Terra-bly Unstable

Both UST & USD are the same type of faith-based ponzi. Which is why the collapse of Terra exposes the fate of every fiat currency: stable until it isn’t

The implosion of Terra's LUNA & UST tokens sent shockwaves through the industry, $60bn of market cap evaporated in about 48 hours, and the full extent of the damage is TBD.

The trigger was a Soros-style attack that broke the 1:1 peg between UST and USD, causing mass redemptions of UST which sent LUNA price into a death spiral as LUNA supply hyperinflated 2,000,000%, reaching 6.5 Trillion in just days.

For more detail on the mechanics of the death spiral, see our May 13th Weekly Airdrop.

M31 Capital's risk management parameters limit our maximum exposure to any one blockchain for this exact reason.

Crypto funds who "diversified" their holdings across the Terra blockchain went bust overnight because of their single-chain exposure. Many individuals lost their entire life savings, and some took their own lives.

It was a tragic event that many are comparing to the crash of Lehman Brothers. But the comparison is off. Terra & UST were never systemically important to the crypto space.

By unbelievable coincidence, both were exactly a $40bn market cap that evaporated overnight and yes, it's true that both of their collapses sped up regulation efforts and slowed down investor enthusiasm for a while.

But Terra's explosion was much more like another faith-based stablecoin with a ponzi-like design: The U.S. Dollar

UST & USD

Viewed objectively, what happened with Terra was a fascinating case study in financial engineering. It was 1,000 years of monetary history condensed into 12 months, and it sheds helpful light on the fate of the U.S. Dollar.

For starters, if all you've heard about Terra is that it's a ponzi, ask yourself why & how it's any different than USD:

Weak Structure:

Both are stablecoins

Neither are backed by a hard asset

Both have expansionary, unknown, & erratic supply schedules

Neither can survive if people stop believing or trusting in it

Both require growth to survive or else they die

Ponzinomic Design:

High yield on Terra's primary platform, Anchor, is needed to drive demand for UST, which drives price appreciation of LUNA, which drives demand for UST.

Otherwise, death spiral.

In the United States, high asset prices are needed to drive consumer spending, which drives GDP, which drives higher asset prices.

Otherwise, death spiral.

Unsustainable Mechanics:

When trust in USD starts to fall, the Federal Reserve needs to intervene

Quantitative Easing: rate cuts, asset purchases, $ printing, etc.

When trust in UST starts to fall, Do Kwon & LFG needed to intervene

"Kwontitative" Easing: BTC-backing, peg-defense, etc.

Both are ultimately a confidence game, which is why UST exposes the fate of every fiat currency.

Stable until it isn’t. Life of a turkey.

What to Focus On

After a brutal month like May, many are quick to throw the decentralization baby out with the bathwater. But that mistake allows investors like M31 Capital to buy the highest quality projects at enormous discounts.

We focus on token projects that are solving real world problems, growing MAUs, increasing revenue, trading at reasonable if not cheap valuations, and are supporting the goals of self-sovereignty. Yes, they exist:

Real World Use Cases (HNT)

Helium's HIP-51 aims to transition the protocol to a modular blockchain that can support more decentralized networks like Wi-Fi, 5G, LoRaWAN, VPNs, etc.

There are currently more than 850,000 hotspots around the world participating in the Helium network, collectively earning ~$4m/month.

Increasing Network Usage (LPT)

Livepeer is on track for a 6th consecutive quarter of network usage all-time highs. Used by both Web2 & Web3 projects because it's 10x cheaper than Amazon Web Services, Livepeer has already transcoded over 38 million minutes of video and earned over $450k in protocol revenue.

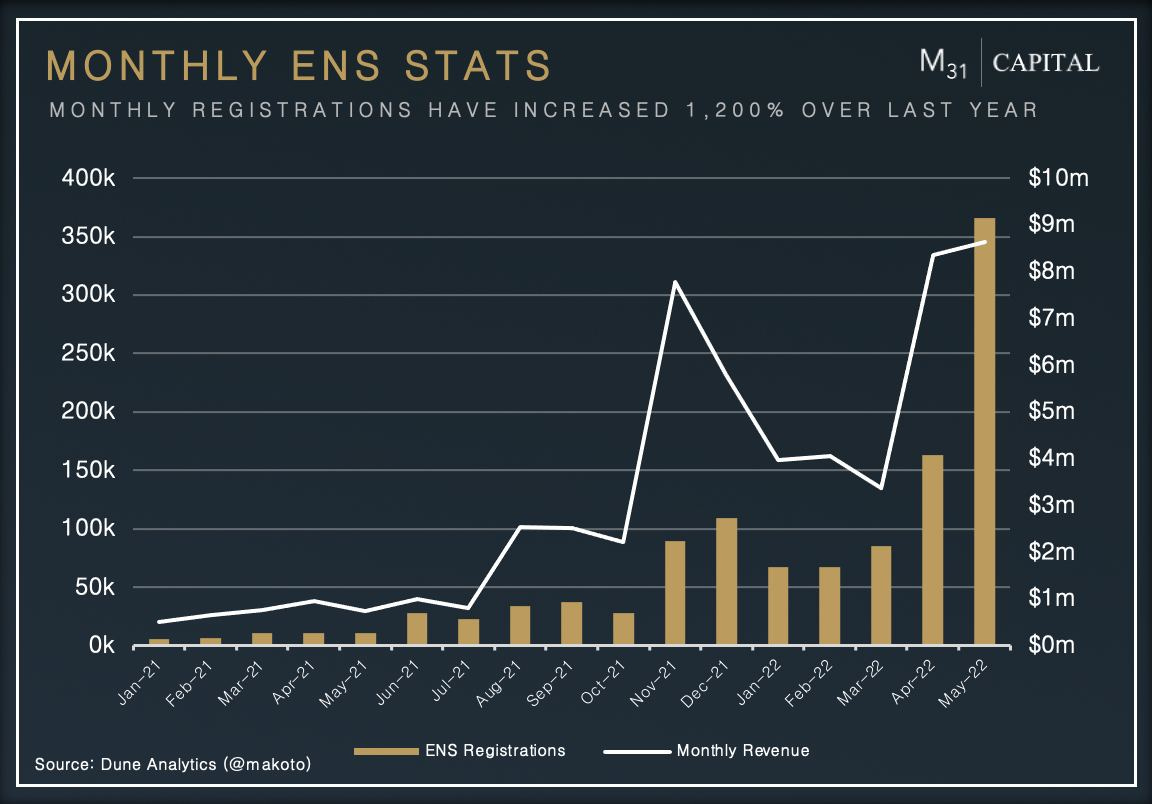

Revenue Generation (ENS)

Ethereum Name Service surged as a result of a sudden burst in ENS domain registrations recently. In the last week, registrations increased by 548% and revenue has grown 1,300%.

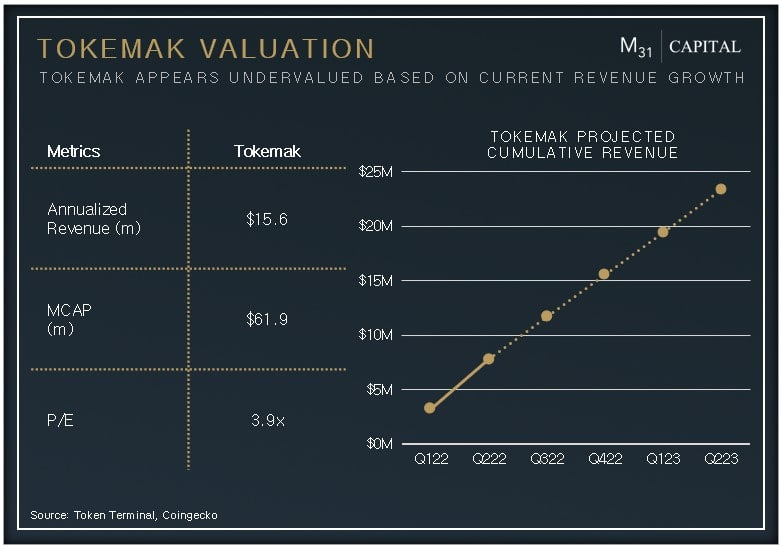

Undervaluation (TOKE)

Tokemak generates ~$4.5m in monthly revenue with just 20% of its TVL deployed. At 50%, the protocol would earn ~$130m/yr.

A conservative 10x P/E multiple would price TOKE at a $1.3bn valuation, or 20.9x higher than its market cap today.

Immunity from Macro (AR)

Intuitively, Web3 infrastructure like file storage technology should be less correlated to Central Bank rate hike decisions.

Arweave daily usage hit an all-time high, ~900GB of data was uploaded onto the network in the last few days. The protocol has generated $1.6m in revenue over the last 3 months.

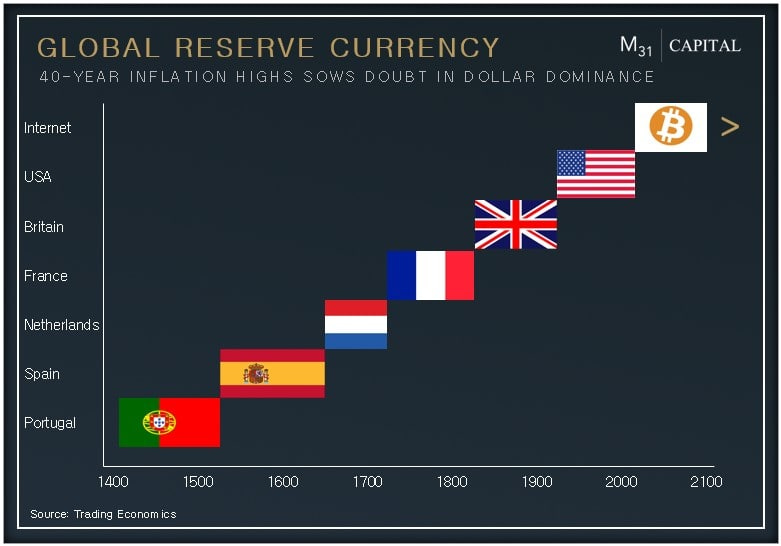

Self-Sovereignty (BTC)

Last, but not least, M31 Capital supports assets that promotes individual sovereignty.

In a time of increasing global instability and decreasing confidence in our leaders and institutions, the importance of stable, sound money governed by the unchanging physical laws of the universe (energy, mathematics) rather than the erratic whims of Putin & Powell, cannot be overstated.

Since its founding in 2009, there has never been a more critical time to own BTC for yourself and your family.

Conclusion

The Terra situation is unfortunate for those affected, but it is simply a distraction from the truth that Bitcoin is the most revolutionary asset in history and is ushering in similar revolutions in finance (DeFi) and technology (Web3).

Investors who remain focused on serious projects solving serious problems like the ones above will be rewarded with generational gains made in the cycle to come.

The LUNA / UST wealth destruction event cost investors and savers $60bn and some of them their lives. How much worse will it be when it’s the entire multi-hundred-Trillion dollar fiat money system?

This is why moving to a hard money Bitcoin standard as quickly as possible is so important and why we've devoted our lives and our careers to advocating for it.

What We’re Reading

Age of Discord II (Peter Turchin)

DeFi's Invisible Revolution (Messari)

How Printing Money Creates Communism (Mark E. Jeftovic)

What's the Carbon Footprint of Fiat (Peter St. Onge)

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies that support individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital