The Federal Reverse

The Fed wants to create a recession in order to fight the inflation it created to avoid a recession.

I honestly don't know how to make this not sound sarcastic, but here is the state of American monetary policy today:

The Fed wants to create a recession in order to fight the inflation it created to avoid a recession.

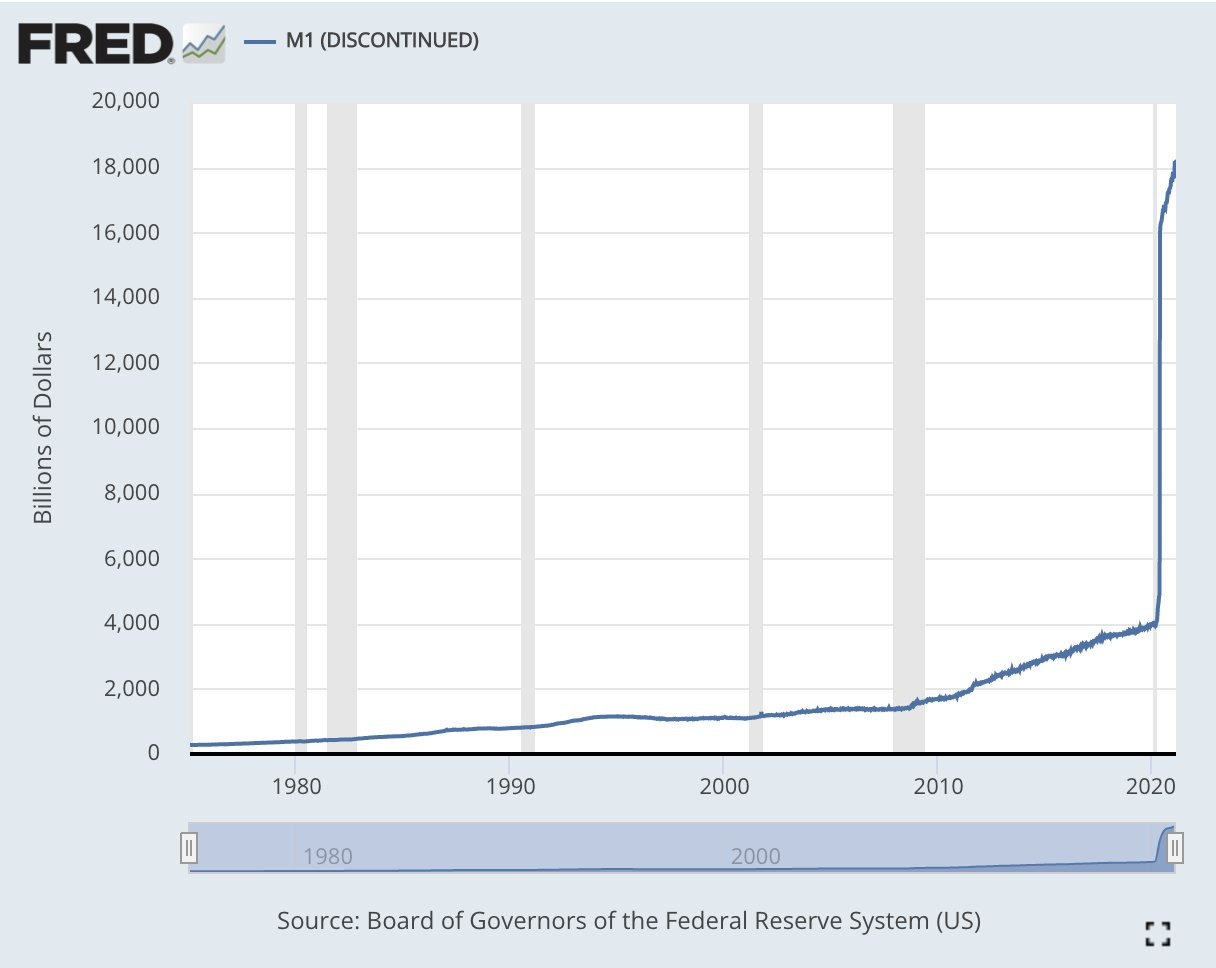

>> The Pump: The Fed spent 2 years printing an ungodly amount of money out of thin air and shoveling it into the hands of a very small number of already-rich individuals, raising the cost of living enormously for everyone else, and wildly exacerbating wealth disparity, all the while assuring us that printing trillions of dollars would NOT cause inflation.

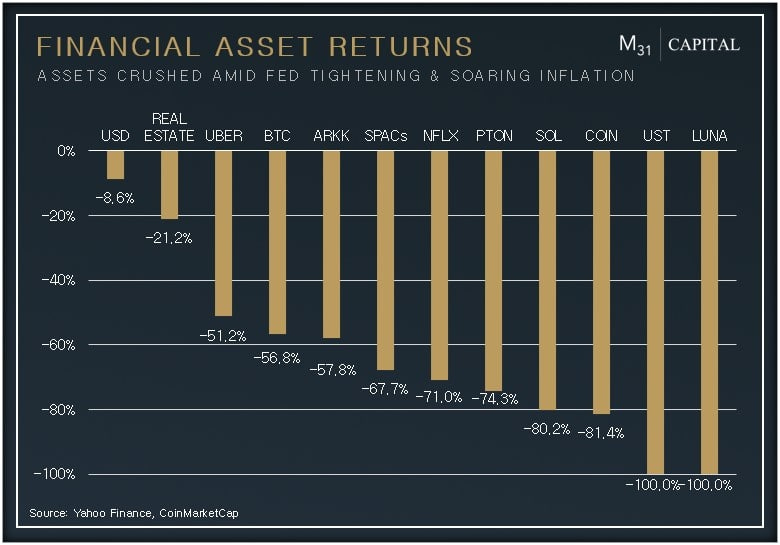

>> The Dump: Then they pivot on a dime and rug the entire global economy. Gaslighting us with fresh commitments to fighting the inflation they said didn’t exist, aggressively hiking rates, and becoming the largest global asset seller, sending every asset class on earth down -50% to -80%. Destroying trillions of dollars of retirement funds, innovation funding, and personal savings for millions in the process.

Every Bitcoiner, Austrian Economist, and human being with a modicum of common sense is looking for an answer to the logical follow-up question: WTF??

Why print all the money in the first place? How is it not a pump and dump when a small group of individuals intentionally inflates asset prices and then intentionally crashes those asset prices? And what happens if they're successful in creating a recession? Won't they then fire up the money printer to "save" us and we're back to where we started?

Neither the recent bull market nor the current bear market were the result of organic market forces, supply/demand factors, or the seasonality of natural business cycles... the market rallied because the Fed decided to inject it with artificial stimulus and crashed because the Fed decided to artificially raise rates.

Good thing they sold all their stocks at the peak to avoid "conflicts of interest"...

All Hail The "Experts"

Rug Pull, Pump & Dump, Exit Scam, Monetary Policy... whatever you want to call it, it's a strange way to manage the global economy...

And a wild amount of power in the hands of 12 people almost no one knows the names of, flipping the 'Economy On / Economy Off' switch like a lighting technician at a rave.

Which might not be so bad if they were at least getting it right, but they appear to be more clueless than everyone else!

Yellen (1 year ago): "Inflation will be transitory"

Yellen (this month): "I was wrong about the path inflation would take"

Powell (last month): "We'll execute a soft landing for the economy"

Powell (this month): "Unlikely we'll be able to manage a soft landing"

It's not comforting that every warm body with a preschool diploma saw this coming before the 400+ PhDs at the Federal Reserve. No wonder trust in our institutions is crumbling.

At M31, we were screaming about this over a year ago in our August newsletter -

Inflation: Temporarily Permanent

And whether the Fed's narrative shift is via intention (gaslighting) or incompetence (drinking too much of their own MMT Kool-Aid), the impact is the same: diminished trust in our institutions.

Here's what I know for sure about America's discretionary monetary policy, however:

We let the Federal Reserve print trillions of dollars and what happened?

>> Elon Musk got 10x wealthier and groceries got 2x more expensive.

Then we let them flip 180 in the great Federal Reverse of 2022 and destroy trillions of dollars and what happened?

>> Life savings were wiped out and we entered a global recession. And groceries are still 2x more expensive.

Centralized, opaque, human emotion driven monetary policy is destined to fail for the same reason the centralized, opaque, human emotion driven CeFi companies fail: Hubris.

"WE UNDERSTAND BETTER HOW LITTLE WE UNDERSTAND ABOUT INFLATION"

- Jerome Powell, June 2022

Conclusion

The Fed created inflation to combat a recession. Now they're creating a recession to combat inflation.

Reflecting on the last few years with the benefit of hindsight, what did we get out of all this monetary interventionism?

What did we achieve by letting a small group of individuals control the world's money supply, intentionally printing trillions of dollars only to intentionally destroy trillions of dollars?

There's the scorecard. You can decide if that's a game you want to continue playing.

But if June showed us anything, it's that a decentralized, trustless financial system (DeFi) is more stable than a centralized, trust-based one (CeFi), and that a predictable, transparent, and programmatic monetary policy of a Bitcoin standard would be preferable to our current erratic, opaque, and schizophrenic monetary policy: the Federal Reverse.

What We’re Reading

Crypto Bear Market Retrospective (Tom Dunleavy)

The Network State (Balaji Srinivasan)

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies that support individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital