Welcome to the M31 Capital Investor Newsletter! We use this platform to share monthly updates on the industry, our views on the broader market, important crypto-native metrics, as well as to highlight specific DeFi & Web3 protocols we find interesting.

February Performance

In This Issue:

Market: Bitcoin & Ethereum L2s (Stacks & Base) generate fresh excitement

Narrative: SEC crackdown & the loss of institutional credibility

Highlight: Stacks (STX) is an L2 for Bitcoin smart contracts

Market Action

U.S. regulators were publicly embarrassed by their failure to spot FTX, one of the largest and most obvious financial frauds in history, so they reacted this month by coordinating one of the largest and most obvious attacks on the crypto space yet.

Did crypto care? Crypto didn't care. Bitcoin & Ethereum posted positive months and nearly every sector was up between 2% and 10% amid the harshest enforcement backdrop ever.

User activity too. Ethereum burned 84.9k ETH in February, it's highest monthly burn since May 2022 as network activity saw a huge increase.

Bitcoin users - both nonzero wallets & hodlers - reached record highs in February.

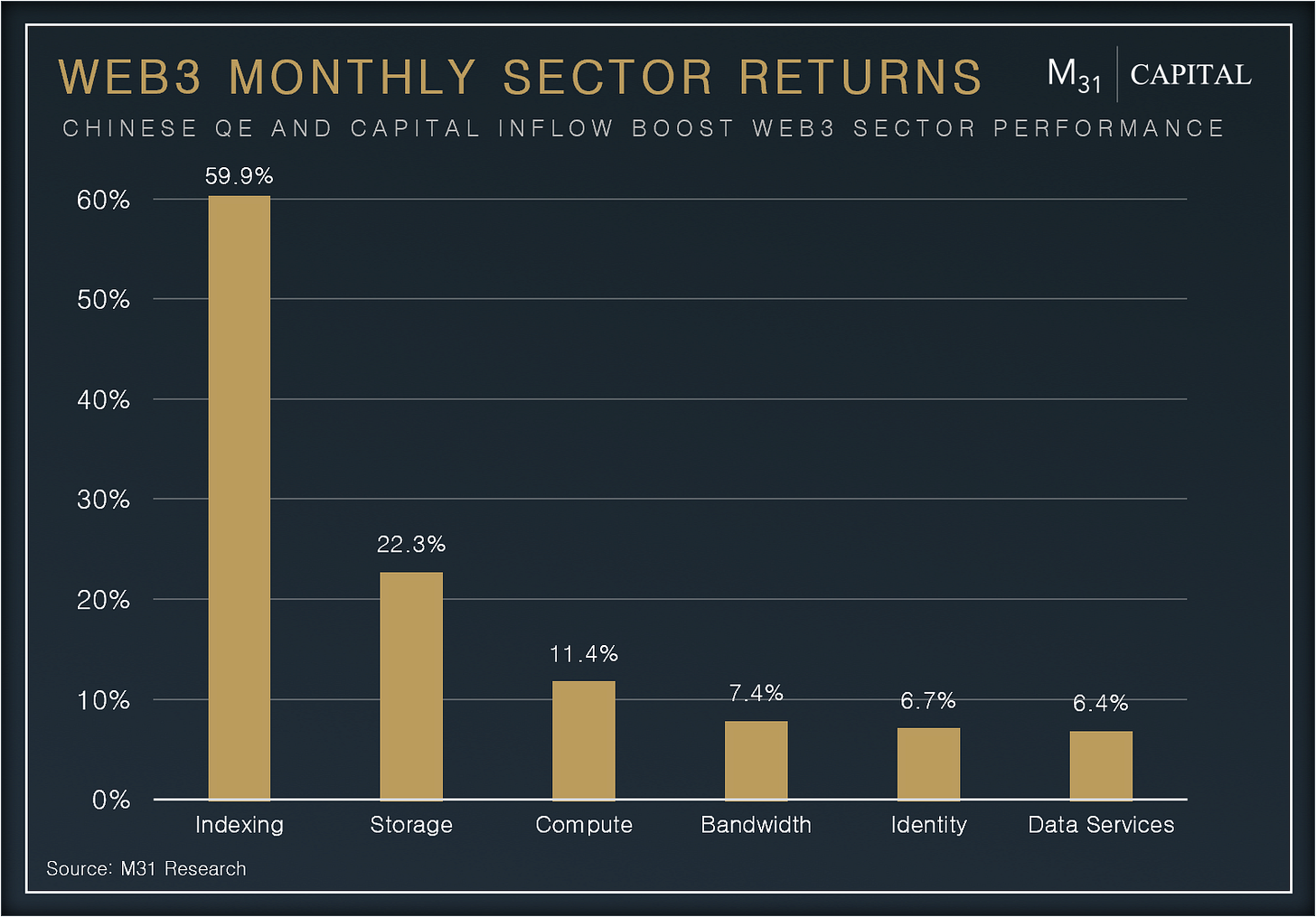

Web3

Real world usage and revenue both saw a big uptick in February. The Graph (GRT) revenue was +90.4% caused by a huge increase in querying demand post-Arbitrum integration.

Render (RNDR) jumped +30.9% as creators continue to enthusiastically onboard. The network reduces rendering times by 32x, from 3 days to 2 hours!

Arweave (AR) reached an ATH in February for transaction activity on the network (~70m transactions), +150.9% YoY

Filecoin (FIL) ATH for active storage deals in February, with over 17 million total storage deals, spanning 490+ PIB worth of data

DeFi

February's regulatory crackdown actually pushed more people into DeFi and drove usage for top DeFi protocols.

Stacks (STX) was a massive outperformer, rallying +173.6% as TVL popped +220.4% and network activity +4x since the launch of Ordinals (more below).

Optimism (OP) also jumped +18.5% after Coinbase announced BASE, a new L2 built on the Optimism stack.

TL;DR

It was incredibly impressive to watch the market shrug off regulatory attacks and post another strong positive month.

Activity is back, evidenced by BTC nonzero wallets ATH, high ETH burns from strong network activity, DAUs for projects like Optimism (OP) +105%, and Web3 protocols like Render (RNDR) & The Graph (GRT) seeing massive adoption.

Also the emergence of an unexpected new narrative: DeFi & Web3 on Bitcoin. Thanks to technical advancements (Taro, Taproot, & L2s like Stacks) as well as strong regulatory pressure.

The harder they push, the faster we decentralize.

February Highlights

Partner Highlights

Arweave Binance announces support for Arweave's network upgrade (link)

Huddle01 introduces Wallet01 an open-source, multi-chain wallet package (link)

Protocol Highlight

Stacks (STX)

Bitcoin's minimalism is a feature that has made it the most secure and censorship-resistant network in the world, but Layer 2's like Stacks now aim to combine the functionality of Ethereum with the security of Bitcoin.

Stacks is a Layer-2 scaling solution, built on top of Bitcoin, that offers smart contract functionality and a secure way to move BTC in and out of the L1. This enables the development of a wide range of primitives and dApps like DEXs, Stablecoins, NFT marketplaces, social media networks, and more.

All backed by Bitcoin.

Why It Matters

Stacks will bring many Ethereum-like applications to the Bitcoin blockchain. NFT marketplaces like OpenSea, social media applications like Lens, decentralized BTC-backed stablecoins, Bitcoin-based DeFi, and more. All with the security of the Bitcoin blockchain.

There are over 40 applications currently on Stacks, and this number will likely grow exponentially from here. Currently, Bitcoin Name Service (similar to ENS) that registers ".btc" domain names, is the most popular application on Stacks, and has been driving overall network transaction activity.

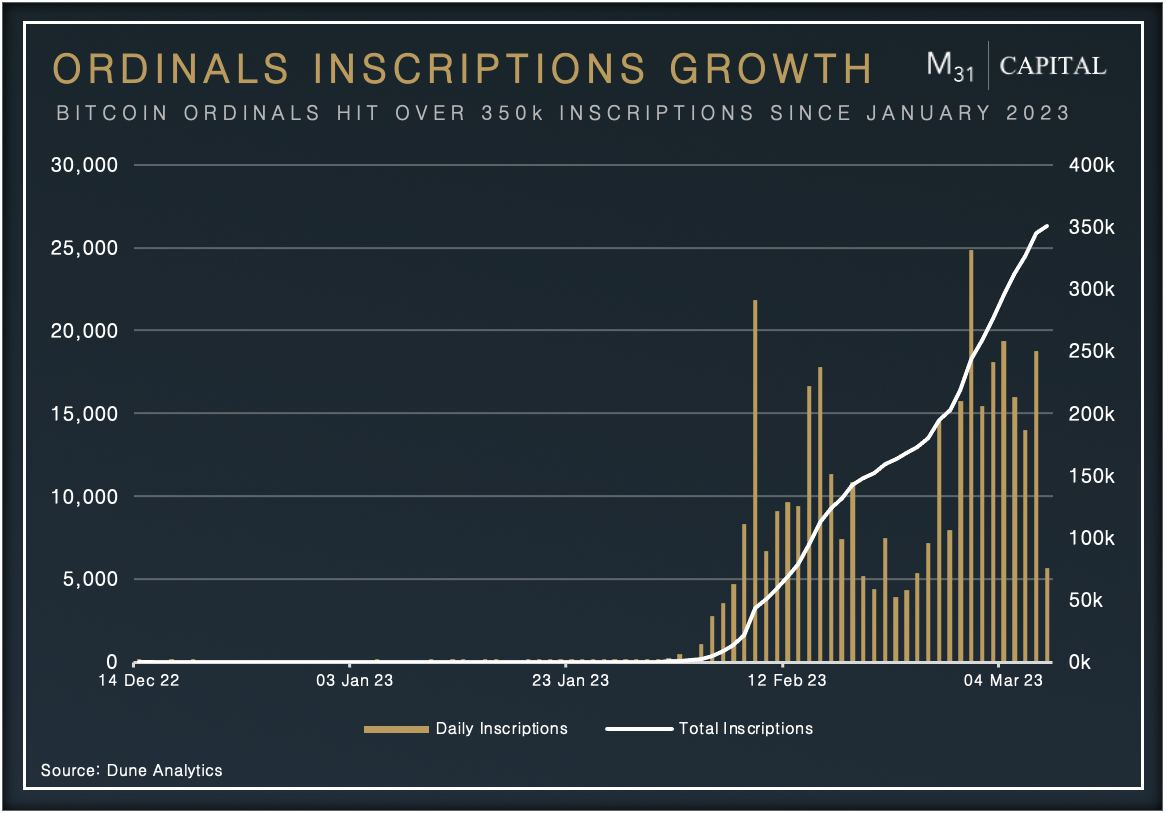

Ordinals (NFTs inscribed directly into satoshis on the Bitcoin blockchain) have become another major use case recently and interest has exploded.

Read more about Stacks in our Weekly Airdrop.

Usage & Network Growth

There are two major network participants in the Stacks Network: Miners & Stackers

Miners: Spend BTC (earned from mining) to build Stacks L2 Blocks

Stackers: Lock STX in order to earn BTC yield, by participating in Consensus

Daily transaction activity reached ~25,000 daily txs

Network activity +253.3% over the last 30 days

Over +47,000 smart contracts have been deployed on Stacks so far

Stackers have earned over 2,200 BTC since 2021

Current Stacking TVL is ~$350m

There are ~500,000 non-zero wallets

Takeaway

The excitement and activity around Ordinals shine a light on a future for Bitcoin, beyond just the base layer. Stacks is well positioned, as the most advanced Bitcoin L2 solution, to be at the center of all this activity and experimentation. With a strong technical team that has been building difficult tech, a strong token model, and new found demand to use BTC beyond just a SoV asset, Stacks is one protocol that you should have your eyes on.

Upcoming Events

The M31 Capital team will be speaking at and attending a number of upcoming conferences and events. Please reach out if you are interested in connecting, or better yet - meet us there:

Los Angeles: NFT LA (3/20 - 3/23)

Paris: Paris Blockchain Week (3/20 - 3/24)

Hong Kong: WOW Summit (3/29 - 3/30)

Miami: Miami NFT Week (3/31 - 4/2)

Tokyo: TEAMZ Web3.0 Summit (4/3-4/9)

New York: NFT.NYC (4/12 - 4/14)

Cambridge: MIT BTC Expo (4/22-4/23)

Austin: Consensus 2023 (4/26 - 4/28)

Tel Aviv: Tel Aviv Blockchain Week (5/1-5/2)

Montreal: W3 Conference (5/5 - 5/6)

New York: Security Summit (5/9 - 5/10)

Portland: ETH Portland (5/12)

Amsterdam: The Web3.Conference (5/19)

Santa Clara: Blockchain Expo (5/17 - 5/18)

Miami: Bitcoin 2023 (5/18 - 5/20)

Lisbon: Non-Fungible Conference (NFC) (6/7 - 6/8)

Paris: EthCC (7/17 - 7/20)

Toronto: ETH Toronto (8/13-8/16)

Austin: Bit Block Boom - (8/24-8/27)

Austin: Permissionless (9/11 - 9/13)

Singapore: Token 2049 (9/13 - 9/14)

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technology.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital