 3) consumer protection.

Stablecoins: Still don’t have a comprehensive regulatory framework. Until a bill is passed, payment network adoption will be limited.

Market structure: The largest crypto blowups this year (ex-LUNA/UST) were centralized companies, and many were regulated by the US. Reform is needed to promote healthier business practices from exchanges, banks, lenders, market makers, etc. — the key pillars of crypto’s financial market structure.

Consumer protection: Crypto’s legal grey areas have made the industry an easy target for conmen and scam artists.

The solution / what to watch: Given all the events of 2022, regulatory reform is needed to gain broader market trust and participation. However, according to BTIG, the only new policy likely to pass in 2023 is stablecoin legislation.

Stablecoins: The House and Senate are working on competing bills that would create definitive rules for stablecoin issuance, oversight, and reserves. Final terms are still TBD, but 2023 should be the year the US finally adopts clear stablecoin policy. This could be a major catalyst for large-scale stablecoin payment network buildouts and mainstream adoption.

House Bill Overview:

Senate Bill Overview:

Market structure / consumer protection: The two most relevant bills addressing these issues aren’t likely to pass this year according to BTIG: The Responsible Financial Innovation Act (RFIA) & The Digital Commodities Consumer Protection Act (DCCPA). The latter is likely dead in its current form, after taking a huge credibly hit from the FTX collapse (conman SBF aggressively tried to push the bill through Congress). Still, the progression of both bills should be closely monitored this year for revisions and a potential push in 2024.

RFIA Overview: (link)

DCCPA Overview: (link)

When markets get chaotic, it helps to keep perspective by simplifying the situation. Instead of worrying about the noise, focus your time and energy on utility curves that are most likely to move up-and-to-the-right.