The Monthly Airdrop: August 2024

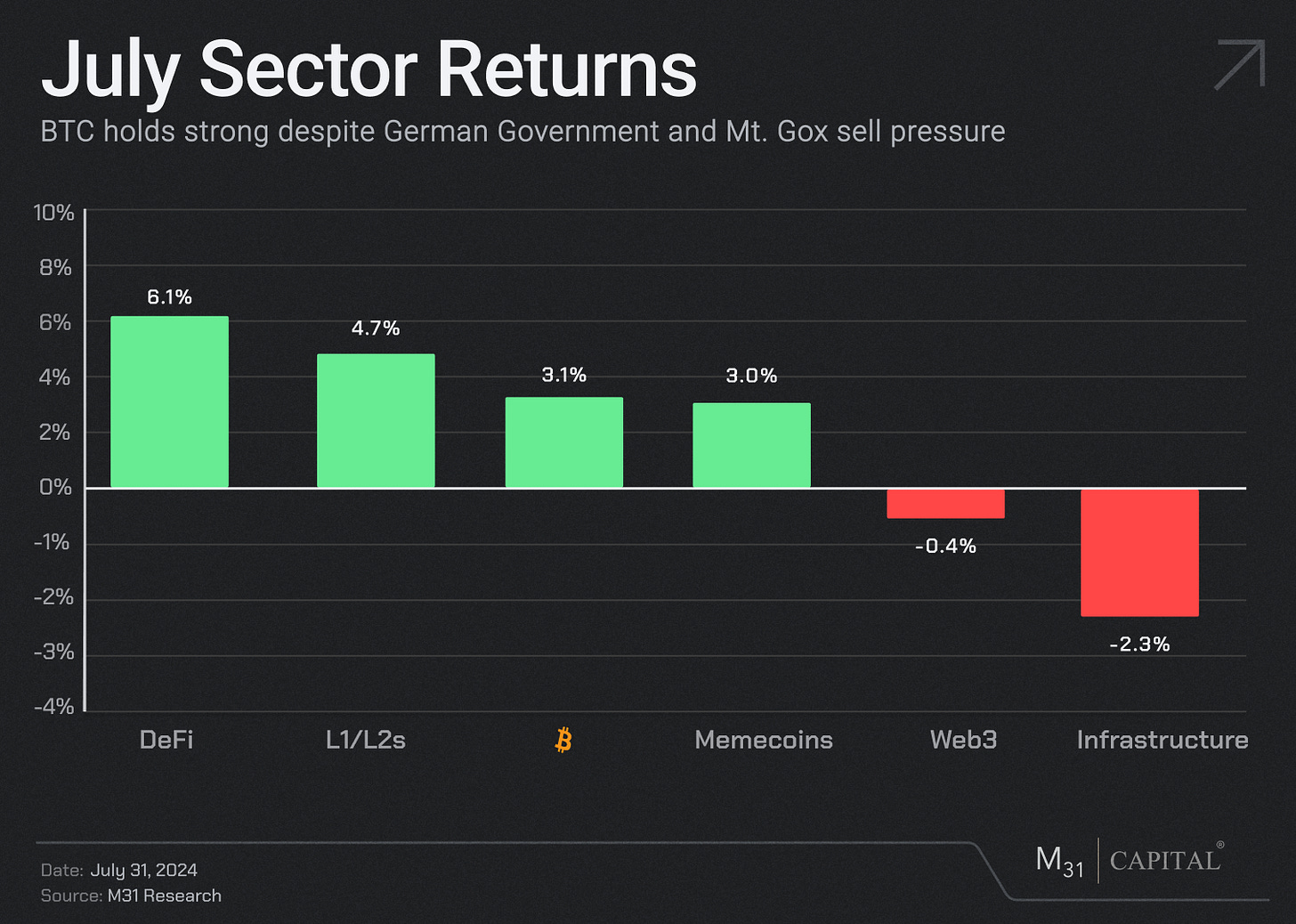

July Market (+3.9%) // U.S. spot ETH ETFs begin trading; Trump gives pro-crypto speech at Bitcoin 2024; U.S. political events drive 9-figure spike in prediction market activity

Bitcoin (BTC): US spot BTC ETFs saw inflows over $3bn throughout the month, while the German government concluded the sale of over $2.5bn worth of BTC. Mt. Gox commenced their $9bn repayment plan, distributing tokens via centralized exchanges such as Kraken and Bitstamp.

Ethereum (ETH): U.S. spot ETH ETFs launched on July 23 with over $1.1bn in trading volume in the first day; they finished the month with over $480m in outflows driven by Grayscale’s ETHE and their industry-leading 2.5% management fee.

Market Focus: The Trump assassination attempt and Biden's exit from the election race caused a spike in prediction market activity, with Polymarket’s volume increasing nearly 250% since June. Web3xAI projects continue to attract significant attention, highlighted by Sentient’s $85m seed round to develop open-source AI on Polygon.

Web3: Web3 bandwidth tokens greatly outperformed despite sector underperformance, driven by significant user growth in Helium subnetworks along with Hivemapper network improvements. Chainlink launched the Digital Assets Sandbox powered by their CCIP, accelerating asset tokenization for institutions through accessible and ready-to-use business workflows.

DeFi: Solana experienced a surge in on-chain activity, seeing more than 45% growth in monthly DEX volumes and surpassing Ethereum in multiple metrics. Aptos and Sei outperformed with over 30% in TVL growth, driven by boosted developer and liquidity incentives. Meanwhile, Indian centralized exchange WazirX had its multisig wallet exploited for over $230m in a coordinated attack.

Solana (SOL): +17.4%

Solana-based DEXes outpaced Ethereum’s in July, with monthly trading volumes growing by 47% to $56.8B. The rise in meme coin activity driven by political events has led to the increase in volumes, with growth supported by new tools such as Blinks that streamline on-chain interactions.

The integration of PayPal's stablecoin (PYUSD) on Solana contributed to the surge in Solana network activity. Partnerships with lending platform Kamino have further fueled this growth, as the platform is offering boosted stablecoin yields up to 14% for a limited-time. With over 270m PYUSD on Solana, the supply has increased by more than 200% since June, and is swiftly taking market share from Ethereum.

Helium (HNT): +40.7%

Helium saw a rise in overall network activity in July, driven by a notable surge in the number of subnetwork usage. The Helium Mobile subnet achieved a new milestone surpassing 100,000 subscribers in July. Helium saw a 12.9% increase in data credits burned versus June, representing the increase in data transfers on the network.

The Helium Foundation unveiled proposals for new subnetworks that go beyond wireless, including the ENERGY subnetwork which will reward users for solar power production and battery energy storage. ENERGY will utilize Helium’s infrastructure to enhance network participation and increase data credit burns, further expanding Helium's market reach and utility.

Hivemapper (HONEY): +46.4%

The Hivemapper network has mapped over 290M kilometers with 11% growth in July, highlighting the active participation of its global user base. The website also underwent a redesign including streamlined navigation and faster load times, making it easier for users to access and interact with the platform.

Hivemapper has paused its Buzz Rewards program as part of a strategic move, since the program led to quality control and spamming issues.The team will use this pause to implement necessary changes to improve the program and enhance the overall user experience of the network.

Blockless (N/A)

Blockless launched The Orchestrator on July 25th, which marks phase 2 of its incentivized testnet. Within the first two hours, all workloads were depleted, and over 20,000 tab node users were onboarded in the first week.

The Orchestrator campaign aims to further secure the network’s compute supply side, with the goal of onboarding over 100K nodes powered by everyday devices. The team is collaborating with ecosystem partners such as Lido, Renzo, and Ether.Fi to amplify the community outreach of The Orchestrator campaign.

SQD Network (SQD): (-51.0%)

Subsquid recently rebranded to SQD, symbolizing their transition into becoming a mature, institutional-grade data infrastructure provider. The team announced a new roadmap detailing their evolution from an indexing & query engine to a hyperscale web3 data platform.

The first step in the roadmap focuses on eliminating RPC endpoint dependency and improving real-time data stream reliability through the incorporation of hot storage and computational capabilities. By the end of in 2025, SQD will enable data retrieval using decentralized indexers, TEEs, and SQL, which is crucial for ensuring secure, scalable, and efficient data access for users.

Avalanche (AVAX): (-12.2%)

AVAX has shown an increase in institutional interest, highlighted by the California DMV’s recent decision to digitize 42 million car titles on Avalanche in partnership with Oxhead Alpha. This initiative enhances transparency and security, providing streamlined warnings for lien fraud and reducing processing times from two weeks to minutes.

Developer activity on Avalanche also grew significantly in July, with over 30% growth in monthly commits.

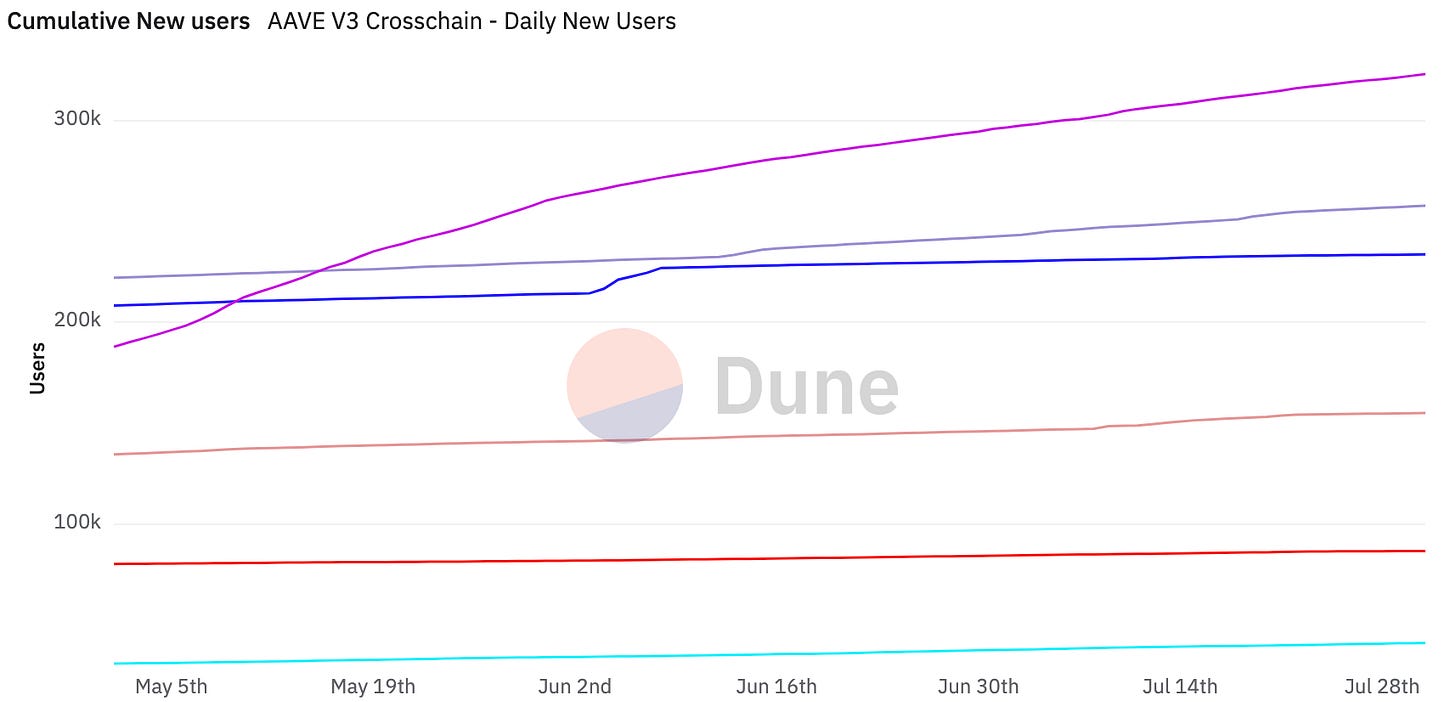

Aave (AAVE): +11.0%

Aave outperformed the borrow/lend sector throughout July, with a 5.8% increase in TVL along with an 8.6% increase in active loan volume. The community has also recently proposed a fee switch implementation. This aims to increase value accrual to the token by distributing a portion of the protocol’s revenue among holders.

Following success on Ethereum mainnet, Aave successfully launched its GHO stablecoin on the Arbitrum network. Aave’s cross-chain expansion strategy for GHO is powered by Chainlink’s CCIP, and aims to make their native stablecoin more affordable and accessible for users across top Ethereum L2s.

Jito (JTO): +23.2%

Solana LST leader Jito announced the launch of Jito Restaking on Solana, providing hybrid staking, staking, and LRT capabilities. The new launch introduces the Vault Program which manages LRTs along with the Restaking Program which manages AVSs and operators.

Jito has transitioned Jito Stake Pool management to the StakeNet protocol. Current Solana LSTs generally rely on a centralized team to handle all operations. In response, Jito introduced the StakeNet Steward Program to make state transitions permissionless and the delegation of stake fully decentralized, shifting control to community-driven governance.

Compound (COMP): +6.4%

On July 11, Google domains forced a migration of several sites to Squarespace, briefly removing 2FA for security and rendering several DeFi projects vulnerable to DNS attacks. Compound was the most notable protocol affected by this vulnerability, as users were briefly redirected to a phishing site; the underlying protocol remained secure and unaffected by the attack.

Compound later faced a governance attack where a whale token holder leveraged his voting power to gain control of over $24m worth of COMP treasury tokens. The holder then used this leverage to push for a fee-sharing mechanism, similar to Aave’s fee switch proposal. This proposal will distribute 30% of market reserves and new reserves generated per year to staked COMP holders.

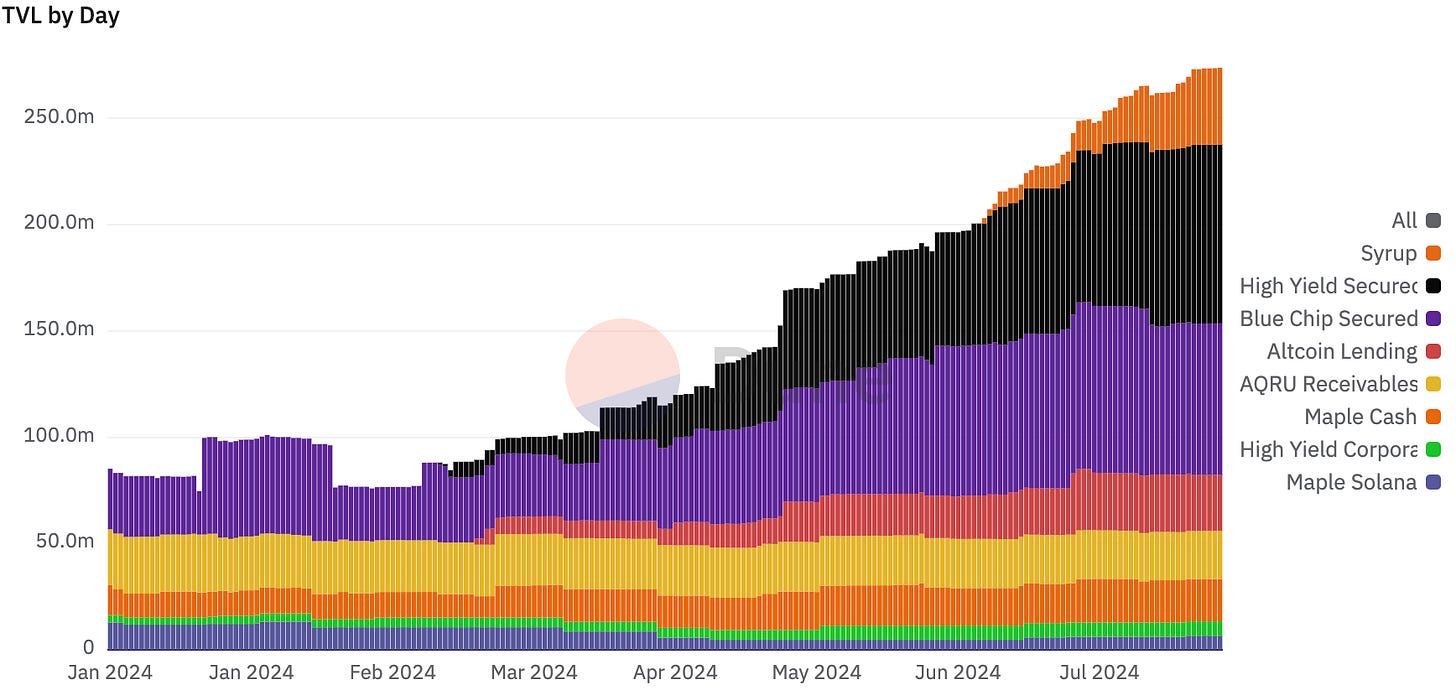

Maple Finance (MPL): +55.5%

Maple’s Syrup pools saw over 200% growth in July after launching in mid-June, providing over 30% APY to the average user. As a whole, lenders earned 17.2% net APY for the month of July, along with an average 14.8% yield from Drip program rewards. This growth led to Maple setting a new record for monthly protocol revenue in July.

Maple Finance has selected Zodia Custody as their preferred custodian for global lending arrangements. Zodia Custody wallets will now fully support the Maple token, helping to drive the broader adoption of Maple’s products among institutional investors and borrowers.

Tokemak (TOKE): +61.5%

Tokemak has announced the upcoming full launch of their Autopilot feature following the limited access release in February. This feature addresses problems with manually providing liquidity, which requires navigating various pools and DEXes with different yields, along with gas and trading fees.

Autopilot’s autoLP connects isolated liquidity through dynamic and autonomous rebalances. This allows users to outperform individual pools while maintaining composability across DeFi with a tokenized network of liquidity. The website will feature a revamped and enhanced UI at open launch.

Dinero (DINERO): +0.9%

Redacted Cartel rebranded to Dinero to better reflect the protocol’s evolving mission and expanding suite of financial products. Their native BTRFLY token is converted to DINERO at a rate of 1:2000, and 84.3% of the BTRFLY supply completed migration by the end of July.

Dinero partnered with Japan-based Laser Digital to launch an institutional pxETH staking fund, following a 30% growth in TVL on pxETH throughout July. This collaboration aims to offer accredited investors with compliant access to high-yield Ethereum staking, which is a key component that was omitted by US ETF issuers to secure regulatory approvals.

July Highlights

Ether ETFs See $107M Inflows on Day One as Trading Volume Tops $1B

Trump Pledges to Fire SEC Chair Gary Gensler ‘on Day One’ if Reelected

Grayscale Launches Artificial Intelligence-Focused Crypto Fund

Chainlink’s Tokenization Sandbox Cuts Trials to Days Instead of Months

Solana Flips Ethereum in Monthly DEX Volume For First Time Ever

Germany Sells Off Final Bitcoin Reserves From Initial $3B Worth of Holdings

Upcoming Events

The M31 Capital team will be speaking at and attending a number of upcoming conferences and events. Please reach out if you are interested in connecting, or better yet - meet us there:

Dubai: M31 Academy (6/1-8/15)

Wyoming: Wyoming Blockchain Symposium (8/19-8/22)

Dubai: Dubai AI and Web3 Festival (9/11-9/12)

Singapore: TOKEN 2049 (9/18-9/19)

Beverly Hills: Marcus Evans Investor Summit (9/18-9/20)

Singapore: Breakpoint (9/19-9/21)

New York: Messari Mainnet (9/30-10/2)

New York: LionHack 2024 (10/4-10/6)

Las Vegas: Apex Invest Las Vegas (10/9-10/10)

Salt Lake City: Permissionless III (10/9-10/11)

Dubai: World Blockchain Summit (10/10-10/11)

Dubai: GITEX Global (10/14-10/18)

San Francisco: CoinAlts Fund Symposium 2024 (10/16)

Riyadh: FII 8th Edition Conference (10/29-10/31)

New York: The Bridge Conference (11/6)

Singapore: Salt iConnections Asia (11/11-11/13)

Abu Dhabi: Apex Invest Abu Dhabi (11/18-11/19)

Florida: Marcus Evans Investor Summit (12/9-12/11)

Doha: World Summit AI (12/11-12/12)

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies supporting individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital