Mind the Gap

2022 charts were Down Only, but usage was Up Only, creating an enormous gap between price & fundamentals that is quickly starting to close

A lot of stuff happened in 2022 - a lot - so I definitely suggest taking the time to read our 2022 Year In Review letter if you haven't yet.

But, to summarize the almost 40-page report in a Tweet: 2022 was a Bear market for prices, but a Bull market for nearly everything else.

An ATH funding ($40bn) poured into the sector, usage & revenue hit ATHs for many assets as global adoption went parabolic, both Web3 & DeFi found incredibly strong product-market fit, innovation flourished, longtime tech problems were finally solved, the world’s top tech talent flowed into the space, bad actors flowed out of the space, and speculation & leverage disappeared.

DeFi operated flawlessly 24/7/365, protecting consumers from financial sociopaths like SBF in the centralized finance world, while Web3 came to the rescue of citizens around the world, protecting them from political sociopaths like Putin.

This uptick in use of decentralized tech drove many onchain fundamentals like usage, adoption, revenue to all time highs, while fear (and a leverage washout) drove prices lower.

I've said for a while that this trend of improving fundamentals and declining prices would not last forever - it's just not how markets work. Eventually price mean reverts to close the gap with fundamentals. And that's exactly what we saw in January.

The under-the-radar improvement in fundamentals last year was particularly strong for Web3 infrastructure protocols which is why that sector was the top performer last month.

Web3 Metrics

Ethereum Name Service (ENS) ignored the bear market and quietly reached ATH sales last year. The decentralized domain provider has sold >2.5m domains to date, collecting >$55m in a bear market, an amount that is wholly owned by ENS tokenholders.

What I love about this is not only that ENS is a profitable protocol with real users paying real money for the product, but also that domain name purchases are a leading indicator that people building something for the long term.

These users aren't going anywhere.

Decentralized video streaming protocol Livepeer (LPT) also saw ATH usage (>200m minutes of video transcoded) & ATH revenue (>$850k).

Livepeer migrated to Arbitrum, reducing gas fees by 97% and significantly increasing network usage from dozens of projects like Huddle01 (below). The uptick in usage led to a large uptick in revenue which jumped +25.8% y/y.

Everything relies on video. Every website, app, streaming service, gaming platform, etc. and the demand is increasing exponentially. So is cost. While Web3 moves to Livepeer for superior privacy, censorship-resistance, and permissionless innovation, Web3 is moving to Livepeer for the 10x cost savings.

Huddle01 (HUDL), a Web3-native Zoom, has been remarkably impressive since launching into a bear market. Every single metric hit an ATH every single month of 2022. ATH users (>16k), ATH usage (>400k minutes to date), ATH meetings (>27.5k), among others.

Critics say blockchain tech is a solution looking for a problem. My problem? Zoom sucks. Terrible audio & video quality, 40 pop-ups when joining a meeting, username/password account log in, bad UX/UI, and apparently everyone's chill with them spying on us...

Huddle01 uses blockchain tech like Livepeer, Filecoin, and Ethereum Name Service to solve all those problems, and since it's superior features appeal to both Web2 & Web3 users, it's TAM is ultimately larger than Zoom's.

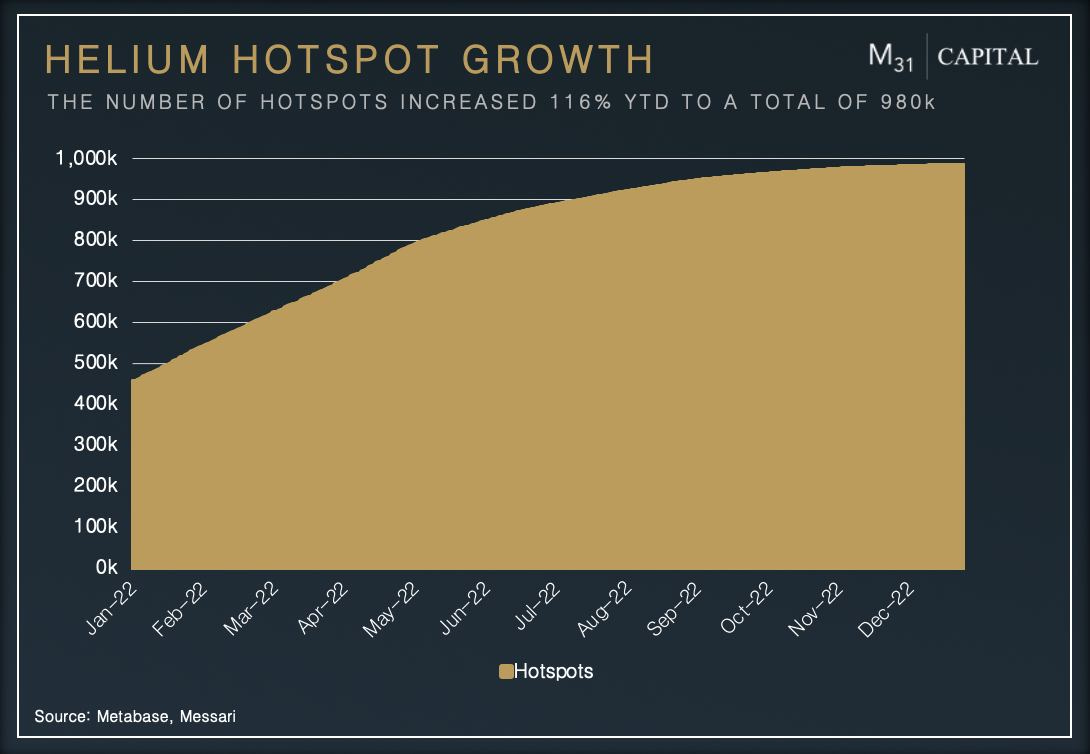

Another example of the real world impact of blockchain tech is Helium (HNT), the decentralized AT&T building a globally decentralized wireless network for the decentralized internet.

Price fell in 2022 even though Helium made enormous progress, forming partnerships with established IoT and 5G companies such as Microsoft & DISH Network, and increasing the total number of hotspots +116% YTD to a total of 980k globally (ATH network size). Helium also expanded their global coverage +120% YTD, providing coverage for 188 different countries (ATH country count) and 76,611 cities (ATH city count).

The protocol is now expanding into 5G, Cellular, VPNs, and began the offline buildout of other, real-world networks.

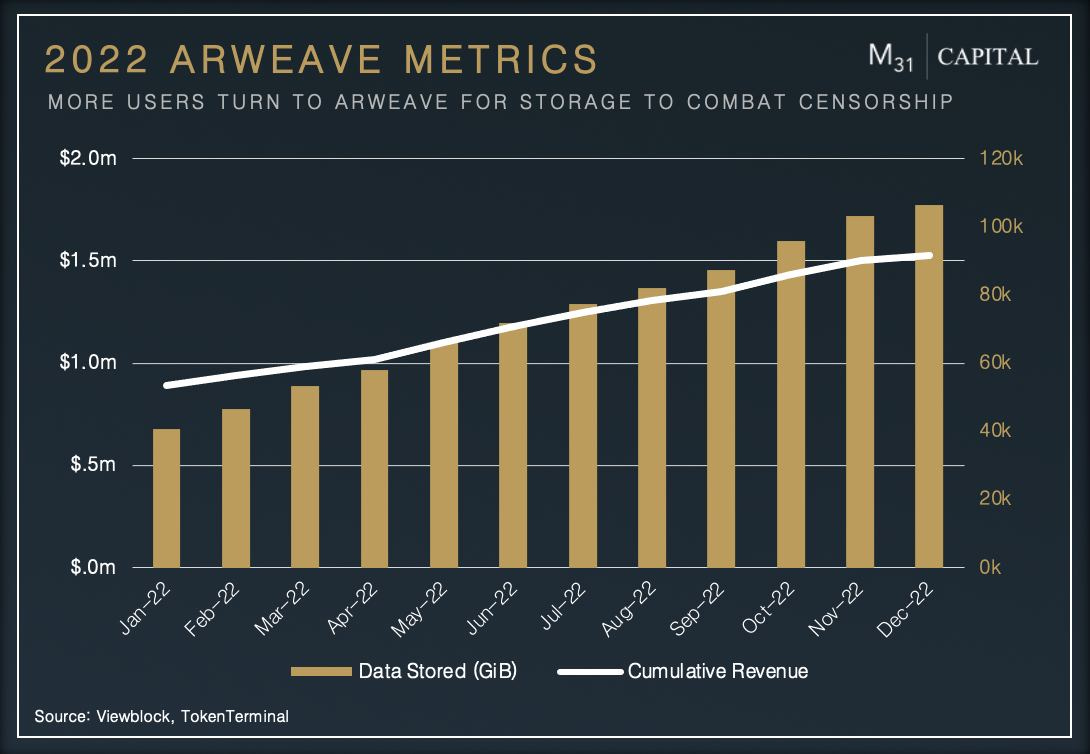

And speaking of significant, tangible, positive impacts of blockchain tech, Arweave (AR) saved Ukraine and reached ATHs doing it. As Russia attempted to erase Ukraine's independent history, Arweave demonstrated its real-world utility by documenting over 90 MILLION cultural documents and events related to the Russian invasion.

The network saw ATH usage & ATH revenue growth as the amount of data stored on the platform reached 71.3 terabytes, +103.2% y/y growth, increasing revenue +84.5% y/y.

Conclusion

Prices were down all year in 2022, but not because people stopped using Web3 products, or because Web3 products stopped innovating, or because that innovation lacked funding. The opposite. A lot of those metrics hit All Time Highs last year and the metrics look even better so far this year.

So January's rally was an early sign that the enormous gap between price & fundamentals starting to close. As investors look at the data and realize these protocols are profitable, heavily demanded, invaluable to the world, and here to stay...

...and are dramatically undervalued

...and the bad actors are gone

...and the leverage is gone

...and the Fed is pumping the brakes on rates

That gap will close.

Mind the gap.

What We’re Reading

Why Decentralization Matters (Chris Dixon)

The Natural Order of Money (Roy Sebag)

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies that support individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital