OceanStream: The Financial Data Layer for $30T+ in Tokenized Assets

why traditional data providers are structurally incapable of serving the next generation of capital markets and how OceanStream is positioned to lead

I’m excited to announce the official launch of OceanStream, a product SQD Network & M31 Labs have quietly working on for several months, in close collaboration with former Bridgewater executive and serial entrepreneur Howie Altman. The team boasts a rare combination of crypto-native technical chops, decades of traditional financial market expertise, and elite professional sales execution. Together, we believe OceanStream will emerge as a core pillar of the global tokenized finance stack, and a key catalyst for driving sustained demand for SQD Network data, as trillions in traditional assets move onchain.

Why Financial Data?

“Blockchain-based capital market infrastructure is enhancing efficiency, liquidity and interoperability by enabling 24/7 asset movement, instant settlement and improved collateral mobility. With only $25 trillion of securities currently eligible for collateral use – out of a $230 trillion potential – tokenization could significantly expand liquidity and capital efficiency.”

The tokenization of real-world assets (RWAs),such as equities, fixed income, and real assets, unlocks several compelling benefits across financial efficiency, market access, and operational transparency:

Faster Settlement & Reduced Costs: T+0 or near-instant settlement via smart contracts reduces counterparty risk and slashes back-office costs by cutting out traditional intermediaries like custodians, clearing houses, and brokers.

Programmability & Composability: Smart contracts allow for automated enforcement of compliance rules, dividend distributions, and fund operations. Assets can be integrated into DeFi protocols (e.g., lending, staking) for superior capital efficiency.

Expanded Collateral Options: Tokenized RWAs can be used as collateral in DeFi, unlocking potentially $200T+ in new liquidity channels (see WEF quote below), bridging the gap between TradFi and crypto-native systems.

Liquidity Enhancement: Fractional ownership enables previously illiquid assets (like real estate or private credit) to be divided into smaller, tradable units. This broadens participation to smaller investors and increases secondary market activity.

24/7 Global Market Access: Tokenized assets can be traded on blockchain-based platforms around the clock, eliminating the constraints of traditional market hours. Investors worldwide can access the same asset pools without relying on centralized intermediaries.

Improved Transparency & Auditability: Ownership, transaction history, and asset data are immutable and visible on-chain, improving compliance and audit readiness. This reduces risk of fraud and enhances trust among investors.

Democratization of Investment: Enables access to high-value or traditionally exclusive assets (e.g., fine art, commercial real estate, venture debt), reducing geographic and wealth barriers to sophisticated asset classes.

Given the long list of benefits, and significant buy-in by institutions and regulators, its clear traditional financial assets are moving onchain.

Even the US Treasury is serious about blockchain adoption, giving a detailed presentation on the topic last October, noting that

“tokenization has the potential to unlock the benefits of programmable, interoperable ledgers to a wider array of legacy financial assets.”

Top traditional financial experts expect a large percentage of the world’s assets to move onchain by the end of this decade. Boston Consulting Group believes up to $23.4T in traditional assets could be tokenized by 2033.

source

While analyst estimates vary between $2T to $30T, its clear tokenization is real. It’s no longer a question if assets will move onchain, but rather how quickly it will happen.

source

Much of the RWA/tokenization narrative to-date has centered around the impact on TradFi institutions and DeFi protocols; but the second-order effects are often overlooked.

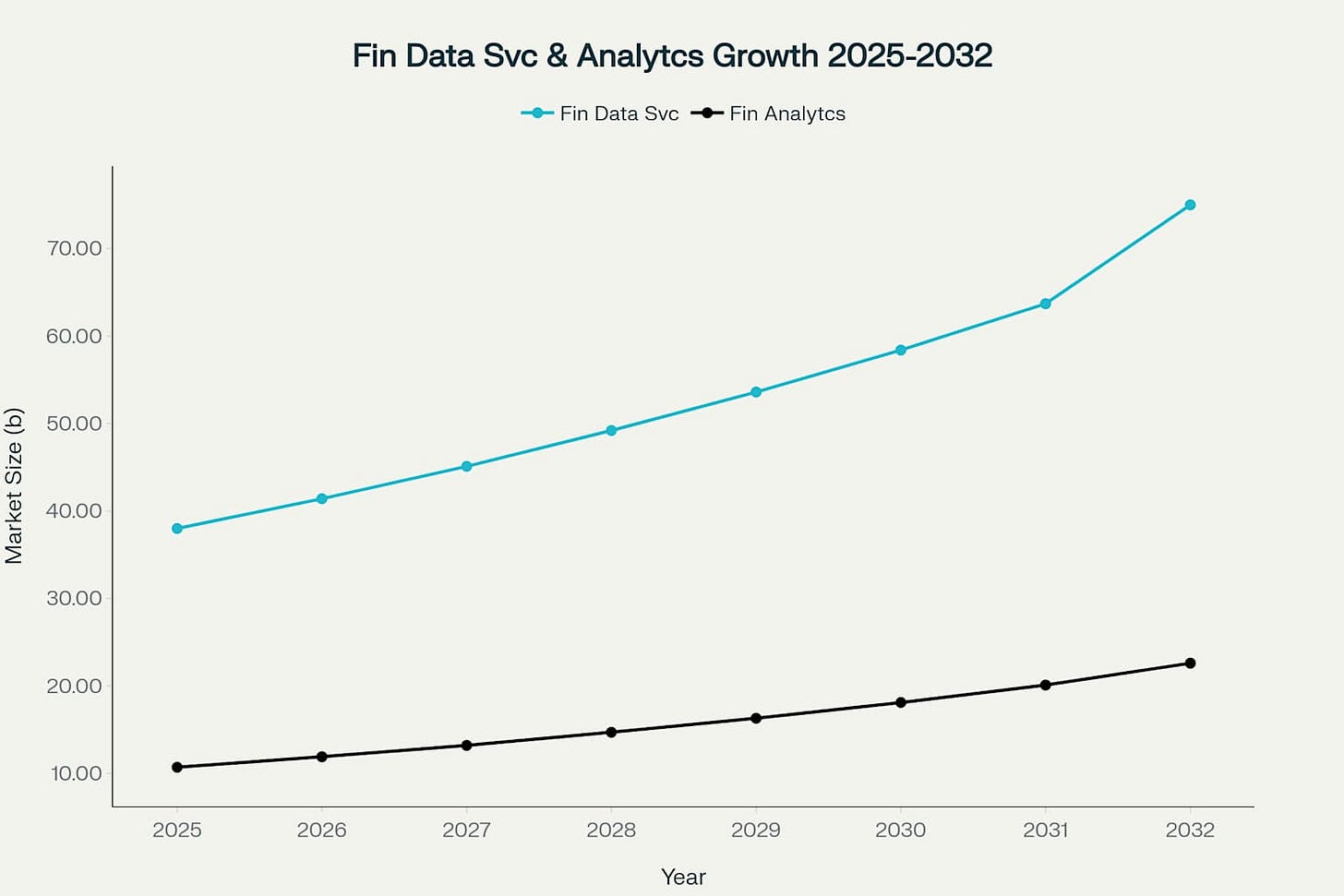

The financial data services & analytics markets, dominated by giants such as Bloomberg, Reuters, and S&P Global, are highly attractive industries, expected to reach a combined $100B by 2032.

Sources: financial data services, financial data analytics

These platforms all source their data from first-party providers such as stock exchanges, trading platforms, and interdealer brokers. Even if these first-party providers adopt blockchain infrastructure, they are no longer the owners and gate keepers of this data, disrupting the traditional financial data supply chain.

Suddenly, the opportunity is open for a new generation of first-party, blockchain-native data providers.

This is the gap OceanStream is designed to fill.

Why Now?

On the heels of the first crypto-friendly administration in the US, the tokenization of traditional assets has transitioned from experimental to operational, with significant developments across product launches, regulatory frameworks, and institutional adoption.

“The long-envisioned integration of traditional financial systems with blockchain technology is now becoming a reality.”

In just the past two months, we’ve witnessed a remarkable acceleration in institutional crypto adoption, one that even seasoned market observers didn’t fully anticipate. The RWA market alone has surged 260%, now surpassing $23 billion in value. BlackRock, Goldman, Schwab, and other TradFi giants are not piloting anymore, they are deploying.

Meanwhile, the regulatory tide has turned. The Trump administration is actively pushing for digital asset leadership, and the SEC’s new Crypto Task Force is shifting from an adversarial stance to a collaborative one. SAB 121 is gone. Banks can offer custody. Rails are being laid for a multi-trillion dollar onchain financial system.

All of this validates OceanStream’s core thesis, and makes its launch impeccably timed.

Institutional Product Launches:

Crypto ETFs

Since launching in January 2024, spot BTC ETFs have grown to nearly $150B in AUM, while ETH ETFs, launched later that year, reached >$10B by early 2025.

Top crypto ETF issuers include Blackrock, Grayscale, Fidelity, ARK Invest/21 Shares, and Bitwise.

Payments

PayPal launched its own stablecoin, PYUSD, expanded token offerings on PayPal and Venmo, and plans to enable merchant settlement in crypto by year-end.

Block (Square) remains focused on Bitcoin, offering trading via Cash App, investing in BTC for its treasury, and advancing Bitcoin mining and open-source development.

Visa is rolling out a tokenized asset platform on Ethereum, partnering with Bridge for stablecoin-linked cards, and enabling cross-border stablecoin payments.

Mastercard has launched over 100 crypto card programs and supports stablecoin transactions through its Crypto Credential initiative and new checkout integrations.

Plaid is enhancing its APIs to support crypto connectivity and emphasizes digital asset integration in its fintech strategy.

Stripe has reintroduced crypto payments with a focus on stablecoins, acquired infrastructure startup Bridge, and is testing global stablecoin tools for emerging markets.

Bank of America has also recently signaled interest in issuing a stablecoin.

Asset Management

Last year BlackRock launched BUIDL, a tokenized money market fund with nearly $2 billion in AUM, and recently filed to create a digital ledger technology (DLT) shares class for its $150 billion Treasury Trust fund.

Franklin Templeton offers an Onchain US Government Money Fund (FOBXX).

WisdomTree offers 13 tokenized funds spanning money markets, equities, and fixed income.

In partnership with Securitize, Apollo launched a tokenized feeder fund providing onchain access to its Diversified Credit Fund.

State Street is considering the establishment of tokenized bonds and money market funds.

“Every stock, every bond, every fund—every asset—can be tokenized. If they are, it will revolutionize investing.”

Investment Banking

This year Goldman Sachs plans to introduce 24/7 trading for tokenized US Treasury bonds and money market funds, and launch three tokenization projects.

Citigroup launched Citi Token Services to streamline cross-border payments and trade finance using blockchain.

Cantor Fitzgerald partnered with Tether, SoftBank, and Bitfinex to launch “Twenty One Capital,” a $3.6B Bitcoin investment firm, making it one of the largest corporate BTC holders.

Nomura continues building its digital asset presence through Laser Digital, investing in DeFi protocols, partnering with GFO-X for regulated derivatives, and piloting blockchain-based digital bond settlements in Japan.

Equity Brokers

Charles Schwab and E*TRADE, who have a combined $12T in assets under management (AUM), recently announced they will start offering crypto trading services by 2026.

They join Fidelity, $15T AUM, who has offered crypto services since 2018 but has been significantly expanding its offerings in 2025.

Crypto Exchanges

In April 2025, Kraken launched commission-free trading for over 11,000 U.S.-listed stocks and ETFs. The move follows Kraken's $1.5 billion acquisition of retail futures platform NinjaTrader, signaling its ambition to merge traditional and crypto financial services.

In February 2025, Crypto.com introduced trading for stocks and ETFs, expanding its services beyond cryptocurrencies.

Coinbase is also actively exploring the integration of traditional financial instruments with blockchain technology through initiatives like tokenized securities.

“The point is, with crypto the line between these categories is blurring…In the updated financial system, you will have a single primary financial account which serves all these functions. A greater % of global GDP will run on more efficient crypto rails over time. We'll have sound money, lower friction transactions, and greater economic freedom for all.”

Regulatory Developments:

SEC's Consideration of a Regulatory Sandbox: The SEC is contemplating a "regulatory sandbox" to allow crypto exchanges to experiment with tokenized securities, potentially enabling platforms like Coinbase to explore offering tokenized securities alongside existing crypto offerings. (source)

Robinhood Advocating Regulatory Reform: Robinhood is urging the SEC to revise custody, registration, and trading rules (SPBD, SAB 121, Reg A/CF) to foster tokenization. They specifically want a federal token-securities framework, ability for broker-dealers to custody & trade tokens, use of ATS or national exchanges for tokens, and streamlined 24/7 settlement, enabled by blockchain. (source)

Ondo Finance's Engagement with the SEC: Ondo Finance met with the SEC's Crypto Task Force to discuss regulatory pathways for tokenized versions of publicly traded US securities, focusing on structuring options and compliance considerations (source)

FIT21 Act: Passed by the House in May 2024, the Financial Innovation and Technology for the 21st Century Act aims to provide regulatory clarity for digital assets, defining responsibilities between the CFTC and SEC. (source)

FDIC's Policy Shift: The FDIC issued new guidance clarifying that FDIC-supervised banks may engage in crypto-asset and blockchain activities without prior approval, provided risks are managed appropriately.

Research & Market Insights:

World Economic Forum (WEF): Tokenization could significantly expand liquidity and capital efficiency, with only $25 trillion of securities currently eligible for collateral use out of a $230 trillion potential. (source)

McKinsey's Analysis: McKinsey highlighted the transition of tokenized financial assets from pilot to at-scale deployment, noting early examples of platforms transacting trillions of dollars of assets on-chain per month. (source)

Citi's Perspective: Citi emphasized the potential of tokenization to reshape financial services through smart contracts and automation, facilitating a shift to 24/7 finance. (source)

These developments illustrate the accelerating integration of blockchain technology into traditional financial systems, signaling a transformative period for asset management and regulatory frameworks.

Why OceanStream Wins

So why do we believe OceanStream will lead this emerging market?

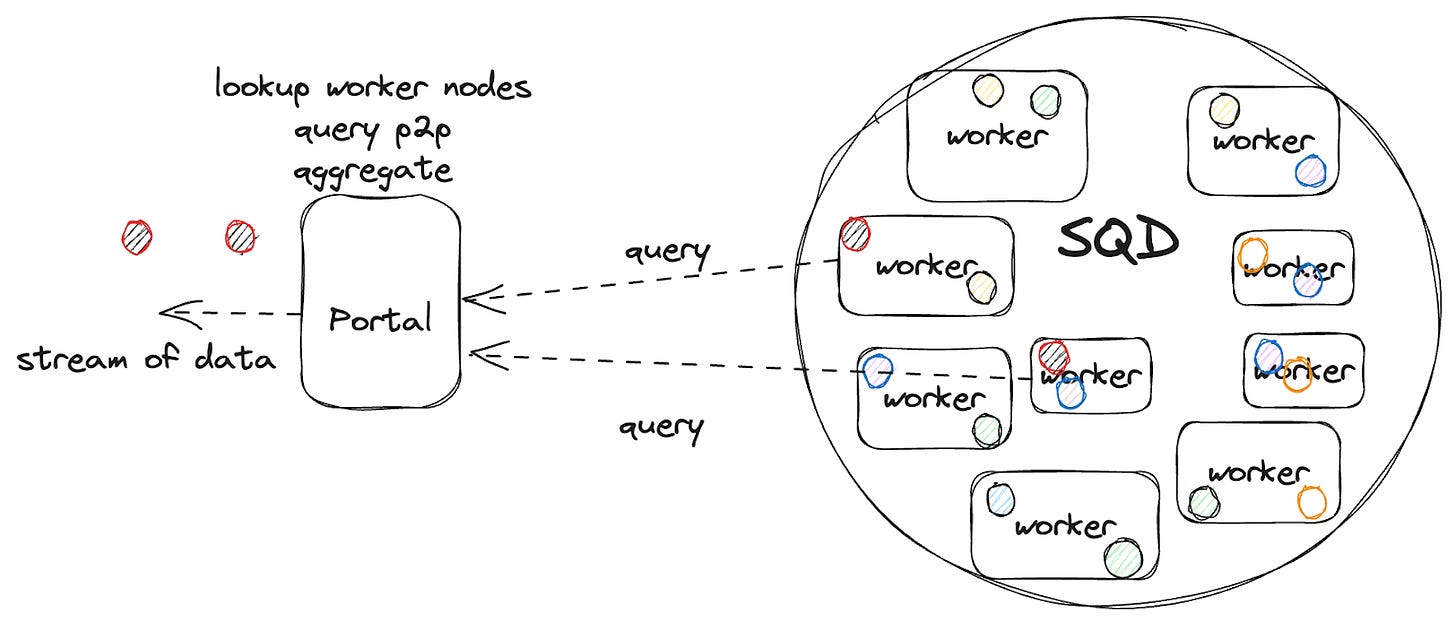

It starts with SQD Network’s structural advantage.

Most existing blockchain data providers are built on static, RPC-based architectures, fast enough for block explorers, but insufficient for institutional-grade tokenized markets.

OceanStream leverages SQD’s modular, high-performance data processing pipeline:

Separation of Extraction, Transformation, and Storage: Each stage is independently optimized for scale and reliability.

Customizable Indexers & Processors: Tailored to specific institutional use cases and asset classes.

Open-source architecture: Rapid innovation cycles and community-driven onboarding of new data sources.

Distributed trust model: No centralized attack surfaces, a critical requirement for financial market adoption.

Upcoming enhancements: TEE and ZK verification will further cement SQD’s lead by offering unparalleled privacy, security, and compliance guarantees, key prerequisites for landing large institutional deals:

“In the banking sector, data security and privacy have become critical in an era of growing data breaches and strict rules. Organizations are making significant investments in services that guarantee adherence to laws such as the CCPA and GDPR, giving top priority to measures that protect confidential financial data. Demand for financial data services that include strong security measures, such as encryption and access controls, to fend off cyberattacks is fueled by this increased emphasis on security.”

Ride the Wave

The institutional tokenization wave is happening now, and it is moving faster than most predicted.

OceanStream is entering the market at exactly the right inflection point:

Legacy data providers were built for yesterday’s markets.

New tokenized markets demand a blockchain-native data stack.

SQD Network offers the only architecture designed from first principles to serve this future.

This is no longer about if tokenization will scale.

It is happening.

The question is: who will provide the data infrastructure layer to power it?

OceanStream is positioned to lead.

As we scale the product and execute our GTM roadmap, we’re actively exploring partnerships with Web3 projects, TradFi institutions, fintechs, and forward-leaning enterprises. If you or your organization would like to collaborate, feel free to reach out to me directly at david@m31.capital.

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies that support individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital