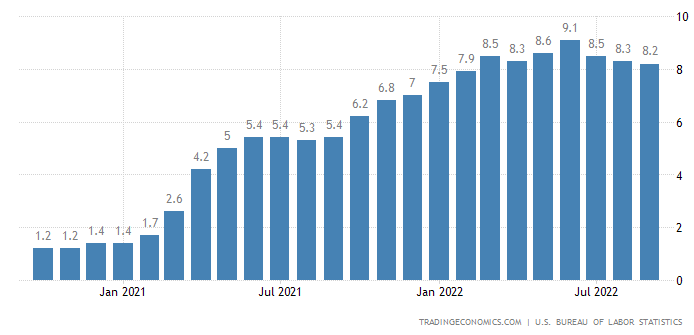

You’ve likely heard we have an inflation problem. The Fed targets a 2% inflation rate to promote healthy capital markets and a strong, functioning economy —under this lens, inflation today is clearly way too high.

US CPI Inflation Rate (%):

Taking a step back — why is inflation bad?

When prices rise higher than wages, general population purchasing power declines, and so to does quality of life. With 65% of Americans living paycheck to paycheck, households budgets are tight already and cannot afford higher prices for everyday goods and shelter. When most people can’t afford everyday necessities, civil unrest typically ensues.

How do we fix it?

Prices go up when demand for goods & services exceeds supply. Supply issues are (arguably) mostly out of our control, so the Fed has stepped in to reduce demand by raising interest rates. This destroys demand in two ways:

Wealth effect: Rising rates decrease asset values across equities (future cash flow is worth less), fixed income (older securities with lower rates become less attractive than newly issued with higher rates), and real estate (financing more expensive). Although real estate prices have a longer lag (sellers can be more patient), liquid securities like stocks and fixed income have lost an astronomical amount of value this year, dwarfing the drawdown of the Global Financial Crisis of 2008. When consumer net worth drops considerably, people feel poorer and spend much less.

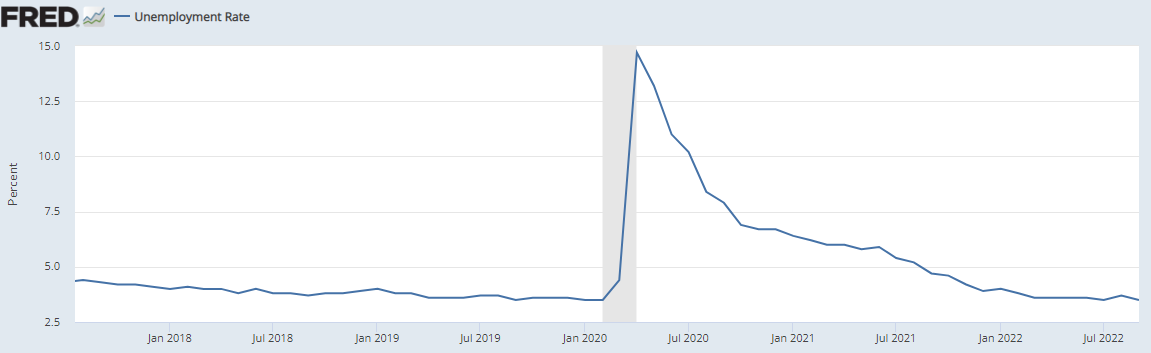

GDP/unemployment: When capital becomes more expensive, it becomes harder to finance growth (new companies, capital expenditures, business expansions, etc.), and the economy stalls and forces layoffs. Slower (or negative) GDP growth decreases total demand for goods and services.

Isn’t the cure just as bad as the disease?

Possibly, but there are two caveats. 1) If inflation spirals out of control into hyperinflation, the US economy and financial system could crash, and while unlikely, the government could collapse. It would then become a matter of national security and civil order — we definitely want to prevent this from happening. 2) The Fed hopes to engineer a “soft-landing” where inflation is tamed but the economy doesn’t stumble too much (or at all).

How did we get here anyway?

For the majority of 2021, as US inflation steadily climbed well above the Fed’s 2% target, leaders from both the Fed and Treasury repeated described the situation as “transitory”. Citing one-time shocks from COVID, they expected prices to come back down once the supply-chain normalized. But in November of 2021 their tone changed, attributing inflation to factors that are “expected to be transitory”. The slight change in language signaled a hawkish turn to the market, which peaked that month.

Nasdaq Performance:

By December 2021 the word “transitory” had been removed completely from the Fed’s rhetoric — and it finally took action in March 2022 by hiking rates 25bps. The Fed has since raised rates four times for a total of 275 bps, and a 75bp hike is expected to be announced on 11/2.

Federal Funds Rate:

Whether inflation was driven by supply shocks from COVID and the Ukraine war, or is simply a result of excessive money printing remains to be seen. The bottom line is the Fed is aggressively raising rates faster than anytime in recent history, myopically focusing on lowering the CPI inflation rate to its 2% target.

Is the Fed acting too aggressively?

The short answer is — its very hard to know. Lagging economic indicators like CPI and wage inflation indicate inflation is still too high, and recent GDP and unemployment numbers suggest the economy is still strong enough to absorb more hikes.

CPI Inflation Rate (still too high):

Economy still strong:

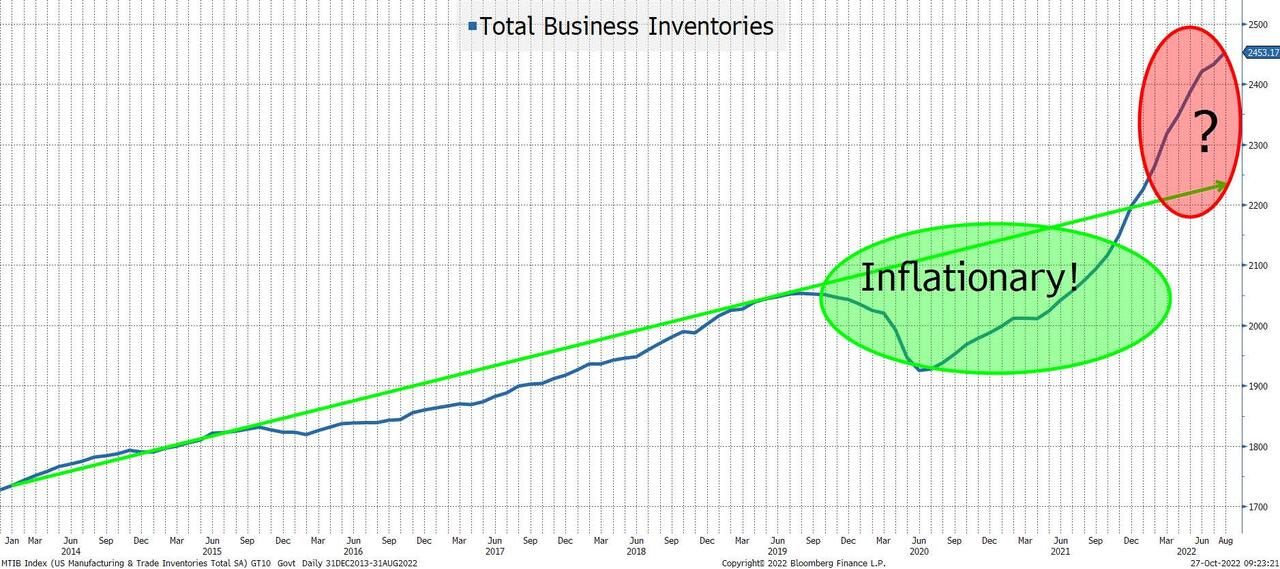

However, leading economic indicators (that illustrate expectations of the future), like the stock market, yield curve, business inventories, manufacturing orders, and commodity prices suggest future demand is already trending much lower, and therefore further hikes could have serious unintended consequences.

Recently inverted yield curve represents the market’s expectation of a recession

US Manufacturing PMI: survey indicating the direction of economic trends in the manufacturing and services sector. In October 2022 it reached its lowest levels since the initial COVID outbreak.

Dow Jones Commodity Index is down almost 20% from 2022 highs.

Lagging effects of rate hikes

The Fed has repeatedly stated the CPI inflation rate is their most important indicator, and will dictate the pace and extent of future hikes. However, most economists agree rate hikes take 9-18 months to fully impact the economy (takes time for negative wealth effects and slowing growth expectations to influence consumption/demand). The Fed is likely to raise rates by 75bps this week based on September CPI data — however assuming a 12-month lag (amortized evenly across), this data has only been impacted by 23% of total rate hikes this year. Therefore, there is a significant risk the Fed will destroy too much future economic demand, overshoot its 2% inflation target, and trigger a dangerous period of deflation.

Why deflation could be catastrophic — leverage

After decades of low rates and several financial crises, the global economy is levered at unprecedented levels today. Interestingly, the recent inflation surge has actually helped lower the global debt/GDP ratio by inflating nominal GDP. Deflation would have the opposite effect, and given the high debt levels today, the situation could quickly spiral out of control.

Moreover, YoY CPI comps start to get much easier this Spring

US CPI:

Looking at the actual CPI (not YoY growth), the index seems to have plateaued in June. However, even if we hold these price levels (no more inflation), it won’t be reflected in YoY growth until June 2023 — so it hardly seems like a telling indicator for the Fed to focus on.

The Fed has 400 Economics PhDs on payroll + have said they “look at all the data” — obviously they know all of this, right?

I hope so. Unfortunately, the Fed has a long history of waiting too long and overdoing policy. More recently they misunderstood inflation for most of 2021 and could be overcompensating for their mistake by being too hawkish now. Although the Fed is supposed to be independent, politics and ego unavoidably influence policy.

Inflation might not be so bad?

Given the lag effect, I believe the Fed should pause hikes for now to better understand the full extent of the demand destruction already done before continuing. Even if inflation runs moderately hot (4-6%) for the next 12 months, it might not be catastrophic for consumers, and it would definitely help lower our unsustainable debt levels.