The Monthly Airdrop: July 2024

June Market (-9.5%) // Bipartisan crypto discussion rises as both U.S. presidential candidates push to win votes; U.S. sees first Solana ETF applications, predicting a shift towards pro-crypto policy

Bitcoin (BTC): Total ETF inflows remained positive for the month despite 9 days of outflows spanning from June 10 to June 24; sentiment remains cautious approaching Q3 2024, with Mt. Gox having announced their $9bn repayment plan which will commence in July.

Ethereum (ETH): L2 scaling solutions continue to garner significant attention and dominate the ecosystem; ETH mainnet closed June by recording its lowest fees since 2016, with average gas hovering around 3 gwei on June 30 (~$0.04 per transfer).

Market Focus: June brought multiple nine-figure airdrops from EVM-based L2s along with other highly-anticipated Web3 projects; BTC performance overshadowed by ETH / SOL ecosystem tokens as ETF narrative shifts.

Web3: The Web3 sector demonstrated user growth throughout June despite market dips. L2s and DePIN protocols reported positive change in user engagement and asset bridging, resulting in high revenues amidst poor market conditions. Several new protocols driving innovation in DeAI and DePIN announced multi-million dollar raises, which highlights the growing relevance and mindshare surrounding these sectors.

DeFi: Although TVL decreased over $5bn in June according to DefiLlama, chains such as Sei and Ton saw exponential growth in DeFi activity. This growth was backed by boosted incentives for liquidity providers, as well as easily-accessible play-to-earn games. Regulatory challenges for centralized exchanges persisted, while prominent platforms such as U.S.-based Kraken and Turkish exchange BtcTurk were harmed by the exposure of contract vulnerabilities.

Solana (SOL): (-11.5%)

Although DeFi TVL on Solana fell over $1bn in June, the chain made several developments that bolstered its position as a leading L1. Institutional interest in Solana has shown significant growth, as 3iQ filed for the first SOL ETF in Canada while VanEck and 21Shares applied in the United States.

Amidst the significant retail inflow and memecoin mania, Solana introduced Blinks and Actions as new tools to increase accessibility. Actions return transactions onchain to be reviewed, signed and sent across various avenues, such as QR codes and widgets. Blinks turn any onchain action into a shareable link, providing a streamlined avenue for users to interact onchain.

LayerZero (ZRO): +10.5%

The LayerZero ecosystem gained attention in the beginning of June regarding their rigorous anti-Sybil measures. Self-reporting and bounty hunting mechanisms helped LayerZero to redirect ~10m tokens from Sybil accounts to real users.

LayerZero launched its ZRO token on June 20 through a novel yet controversial mechanism dubbed "Proof-of-Donation." The protocol required users to donate $0.10 per token to claim their respective airdrops, resulting in $18.5 million being donated to Protocol Guild.

This new mechanism was met with backlash from the community, but was favorable for Arbitrum as the L2 network recorded a new high of over $3.4m in revenue on the date of the ZRO airdrop.

AO Computer (AO): N/A

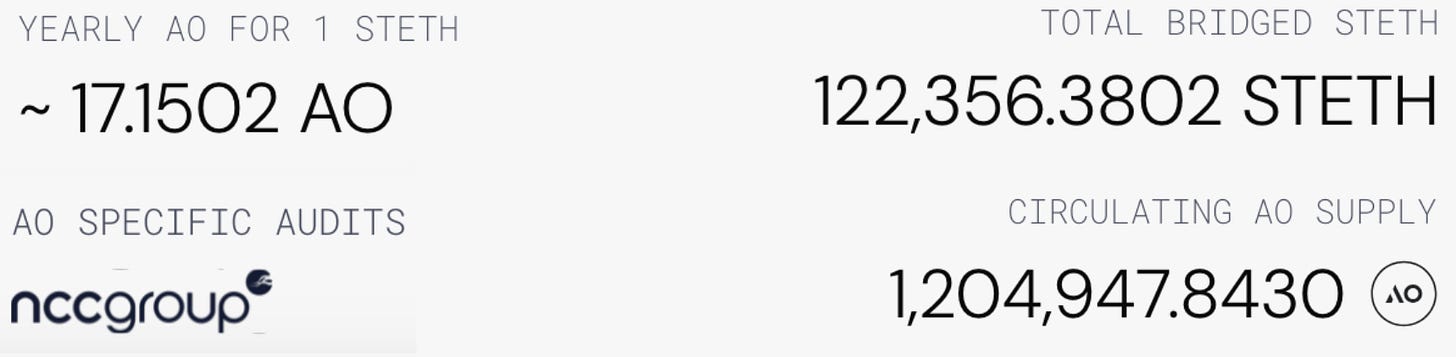

The AO genesis block launched on June 13th, which was marked by a notable change in their minting mechanism. Previously, 100% of AO tokens minted were granted to AR token holders according to their ownership, which has now been reduced to 33.3%. Now, 66.6% of AO tokens minted are granted to users who bridge their stETH onto the network.

AO ecosystem has experienced exponential growth as a result of this new minting mechanism, as users have bridged over $400m in stETH onto the AO network in under three weeks, and growth has remained strong throughout June.

Blast (BLAST): (-20.2%)

The Blast L2 saw TVL plummet over 40% throughout June. Despite this decrease, Blast saw an exponential MoM increase in volume leading up to the native token airdrop.

The L2 launched its native BLAST token on June 26, airdropping 17% of the supply at a $2.5bn market cap. The 9-figure airdrop was distributed equally between developers and stakers, with an extra 3% being allocated to the Blur Foundation for farmers and active users of their NFT marketplace.

Render (RNDR): (-25.0%)

The Render Network released their Summer 2024 update in June, reporting 17.7% YoY growth in frames rendered, as well as over 60% growth in adjusted token usage on the network.

Render governance has approved a new RNP proposal for the integration of Blender’s Cycles on the Render Network, which expands their market capture and gives millions of Blender users seamless access to the Render Network.

Render has also directly incorporated downloading to 3rd party professional storage solutions such as Dropbox, with support for other major cloud providers coming in the near future.

Helium Mobile (MOBILE): +1.3%

After successfully launching boosted locations in Los Angeles earlier this year, Helium Mobile expanded their boosted location incentives to high traffic areas in New York City. This program aims to expand coverage to the largest U.S. cities, targeting areas that will have the greatest impact for the most network users.

The core team launched a tech stack licensing program for manufacturers, which will help to broaden their market share and increase revenue through licensing fees.

The Helium Mobile network also saw a MoM increase in new user inflow, with a 21% increase on average in daily subscribers.

Ethereum Name Service (ENS): +11.3%

After weeks of volatile price action following the SEC’s approval of U.S. spot Ether ETFs in May, ENS finished the month positive in anticipation of the transition to ENSv2, as well as an upcoming rebrand set to launch in July.

ENS Labs has also released their project plan for ENSv2, including a roadmap for upcoming developments and research into the project that will be completed before the L2 is deployed.

Subsquid (SQD): (-15.4%)

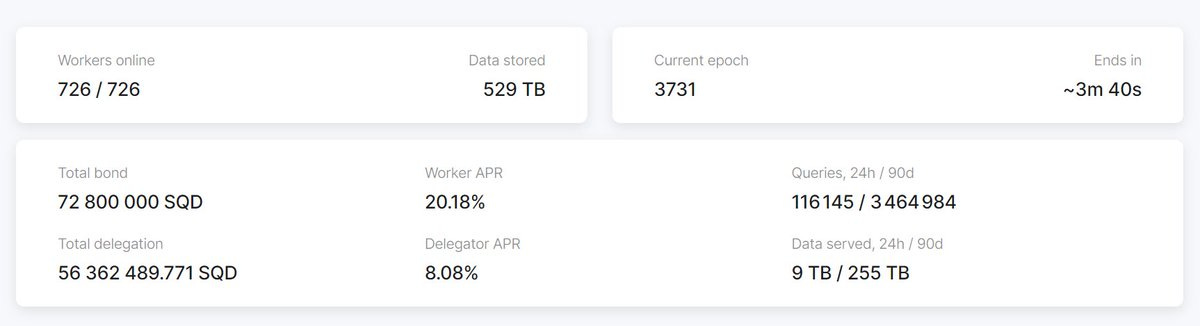

Subsquid is a modular query engine and data lake optimized to process on-chain data from over 100 EVM and substrate networks, as well as Solana and Starknet. The mainnet launched on June 3, and onboarded over 700 worker nodes within just a few weeks. The network is also developing coprocessor and RAG functionality, with several other developments on their roadmap for the coming months.

Aave (AAVE): (-5.5%)

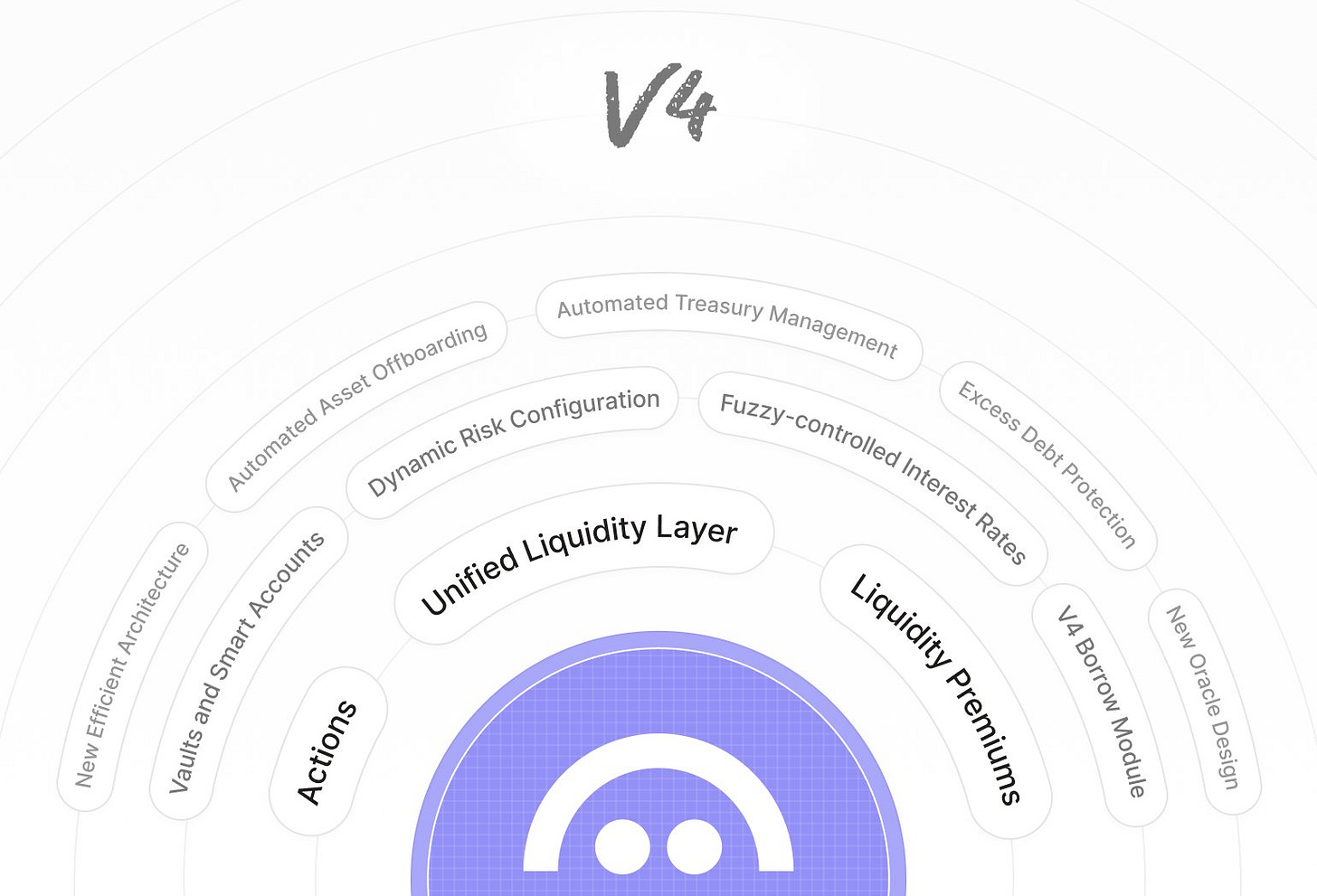

Aave governance voted in favor of providing Aave Labs with a $12m grant to build out Aave v4 over 12 months, with the goal of developing new modular infrastructure and new features for GHO, Aave’s native stablecoin.

According to Token Terminal, June saw Aave’s net deposits and active loans increase 15% and 25% respectively. Aave recorded a 28.8% month-over-month increase in fees generated, as well its largest month of earnings to date. The market trend is starting to shift away from memecoins, as projects that generate real profits are starting to regain investor attention.

Toncoin (TON): +22.7%

The TVL on TON dApps doubled in June, increasing by over $350m, while also surpassing Ethereum in Daily Active Addresses throughout the first half of June. This parabolic TVL spike was driven by DeDust, which offers boosted rewards by liquidity providers on USDT pools backed by the TON Foundation.

The TON network has seen a surge in retail enthusiasm thanks to easily-accessible play-to-earn Telegram games such as “Notcoin” and “Hamster Kombat.” As a result, investor confidence has also reached new heights, with Pantera Capital raising funds for their second investment mere weeks after they had made their largest investment ever into TON.

MakerDAO (MKR): (-4.3%)

Total deposits into the Spark DAI Vault on Morpho Blue increased by $100m in June. This enables Maker’s newly-launched Spark SubDAO to seamlessly allocate more capital to Ethena’s USDe and sUSDe markets.

The Maker core team recently announced $1.35m bug bounty running in July to ensure rock-solid security before launching key Endgame roadmap developments, which aim to ensure the ecosystem can scale in a decentralized manner.

Lido DAO (LDO): (-17.6%)

Lido has continued to consistently generate around $100m in monthly fees, despite the $2bn decrease in TVL. As over 300,000 net new ETH was staked through Lido throughout the month, the TVL dip was a result of the decrease in the price of ETH.

Lido staked ETH is also consistently used for liquidity on various L2s, with nearly $500m worth of tokens bridged onto top L2s such as Arbitrum and Optimism.

Towards the end of June, Lido DAO experienced a sharp dip in its LDO token price following actions by the SEC against Consensys for MetaMask Staking, as the SEC continues to target the crypto sector with aggressive securities lawsuits.

Curve DAO (CRV): (-40.0%)

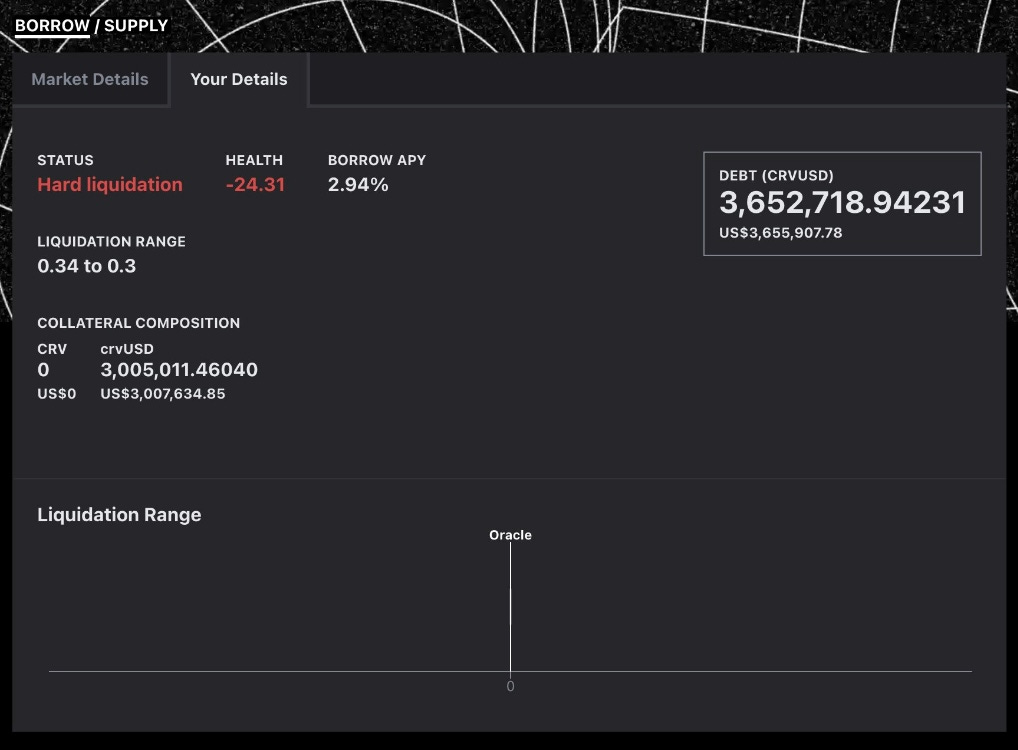

On June 10, Ethereum-based lending protocol UwU Lend was hacked for nearly $20m in a swiftly executed attack utilizing flash loans. This indirectly had a significant impact on Curve Finance, as the hacker stole nearly $10m worth of Michael Egorov’s CRV tokens from the platform. Curve Finance Founder Michael Egorov had over 9 figures worth of CRV lent as collateral across several different DeFi protocols, and this sharp drop in price put his loans at significant liquidation risk.

On June 13, the price of CRV fell through Egorov’s liquidation threshold, with over $140m in CRV tokens being liquidated across five protocols within hours. Although the liquidation caused the native CRV token price to quickly drop 30%, the events helped to demonstrate the robustness and effectiveness of Curve’s soft liquidation mechanisms.

Convex Finance (CVX): +11.5%

Following the CRV liquidations, net inflows into vote-escrowed CRV skyrocketed to over 14m CRV on June 14, and have remained high ever since. Convex Finance is the largest holder of veCRV, managing over 40% of the supply. Convex has benefitted significantly from these inflows, as CVX briefly surged 100% following the event. Convex users took advantage of this opportunity to stake their cvxCRV tokens, earning over 25% vAPR on platform revenue earned from veCRV.

June Highlights

Crypto Industry Super PAC is 33-2 in Primaries, with $100 Million for House, Senate Races

Bitcoin Eclipsed by Ether, Solana in Crypto Bets Tapping ETF Hype

SEC Sues Consensys Over MetaMask’s Brokerage, Staking Services

Polymarket Trading Volume Surges With $200M Bet on US Presidential Election

Crypto Emerges as Key Issue in 2024 U.S. Elections, Reshaping Political Contest

Solana Actions and Blinks Provide a Bonanza for Crypto Enthusiasts

JPMorgan & CoinShares Predict Bitcoin Shake-Up From Mt. Gox $9B Payout

Coinbase Accuses U.S. SEC, FDIC of Improperly Blocking Document Requests

NFT Sales Fell 44% as Crypto Dipped, Memecoins Steal ‘Mind Share’ in Q2

Upcoming Events

The M31 Capital team will be speaking at and attending a number of upcoming conferences and events. Please reach out if you are interested in connecting, or better yet - meet us there:

Dubai: M31 Academy (6/1-8/15)

Brussels: EthCC (7/8-7/11)

Wyoming: Wyoming Blockchain Symposium (8/19-8/22)

Singapore: TOKEN 2049 (9/18-9/19)

Singapore: Breakpoint (9/19-9/21)

Las Vegas: Apex Invest Las Vegas (10/9-10/10)

Salt Lake City: Permissionless III (10/9-10/11)

San Francisco: CoinAlts Fund Symposium 2024 (10/16)

Doha: World Summit AI (12/11-12/12)

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies supporting individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital