The Monthly Airdrop: April 2024

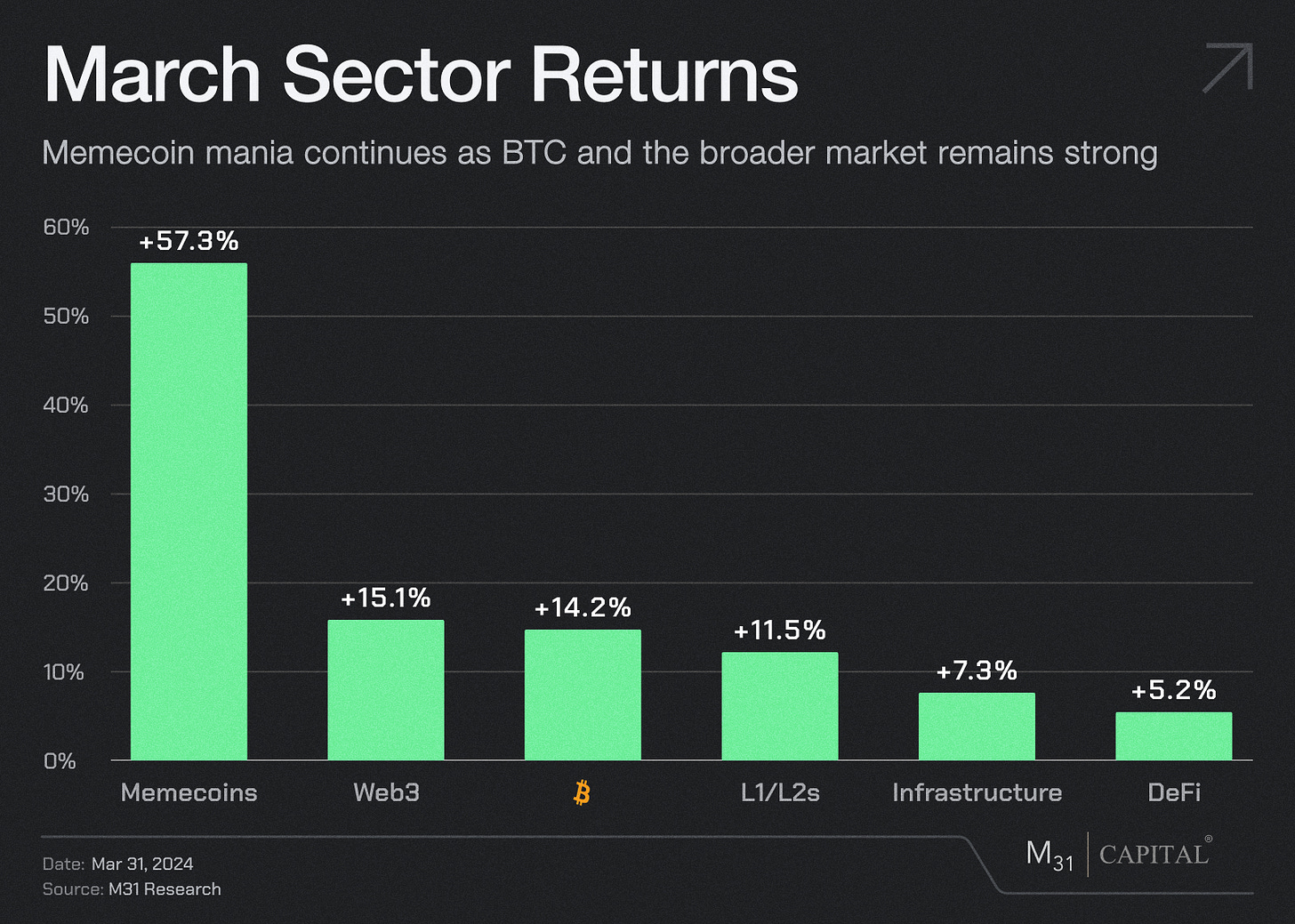

March Market (+11.1%) // BlackRock launches fund on Ethereum. Memecoins takeover the world. SBF sentenced to 25 years in prison.

Bitcoin sees strong rally +14.2% throughout the month, primarily driven by Bitcoin ETFs. The various ETFs experienced $111 billion in trading volume, nearly triple the $42 billion traded in February. Although there was a dip midmonth, inflows netted $4.6 billion over the month, bringing cumulative inflows to $12.13 billion. The ETFs bought around 66,000 BTC in March, while miners only produced 28,500.

ETH saw a moderate rally +7.2%, most likely dragged down by Ethereum ETF approval expectations being pushed down to 25%.

Web3: Sectors like infrastructure, memecoins, and AI shared the limelight in March. Social platforms like Farcaster and Twitter are multiplying the positive sentiment around projects - namely low cap memecoins - but SBF’s sentence quickly humbled the market highs. We are also witnessing large-scale Web2 to Web3 integrations that illustrate broader confidence and a focus on scaling digital products.

DeFi: EIP-4844 went live, drastically reducing the cost to post data on Ethereum by L2s and Rollups. L2s like Base saw significant cost reductions and volume spikes as a result, bringing TVL up and more user activity. Blackrock announced BUIDL, its tokenized fund on Ethereum, designed to provide institutional investors with a blockchain-based investment product, fully backed by cash, U.S. Treasury bills, and repurchase agreements. As a result, RWAs saw a spike in interest.

Fetch.ai (FET): +55.5%

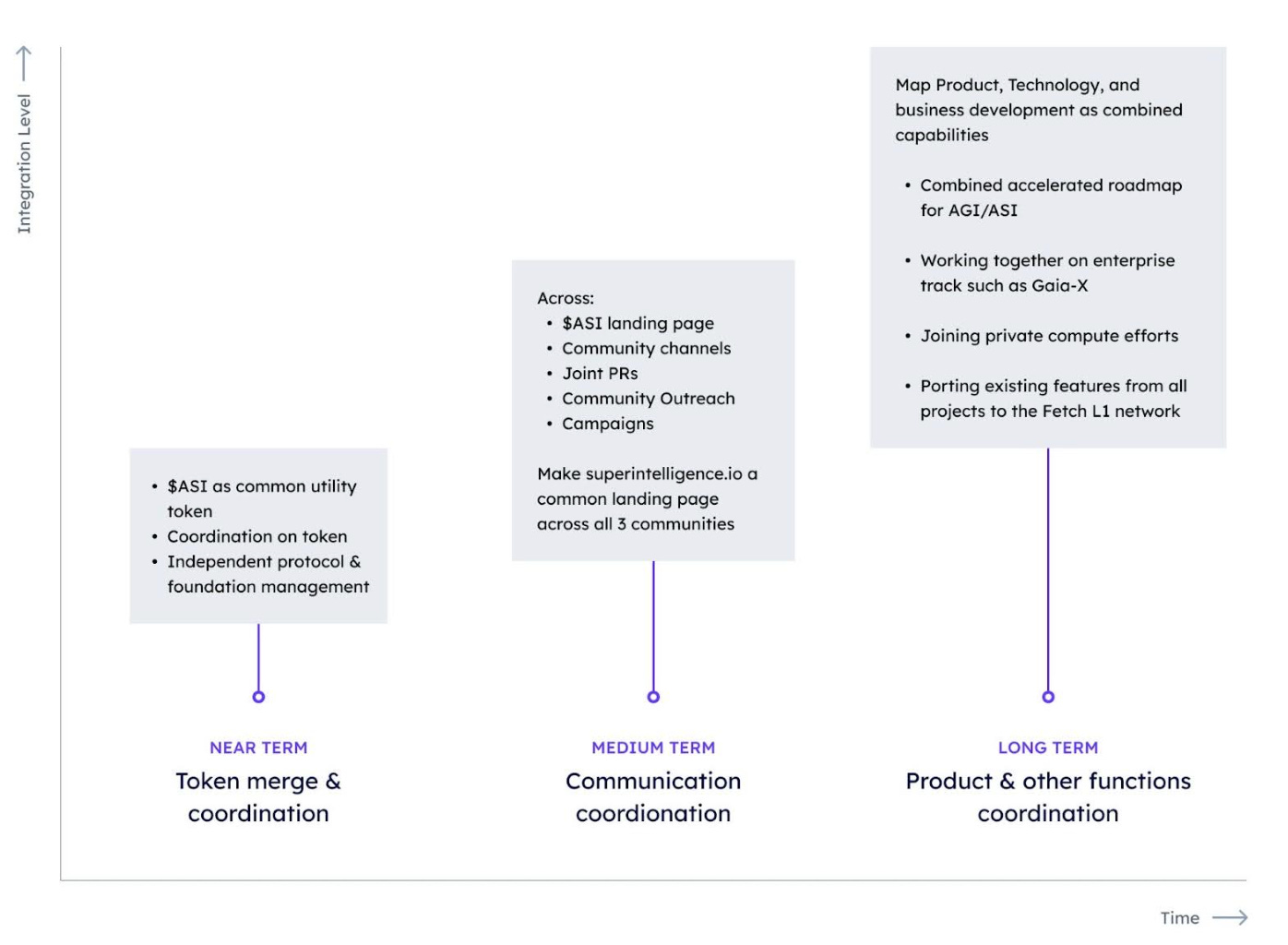

SingularityNET, Fetch.ai, and Ocean Protocol are negotiating a merger to establish a unified decentralized AI platform. This move, potentially consolidating their tokens into a single ASI token valued at $7.5 billion, has boosted all three token values - especially considering Fetch.ai recent tailwinds from v0.17. While the platforms would still function independently, they aim to collaborate under a "Superintelligence Collective" which is highlighted in their timeline below.

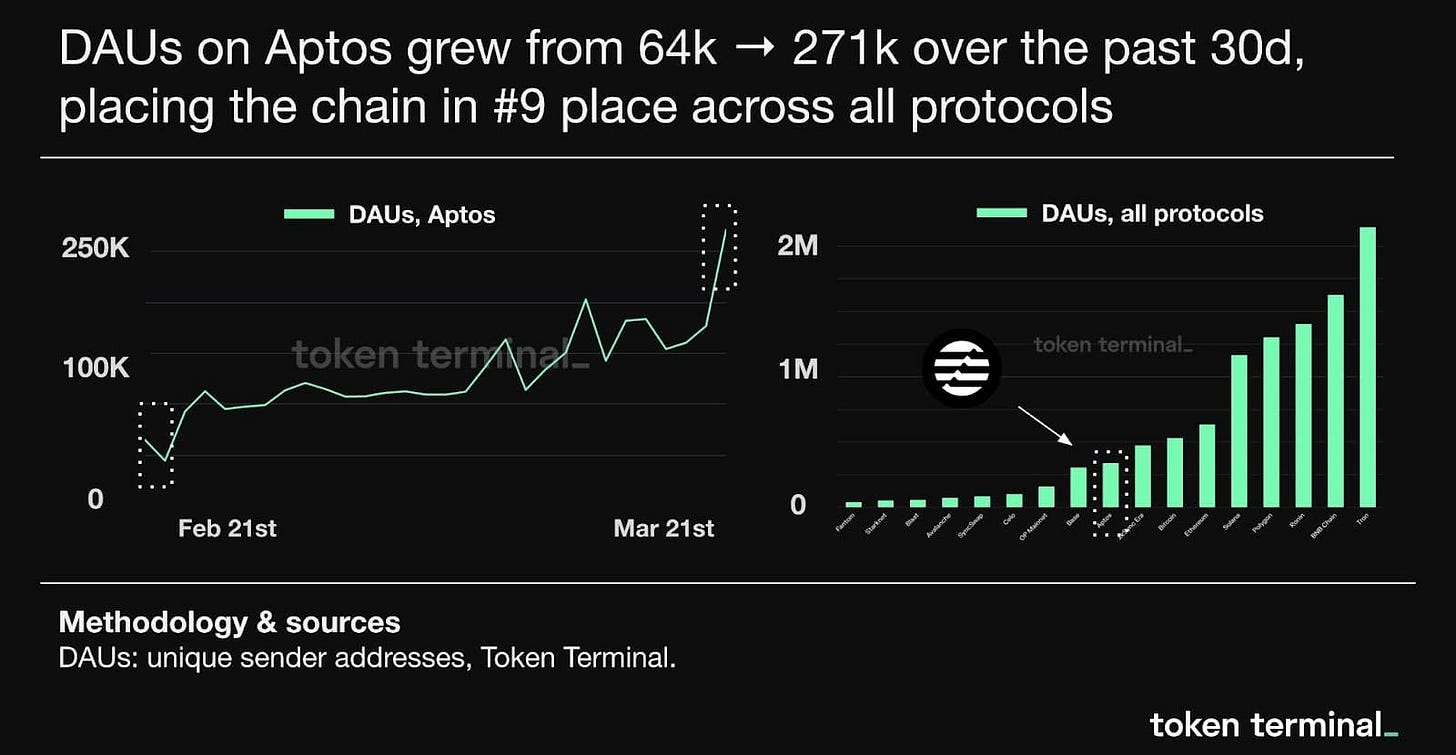

Aptos (APT): +34.5%

Aptos boasts a parallel execution engine with high throughput, low transaction fees, and robust security attributes. In March, daily active users counts rose from from 64k to 271k and revenue increased by 106.8%. These metrics, coupled with increased code commits and network usage, are the underlying reasons for APT’s recent price surge.

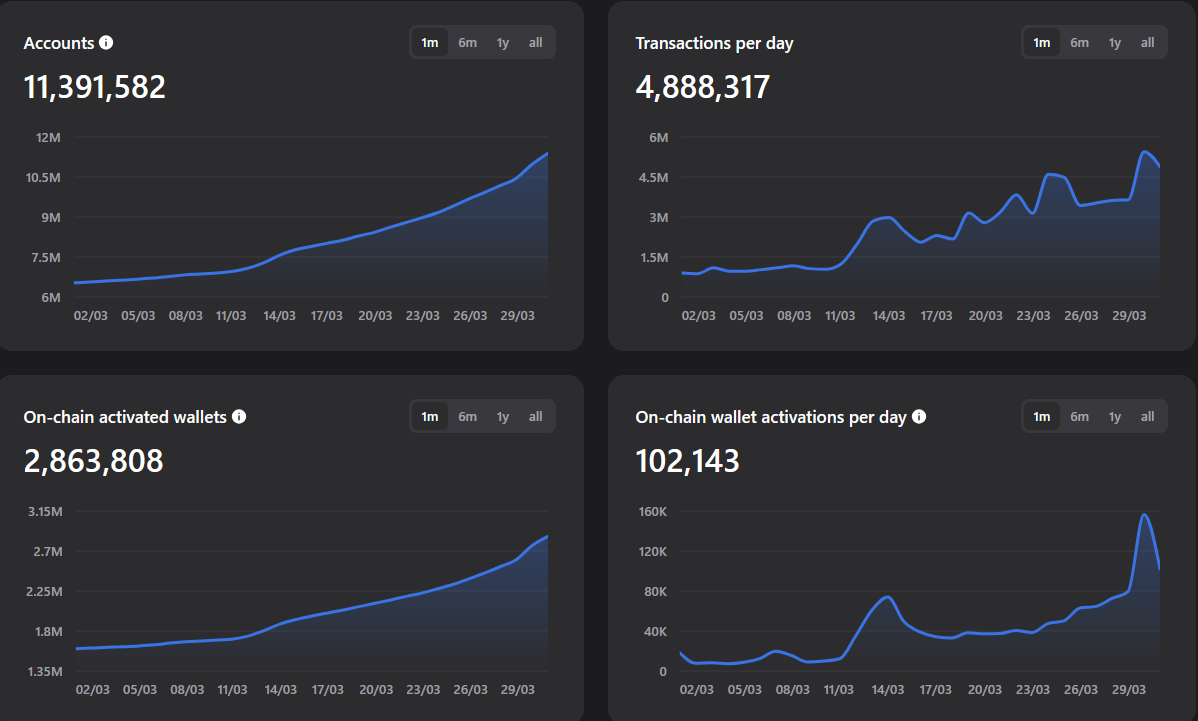

Toncoin (TON): +89.0%

Toncoin's price increase was fueled by Telegram's new ad revenue-sharing model, which uses Toncoin as the underlying currency. Other price catalysts include Telegram's potential IPO announcement, its introduction of a $115+ million community rewards program called The Open League, and continued growth in on-chain user activity.

Arweave (AR): +43.7%

Excitement around Arweave’s newly launched AO testnet continued to fuel the token this month, with total messages reaching over 14 million since launching in February.

The highly scalable parallel computing layer is already fostering an impressive ecosystem on top, including a multi-sig wallet (AftrMarket), a DEX (bark.arweave.dev), a stablecoin (AstroUSD), an oracle (0rbitco), wallets (arconnectio & KeysArentSimple), and block explorers (ao.link and viewblock)

Aerodrome (AERO): +257.0%

Base, a Layer 2 Ethereum network incubated at Coinbase, saw its total value locked surge to $1.4 billion — over doubling the network’s deposits since the start of March, which stood at $600 million. The reason for this is EIP-4844 brought transaction costs on Base to nearly zero, and native-Base decentralized exchange Aerodrome saw an uptick in user activity and a major spike in the value of its native Aero token as a result. Aerodrome accounts for about 40% of Base’s TVL. Aerodrome’s TVL surged from $150 million at the end of February to now over $530 million.

Ondo (ONDO): +98.7%

Ondo Finance, a platform for tokenized real-world assets (RWA), is transferring $95 million worth of assets into BlackRock's newly launched tokenized fund BUIDL. This move is designed to facilitate instant settlements for Ondo's U.S. Treasury-backed token, OUSG. This marks the first instance of a crypto protocol utilizing BlackRock's tokenized fund service, introduced last week. The BUIDL fund, which is based on the Ethereum blockchain and backed by U.S. Treasury bills and repurchase agreements, is aimed at white-listed institutional clients and demands a minimum investment of $5 million. Despite the fund's stringent entry criteria limiting access to smaller investors, it enables platforms like Ondo to utilize the fund for their own offerings targeted at retail investors.

Degen (DEGEN): +5,292%

The meme cryptocurrency DEGEN has unveiled its own Layer 3 network, in collaboration with Syndicate, a provider of Layer 3 infrastructure. This development, announced on March 28, led to the creation of Degen Chain. Constructed using the Arbitrum Orbit technology stack, Degen Chain processes transactions on the Base network. The launch of the DEGEN token in January was strategically timed to capitalize on the growing popularity of Farcaster, a rising decentralized social media platform.

March Highlights

Osmosis, dYdX, and Synthetix most actively developed DeFi projects: Santiment

$7.5B AI crypto token merger scheduled for community vote on April 2

Do Kwon Released From Montenegrin Prison on Bail; Terraform Labs' Civil Trial Begins in NYC

Upcoming Events

The M31 Capital team will be speaking at and attending a number of upcoming conferences and events. Please reach out if you are interested in connecting, or better yet - meet us there:

New York City: NFT NYC (4/3-4/5)

Hong Kong: Web3 Festival 2024 (4/6-4/9)

Dubai: TOKEN2049 (4/18-419)

Dubai: ETH Dubai (4/19-4/21)

Dubai: HFM Middle East Summit (5/14-5/15)

Austin: Consensus 2024 (5/29-5/31)

Dubai: M31 Academy (6/1-8/15)

Brussels: EthCC (7/8-7/11)

Singapore: TOKEN 2049 (9/18-9/19)

Singapore: Breakpoint (9/19-9/21)

Salt Lake City: Permissionless III (10/9-10/11)

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies supporting individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital