The Monthly Airdrop: June 2024

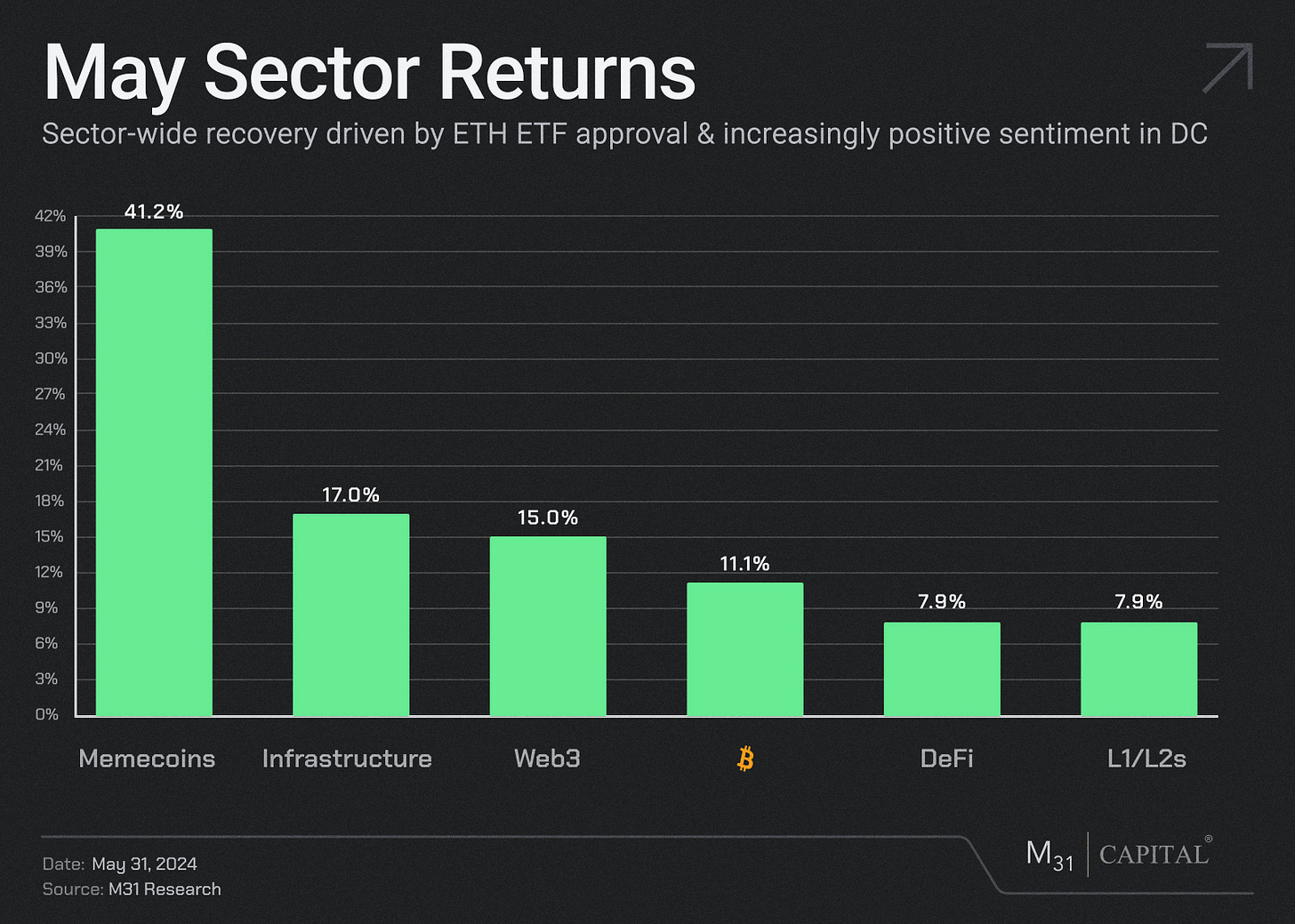

May Market (+10.5%) // SEC Approves Eight Spot Ether ETFs, SAB 121 Repealed then Vetoed, Donald Trump Accepts Crypto Campaign Donations

Bitcoin (BTC): Price rebounded +11.1% in May briefly surpassing $71k, with BTC spot ETFs recording over $2.3 billion in net inflows

Ethereum (ETH): Price rallied +28.4% throughout the month, led by a 20% price surge on May 20th after Bloomberg analysts increased their odds of spot ETH ETF approval from 25% to 75%

Market Focus: Positive market sentiment around spot ETH ETF filings caused several ERC20 tokens to reach new ATHs as investors rushed to place beta bets on Ethereum ecosystem tokens

Web3: May included a push for digital asset regulation clarity and rebounds in infrastructure sector returns paved the way for considerable Web3 growth in May. AI continues to drive innovation which has shined light on underlying data and compute solutions like Arweave and Livepeer. We anticipate this infrastructure trend, along with application-side adoption, to increase as global digital asset regulation continues to progress.

DeFi: TVL on dApp’s increased by over $20 billion in May according to DeFiLlama (+24.6%), as liquid staking and restaking remains the leading narrative. The tokenized treasury bonds market continues to rise consistently, with total market value approaching $1.5 billion (up ~100% YTD). May also saw nearly $3 trillion in stablecoin transaction volume (+31% MoM), along with a 21% increase in active addresses onchain.

Arweave (AR): +11.4%

AO - the protocol built atop Arweave’s permanent data storage layer that can run parallel applications and maintain network states locally - surged in popularity this month and boosted underlying AR. AO has recently experienced an influx of testnet usage, highlighted below in processes, transactions, and messages sent. AO also announced its egalitarian tokenomics with a 100% fair launch, no pre-sale, and an iconic 21 million token supply. The genesis block will launch on June 13th, and AR holders, AO testnet developers, and bridging participants may be eligible for AO tokens.

Livepeer (LPT): +44.5%

Video infrastructure network Livepeer launched its AI subnet that handles generative tasks like text-to-image and text-to-text. The subnet leverages Livepeer’s existing GPU network to pursue a permissionless, affordable AI media marketplace. This addition - and Livepeer’s continued focus on AI video generation - has been positively received as reflected in treasury growth over the last few months.

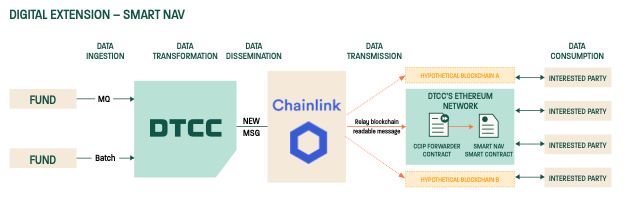

Chainlink (LINK): +40.2%

The Depository Trust and Clearing Corporation (DTCC), the world’s largest securities settlement system, which processed $3 quadrillion in securities in 2023, announced it has successfully completed a pilot project in collaboration with Chainlink. Chainlink has integrated Data Feeds and CCIP into the Aptos and Celo blockchains.

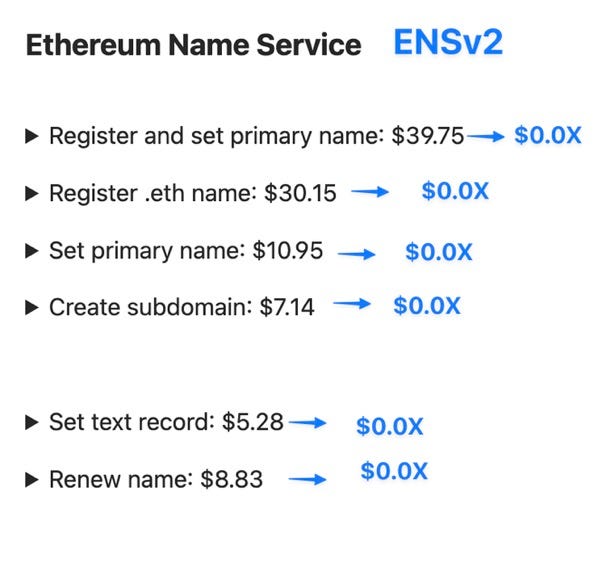

Ethereum Name Service (ENS): +77.7%

ENS Labs announced ENSv2, a proposal to extend the Ethereum Name Service (ENS) to a Layer 2 network. ENSv2 brings lower gas costs, faster transaction speeds for .eth name management, a hierarchical registry system for enhanced customization and control, improved multi-chain interoperability, and much more.

Ethena (ENA): +19.3%

Ethena's USDe stablecoin surpassed $3 billion in supply within less than four months of the token’s public launch in late February. Ethena’s USDe has already flipped First Digital’s FDUSD in market cap, and is quickly approaching the ~$5.3 billion market cap of MakerDAO’s DAI. The protocol leverages cash-and-carry trades at high volumes along with Ethereum staking rates to generate high yields for users. The Ethena Labs founder publicly stated that Ethena related hedges account for more than 200% of the total open interest across all perpetual DEXes combined. Ethena Labs has also recently announced a new partnership with BounceBit so users can generate real yield on Bitcoin collateral. This announcement led to the BounceBit ($BB) token price rallying over 100% at the end of the month.

THORChain (RUNE): +15.9%

THORChain released its user-friendly SwapKit SDK, which refactors and simplifies multi-chain integration. The SwapKit includes an easy-to-use API with monetization features, support for 11+ DEXs/aggregated liquidity sources, and accurate gas pricing.

In May, the team also pushed THORNode v1.133.0, which fixed several core issues, including the depreciation of Smoke Tests and the revival of Taproot. Together, these improvements signify the project’s continued emphasis on user and developer experiences.

Justin Sun’s 120,000 eETH deposit into the Swell L2 pre-launch kicked off a record-breaking month for the network. This eye-opening transaction was followed by three weeks of net inflows totaling over $1 billion. Overall, Swell L2 pre-launch deposits are quickly approaching the $2 billion milestone, placing Swell in the top five largest L2s along with Arbitrum, Optimism, Base and Blast. The network also possesses an impressive 150,000+ stakers and restakers. Overall, Swell places in the top 15 largest DeFi protocols with around $3 billion in TVL. The SWELL token generation event is set to occur within the next several weeks, following the completion of audits for rswETH withdrawals to promote stability.

Uniswap (UNI): +41.6%

The Uniswap Foundation announced that Uniswap v4 will launch later this year. The foundation is currently collaborating with five top auditing firms, and this auditing process will continue over the next few months. Uniswap v4 introduces features such as Hooks and custom pools, improved architecture, and gas savings. It also provides a range of customization options for developers to cater to different users, among many other features, all aimed at enhancing the user experience.

PepeCoin (PEPE) + 68.7%

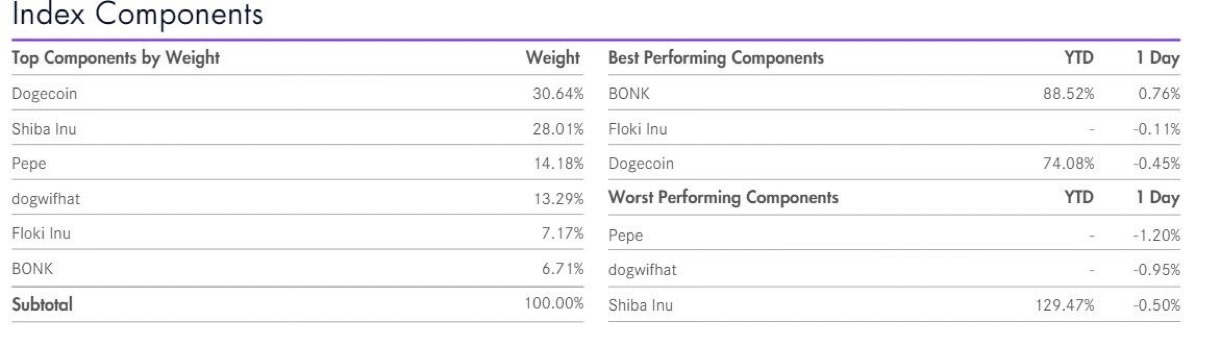

Fueled by positive sentiment surrounding the Ether ETF filings, PEPE’s price rallied over 70% from May 19 to May 26, briefly surpassing $MATIC with a $7 billion market cap on May 27. Several ERC20 meme coins experienced intense activity throughout the end of the month, as investors viewed these tokens as beta bets pertaining to Ethereum’s regulatory advancements in the United States. Several established financial institutions are also showing increasingly positive sentiment surrounding meme coins, as VanEck’s MarketVector recently launched a Meme Coin Index which tracks the performance of the six largest tokens.

June Highlights

Trump posts crypto-friendly message before speaking to Libertarian Convention

SEC Chair Gensler opposes today’s FIT21 vote yet White House calls no ‘veto’

AI is driving a 1220% surge in demand for computer power. How blockchain firms are riding the wave

Deutsche Bank Says Tokenization Is The Future Of Financial Innovation

Paradigm leads $150 million raise for web3 social media platform Farcaster

White paper that birthed crypto ZK-proofs receives IEEE ‘Test of Time’ award

Upcoming Events

The M31 Capital team will be speaking at and attending a number of upcoming conferences and events. Please reach out if you are interested in connecting, or better yet - meet us there:

Dubai: M31 Academy (6/1-8/15)

Virtual: Gaining the Edge-Global Capital Intro (6/17-6/28)

New York: US Emerging Manager Summit (6/6)

Brussels: EthCC (7/8-7/11)

Wyoming: Wyoming Blockchain Symposium (8/19-8/22)

Singapore: TOKEN 2049 (9/18-9/19)

Singapore: Breakpoint (9/19-9/21)

Las Vegas: Apex Invest Las Vegas (10/9-10/10)

Salt Lake City: Permissionless III (10/9-10/11)

San Francisco: CoinAlts Fund Symposium 2024 (10/16)

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies supporting individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital