After a record year for the fund (+204%), I have some exciting news to share: Omnichain Capital has entered into a strategic partnership with M31 Capital in a multi-phased process that will ultimately result in a formal asset merger later this year. This post will explain what the partnership means, why we chose to go this route, and future implications.

Partnership structure

I will initially continue managing Omnichain Capital as an employee of M31 Capital, leveraging their global investment platform & institutional-grade resources. Over time, Omnichain’s assets will merge with M31’s Web3 Opportunity Fund and I will manage the combined entity, executing the same investment strategy.

Why M31

Aligned investment thesis & strategy: M31 discovered Omnichain through our Substack and immediately recognized the strong similarities in web3 vision and investment strategy. We both have a sharp focus on underlying tech fundamentals & long-term TAM opportunities and are less concerned with short-term volatility.

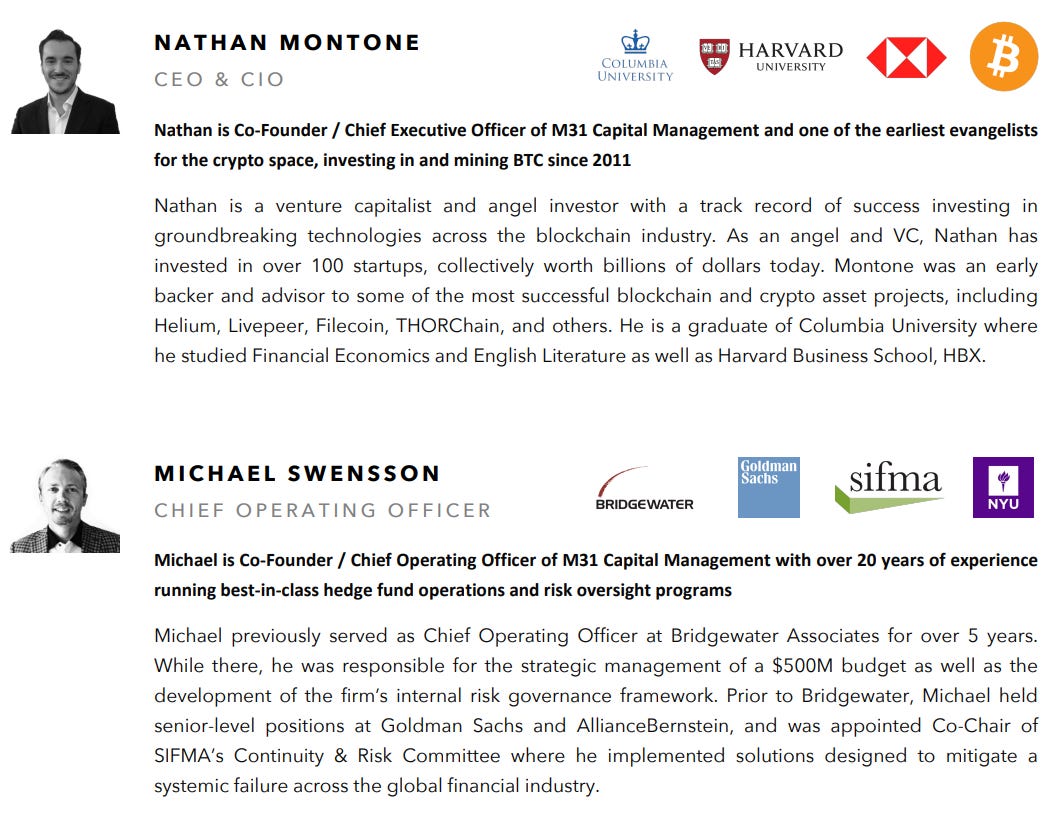

Seasoned leadership: We’ve gotten to know CEO/CIO Nathan Montone and COO Michael Swensson well over the past few months and have been especially impressed with their work-ethic, values, passion for web3 tech, and ambition to build M31 into a leading global crypto investment firm. They both bring unique experiences and attributes to the table – Nathan has been investing in the space since 2011 and has a deep understanding of crypto technology and markets, while Michael has over two decades of traditional finance experience, specifically focused on fund operations and risk management. We believe our research thought-leadership and successful investment experience will be perfect complements to what Nathan and Michael have built to date.

Strong focus on security & compliance: Given Michael’s extensive background with top asset managers in traditional finance, he understands the incredible importance of risk management and regulatory compliance. He has created comprehensive formal procedures for counterparty diligence and oversight, portfolio risk exposures, the investment committee process, and investor KYC/AML diligence.

Long-term industry track record: Although the fund was founded in 2020, Nathan has been successfully investing in the asset class since 2011 and has operated mining rigs and other crypto nodes since 2014. The team also successfully navigated the disastrous events of 2022, a testament to their institutional-grade operations & procedures.

Moving forward

Nothing will change in terms of my investment strategy, sector focus, or substack research - I will continue to post ideas I think others will find unique & interesting. (My next post will be co-published with CoinDesk on Jan 10, and will explore web3’s AI supply-chain & competitive landscape)

M31 actively participates in VC deals as well, so please reach out on twitter (@atterX_) if you’re raising capital for differentiated web3 startups in the infrastructure, middleware, compute, and/or AI space.

Lastly, I’ll be spending a good amount of time in Dubai as part of M31’s Middle Eastern expansion, so feel free to reach out if you’re ever in the area.

About Omnichain Capital LLC

Omnichain Capital was founded in 2021 and manages a portfolio of liquid tokens focused on web3 infrastructure. The firm’s fundamental approach combines technical expertise in crypto and data networking with professional investment experience in both early stage and liquid assets.

Website: Omnichain Capital

Twitter: David Attermann (@atterX_)

Substack: Omnichain Observations | Substack

About M31 Capital Management LLC

M31 Capital is a global investment firm dedicated exclusively to blockchain technology. Since 2011, the Firm has been an early investor in more than one hundred companies, tokens, DAOs, and projects leveraging blockchain technology. Today, the Firm is privileged to manage institutional-grade Hedge Funds, Venture Funds, & Index Funds for some of the top investors in the world.

Website: M31 Capital | Global Investment Firm

Twitter: M31 Capital (@M31Capital)

Substack: M31 Capital | Substack