The Monthly Airdrop: March 2025

February Market (-21.3%) // Crypto loses over $750bn in market cap, ByBit suffers record-breaking $1.5bn hack, FTX begins creditor repayments

Bitcoin (BTC): BTC saw over $3.54bn in ETF outflows in February, with a record $1.14bn in outflows on Feb 25th. Microstrategy acquired $1.99bn in BTC on February 24th, marking their largest BTC acquisition of 2025. Core partnered with Maple Finance and several leading custodians to enhance utility for lstBTC.

Ethereum (ETH): ETH ETFs saw $60M in inflows despite falling over 30% in February. The Ethereum Foundation announced a rework in leadership, welcoming Hsiao-Wei Wang and Tomasz Stanczak as co-Executive Directors. The Ethereum Pectra upgrade, designed to enhance scalability, activated on the Holesky Testnet, with plans to launch on Sepolia testnet in March.

Market Focus: The SEC dropped lawsuits against several crypto companies, including Coinbase, Consensys, and Robinhood. Bybit suffered the largest hack in crypto history as $1.46bn worth of ETH and stETH was exploited by North Korea’s Lazarus Group. Crypto VC saw increased activity in February, highlighted by Figure’s $200M raise led by Sixth Street. Meanwhile, FTX made progress in their bankruptcy proceedings as they initiated their first round of creditor repayments.

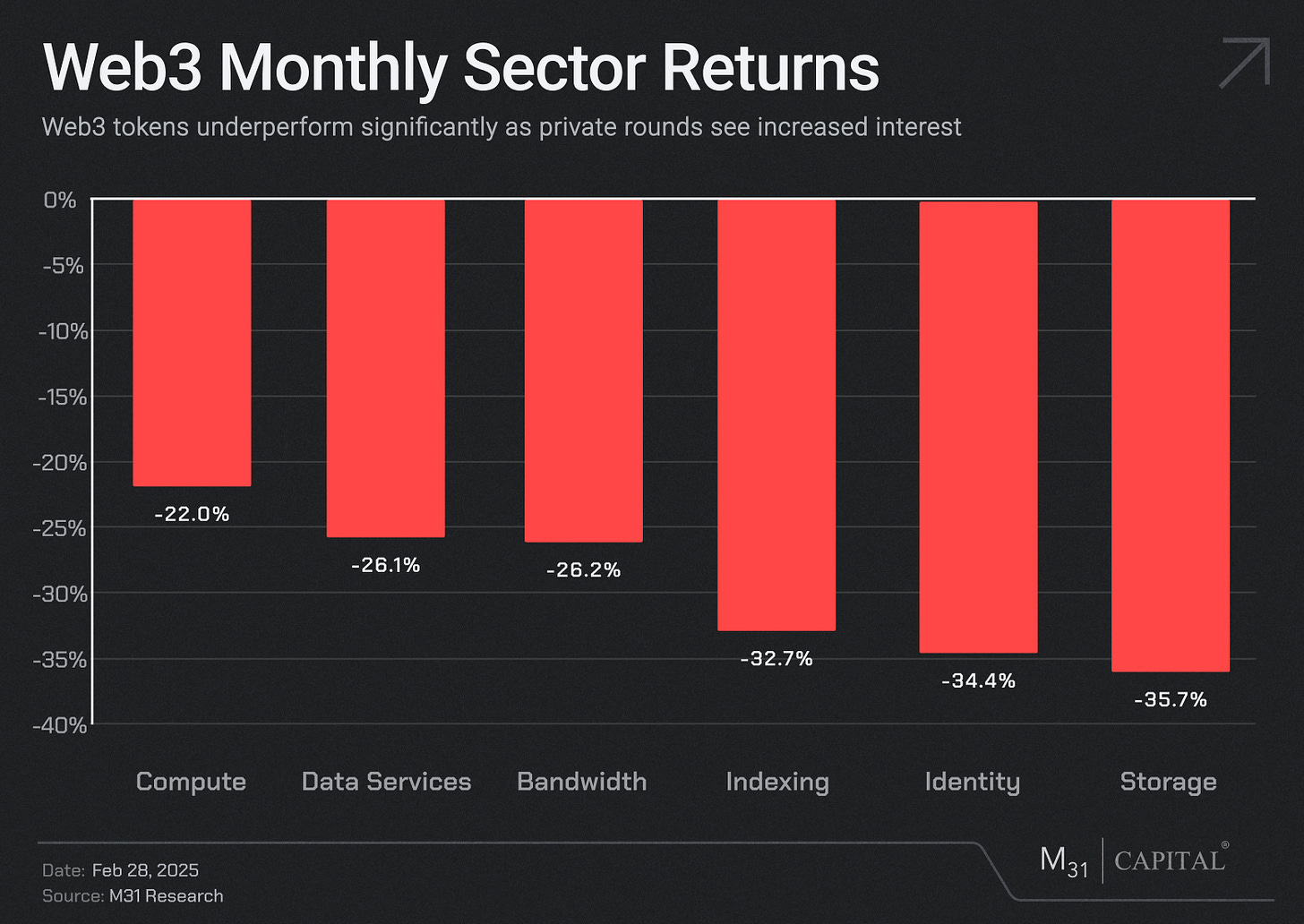

Web3: ETHDenver 2025 drew a crowd of tens of thousands this February, with a key focus on the intersections of blockchain and AI applications. Web3 projects saw an increase in private rounds, as GEODNET announced an $8M raise to provide precision location services to thousands of autonomous robots globally. Helium partnered with Telefonica Mexico to serve over 2M subscribers across the country.

DeFi: Berachain launched the mainnet for their EVM-based L1, with the native BERA token trading at a 10-figure FDV. Argentinian President Javier Milei endorsed the LIBRA memecoin, which crashed over 95% in hours leading to allegations of a rugpull scam. Ethena announced a $100M raise to support their upcoming iUSDe stablecoin for institutional investors.

Gensyn: (N/A)

Gensyn AI released several groundbreaking announcements in February, including Verde, RL Swarm, and Diverse Expert Ensembles. These upgrades bring innovation in collaborative reinforcement learning and new model training architectures.

The Verde upgrade provides a large-scale verification system that ensures the correct execution of ML operations across untrusted nodes.

Story Protocol (IP): +192.3%

Story Protocol launched their public mainnet on February 13, with over 130 apps live on mainnet. The native IP token launched at a 10-figure FDV and saw a surge in trading volume at the end of February.

Story hosted the Super Agent Hackathon at ETHDenver in partnership with leading AI agent platforms, with over $70k in bounties awarded to the top builders onchain.

Celestia (TIA): -5.6%

Founder Mustafa Al-Bassam highlighted a proposal to quadruple Data Availability fees on the Celestia platform, which would massively boost TIA revenues while still remaining cheaper than Ethereum DA costs.

Celestia has seen an 8.7% increase in revenue MoM, as the amount of data posted per day has increased over 1000% since Q4 2024.

IO.net (IO): -52.0%

IO.net launched co-staking for their IO token, allowing token holders to earn block rewards by delegating alongside GPU suppliers.

Newly released IO Intelligence combines Vector Database-as-a-Service with open-source AI agents. This simplifies agent access to real-time onchain analytics, providing faster and reliable insights while protecting sensitive data.

Arweave (AR): -47.3%

AO launched its mainnet along with a fair launch for the native AO token, utilizing TEEs for secure and decentralized computation.

New protocols including AR.IO launched on the Arweave mainnet, which aims to provide a decentralized and permanent cloud storage solution leveraging the Arweave stack.

Ondo Finance (ONDO): -33.3%

Ondo introduced the Ondo Global Markets platform, which will allow investors outside of the U.S. to gain onchain exposure to U.S. based stocks, bonds, and ETFs.

The newly announced Layer-1 Ondo Chain is designed to seamlessly facilitate the tokenization and transaction of real-world assets.

Mastercard’s Multi-Token Network has integrated Ondo’s OUSG government treasuries fund, allowing regular businesses to earn yield on idle cash.

Hyperliquid (HYPE): -25.4%

Hyperliquid saw $72M in USDC deposits in February, sustaining derivative volumes over $180bn while leading competitors saw 20% declines in volume.

The HyperEVM execution layer was integrated with its L1, providing strong developer tooling and diversity to the Hyperliquid DeFi ecosystem.

Solana (SOL): -36.0%

FTX’s began repaying small creditors in their bankruptcy proceedings, distributing over $1.2bn. Over 11M SOL is expected to be repaid by FTX over the coming months, sparking concerns over potential sell pressure.

DeFi TVL on Solana fell over 32% in February, driven by sell pressure concerns along with the decline in token price.

Franklin Templeton expanded their FOBXX money market fund to Solana, bringing over $500M worth of RWAs onchain.

THORChain (RUNE): -39.2%

THORChain is addressing their $200M insolvency risk by issuing TCY tokens, which will convert creditors into equity holders. Each TCY token will grant holders 10% of the network’s revenue indefinitely, with distributions made in RUNE.

TVL on THORChain fell over 20% in February, despite a surge in transaction volume driven by Lazarus Group swaps following the ByBit hack.

Virtuals Protocol (VIRTUAL): -43.8%

The Agent Commerce Protocol (ACP) on Virtuals provides a new open standard designed to facilitate autonomous multi-agent commerce and coordination.

The ACP framework went live on Base Sepolia testnet, with plans to deploy cross-chain after Virtuals successfully went live on Solana.

Despite the recent developments, the Virtuals AI Agent Launchpad on Base has seen a sharp decline in daily revenue, down over 97% since January highs.

Aave (AAVE): -42.2%

Following Polygon’s community proposal to deploy over $1bn in bridged stablecoin reserves onchain, Aave proposed withdrawing its services due to security concerns surrounding bridge vulnerabilities and bad debt exposure.

The Aave Community has proposed deploying on Sony’s Soneium L2, highlighting their initiative to enhance consumer access across multiple platforms.

February Highlights

Tether Moves to Acquire 51% Stake in Renewable Energy Giant Adecoagro

A16z's Crypto Policy Head Brian Quintenz Picked to Lead CFTC

Dubai Approves Circle's Stablecoins USDC and EURC for Use in DIFC

SEC Drops Uniswap Investigation Amid Shift to Crypto-Friendly Regulation

FBI Says North Korea Was Responsible for $1.5 Billion ByBit Hack

Figure Gets $200M Equity Investment from Sixth Street Through JV

AI Agents Take Center Stage at ETHDenver 2025 with Hedera and Olas

Upcoming Events

The M31 Capital team will be speaking at and attending a number of upcoming conferences and events. Please reach out if you are interested in connecting, or better yet - meet us there:

New York: Digital Asset Summit 2025 (3/18-3/20)

Dubai: Dubai AI Festival (4/23-4/24)

Dubai: Token2049 (4/30-5/1)

Washington DC: SelectUSA Investment Summit (5/11-5/14)

Toronto: Consensus 2025 (5/14-5/16)

Doha: Qatar Economic Forum (5/20-22)

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies supporting individual sovereignty.

Website: https://www.m31.capital/