Disclosure: Omnichain Capital may have positions in tokens mentioned below. This analysis is meant for informational purposes only and should not be considered investment advice.

Philosophy of Financial Modeling

Financial modeling can be a valuable tool for investors trying to quantify the upside of a particular thesis. These models vary wildly across company lifecycles, so its important to understand their nuances and limitations. VCs may create a 10-year forecast for an entirely new industry, PE analysts work on 5-7 year LBO (leverage buyout) models, while HF analysts typically focus on highly detailed quarterly EPS models. I’ve been fortunate enough to work professionally in all three segments, and I’ve learned what really matters for each. I believe liquid token analysis is most like VC — forecasting long-term metrics requires creativity, since these markets are new, tech is continuously advancing, and business models are rapidly changing. Even a more established network like Ethereum, with ~7 years of historical on-chain data, is tricky to forecast through 2030:

Use-cases, applications, end-users, and UI/UX will be completely different

Fee dynamics to the consensus layer continue to evolve as the network shifts to a modular architecture

No agreed upon way to value blockchains right now — valuation methodologies will likely evolve (i.e. should investors focus on Ethereum security fees or the economic activity of applications built on top?)

Obsolescence risk; there is a non-zero chance that the Ethereum ecosystem fails to sufficiently scale throughput or establish composability across L2s

Financial models are said to be “garbage in, garbage out”; i.e. the quality of the output is only as good as the quality of the inputs (assumptions). With longer-term models especially, more assumptions = lower probability of accuracy. With this in mind, and a long-term focus, I like to keep my web3 forecasts as simple as possible, using minimal assumptions that I can get reasonably comfortable with. I’m less interested in the specific price output the model generates — the real value is understanding the assumptions you need to believe for the asset to justify its risk profile.

Similar to my article “An objective comparison of smart contract platforms”, the purpose of this exercise is to illustrate a framework (not shill a specific price target), and receive feedback on methodology, assumptions, and general logic. I’m much more interested in making money than being right.

Chainlink Valuation

I’ve previously written about Chainlink (Chainlink’s endgame: beyond data feeds), specifically its evolution from oracle to full-service middleware provider. Although many of its newer products & services have yet to materially roll-out yet, the model below explores what the operating metrics could look by 2030 in a bullish scenario. Given the new LINK 2.0 tokenomics, which shares network revenue between the supply-side and stakers, I believe Chainlink can be valued on future staker cash flow (aka “contribution margin”).

Chainlink TAM (Total Addressable Market)

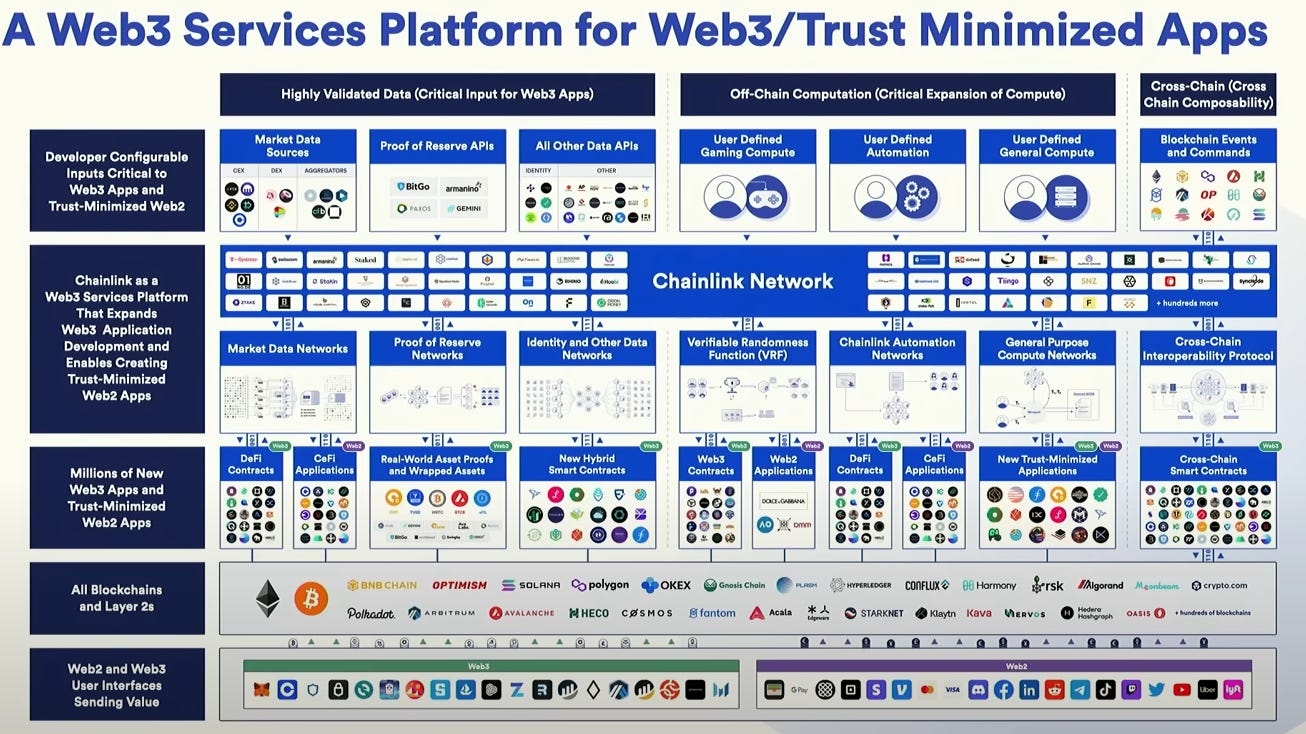

Chainlink’s technology enables the decentralized flow of data from blockchain to off-chain, off-chain to blockchain, and blockchain A to blockchain B. Although mostly associated with the DeFi end-market, Chainlink aspires to offer middleware products for all industries and applications in web3:

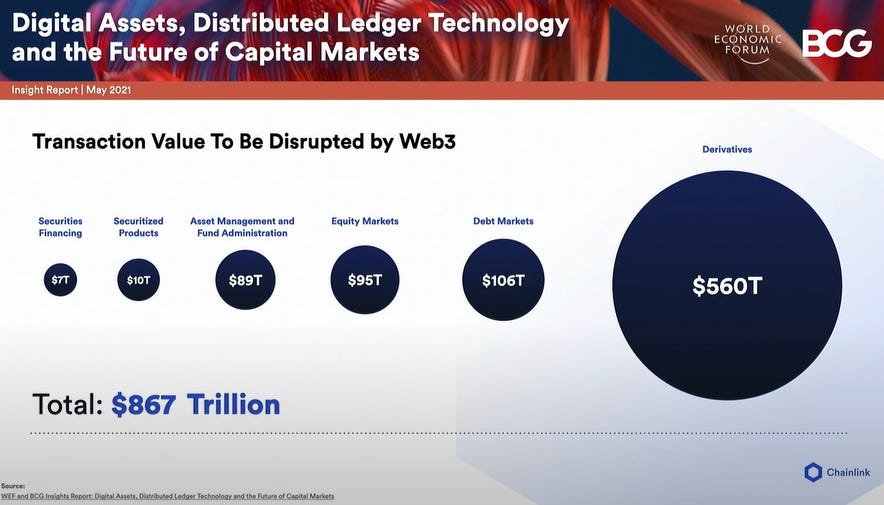

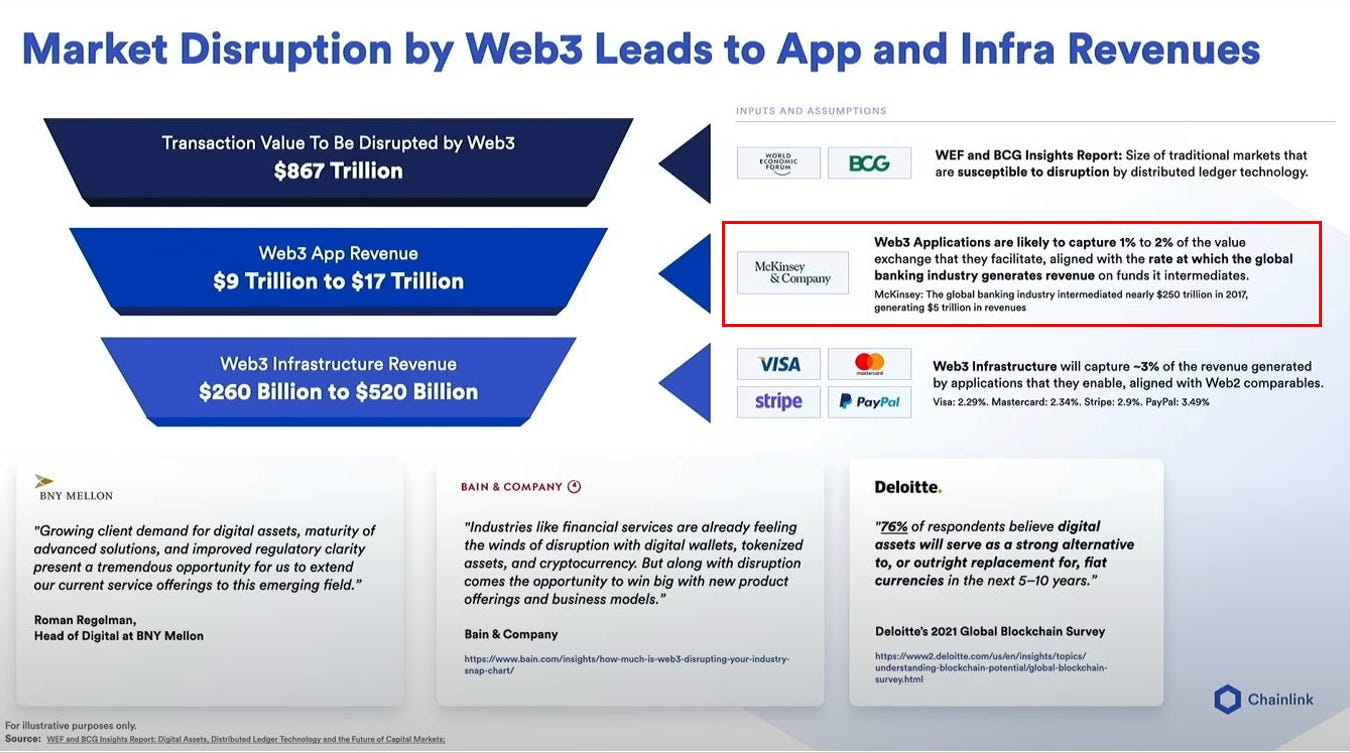

In an effort to keep this model simple and more conservative, I only use capital markets for my TAM analysis. According to the World Economic Forum (WEF) and Boston Consulting Group (BCG), this represents a nearly one quadrillion dollar opportunity for web3…

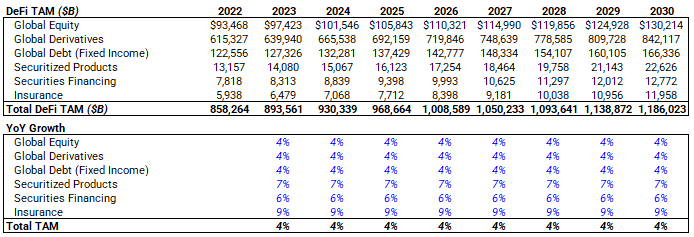

To calculate DeFi’s potential TAM, we sum the total global market valuations across asset classes, forecasted out to 2030.

(sources: WFE, BIS, BusinessWire, WEF, BCG, Eric Wallach)

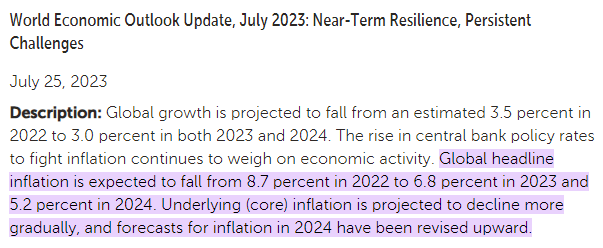

This results in a TAM of $1,186T by 2030; but is our 4% CAGR from 2023-2030 too aggressive? Given global inflation is still mid-to-high single digits (below), we believe these growth assumptions are fair (markets should grow by at least inflation each year).

(International Monetary Fund)

Web3 TAM Penetration

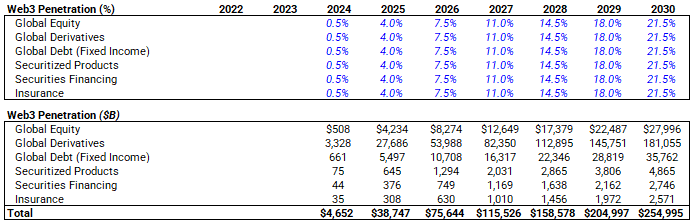

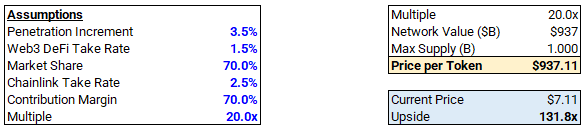

What could web3 penetration look like? I assume a 0.5% market share across all assets in 2024, increasing by 3.5% increments (350bps) each year. Is this too aggressive? We end with ~20% penetration by 2030, which seems reasonable for a bull scenario.

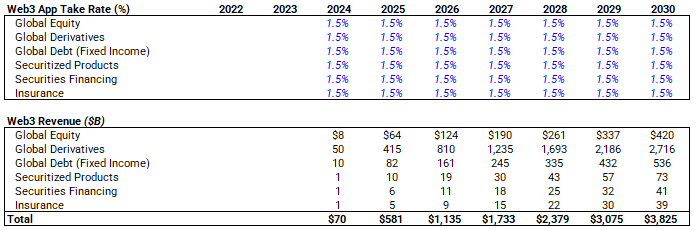

Web3 Application Take Rate & Revenue

How much money will web3 apps make servicing these assets? McKinsey & Co. believes these applications will earn 1%-2% on the value exchange they facilitate (below); we therefore use the midpoint (1.5%). Because we’re modeling asset value, not transaction volume (which is typically much higher), we believe this assumption is sufficiently conservative.

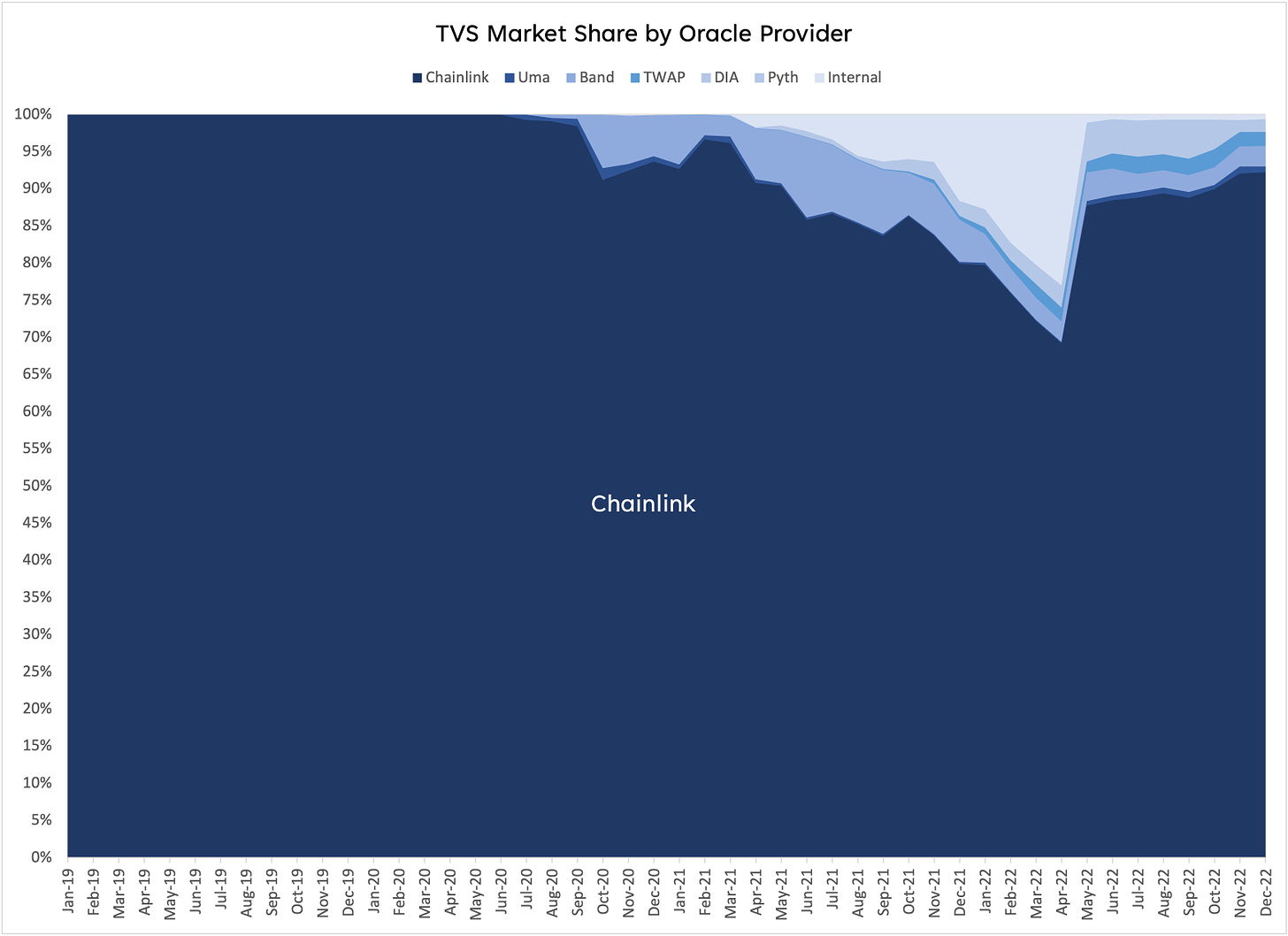

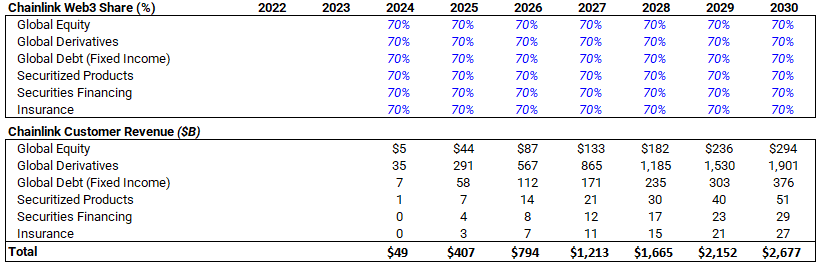

Chainlink Market Share

Chainlink ended 2022 with ~90% market share of oracle services. Given its product stickiness and network effects (adding more middleware products & services from the platform doesn’t increase trust assumptions), we believe Chainlink will become the de facto DeFi (if not total web3) middleware platform. We therefore think its reasonable to expect it can hold a 70% share through 2030.

(h/t Eric Wallach)

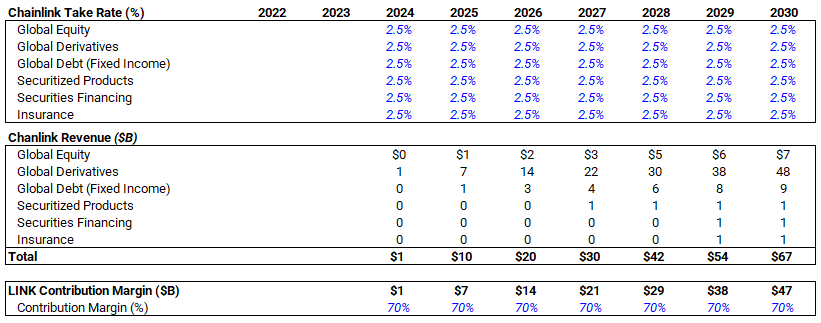

Chainlink Take Rate & Cash Flow

Chainlink can be thought of as a B2B service provider; we therefore believe the best way to forecast potential revenue is to apply a take rate to its customer’s revenue. Similar services charge 2.5%-3.5% in web2; we use 2.5% to be conservative.

For context, Chainlink recently entered an agreement with GMX (leading decentralized perps exchange) to supply price feeds in exchange for 1.2% of the fees generated by GMX v2:

We think the future take rate has the potential to be much higher as Chainlink builds out its product portfolio to upsell to its existing large customer base. If most customers end up using multiple middleware services (including upside from the BUILD program not baked into the model), the take-rate will likely be materially higher.

As mentioned earlier, Chainlink has been rolling out staking functionality — this will allow holders to stake their LINK to the network in order to earn a share of profits.

Staker profit (contribution margin) = Chainlink revenue - supply-side costs (depends on specific product/service)

Typical software businesses have 40% EBITDA (cash flow) margins, but 80-90% gross margins (similar to contribution margin), so we assume 70% for LINK stakers. Margin has been a point of contention in the past for Chainlink (bears pointing to its history of customer subsidies and low profitability), but we don’t believe early stage profitability (especially in a new industry) should be extrapolated to forecast the next 5-10 years. As blockchains become cheaper and more efficient, new Chainlink products are adopted, and the industry matures as a whole, we believe 80%-90% contribution margins are possible.

Valuation Sensitivities

Applying a 20x multiple to 2030 staker cash flow, the model yields an upside target of $932 (~130x from today’s price). As mentioned earlier, the exact number isn’t important (most of you will disagree with my assumptions anyway).

However, as you can see in the sensitivity tables below, even with much more conservative assumptions, investors can yield highly attractive returns.

(LINK price as of 8/7/23)

Takeaway

To be very clear: we are not saying LINK should be worth $1T today. But, given (what we believe to be) reasonable assumptions in a bullish scenario, there seems to be a logical path to significant price appreciation.

Feedback is more than welcome — this is meant to be a discussion.

h/t: Eric Wallach — check out his substack (link) for a deeper analysis of on-chain metrics