The Monthly Airdrop: March 2024

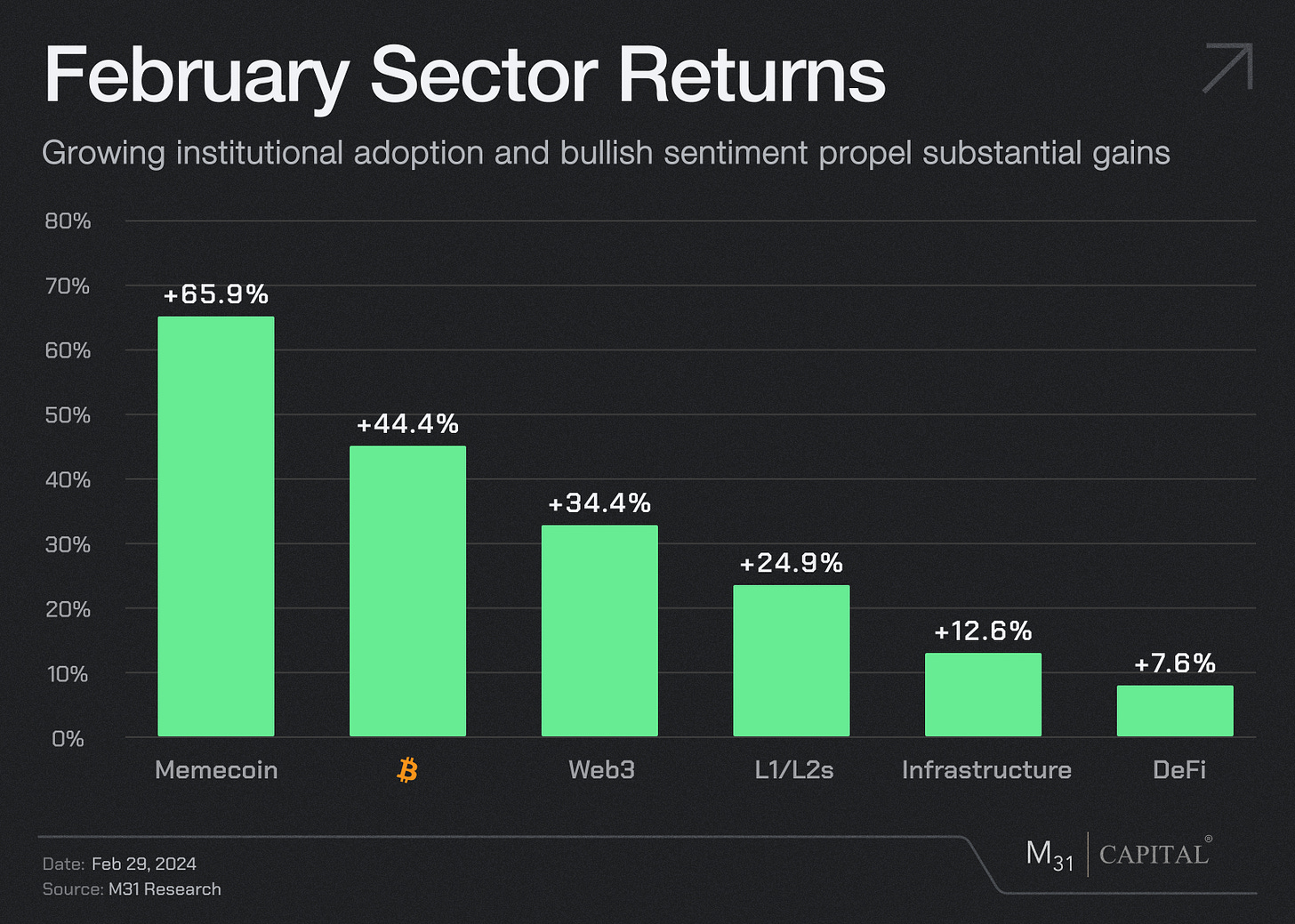

February Market (+40.4%) // BTC (+44.4%) pushes ATHs, ETH (+46.7%) soars, AI narrative dominates, and memecoin mania returns with a vengeance

February was a historic month for crypto assets. BTC surged past the $60k resistance as $2.8bn of ETF inflows from Blackrock & Fidelity overwhelmed the $1.5bn of ouflows from Grayscale, sending the orange coin well past $1T in market cap for the first time since early 2022.

Ethereum ETFs also had their largest inflows since July 2022, totaling $85M last week with AUM $14.6B, still below the $23.7B peak.

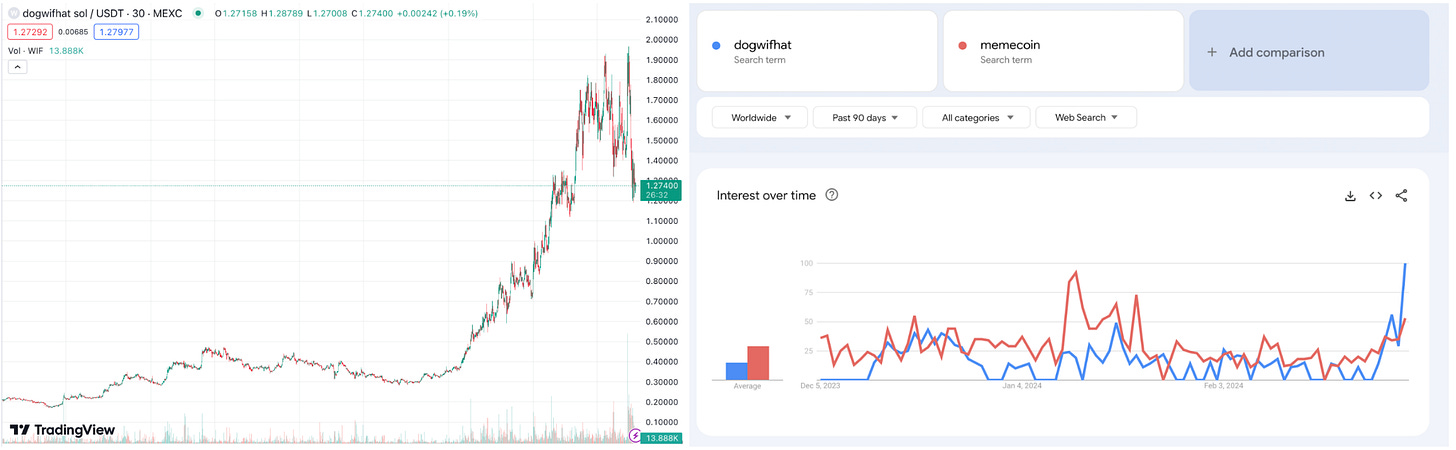

Memecoins rallied giving the 3 largest coins (DOGE, SHIB, PEPE) a combined market cap of $48.5B and WIF rallying 546% this month.

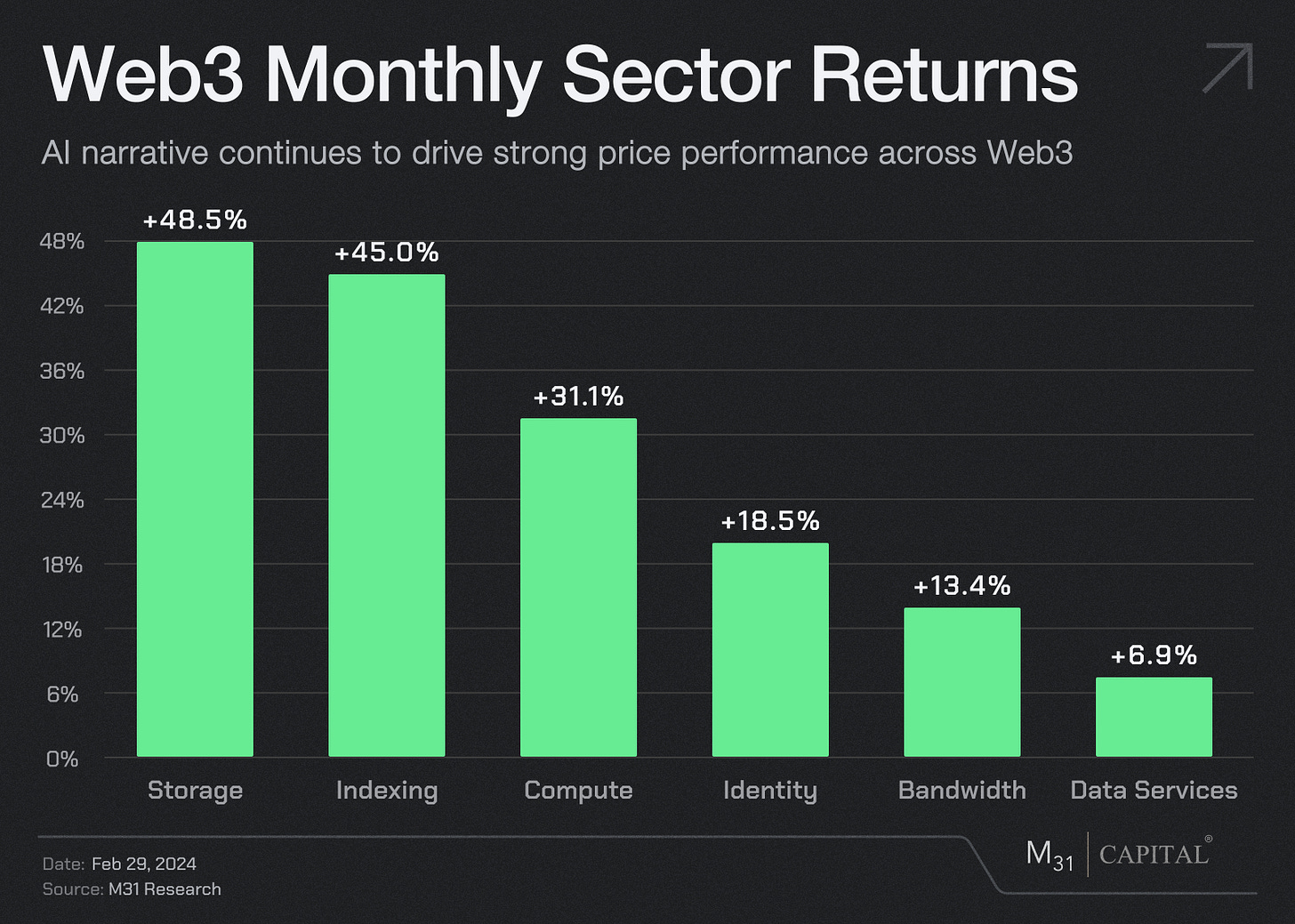

Web3: The AI narrative continued to drive strong price performance across Web3 this month, most notably after OpenAI unveiled its impressive generative text-to-video product, Sora. Google added fuel to the flame with the release of its highly controversial Gemini chatbot and image generator, which produced consistently biased output, underscoring the dangers of centrally controlled and influenced AI products and highlighting the importance and value of decentralized AI.

DeFi: Activity in February was extremely high as the overall crypto market rallied. Weekly fees for the Top 20 DEXs reached their highest since Nov. 2022, last week at $39M dollars, as trading volume reached $35.5B. TVL increased significantly during February, now up 57% month-over-month to $97B. BTC transfers continue to be elevated, especially as outflows from GBTC to IBIT continue.

Arweave (AR): +220.7%

AR surged in reaction to the launch of Arweave AO this month, a compute abstraction layer built on top of the Arweave data storage network. The technology will enable high transaction capacity and EVM compatibility and will focus on big data storage support, AI, and social media use-cases. Compared to previous decentralized computing systems, AO can achieve both large-scale and verifiable computing. AO not only increases the number of verifiable calculations, but also realizes verifiable calculations of any magnitude.

Syntropy (NOIA): +137.2%

Syntropy launched its much-anticipated Silverstone update in Feb, opening up the Data Layer for decentralized, real-time data access across major blockchains. This update enables anyone to interact with streaming on-chain data without specific invites or tech know-how, democratizing live Web3 data access. The update also introduced a new intelligence layer for DeFi users and DEX traders, built on the Data Layer’s multichain streams. Users can now view slippage rates and figures in real-time when swapping from one token to another, helping traders make smarter and more cost-efficient swap decisions.

Syntropy's Data Layer Dashboard (syntropynet.com)

Theta Network (THETA): +88.9%

Theta announced its EdgeCloud AI product will be launching on May 1, 2024. The new platform will allow AI developers to easily select and deploy popular models such as Stable diffusion, Llama 2 and other out-of-the box models to build AI-powered apps on top. In a second release in the Spring-Summer, Theta will unveil its upgrade to the Edge node software with Elite+ Booster feature for EENs that have the full 500,000 TFUEL staked. This enables node operators to participate and share in the rewards from all EdgeCloud AI compute tasks.

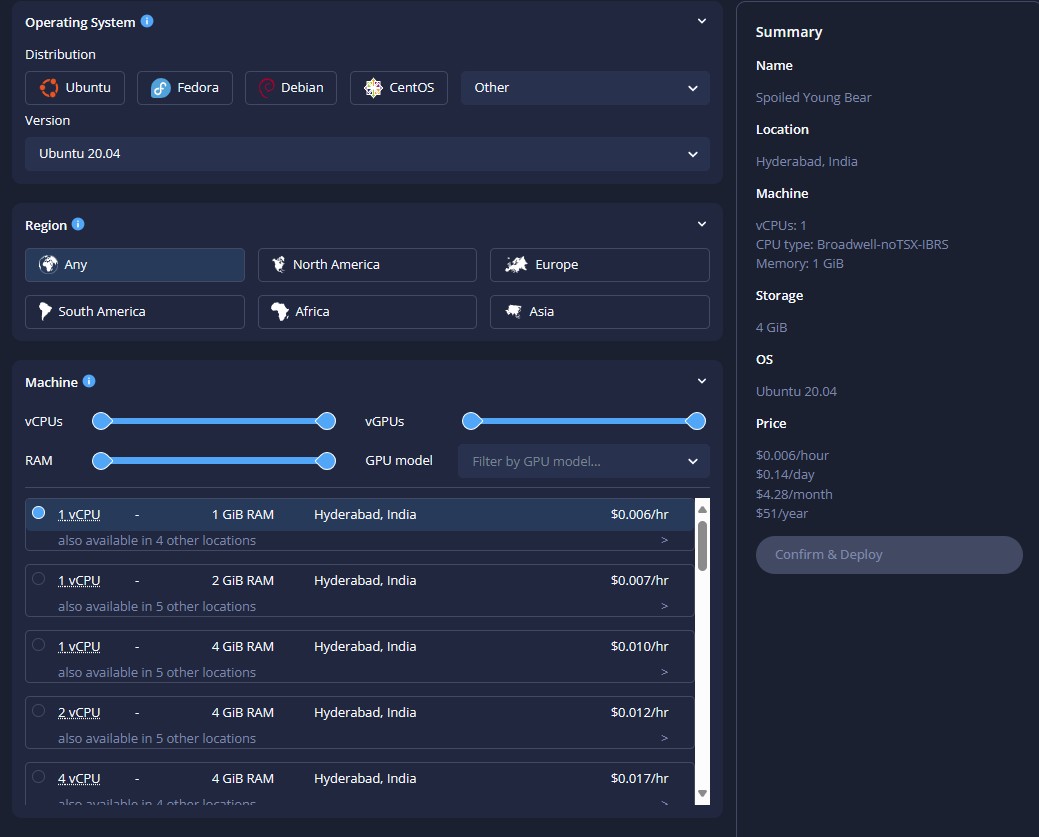

Cudos (CUDOS): +154.8%

Cudos, the decentralized cloud infrastructure provider, released its 2024 roadmap this month, outlining its plans to add MetaMask support, multi-chain computing, additional Cosmos and EVM-based currencies for payment, support for AI templates, improved cross-chain communications (in partnership with Axelar), and additional smart contract functionality. Users of the Cudos Intercloud application can now build custom virtual machines (VMs) by selecting their desired operating system, geographic location, CPU/GPU power, and storage capacity.

Avalanche (AVAX): 23.3%

Ava Labs released the outline for its scaling solution, Vryx, as it aspires to scale the Avalanche blockchain to 100k TPS. The scaling approach will first be enabled on the HyperSDK testnet, which is targeted for the middle of Q2. HyperSDK is the framework for building high-performance blockchains that have virtual machines, enabling them to offer smart contracts. Vryx will be used to support such blockchains built using the HyperSDK — known as HyperChains — which should trickle down to the main blockchain platform over time. Citibank also published a report outlining how it leveraged Avalanche to test the blockchain infrastructure, tokenization, and smart contract logic. The bank tested use cases on Avalanche “Spruce,” an Evergreen testnet Subnet designed for buy & sell-side institutions.

EigenLayer: N/A

Leading restaking protocol Eigenlayer is now the second largest Ethereum protocol with TVL of $11.47B, up 151% MoM. a16z announced a $100M funding round in the protocol on Feb. 22. In addition, Eigenlayer stated its plans to build AI-enabled DApps on Feb. 23, partnering with decentralized AI compute platform Ritual. This comes less than 2 weeks after Vitalik posted about AI-powered smart contract auditing on X.

Stacks (STX): +99.6%

Stacks, a leading BTC L2, surged 99.6% this month, more than doubling BTC gains (45.6%). TVL is up 157.7% MoM to an ATH of $142.91M. On Feb. 28, the protocol released the launch website to “Nakamoto”, an upgrade to the Stacks network. Nakamoto allows trustless, two-way Bitcoin peg (sBTC), enabling transactions secured by Bitcoin finality and faster Stacks transactions between blocks.

Axelar (AXL): +165.9%

This month Ripple announced a partnership with the Axelar Foundation to make it easier for the XRP Ledger (XRPL) blockchain to work with real-world assets. Developers can use Axelar's technology to connect and interact with smart contracts across more than 55 blockchains. This will help developers create and run decentralized apps on XRPL.

dogwifhat (WIF): +573.4%

"Blue chip memes'," like DOGE (94.5%) and SHIB (151%), and newcomers, like WIF (573.5%), MAGA (666.9%), and PEPE (517.5%) rallied this month. Particularly, WIF has had strong inflows after a Robinhood Europe listing and continued mentions by high profile industry figures like Arthur Hayes. Memecoins prove to be an existential part of the digital asset ecosystem.

February Highlights

Dencun Scheduled for March 13 as Ethereum Aims to Onboard More Core Contributors

OpenAI Jumps into Text-to-Video Fray with Sora, Challenging Meta, MidJourney and Pika Labs

Gold ETFs Witness $2.4 Billion Outflows Amid Bitcoin ETF Surge

Coinbase International Exchange Tops $1B Daily Volume While Bitcoin ETF Volumes Surge

BlackRock’s IBIT spot bitcoin ETF crosses $10 billion in AUM

Gemini to return $1.8bn of crypto lost in Genesis collapse in ‘win for customers’

Bank of America, Wells Fargo to Offer Spot Bitcoin ETFs to Clients: Bloomberg

Upcoming Events

The M31 Capital team will be speaking at and attending a number of upcoming conferences and events. Please reach out if you are interested in connecting, or better yet - meet us there:

London: DAS London (3/18-3/20)

New York City: DEFICON (3/30)

New York City: NFT NYC (4/3-4/5)

Hong Kong: Web3 Festival 2024 (4/6-4/9)

Dubai: TOKEN2049 (4/18-419)

Dubai: ETH Dubai (4/19-4/21)

Dubai: HFM Middle East Summit (5/14-5/15)

Austin: Consensus 2024 (5/29-5/31)

Dubai: M31 Academy (6/1-8/15)

Brussels: EthCC (7/8-7/11)

Singapore: TOKEN 2049 (9/18-9/19)

Singapore: Breakpoint (9/19-9/21)

Salt Lake City: Permissionless III (10/9-10/11)

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies supporting individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital