The Monthly Airdrop: April 2025

March Market (-5.3%) // Trump executive order creates U.S. Strategic Bitcoin Reserve, White House holds first ever Crypto Summit, OFAC lifts Tornado Cash sanctions

Bitcoin (BTC): President Trump signed an executive order to establish a Strategic Bitcoin Reserve using BTC seized in criminal proceedings. MicroStrategy’s BTC holdings surpassed 500,000, maintaining its aggressive position as the largest corporate Bitcoin holder. Bitcoin ETFs recorded $680M in net outflows across the month despite the positive regulatory developments.

Ethereum (ETH): Ethereum core contributors completed the final testnet validation for the upcoming Pectra upgrade, with mainnet launch confirmed for April 30. Fidelity announced plans to launch FYHXX on Ethereum, a direct competitor to BlackRock’s BUIDL. ETH ETF sentiment remained week, seeing $389M in net outflows and 16 consecutive red days.

Market Focus: The SEC continues rolling back legal pressure on crypto, dropping investigations into Crypto.com and Immutable. Kraken acquired NinjaTrader for $1.5B to expand into U.S. crypto derivatives, while Coinbase explores acquiring Deribit to compete. Abu Dhabi’s MGX became Binance’s first institutional investor, with a massive $2bn investment settled using stablecoins.

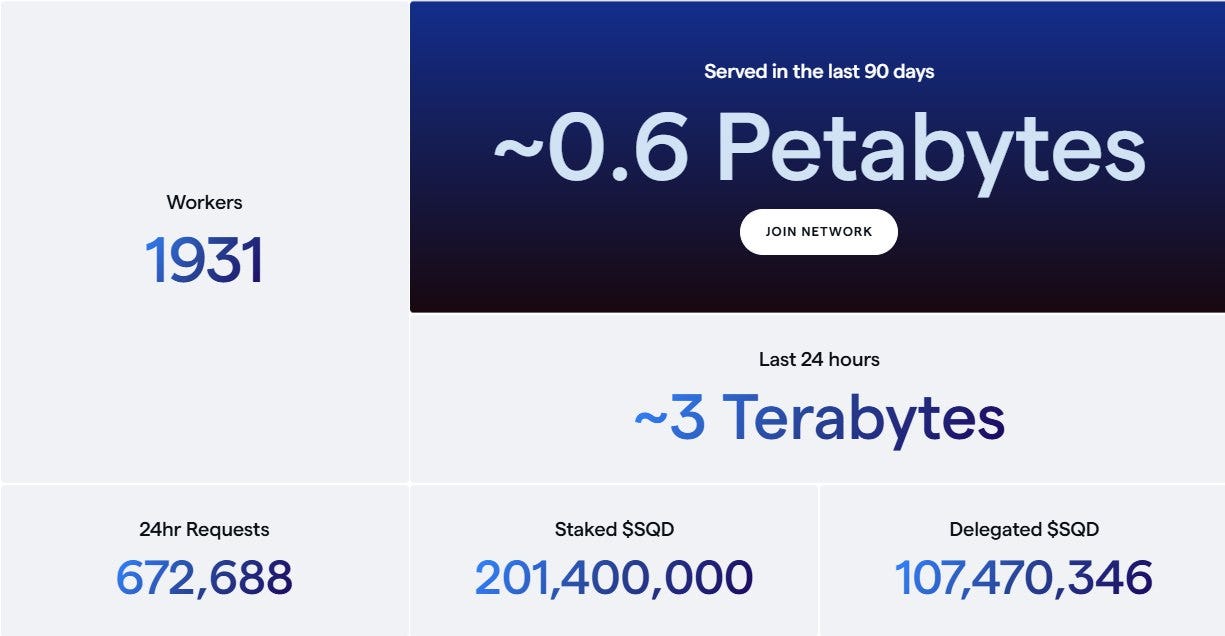

Web3: VC activity remained strong despite market underperformance; DoubleZero raised $28M to build a high-performance, private fiber network while Prime Intellect secured $15M to build novel DeAI infrastructure. SQD significantly outperformed the market with rising volume and deeper liquidity as decentralized data infrastructure gains traction.

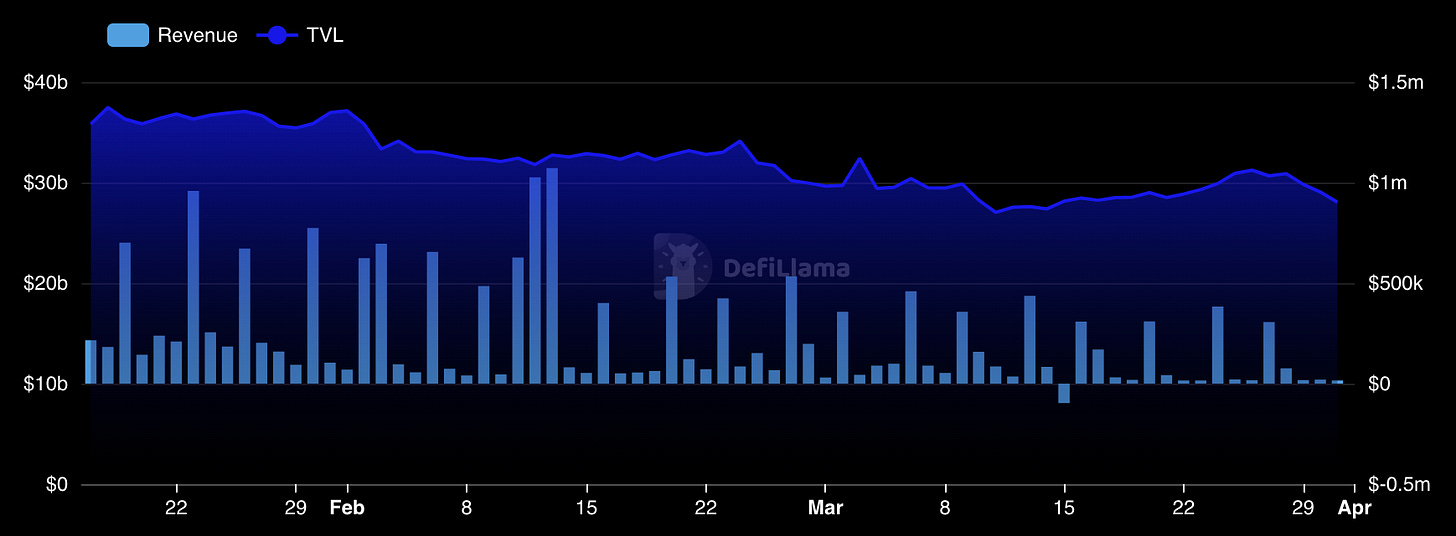

DeFi: Tornado Cash saw a milestone legal victory, as OFAC sanctions were lifted following a court ruling that smart contracts could not be sanctioned directly. BlackRock’s BUIDL surpassed $1.8bn in AUM, driven by Ethena's use of the asset as collateral for its USDtb product. Trump-backed World Liberty Financial announced USD1, a new treasury-backed stablecoin in partnership with BitGo.

SQD.AI (SQD): +92.4%

SQD entered the rollout phase of its roadmap, with a focus on upgrading tokenomics to align with network adoption.

Key partnerships were formed with DeFAI protocols including Fetch AI, Symphony, and Krain AI.

The SQD token expanded to Base, improving liquidity and investor access.

Chainlink (LINK): -8.9%

Chainlink announced a partnership with Abu Dhabi Global Markets to develop compliant frameworks for RWA tokenization.

The Chainlink SVR (Smart Value Recapture) product went live in partnership with Aave, allowing the lending protocol to reclaim lost MEV.

Walrus Protocol (WAL): -11.5%

Walrus completed a $140M round with backing from both crypto-native and traditional finance institutions.

The Walrus mainnet launched shortly after on Sui, leveraging its high-performance architecture for decentralized game infrastructure.

The WAL token launched at a 10-figure FDV, listing on several exchanges with LP incentives to bootstrap DEX liquidity.

DIMO Network (DIMO): -27.0%

DIMO surpassed $100k in gross protocol fees this month and surpassed 170k total vehicles connected to the network.

DLP Labs partnered with DIMO, onboarding over 5,000 vehicles and becoming the #2 app in the DIMO marketplace.

Over 3M DIMO tokens were staked in March after the protocol launched their staking product on February 20th.

Euler Finance (EUL): +10.8%

Euler's TVL doubled in March, surpassing $1bn and marking a strong DeFi comeback with its V2 rollout launched in September 2024.

EUL token trading volume hit two-year highs, with sustained interest across major DEXs and CEXs.

Ethena (ENA): -16.9%

Ethena announced “Converge,” an EVM-compatible L1 in partnership with Securitize built for institutional clients.

The USDtb stablecoin gained momentum, using BlackRock’s BUIDL fund as the main reserve asset and driving the fund beyond 10-figure AUM.

Hyperliquid (HYPE): -35.4%

HYPE staking was introduced, expanding token utility and giving traders a mechanism to earn yield.

The protocol delisted meme coin JELLYJELLY after a whale’s position posed ecosystem-wide liquidation risks.

This event exposed HLP vault risks, as Hyperliquid’s TVL fell over 58% throughout the month.

Solana (SOL): -15.7%

BlackRock’s $1.8bn BUIDL fund launched on Solana through Securitize, marking a major TradFi milestone.

Fidelity submitted an application for a SOL ETF on CBOE, following increased institutional interest.

Memecoin launchpad pump.fun launched its own DEX, redirecting activity from Raydium and capturing more value within the SOL stack.

Aave (AAVE): -17.2%

Institutional liquidity and stablecoin innovation drove Aave’s dominance in March, overtaking Lido’s TVL.

Aave DAO proposed a yield-bearing product tied to GHO, using protocol revenue to enhance GHO utility.

Aave launched Project Horizon, creating institutional-grade access to stablecoin liquidity and tokenized RWAs.

Across Protocol (ACX): -10.1%

Across raised $41M in a token round led by Paradigm to expand its cross-chain intent-based bridging system.

The protocol surpassed 3M total bridge users and facilitated $750M+ in March bridge volume.

March Highlights

SEC Confirms Bitcoin and PoW Mining Are Not Securities Under U.S. Law

Lummis Proposes U.S. Sell Gold to Buy 200,000 Bitcoin Annually for Five Years

New York Attorney General and Galaxy Digital Settle for $200 Million

Ethereum’s Pectra Upgrade Could Lay Groundwork for Next Market Rally

Bitwise Makes First Institutional DeFi Allocation via Maple Finance

Circle's USDC Becomes First Regulated Stablecoin in Japan with SBI Partnership

Upcoming Events

The M31 Capital team will be speaking at and attending a number of upcoming conferences and events. Please reach out if you are interested in connecting, or better yet - meet us there:

Dubai: Dubai AI Festival (4/23-4/24)

Dubai: Token2049 (4/30-5/1)

Washington DC: SelectUSA Investment Summit (5/11-5/14)

Toronto: Consensus 2025 (5/14-5/16)

Doha: Qatar Economic Forum (5/20-22)

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies supporting individual sovereignty.

Website: https://www.m31.capital/