The Monthly Airdrop: July 2025

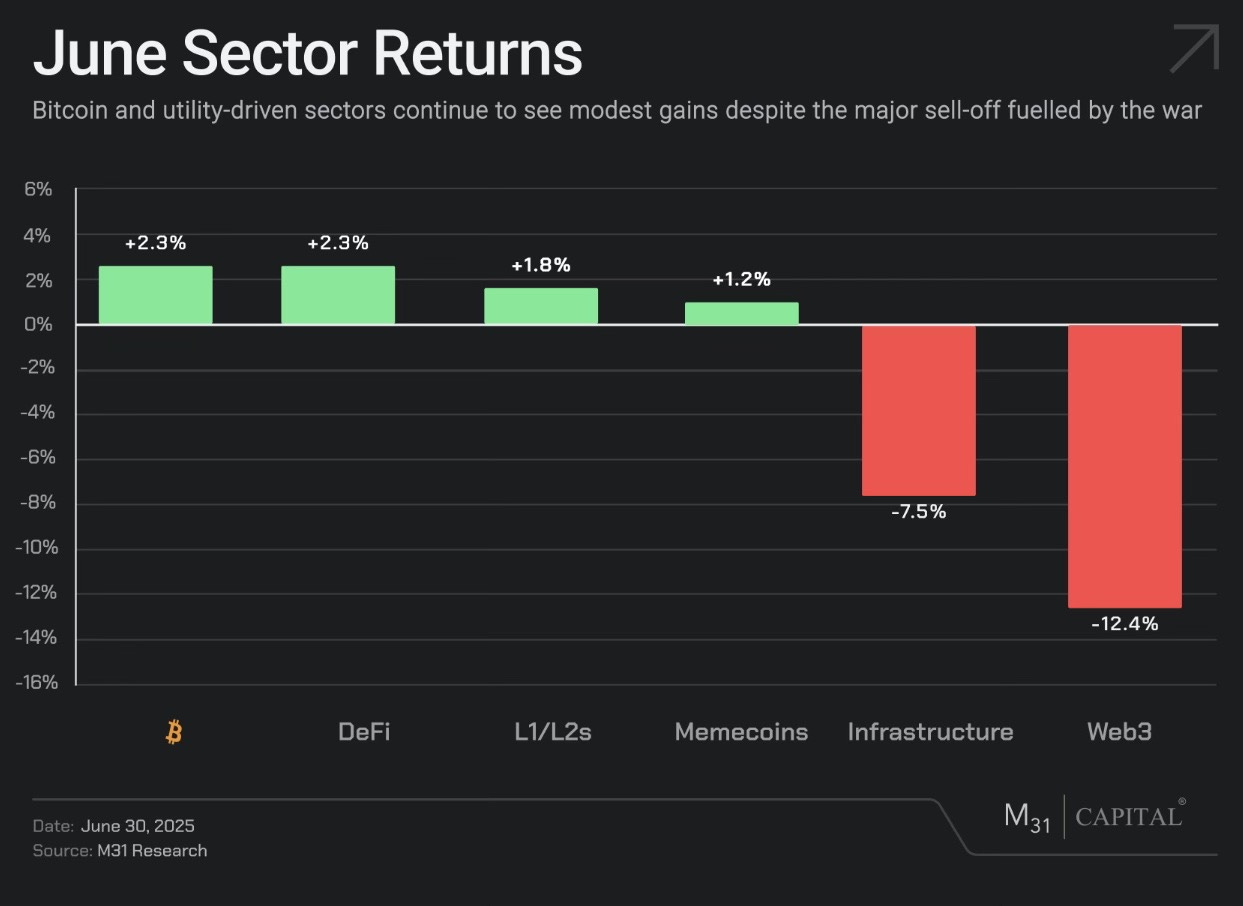

June Market (+2.6%) // Senate passed GENIUS Act, SEC backs DeFi, Solana ETF and Circle IPO signal TradFi crossover

Bitcoin (BTC): Bitcoin traded sideways between $100k–$110k, as Israel-Iran tensions and Fed uncertainty triggered early June sell-offs, but markets rebounded on ceasefire news. Accumulation remains healthy, though profit-taking muted volatility. ETFs saw $2bn inflows for the week ending June 27, 2025, extending a $4.63bn three-week rebound, with stronger catalysts needed to reignite momentum.

Ethereum (ETH): June’s Ethereum ETFs have seen cumulative inflows totaling $4.2bn. Meanwhile, with BTC treasury adoption on the rise, June marked ETH’s emergence as the next major treasury asset. The latest addition saw Bitcoin miner BitMine raising $250M to adopt ETH as its primary reserve, aiming to capture both price appreciation and staking yield, mirroring MicroStrategy’s Bitcoin playbook. Following the successful Pectra upgrade, Ethereum’s next milestone, the Fusaka upgrade, focused on scalability and efficiency, is slated for release in late 2025.

Market Focus: June saw a wave of major institutional developments, led by Circle’s successful IPO, underscoring growing mainstream confidence in stablecoins, alongside expectations for Solana ETFs to debut. The SEC publicly backed DeFi, framing it as aligned with core American values of economic freedom, property rights, and innovation. Meanwhile, Tron is preparing to go public via a reverse merger, with Eric Trump joining its leadership. Regulatory momentum also strengthened, with South Korea unveiling a crypto ETF and stablecoin roadmap which further highlight global momentum. The U.S. Senate’s passage of the GENIUS Act added legislative support, and the FHFA directed Fannie Mae and Freddie Mac to consider cryptocurrency holdings as reserve assets in mortgage underwriting signified a landmark shift in how digital assets are treated in finance. June also witnessed Blockworks unveiling the first‑of‑its‑kind open‑source Token Transparency Framework to combat opacity in token projects with legacy‑grade disclosure standards.

Web3: Web3 saw a modest pullback in June, with modest venture activity and institutional adoption. a16z plowed $70M into Eigen Labs to launch a trust-minimized off-chain computation platform via Ethereum restaking EigenCloud. Meanwhile, traditional Web2 and TradFi players are betting on privacy as their gateway into Web3. Chinese tech giant Alibaba Cloud has joined Nillion’s Enterprise Cluster to support privacy-preserving data computation through decentralized MPC infrastructure, signalling gradual Web3 demand in Web2. Zama raised $57M to become the first unicorn focused on fully homomorphic encryption for private blockchain computation.

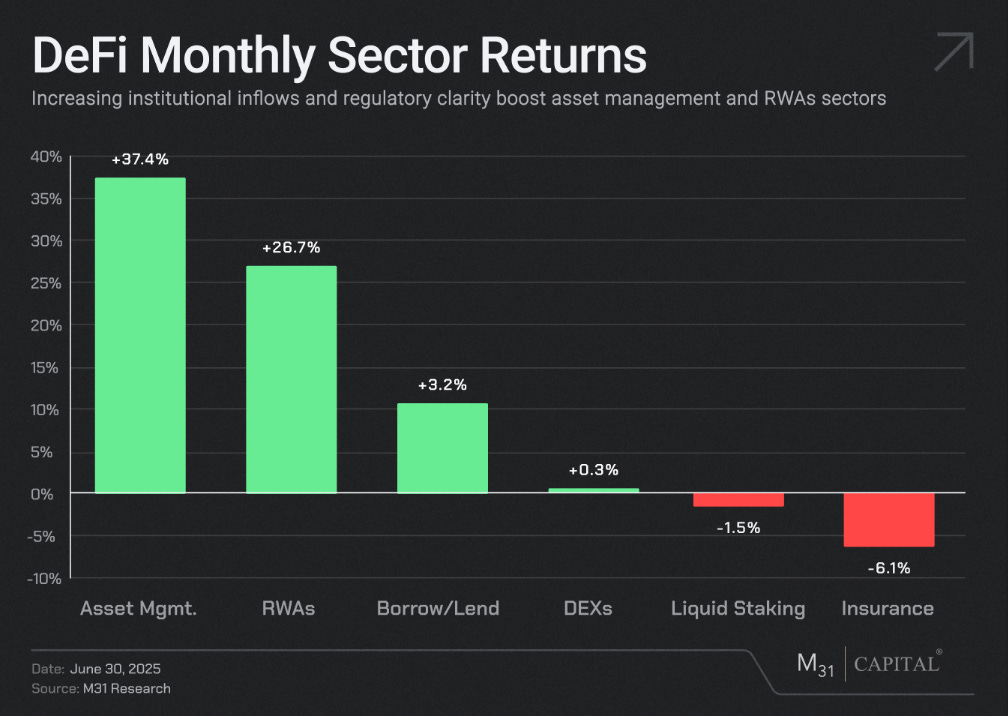

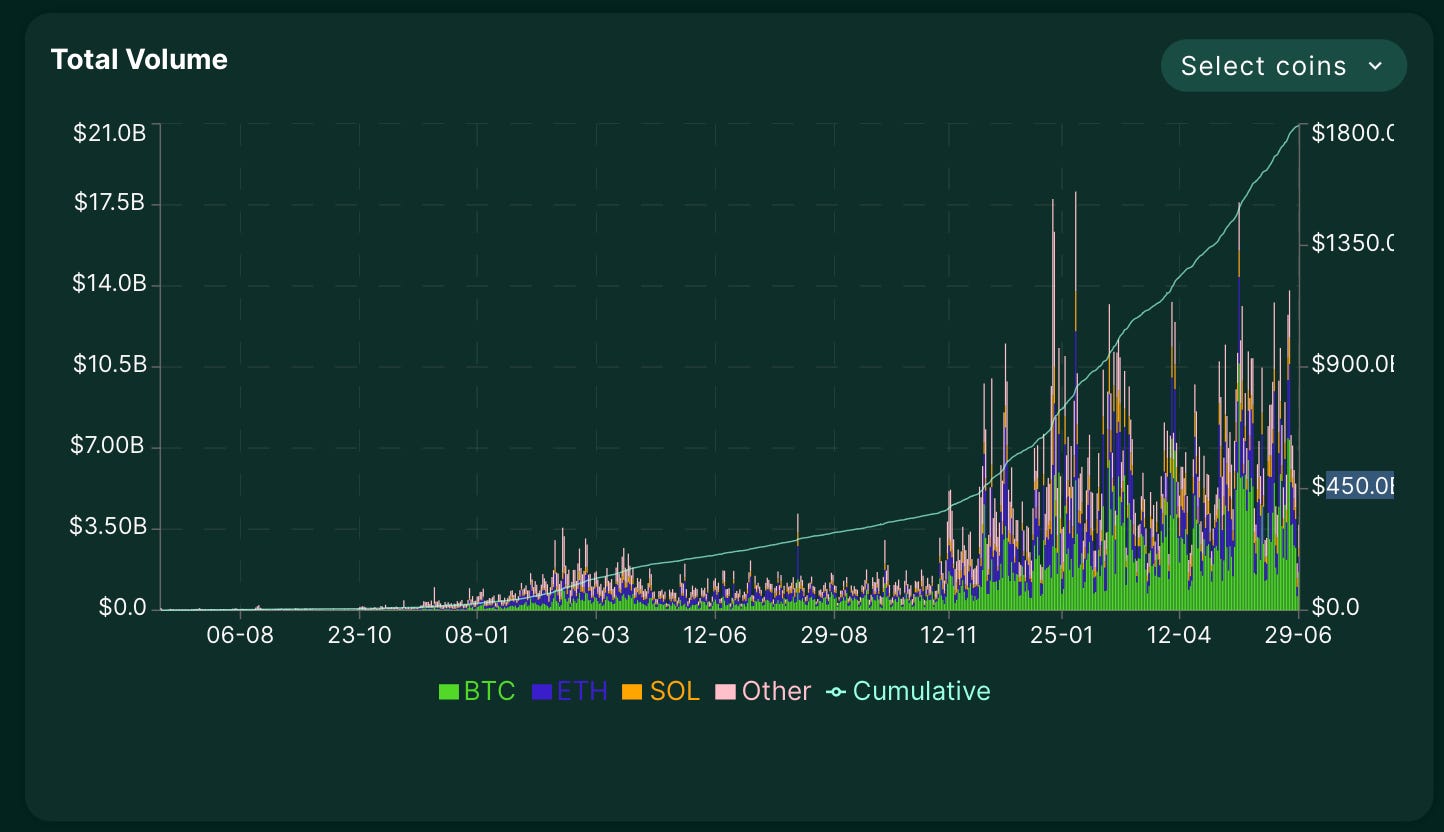

DeFi: DeFi markets gained momentum in June, quickly bouncing back despite gloomy geopolitical shocks, led by Hyperliquid’s dominance in the booming perp DEX space, now commanding over 70% of DeFi perp volumes with CEX-like speed and deep on-chain liquidity. Coinbase followed suit with a CFTC-regulated perp product for US users, signaling broader market validation.Paradigm also led a $15M Series A for GTE, a decentralized exchange targeting to rival Binance and Coinbase. Lending also hit new highs, with $56bn in TVL and rising stablecoin demand, while Keyring Network’s zkVerified pools introduced privacy-preserving, institutional-grade borrowing, reflecting deeper liquidity and growing maturity across DeFi. Meanwhile, infrastructure developments continue to strengthen the Web3 ecosystem in which Morpho joined forces with Uniswap and others via the Web3SOC framework to introduce maturity tiers and institutional self‑assessment tools to signal DeFi readiness for institutional partnerships.

Chainlink (LINK): +5.8%

Mastercard chose Chainlink as a key infrastructure provider to enable 3 billion Mastercard cardholders worldwide to securely purchase cryptocurrencies directly on-chain via DEXs like Uniswap.

Chainlink officially launched the Automated Compliance Engine (ACE), a modular, privacy‑preserving compliance framework in collaboration with Apex Group, GLEIF, and the ERC‑3643 Association, unlocking over $100T in institutional capital to be brought onchain.

As part of the Hong Kong Monetary Authority’s (HKMA) CBDC pilot, Visa, ANZ, and Chainlink collaborated to enable instant, compliant swaps between the Australian dollar stablecoin (A$DC) and Hong Kong’s digital currency (e‑HKD) using Chainlink’s CCIP for cross-border settlement.

Chainlink recorded 12 new integrations across four services: CCIP, Data Streams, Functions, and Price Feeds which span 11 blockchains. Notable adopters include SynFutures, a top perp DEX with over $67bn in quarterly volume, now using Chainlink’s tamper-proof market data for its XAU market on Base.

Aave expanded Chainlink’s Smart Value Recovery to 75% of its Ethereum assets, unlocking shared liquidation profits and reducing MEV bot extraction.

Fluence (FLT): +17.0%

Fluence unveiled its Vision 2026 plan to scale decentralized AI infrastructure, introducing four key initiatives: Guardian nodes, the Pointless community rewards program, a revenue-backed FLT buyback, and GPU-ready AI compute, while surpassing $20M in FLT delegations.

Native FLT bridge withdrawals have been upgraded, reducing transfer times from the Fluence Network to Ethereum to just 12–24 hours, down from week-long waits.

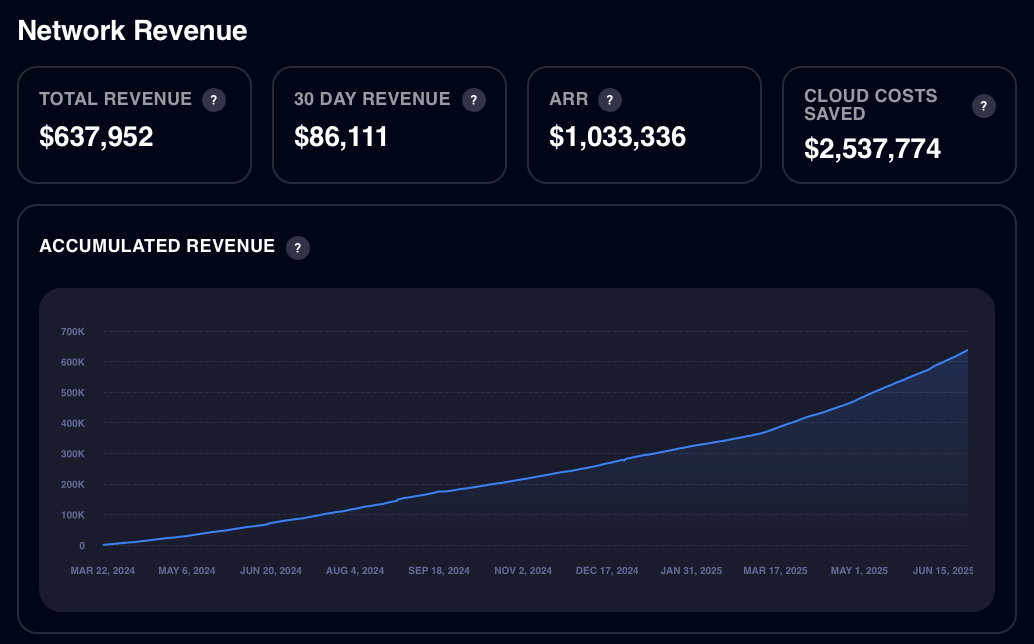

Fluence Network’s revenue is scaling steadily, with over $637k earned, $86k in monthly revenue, $1M+ ARR, and $2.5M in user cloud cost savings.

Super Protocol: (N/A)

Google Cloud provided Super Protocol with $200k in cloud resources, with a pathway to $350k, to expand confidential computing capabilities using Google Confidential VMs and NVIDIA GPU TEE hardware.

Super Protocol added EudraVigilance, Europe's largest public database of medicine side effects, containing over 29.3M case reports covering 16.9M unique adverse drug reaction cases, to their Data-for-AI campaign.

As members of the NVIDIA Inception Program, Super Protocol and Tytonyx have partnered to pioneer verifiable and privacy-preserving AI training for healthcare applications.

io.net (IO): -15.0%

io.net made Total Network Earnings (TNE) fully on-chain via Solana, enabling real-time earnings through zero-trust verification.

The network generated $2.3M in TNE in June, now surpassing $15M since inception.

io.net launched TDX-enabled confidential compute clusters, using Trusted Execution Environments (TEEs) to deliver hardware-enforced privacy for sensitive AI workloads.

Its partnership with Walrus is set to launch a decentralized “Bring Your Own Model” AI/ML platform where io.net provides decentralized GPU compute while Walrus delivers the role as a tamper-proof storage with pay-as-you-go pricing.

Trendence, an AI orchestration platform for managing complex workflows, also partnered with io.net to run 8 large language models on decentralized GPU compute, enabling faster, cheaper, and more secure AI workflows.

Sky Ecosystem (SKY): +24.9%

Sky launched SPK, the first “Star token” powering governance, staking, and yield farming for Spark Protocol within the Sky ecosystem.

Sky is completing the third phase of its MKR-to-SKY migration, making SKY the sole utility token for participating in governance, staking, and stablecoin rewards across the ecosystem as part of its “Endgame” migration.

Spark has expanded onto Optimism’s OP Mainnet and Unichain, launching yield-bearing stablecoins sUSDC and sUSDS to provide native savings and liquidity infrastructure across the Ethereum Superchain.

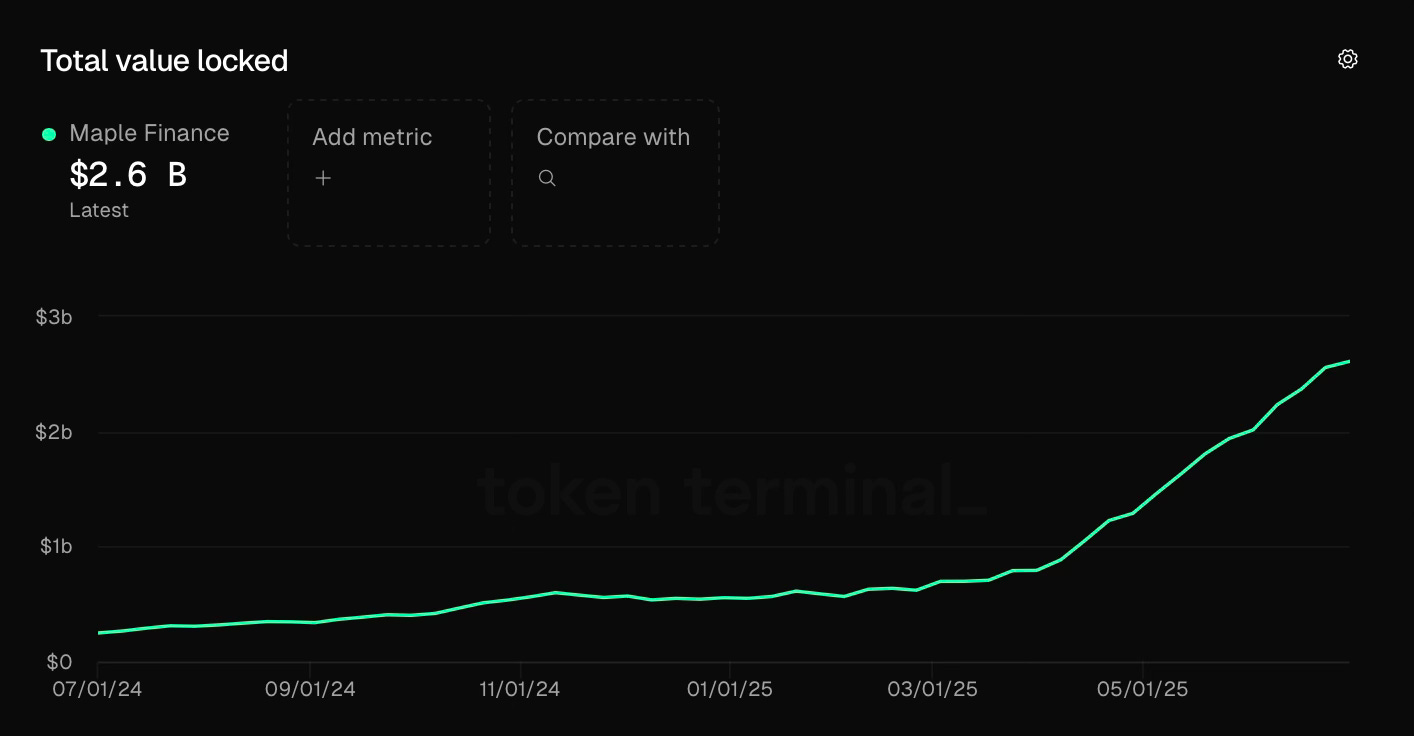

Maple Finance (SYRUP): +64.6%

Maple outperformed the market significantly, seeing the massive growth of TVL from $513M in early 2024 to over $2bn today.

Maple’s “Sovereign Pools” expand its lending beyond crypto by offering tokenized real-world assets like Treasuries and trade finance, attracting institutional and non-crypto clients.

$SYRUP token is now listed on South Korea’s Bithumb, expanding its presence in the Asia-Pacific market.

Maple expanded to Solana with $500k in incentives and $30M in liquidity, launching its syrupUSDC yield-bearing token natively on the blockchain through partnerships with Kamino, Orca, and the Global Dollar Network.

Hyperliquid (HYPE): +23.2%

Hyperliquid’s Assistance Fund has used over $1bn for HYPE buybacks, reinvesting 97% of platform fee revenue into supporting the token price.

Hyperliquid has reached a significant milestone by processing over $1.6T in cumulative trading volume.

Addition of new tokens for perpetual trading such as $SYRUP onto the platform continued to be driven by the community.

NASDAQ-listed Eyenovia announced a $50M investment to build a HYPE token treasury reserve to become a top global validator for Hyperliquid’s network.

Euler Finance (EUL): +21.5%

Euler officially crossed $1bn in total borrows, with utilization approaching 50%.

Frontier is Euler Finance's recently launched stablecoin lending infrastructure that lets users lend/borrow without governance oversight, as part of their comeback after a $200M hack in 2023.

EulerSwap uses Uniswap v4 hooks to route AMM deposits into lending vaults, enabling users to earn both swap fees and lending yield simultaneously.

June Highlights

Crypto Tycoon Justin Sun’s Tron Group to Go Public in U.S. via Reverse Merger

Landmark Stablecoin Bill Passes Senate with Overwhelming Bi-Partisan Support

Ripple to Drop Cross-Appeal Against SEC, Ending Years-Long Legal Battle With SEC

First Solana ETF to Hit the Market This Week; SOL Price Jumps 5%

Bank of Korea deputy chief says desirable to introduce stablecoins gradually

Iranian crypto exchange Nobitex hacked for over $90 million by pro-Israel group

DeFi Lending Sector Surges 100% to $55 Billion TVL in June 2025

Metaplanet Overtakes CleanSpark to Become Fifth-Largest Corporate Bitcoin Holder

Upcoming Events

The M31 Capital team will be hosting their annual M31 Academy Summer Speaker Series - every Wednesday, where we spotlight founders from the M31 Capital portfolio who are shaping the future of AI and Web3.

Join us live on X @M31Capital

7/2: Sota Watanbe - Soneium

7/9: Dhawal Shah - Elsa AI

7/16: Rob Solomon - DIMO

7/23: Alex Campbell - Rose AI

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies supporting individual sovereignty.

Website: https://www.m31.capital/