The Monthly Airdrop: December 2024

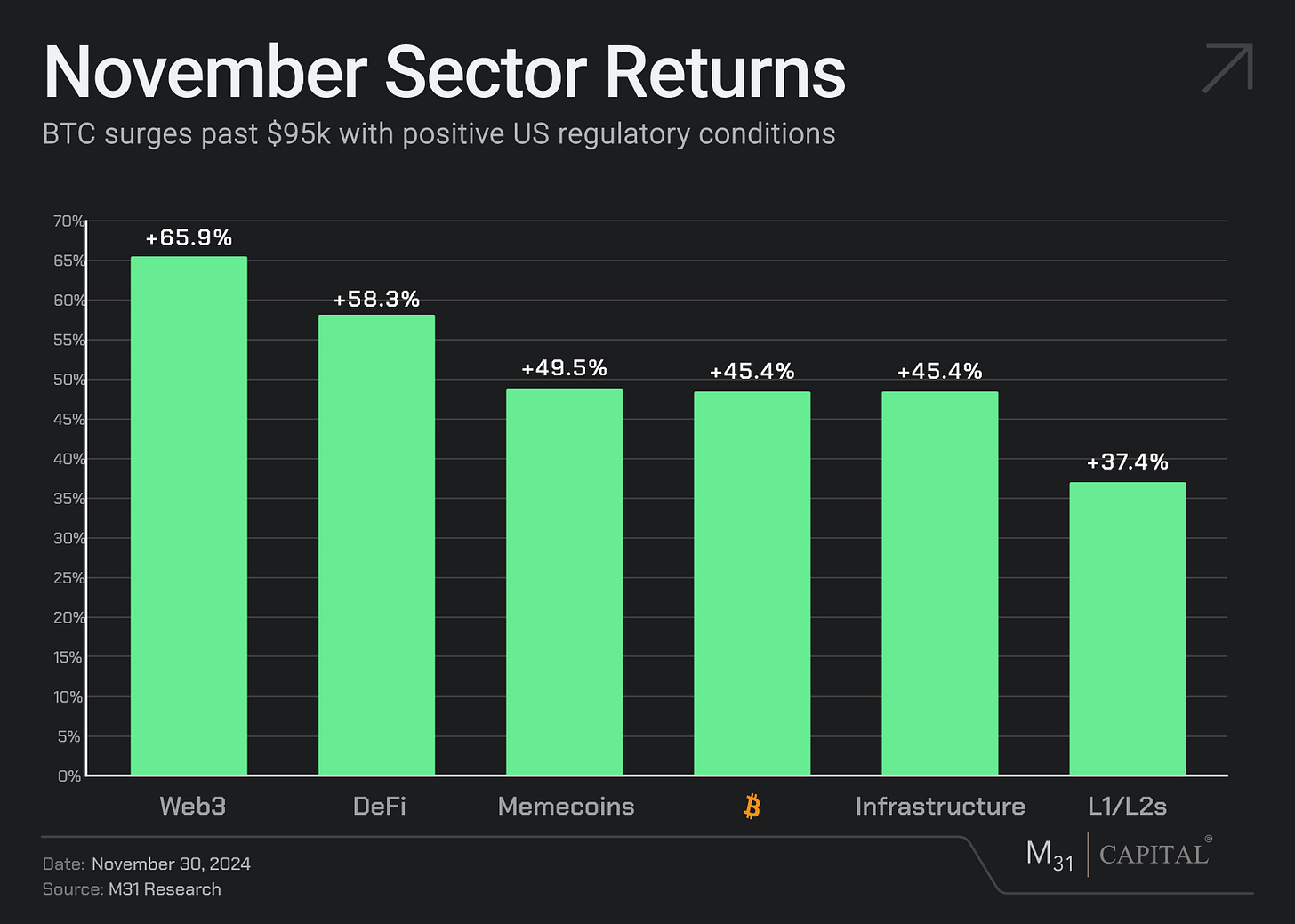

November Market (+40.2%) // Crypto market reaches new highs following Trump election victory, SEC Chair Gary Gensler announces upcoming resignation, Microstrategy purchases $12Bn of BTC

Bitcoin (BTC): Bitcoin’s price surged to a new all-time high, nearing $100,000, driven by record-breaking ETF inflows totaling over $6.4Bn. Speculation around the establishment of a Bitcoin Strategic Reserve, the elimination of capital gains tax on U.S. crypto holdings, and the appointment of crypto-friendly figures like Scott Bessent and Howard Lutnick into key positions fueled the market's enthusiasm.

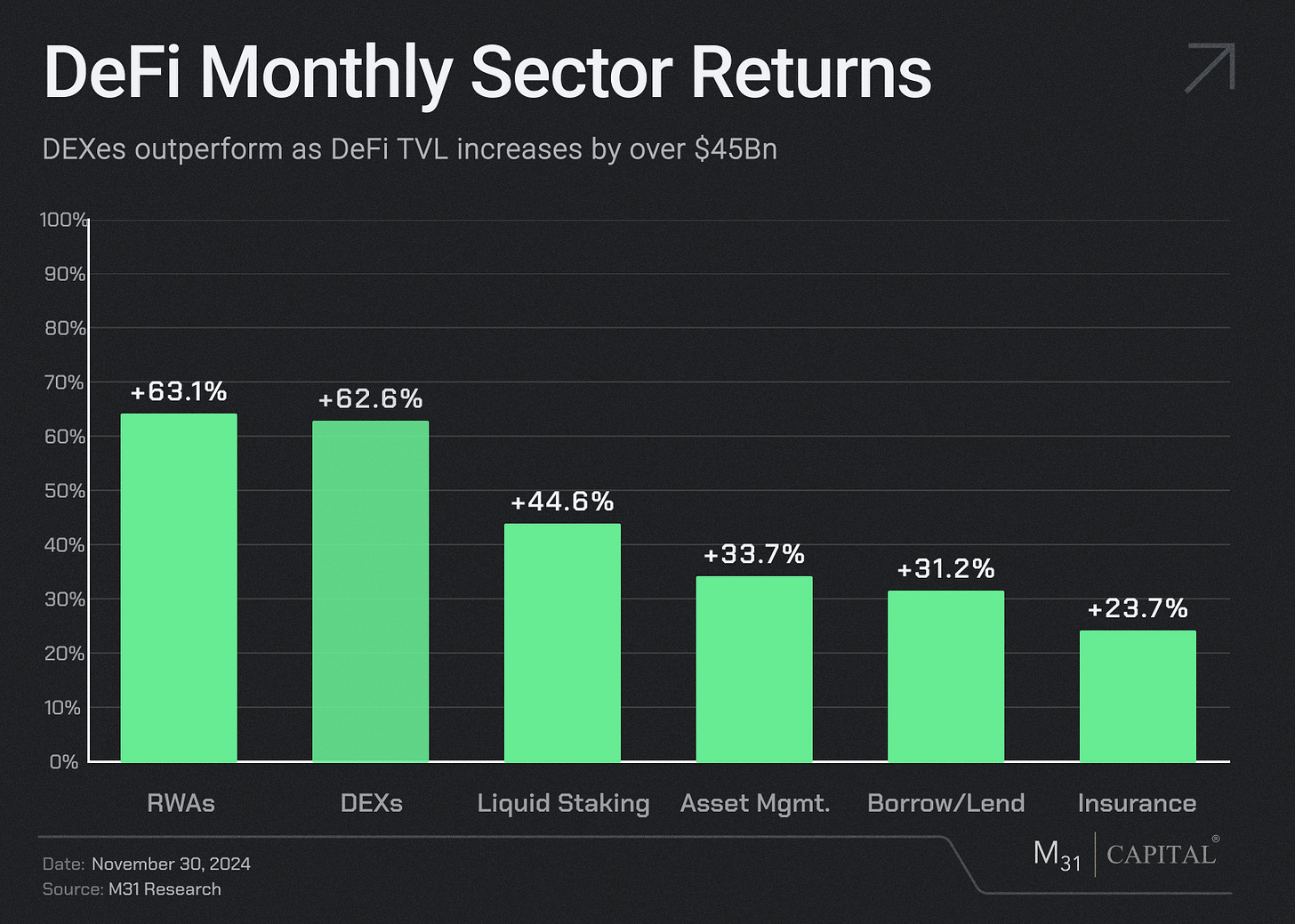

Ethereum (ETH): Ethereum also saw positive momentum with nearly $1.1Bn in ETF inflows, driven by increased DeFi activity. The ETH to BTC market cap ratio showed signs of stabilization as institutional interest in Ethereum gained significant traction.

Market Focus: The U.S. political landscape became the central focus, with Trump's win leading to a crypto market boom. SEC Chair Gary Gensler’s impending resignation signaled a potential shift towards more favorable crypto regulations under the incoming administration. These developments fueled a 280% spike in XRP, which has been under heavy regulatory scrutiny for years by the SEC. MicroStrategy continued its aggressive accumulation strategy, purchasing an additional $12Bn worth of Bitcoin throughout the month.

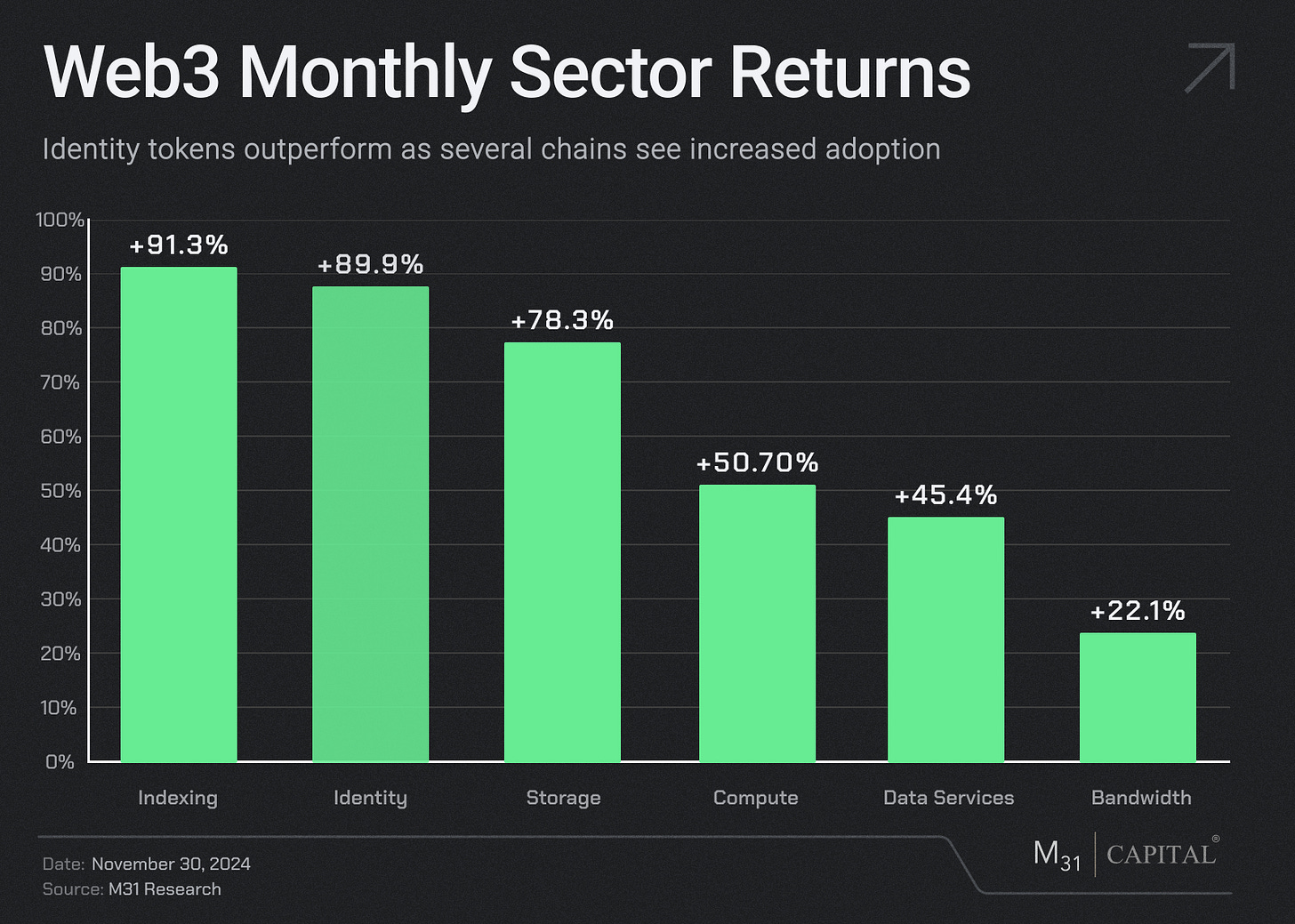

Web3: November was notable for substantial funding rounds in the Web3 space, with a focus on AI agent developments and blockchain infrastructure. 0G Labs raised a $40M seed round for their decentralized AI Operating System, with an additional $250M token purchase commitment. Brevis also secured $7.5M to advance their ZK coprocessor technology, which is now integrated with several dApps.

DeFi: DeFi continued to evolve with news around Justin Sun's $30M investment in Trump's World Liberty Financial, and the Hyperliquid airdrop event which stirred activity in the space. There was also a marked increase in real-world asset tokenization, with traditional finance players showing more interest. Solana maintained its momentum with robust DEX activity and new restaking features.

Chainlink (LINK): +66.9%

Several leading Bitcoin DeFi projects adopted the Chainlink Standard, including Lorenzo Protocol, Solv Protocol, and Ignition (FBTC). Astar Network also adopted Chainlink's CCIP, enhancing the potential for unique cross-chain applications.

Chainlink, Swift, and UBS announced a successful pilot for settling tokenized real-world asset transactions using Swift payment rails.

Solana (SOL): +41.4%

Solana’s daily transactions on-chain reached 59.3M towards the end of the month, >100% higher than its 2024 average.

Coinbase launched cbBTC on the Solana network as a competitor to wBTC.

Akash (AKT): +83.0%

CPU capacity on Akash increased over 15% throughout November, as the network continues to see high demand for both CPU and GPU compute.

Akash PIP-02 passed governance voting, which will help scale GPU supply to meet rising network usage.

Akash onboarded a handful of compute providers from Latin America to the Akash Supercloud, further decentralizing the network and bringing more GPU supply.

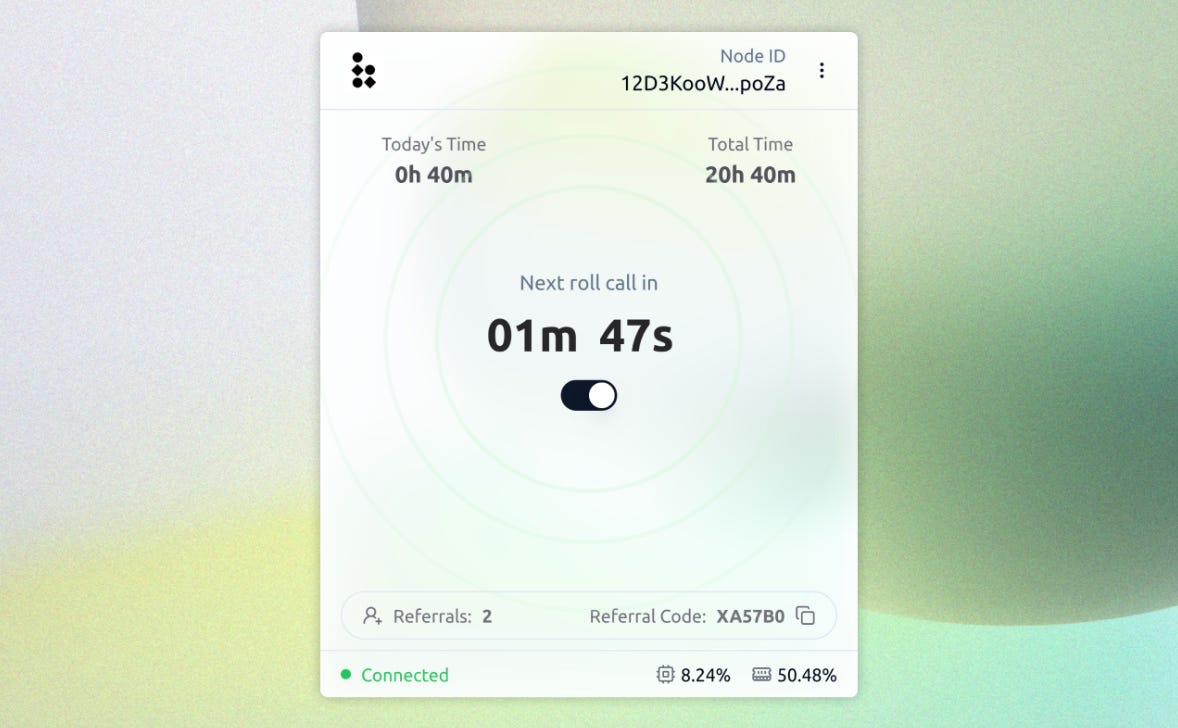

Bless Network: (N/A)

Bless Network launched an incentivized testnet on Solana for their browser extension. The launch achieved over 100,000 devices in the first two days, and onboarded over 600,000 devices to their shared computer within three weeks.

The team announced a new patch to their browser extension at the end of the month, which features auto-reconnect for offline PCs and fixes for alternative browsers like Brave.

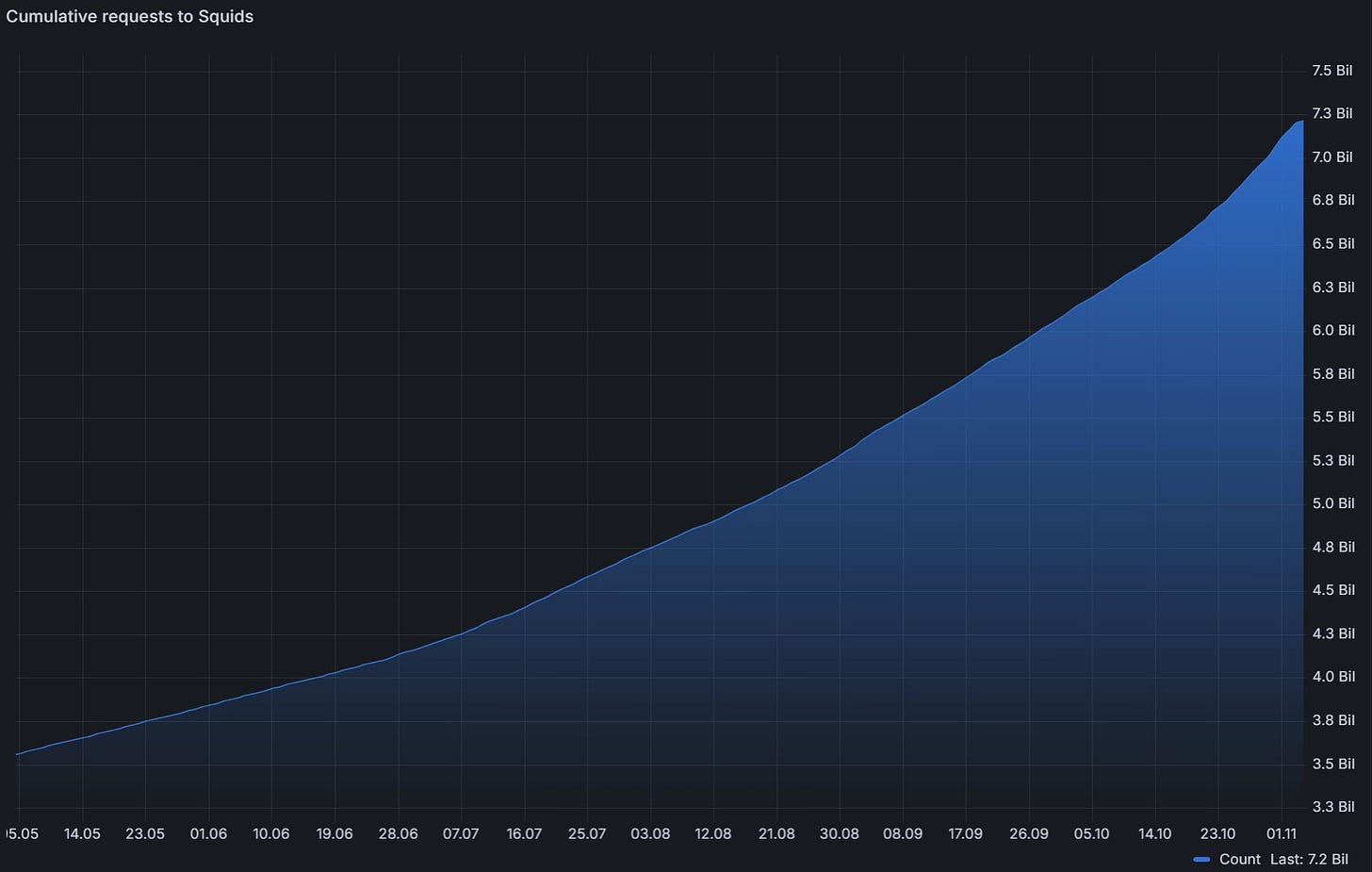

SQD (SQD): +65.2%

SQD is serving over 1Bn queries monthly in the SQD data lake, providing data across a wide range of chains. The team announced support for Tron, Plume, CrossFi, and Uniswap’s upcoming Unichain.

SQD launched the SQD portal in closed beta, with plans for full decentralization of the SQD data lake by January 2025. The SQD portal enhances reliability with data replication and improves performance with a new Rust-based query engine.

Super Protocol: (N/A)

Formed a partnership with 0G Labs, aimed at advancing decentralized AI.

Featured in NVIDIA's blog exploring self-sovereign AI and confidential computing.

Ethereum Name Service (ENS): +140.2%

ENS Labs announced the development of Namechain, a Layer 2 network designed for interoperability and lower fees.

Namechain will allow users to commit and pay for their ENS domain from any other L2, reducing costs significantly and expanding ENS’s reach in the Ethereum ecosystem.

Hyperliquid (HYPE): +150.8%

Hyperliquid airdropped 31% of its supply to users who earned points trading on the platform, making it the largest crypto airdrop at nearly $1.8Bn in unlocked value.

Hyperliquid achieved over $80Bn of derivatives trading volume in November, surpassing previous all-time highs by over 50%.

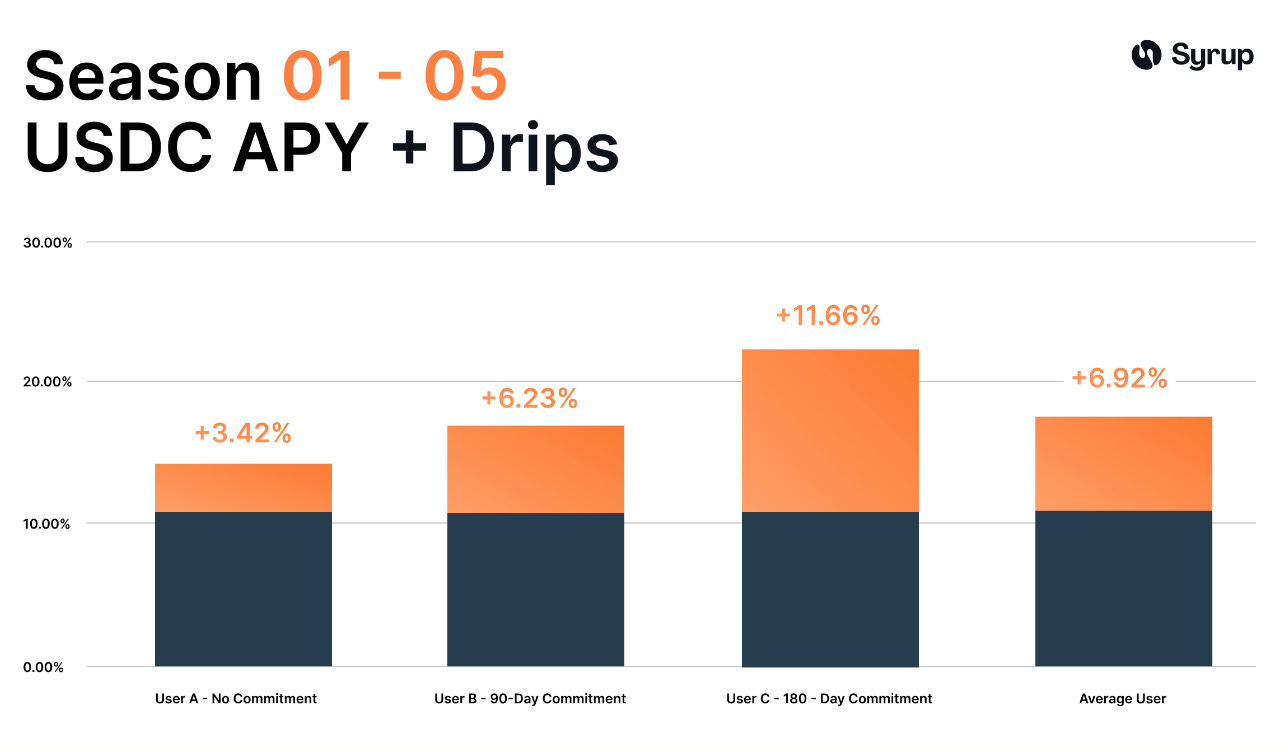

Maple Finance (MPL): (-2.3%)

Maple’s TVL grew to approximately $560M, driven by increased institutional credit demand amid a broader market rally.

Maple’s High Yield pool delivered a 12.9% net APY in November, while the Blue Chip Secured Lending pool generated a 9.35% net APY with an over 50% loan-to-value ratio.

Maple maintained stable yields while Aave’s performance fluctuated, averaging 6.7% APY with heightened volatility during the same period.

Jito (JTO): +62.7%

Jito DAO approved a proposal to allocate 3% of MEV tips to the DAO treasury and the TipRouter program, increasing the total fee from 5% to 6%. The new fee structure is projected to generate over 8 figures in annual revenue for the Jito DAO.

Jito reopened Restaking deposits in November, quickly filling the new $50M deposit cap.

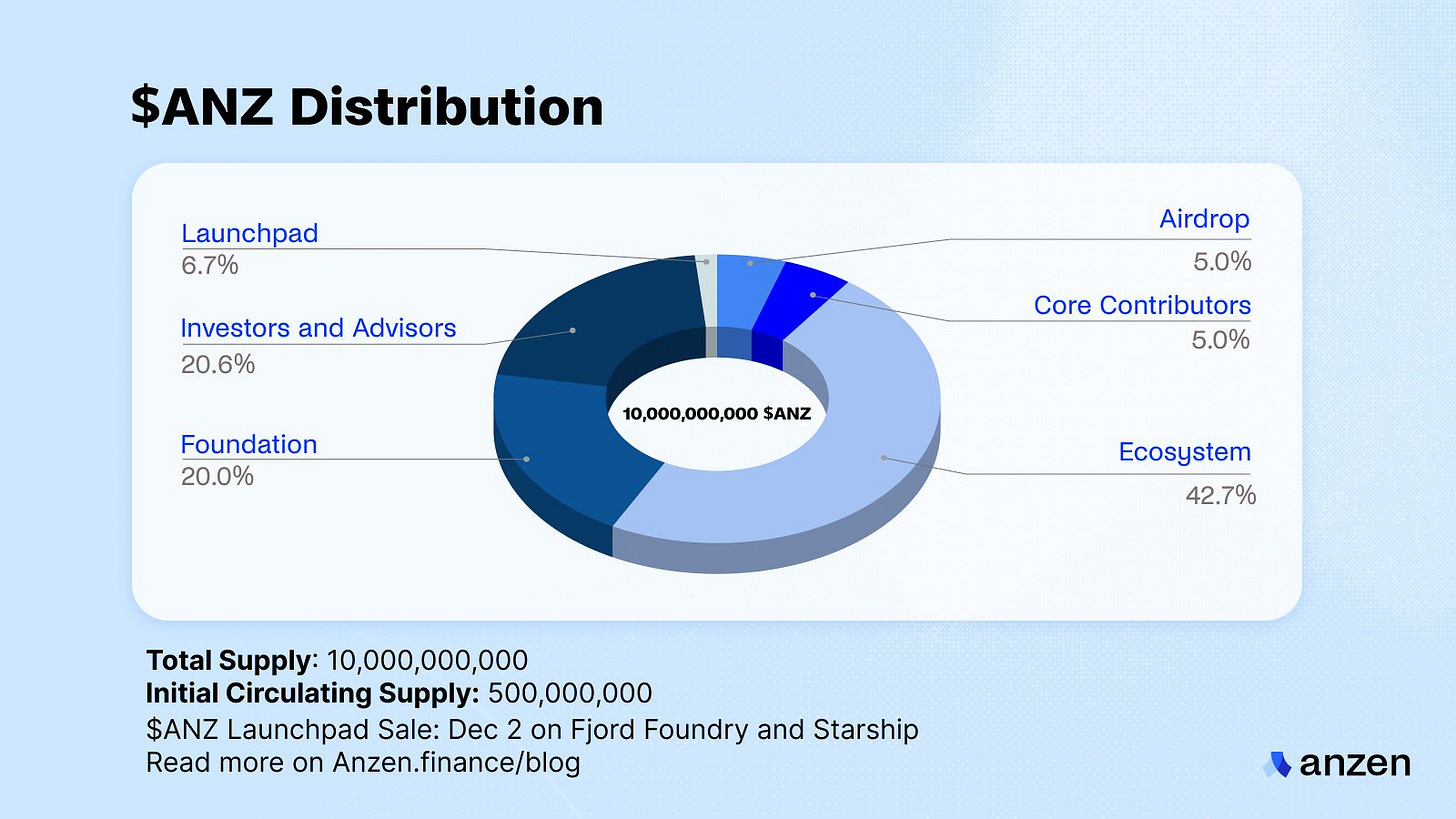

Anzen Finance: (N/A)

Anzen increased it’s DeFi capabilities for USDz across the Base ecosystem, with new pools on Aerodrome and PancakeSwap, along with boosted lending APYs on ZeroLend.

Anzen’s ANZ token will be available to claim in December for users who have been using USDz and earning z-points by interacting with ecosystem partners.

Sky (MKR): +47.2%

Sky (formerly Maker) introduced the USDS stablecoin on Solana, offering significant rewards to early liquidity providers on platforms like Kamino Finance and Save Finance. USDS surpassed $50M in lent collateral on Kamino in under 10 days.

USDS on Solana is supported by Pyth, which provides oracle price feeds for a wide range of Solana dApps that have integrated USDS.

Ethena (ENA): +132.8%

Ethena plans to create a new stablecoin, USDtb, which will be powered by Securitize and will use BlackRock’s BUIDL as the primary reserve asset backing the coin.

Ethena’s USDe stablecoin surpassed $4Bn in circulating supply, up over 50% from October.

Wintermute’s proposal to enable an ENA fee switch was approved by the Ethena Foundation, which will allow revenue sharing for token holders once the Risk Committee approves specific parameters.

November Highlights

Bitcoin Jumps to Record as Trump's Election Turbocharges Cryptocurrencies

Trump Eyes Pro-Crypto Candidates for Key Federal Financial Agencies

Robinhood to Relist SOL, ADA, XRP After Delisting Due to SEC Complaints

18 States Sue SEC for Constitutional Overreach and Unfair Persecution of Crypto

Gary Gensler Announces His Resignation Effective January 20th

FBI Raids Polymarket CEO’s Home Post-Election, Seizes Phone and Computer

Trump’s Leading Pick for Treasury Secretary is ‘Very Pro-Crypto’

Trump’s Plans for a ‘Crypto Czar’ and a Crypto Advisory Council

Manhattan US Attorney’s Office to Reduce Pursuit of Crypto Cases

Brazilian Congressman Introduces Bill for National Bitcoin Reserve

Japan's Metaplanet to Raise ¥9.5 Billion ($62M) to Expand Bitcoin Holdings

Upcoming Events

The M31 Capital team will be speaking at and attending a number of upcoming conferences and events. Please reach out if you are interested in connecting, or better yet - meet us there:

Florida: Marcus Evans Investor Summit (12/9-12/11)

Abu Dhabi: Bitcoin Mena (12/9-12/10)

Doha: World Summit AI (12/11-12/12)

Dubai: Global Blockchain Show (12/12–12/13)

Washington: Blockchain Association’s Policy Summit (12/16–12/17)

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies supporting individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital