The Monthly Airdrop: February 2025

January Market (+9.5%) // BTC reaches new ATH over $108k, Trump passes first crypto executive order after inauguration, Ross Ulbricht pardoned after 11 years

Bitcoin (BTC): BTC saw over $5.2bn in ETF inflows, reaching a new all-time high surpassing $108k just before Trump’s inauguration. Microstrategy acquired over 24k BTC in four separate purchases as their total holdings quickly approach 500k. Bitcoin staking protocols saw their TVL decrease over $170M throughout the month.

Ethereum (ETH): Despite >$100M in ETF inflows, the ETHBTC chart reached a 3 year low in the midst of Ethereum Foundation controversy. Vitalik Buterin posted an article highlighting the next steps to scale the Ethereum ecosystem, focusing on the limited blob space that is hindering L2 scalability. The imminent Pectra upgrade is set to double Ethereum blob space before Q2 2025.

Market Focus: The Trump administration’s crypto task force and the first crypto executive order were the central focus of January. White House AI and Crypto Czar David Sacks will lead a working group to develop a federal regulatory framework regarding crypto, along with working to create a national digital assets stockpile. The President’s official $TRUMP meme coin launch also contributed to heightened market enthusiasm.

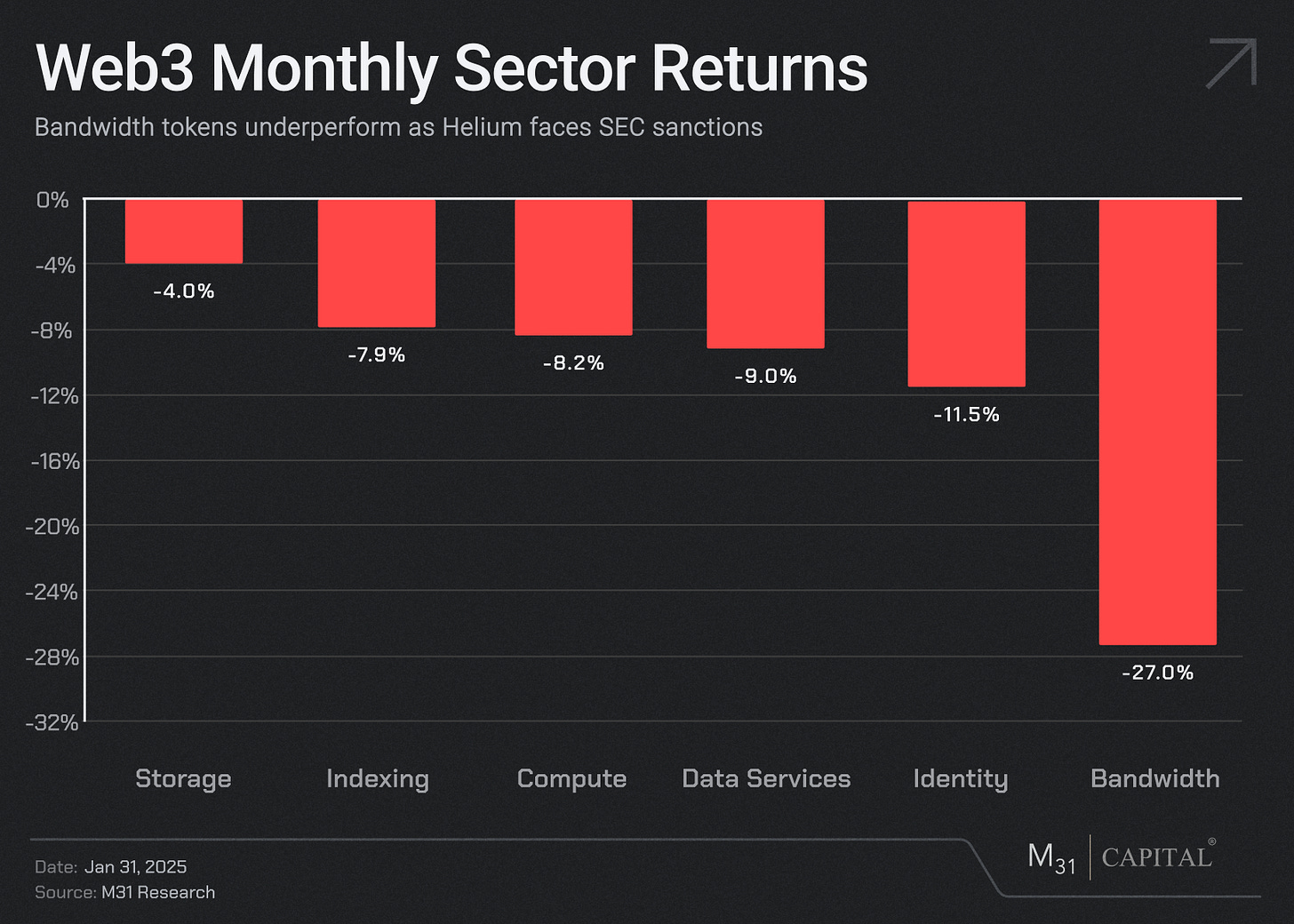

Web3: Leading DeAI tokens pulled back significantly from December highs as investor attention shifted despite further developments in the sector. Decentralized social networks such as Farcaster and Lens saw a notable decrease in user activity. In the decentralized identity subsector, Humanity Protocol announced a massive private raise at a $1.1bn valuation to accelerate development.

DeFi: World Liberty Financial made over $100M in crypto investments following Trump’s inauguration, including wBTC and TRX along with several Ethereum-based DeFi tokens. The President’s official TRUMP meme coin launch also contributed to heightened market enthusiasm, driving SOL to all-time highs after launching on Solana DEXes.

SQD.AI (SQD): +63.8%

SQD rebranded to SQD.AI, highlighting their initiative to support the future of decentralized AI agents. The SQD Surge Program aims to better align the community with the protocol’s long term vision to accelerate agent use cases.

SQD.AI strategically opened a new office in New York City to capitalize upon the AI innovation momentum in the US.

Chainlink (LINK): +25.6%

Chainlink revealed the CCIP v1.5 upgrade, simplifying the developer experience to launch tokens cross-chain. The CCIP SDK was also released, enabling developers to easily manage cross-chain token deployments and integrate with frontend dApps.

Chainlink supported over 40 new integrations of the Chainlink Standard, with key partnerships including Worldcoin and the BX Swiss stock exchange.

Astar Network (ASTR): -15.0%

Astar was a first-day integration partner for the Soneium mainnet launched by Sony. ASTR acts as a key asset to drive liquidity and engagement in the Soneium ecosystem, along with cross-chain applications.

Astar launched a proposal with AltLayer to enhance Soneium’s economic security and build a fast finality layer using ASTR as the key asset along with restaked ETH.

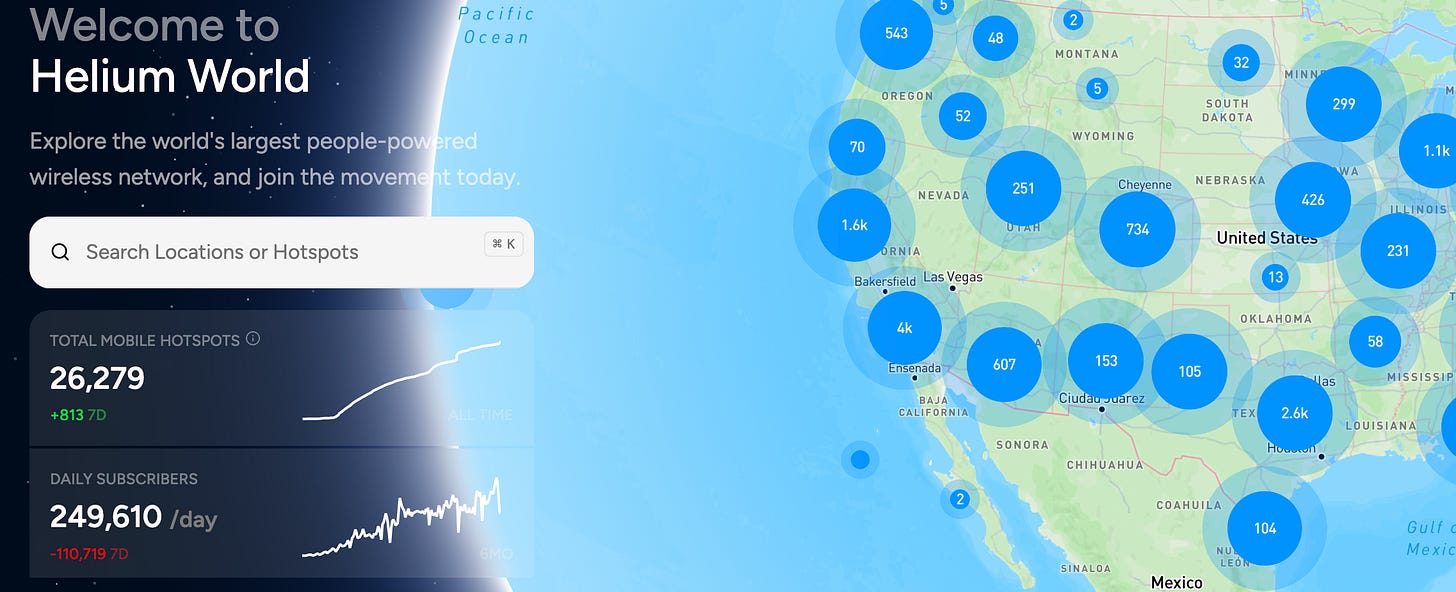

Helium (HNT): -28.2%

The SEC filed a lawsuit against Helium just days before Gary Gensler stepped down as SEC chair, alleging that Helium violated securities laws through its Discovery Mapping program and the sale of Helium Hotspots.

HIP 138 and 141 were both fully deployed, ending emissions for IOT and MOBILE tokens and returning to single-token governance with HNT.

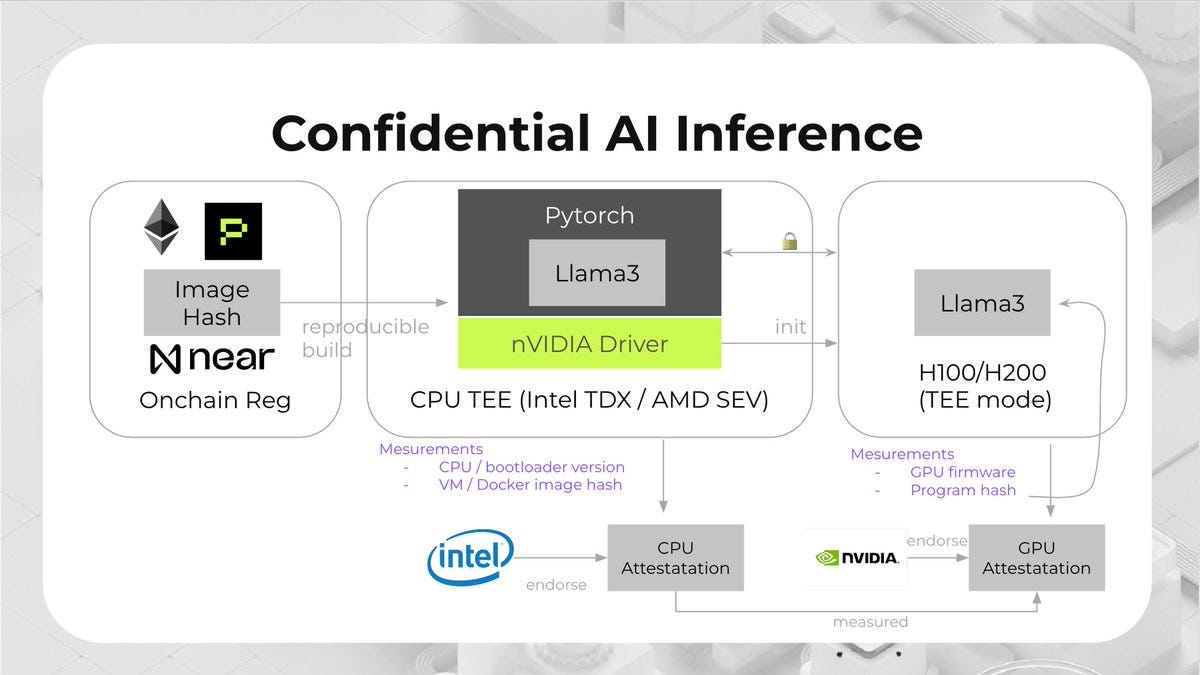

Phala Network (PHA): -48.6%

PHA pulled back sharply this month despite launching Phala 2.0, the first Op-Succinct Layer 2 on Ethereum in partnership with Conduit for security and scalability.

The monthly Phala Cloud Builders Challenge program was introduced, encouraging developers to deploy TEE projects and rewarding winners with Phala Cloud credits.

The NVIDIA Inception Program recently welcomed Phala, helping provide builders with GPU TEE hardware for confidential AI projects.

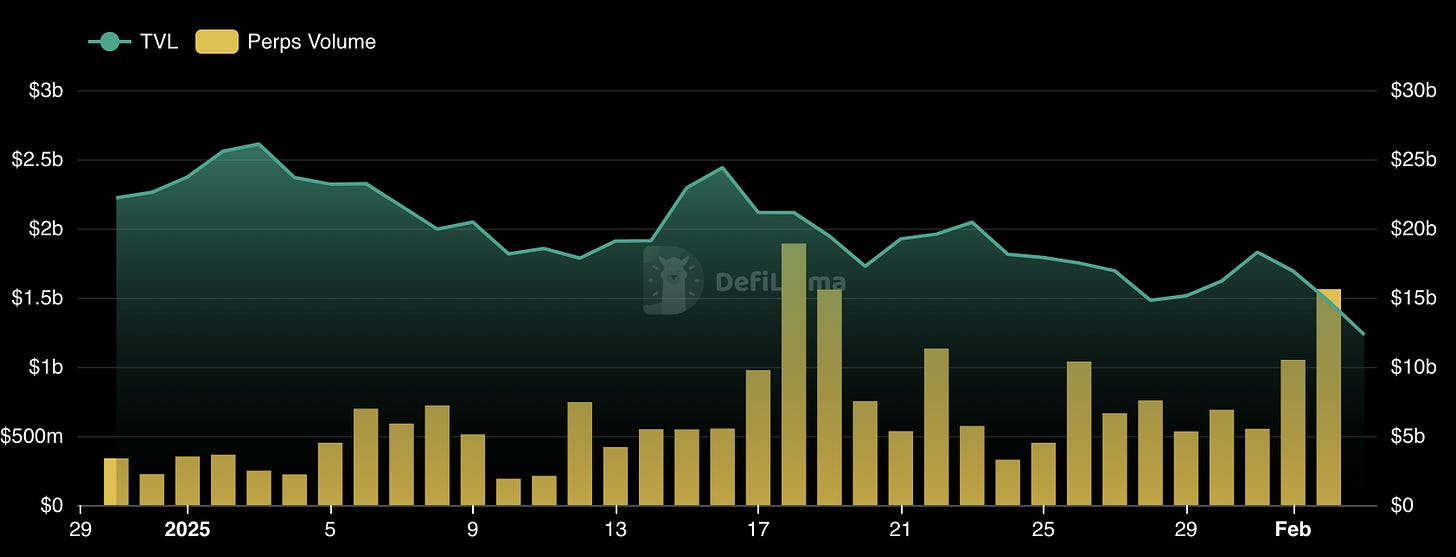

Hyperliquid (HYPE): +11.6%

Hyperliquid’s native token outperformed despite TVL dropping over $600M throughout January.

Hyperliquid achieved new all-time highs in volume following the integration of several new meme coin perpetuals.

Jupiter (JUP): +26.5%

Jupiter completed their Jupuary airdrop, distributing 7% of the JUP token supply to users and stakers.

The Catstanbul 2025 conference in Istanbul, hosted by Jupiter, concluded with a 30% burn of the total JUP token supply worth over $3bn.

Jupnet was launched in beta, introducing an omnichain network designed to facilitate seamless cross-chain interactions.

Virtuals Protocol (VIRTUAL): -50.1%

Virtuals expanded to Solana, allowing developers to deploy AI agents across multiple ecosystems enhancing cross-chain functionality. This expansion also established a strategic Solana reserve, allocating 1% of protocol revenue for conversion into SOL.

With the Terminal API upgrade, agent creators can now build using any framework, enabling activity streaming beyond the G.A.M.E. ecosystem.

Virtuals experienced a drop in direct protocol fees as trading volume from agent tokens shifted to DEXes such as Aerodrome and Uniswap.

THORChain (RUNE): -52.5%

THORChain’s Lending and Savers programs faced a liquidity crisis, with a $200M debt risk triggering investor concerns over potential insolvency.

In response, node operators voted to pause Lending and Savers withdrawals for 90 days to mitigate the potential insolvency risks and stabilize the system.

As the THORChain DEX and blockchain remains operational, liquidity providers are able to deposit and withdraw without issue.

January Highlights

Republicans Want to Kill Tax-Reporting Rule for Some Crypto Trades

Fifth Circuit Reverses U.S. Sanctions Against Cryptocurrency Mixer Tornado Cash

Melania Trump Launches Meme Coin as Crypto Conflicts Worry Experts

Phantom Crypto Wallet Raises $150M in Series C at $3B Valuation

Crypto Czar David Sacks Says NFTs and Memecoins Are Collectibles, Not Securities

Vitalik Buterin Announces Leadership Changes for Ethereum Foundation

Upcoming Events

The M31 Capital team will be speaking at and attending a number of upcoming conferences and events. Please reach out if you are interested in connecting, or better yet - meet us there:

Doha: Web3 Summit Qatar (2/23-2/26)

Denver: ETH Denver 2025 (2/23-3/2)

Dubai: Dubai AI Festival (4/23-4/24)

Dubai: Token2049 (4/30-5/1)

Washington DC: SelectUSA Investment Summit (5/11-5/14)

Toronto: Consensus 2025 (5/14-5/16)

Doha: Qatar Economic Forum (5/20-22)

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies supporting individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital