The Monthly Airdrop: January 2024

January Market (-2.7%) // Spot BTC ETF approval was another "buy-the-rumor, sell-the-news" event, massive $GBTC outflows drive negative price action, ETH ETF likely delayed until May

January was a volatile month for crypto assets, driven by several large developments in the space. In the first half of the month, we saw BTC ETF approval anticipation drive much of the ecosystem to double digit positive returns until the actual approval was announced. Afterwards, Greyscale’s GBTC Bitcoin ETF witnessed significant outflows, due to its industry-high 1.5% fees and the unwinding of billions in carry trade positions. As it stands currently, there has been a total net flow of +$1.5b into BTC ETFs, despite GBTC’s -$6b outflow. On a more positive note, GBTC outflows are slowing, now down into the low $100m range per session, which has led to a market-wide recovery in the last week of the month.

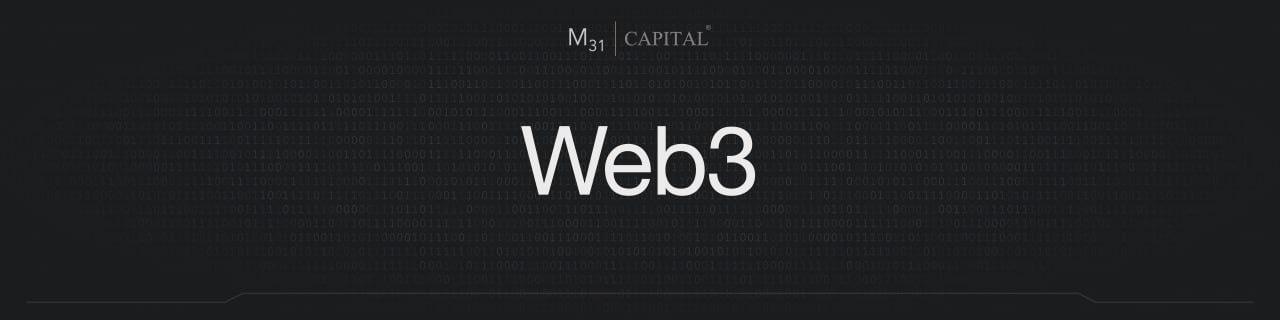

The AI compute narrative continued to have legs this month, as AI marketplace Bittensor (+76.5%) and GPU marketplace Nosana (35.4%) both enjoyed significant price surges in January as on-chain participation continued to heat up. Additionally, Aleph.im’s native token more than doubled this month after the launch of its full-service decentralized cloud resource platform, TwentySix Cloud.

Bittensor (TAO): +76.8%

Bittensor had its first governance proposal this month, titled BIT1, which aims to better incentivize subnet development and utility optimization. Although the final terms are still being discussed, the basic premise is for each subnet to have its own native token, which should theoretically better compensate subnets that provide more utility.

Also in the month, OSS Capital committed $25M to invest exclusively in the Bittensor ecosystem. The capital will be allocated across open-source grants, startups, validator initiation, subnet creation& scaling, staking across the community, accumulating and holding $TAO in size over very long timeframes (10+ years) and more.

Development on the network has exploded in recent weeks, with subnets now totaling 32, across a wide range of applications.

Aleph.im (ALEPH): +111.8%

Aleph.im, the decentralized storage and compute platform, released its 2024 roadmap this month, highlighting its plans to add pay-as-you-go capabilities, a native oracle, GPU support for virtual machines, IPFS on virtual machines executors, confidential virtual machines, and support for new EVM chains.

On January 26, Aleph.im announced the launch of Twentysix Cloud, its highly anticipated marketplace for business and developer decentralized cloud solutions. In partnerships with Avalanche and Superfluid, the platform will offer a pay-as-you-go model, enabling users to pay for exactly the amount of computing or storage resources they consume, by the millisecond.

Dimo (DIMO): +35.4%

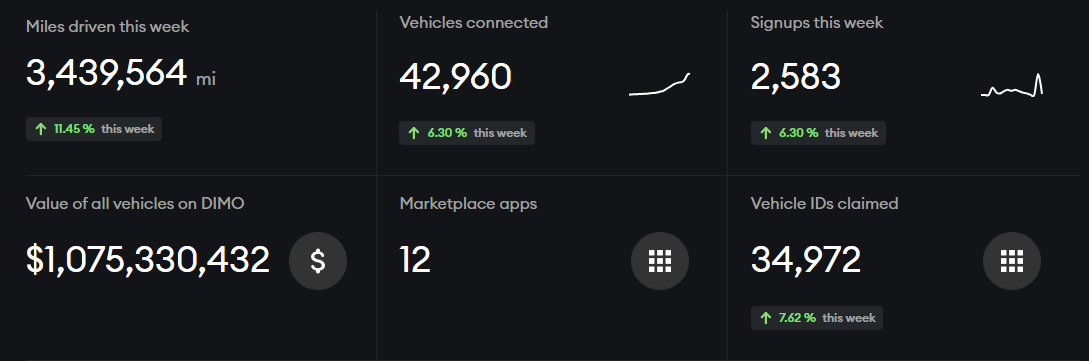

Digital Infrastructure Inc, the DePIN startup building out the DIMO network, raised $11.5 million in Series A funding this month, led by CoinFund. The round brings the startup’s total funding to $22m and will be used to continue to scale operations. The network experienced tremendous growth in 2023, increasing by 900%, and currently has ~43k cars connected, representing over $1b in assets, and 12 marketplace applications.

Nosana (NOS): +35.4%

The Render Foundation introduced RNP-008 this month, proposing Nosana as Render’s fourth Compute Client. As part of the technical integration, Nosana is proposing a Nosana-Render Working Group with a 30k $RENDER token grant to integrate Nosana as a Compute Client. Nosana will serve as a bridge between the AI inference community and the Render Network's decentralized GPU network to tackle GPU shortages, idle compute inefficiencies, and high public cloud pricing.

The Nosana network witnessed a large surge of activity in January, processing nearly 100k AI inference jobs.

Huddle01 recently published its 2024 Roadmap which outlines its transition to a fully permissionless network operated entirely by Huddle01 Node Operators. This includes the launch of physical hardware nodes that anyone in the community can run, which will be rewarded with Huddle01 tokens after mainnet launch (expected in Q3). The 2024 Roadmap also unveiled Layer01, Huddle’s infrastructure layer for more generalized dRTC use cases, including DeFi and more.

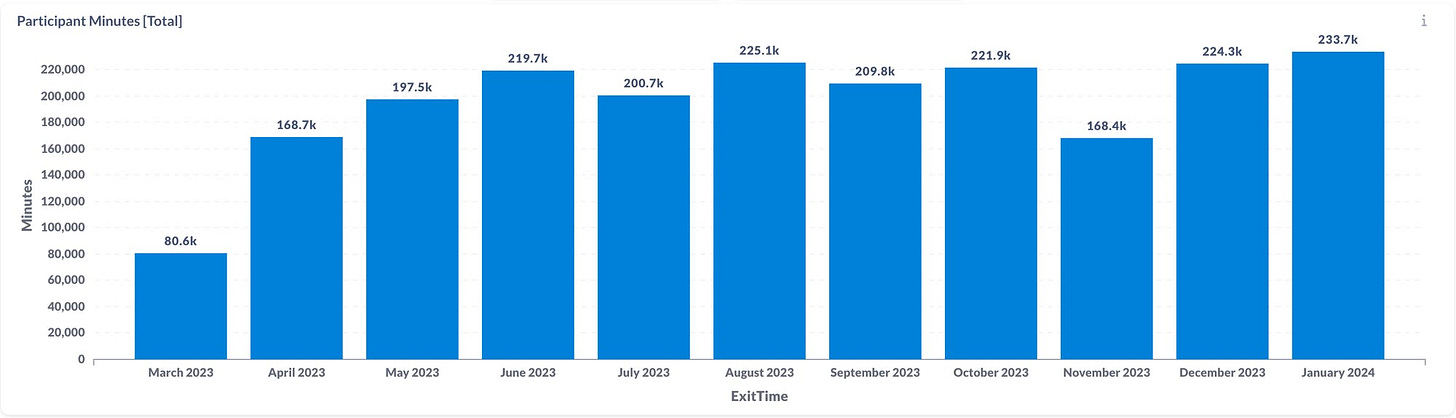

Network adoption continues to be strong, hitting an all-time high of 230k+ participant minutes in January. Huddle01 formed new partnerships with Mailchain & Lenspeer, integrating native audio spaces into their apps using our APIs and SDKs.

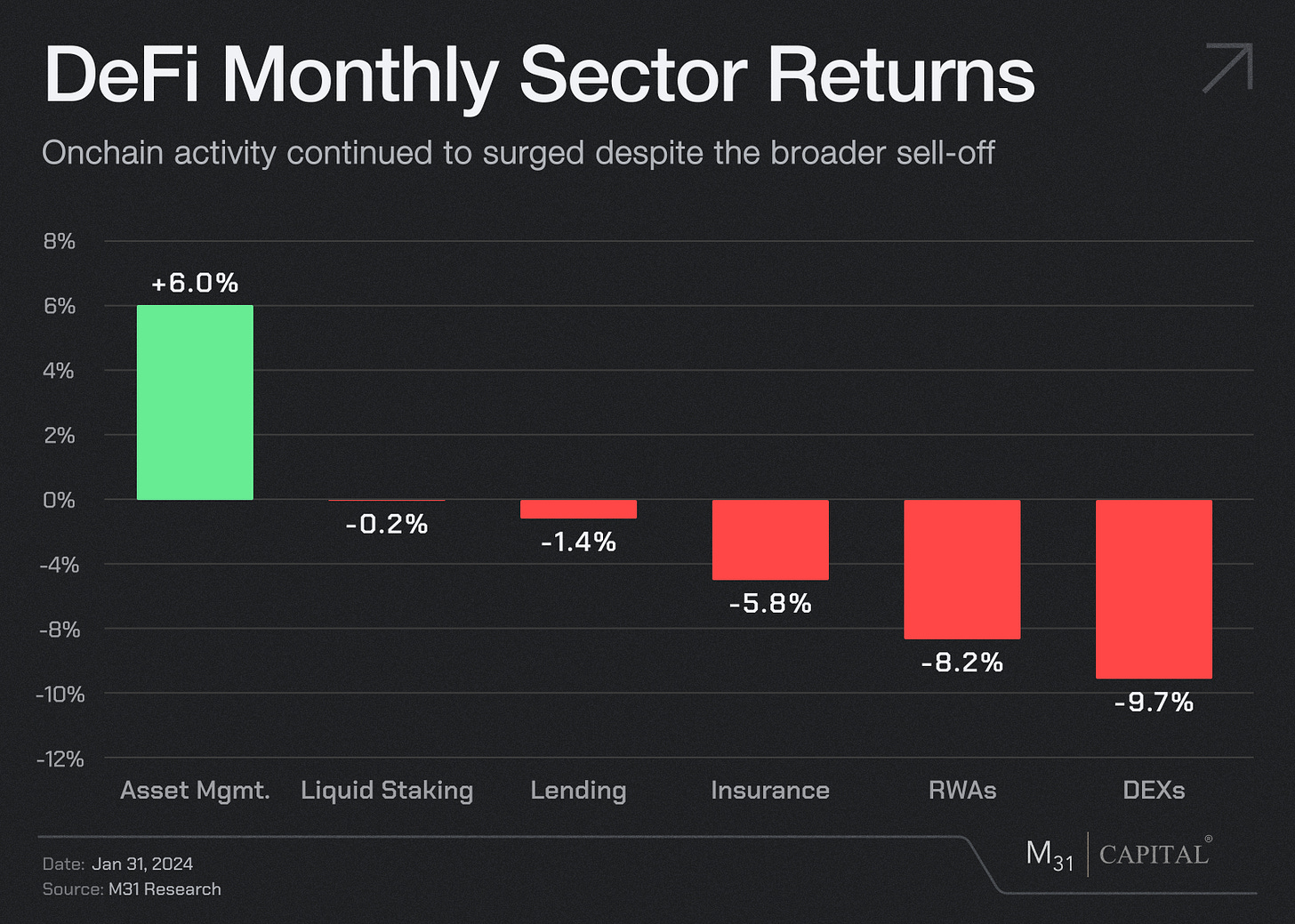

On-chain activity in January was quite significant as we saw the highest volume of BTC transfers since September 2022; a significant portion of this can be attributed to BTC moving out of GBTC and into other ETF products. Despite a notable increase in on-chain activity, performance across the board in DeFi was muted after the market wide sell-off mid-month.

Injective (INJ): (-4.8%)

Injective rolled out its “Volan” upgrade this month, which is focused on adding support for RWAs as the trend remains strong. This upgrade also integrates with Cosmos IBC, which will allow cross-chain transactions through the Cosmos ecosystem and improve liquidity sourcing.

Injective also introduced gas compression in January, leading to lower transaction costs as the protocol aims to gain adoption from institutions in the financial sector.

Stacks (STX): +3.6%

Stacks had a rollercoaster of a month in January, trading up 39.9% and then erasing those gains and trading down (-12.6%) before settling almost flat on the month. As the leading Bitcoin-secured L2, Stacks still performs as the beta trade to BTC.

Stacks ran into a minor block production delay towards the end of the month which was likely the result of miners running new software that was quickly fixed.

MakerDAO (MKR): +15.5%

MKR was one of the stronger performers in the DeFi space this month as revenues came in just above $21m, notching its second highest month in the past year. MakerDAO’s revenues are primarily driven by their RWA program which has grown significantly in the past year

ZetaChain (ZETA): +42.4%

ZETA’s mainnet beta and native token trading went live in January. Zetachain is a L1 smart contract platform that enables communication between L1s, L2s, and non-SCP chains like Bitcoin. The protocol is an important piece of infrastructure for bridging fragmented ecosystems across blockchains and brings seamless functionality with their omnichain dApps.

January Highlights

Upcoming Events

The M31 Capital team will be speaking at and attending a number of upcoming conferences and events. Please reach out if you are interested in connecting, or better yet - meet us there:

Dubai: Satoshi Roundtable X (2/1-2/6)

Denver: ETH Denver (2/23-3/3)

London: DAS London (3/18-3/20)

New York City: DEFICON (3/30)

New York City: NFT NYC (4/3-4/5)

Hong Kong: Web3 Festival 2024 (4/6-4/9)

Dubai: TOKEN2049 (4/18-419)

Dubai: ETH Dubai (4/19-4/21)

Dubai: HFM Middle East Summit (5/14-5/15)

Austin: Consensus 2024 (5/29-5/31)

Dubai: M31 Academy (6/1-8/15)

Brussels: EthCC (7/8-7/11)

Singapore: TOKEN 2049 (9/18-9/19)

Singapore: Breakpoint (9/19-9/21)

Salt Lake City: Permissionless III (10/9-10/11)

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies supporting individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital