June Performance

In This Issue:

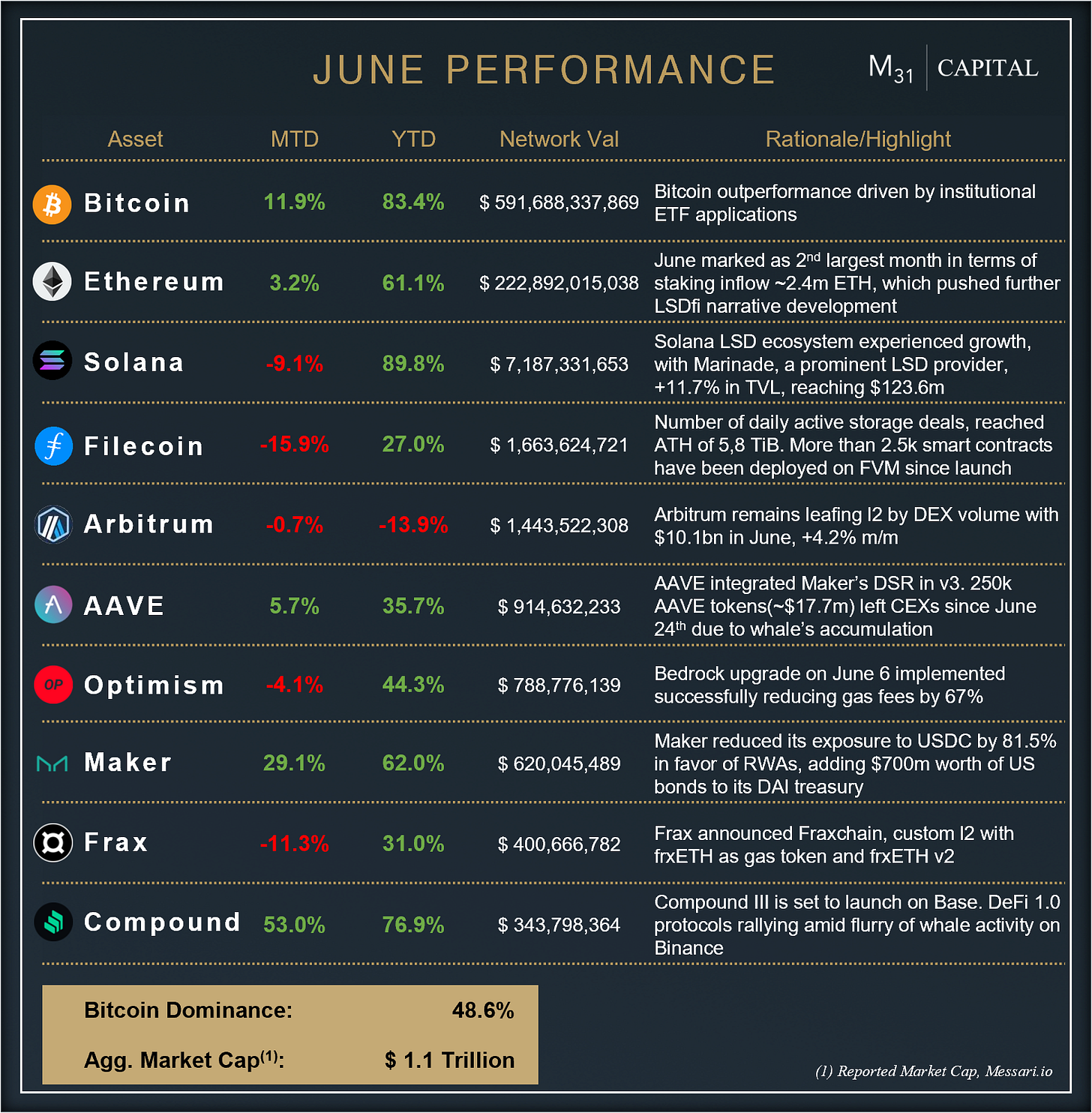

Market: BTC outperformed the market, regaining centre stage after Institutions rushed to file BTC ETFs

Narrative: BTC ETF applications rally markets, DeFi makes a comeback, & Web3 assets and NFTs see a sharp pullback

Highlight: We highlight Pendle Finance amidst its impressive outperformance

Market Action

The month began on a sour note as the the SEC launched another wave of attacks on the blockchain industry. Lawsuits against Binance and Coinbase for alleged U.S. securities violations, and the pronouncement of 67 assets as securities, including BNB, SOL, ADA, MATIC, FIL, and ATOM. These actions, and primarily the latter, resulted in a forced sell off in alts. Stablecoin reserves on CEXs dropped to levels not seen since late March, and USDT de-pegged once again. Things weren’t looking good and by the middle of June, the market was down -9.4%.

Then came the ETFs. In a massive sign of support for Bitcoin, institutions including BlackRock, WisdomTree, Invesco, Valkyrie Funds, Bitwise, & Fidelity practically tripped over themselves to file one Bitcoin ETF after another. Gensler who?

Even Jerome Powell effectively surrendered the anti-crypto fight this month, saying “Cryptoassets, like Bitcoin, have staying power” as an asset class.

The overall market ended June +6.9%, rallying +18.0% since the first ETF application was filed.

Although the timeline for approval of a Bitcoin spot ETF remains uncertain, institutions continue to demonstrate their still rapidly growing interest in crypto. Deutsche Bank filed for a crypto custody license, and EDX Markets, a new cryptocurrency exchange backed by Citadel Securities, Fidelity Investments, and Charles Schwab, launched this month.

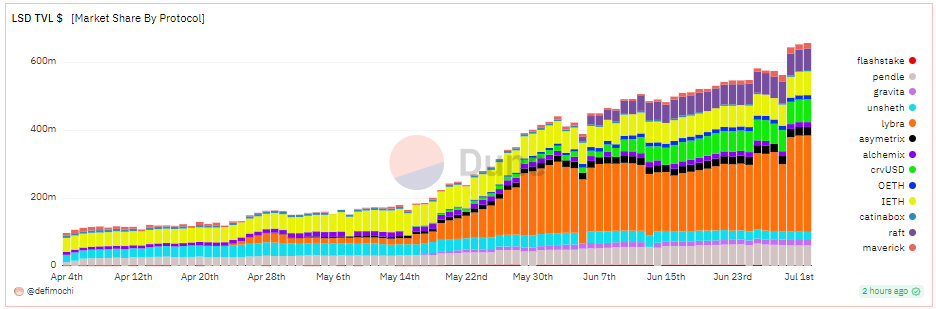

Despite challenging macroeconomic and regulatory conditions, the adoption of ETH staking remained strong, witnessing a monthly increase of +9.1% in ETH staked, reaching a total of 23.5m (19.8% of total supply) which has helped catalyze the development of a growing LSD-Fi narrative.

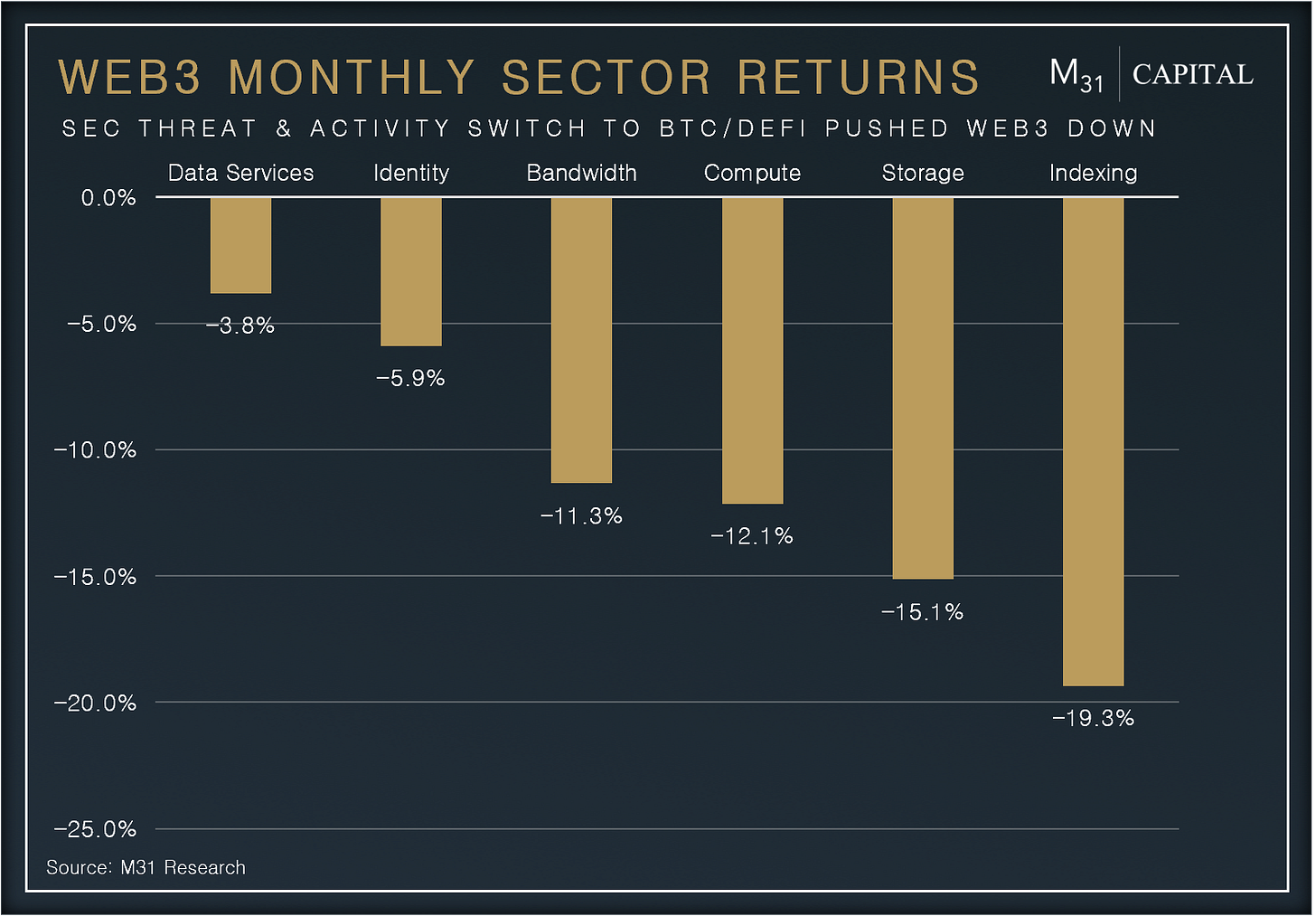

Web3

Despite the historical trend of Web3 assets outperforming the market in risk-on conditions, this time Bitcoin led the rally with several alts such as ADA, MATIC, and SOL facing forced selling by centralized platforms like Robinhood and Revolut US. Furthermore, Celsius is planning to liquidate approximately $290m worth of its alts. The rally in BTC, driven by institutional ETF adoption, and the underperformance of Web3 assets, despite the uptick in fundamentals, resulted in a shift in focus towards BTC and blue-chip DeFi assets.

Filecoin's storage utilization remains strong with an 2.6% m/m increase in average daily active storage deals, reaching ATH of 5,8 TiB in June. The network capacity grows by 3.9% to 21.7 PiB, attracting new participants despite the SEC's security classification

Pocket Network announced the wPOKT launch on Ethereum, enabling POKT to be interoperable with best-in-class DeFi, DAO tooling, and infrastructure while also improving its liquidity and accessibility. Additionally, another Burn Gateway occurred resulting in total ~$1.7m POKT burned (~0.1% of supply)

Arweave has unveiled its U token, a programmable asset that can be obtained by burning AR tokens for data storage on the Permaweb. U token utility includes facilitating the monetization of stored content, seamless integration with dApps due to its programmability, and its potential use for trading or providing liquidity on Permaswap. Following the launch, monthly transactions reached new ATH of 92.8m, +23.7% m/m

DeFi

AAVE remains the leading money market with a TVL of $8.4bn, +3.8% m/m and $2.7bn in active loans in June alone, +6.0% m/m. AAVE has earned ~$7.2m in monthly fees, +17.8% m/m

Maker has significantly reduced its exposure to USDC as collateral for DAI, and has moved into RWAs (U.S. Treasuries and money market funds), adding $700m worth of assets, taking the total to $1.56bn

GMX has made a strong comeback and reclaimed its leading position in the derivatives DEX market. GMX processed $4.1bn in trade volume and earned $11.6m in fees in June, +85% m/m

Lybra Finance is leading the LSDFi sector so to speak, attracting ~$283m in TVL +44.0% in the last month

AEVO, a decentralized options exchange by the Ribbon Finance team attracted over $4m TVL in just 2 weeks since its public launch and over $120m in cumulative trade volume

March Highlights

Binance and SEC reach agreement to keep US customer assets in country

EDX Markets, backed by Charles Schwab, Citadel Securities, Fidelity launched

U.S. House committee prepares to vote on crypto and stablecoins legislation

Robinhood ends support for all tokens named in SEC lawsuit as securities

Partner Highlights

Coinbase is the leading spot exchange for Bitcoin ETF applications

Akash is preparing for AKT 2.0

Uniswap releases its vision and architecture for Uniswap v4

Protocol Highlight

Pendle Finance (PENDLE)

LSDFi protocols leverage staked assets to offer attractive yields. This specific market experienced rapid growth over the last few months, reaching $659m in TVL, +64.7% +499.0% YTD, driven by building boosted yield products on top of DeFi use cases like yield baring stablecoins (CDP), derivatives, borrow/lend and, most importantly, liquid staking. While most of the LSDFi protocols compete between each other for market share, Pendle is standalone securing strong use cases which led to a rapid growth over past months.

Pendle is a yield-trading protocol that enables users to speculate, leverage, or hedge yield by splitting the underlying yield-bearing asset into a principal and a yield component, which can be traded on Pendle's AMM.

vePENDLE:

The introduction of vePENDLE (locked PENDLE tokens), has led to the emergence of the "Pendle wars" where protocols accumulate voting power to achieve the highest yield. vePENDLE holders benefit from historically attractive yields, which has resulted in 37.9m PENDLE tokens currently locked (26% of circulating supply).

15.3m vePENDLE has been accumulated by Equilibria, Penpie and Stake DAO over past few months, effectively reducing the circulating supply of PENDLE

Pendle Wars:

Growth Metrics:

Pendle has been one of the top performing assets over the past month due to a significant growth of its TVL, demand for vePENDLE aided by the growth of the overall LSDFi ecosystem and narrative

Takeaway

Pendle has shown significant strength despite turbulent market conditions in the past month. It has done so by focusing on one thing and one thing only: yield. As LSDFi has still only captured ~4.1% of the overall LSD market, there is still a lot of space to grow. Pendle has also been able to accrue value from the derivatives market by adding new pools alongside already listed GLP pool to leverage real yield.

Upcoming Events

The M31 Capital team will be speaking at and attending a number of upcoming conferences and events. Please reach out if you are interested in connecting, or better yet - meet us there:

Lisbon: Block 3000 (7/6-7/7)

Valencia: NFT Show Europe (7/14-7/15)

Paris: EthCC (7/17 - 7/20)

Goa: Web3Conf India 2023 (8/11-8/14)

Toronto: ETH Toronto (8/13-8/16)

Austin: Bit Block Boom (8/24-8/27)

Bali: Coinfest Asia (8/24-8/25)

Copenhagen: Nordic Blockchain Conference (9/7-9/8)

Austin: Permissionless (9/11 - 9/13)

Singapore: Token 2049 (9/13 - 9/14)

Cologne: W3.vision (9/20-9/21)

Barcelona: European Blockchain Convention (10/24-10/26)

Dubai: AIM Summit (10/30 - 10/31)

Athens: Decentralized (11/1-11/3)

Miami: Quantum Miami (1/24-1/26)

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies supporting individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital