The Monthly Airdrop: May 2024

April Market (-8.6%) // Tether announces record profit of $4.5B, EigenLayer announces highly controversial airdrop, Syntropy rebrands to Synternet

BTC sees worst month since November 2022, dropping below $60k amid worsening macro conditions before rebounding, down (-6.34%) MoM

ETH saw a decline of (-7.42%) MoM, while alts finished April significantly lower after one of the largest liquidation events crypto has seen earlier this month on Binance

Investors closely watching the SEC’s decision on VanEck and ARK's ETH ETF filings, May 23rd and May 24th, respectively

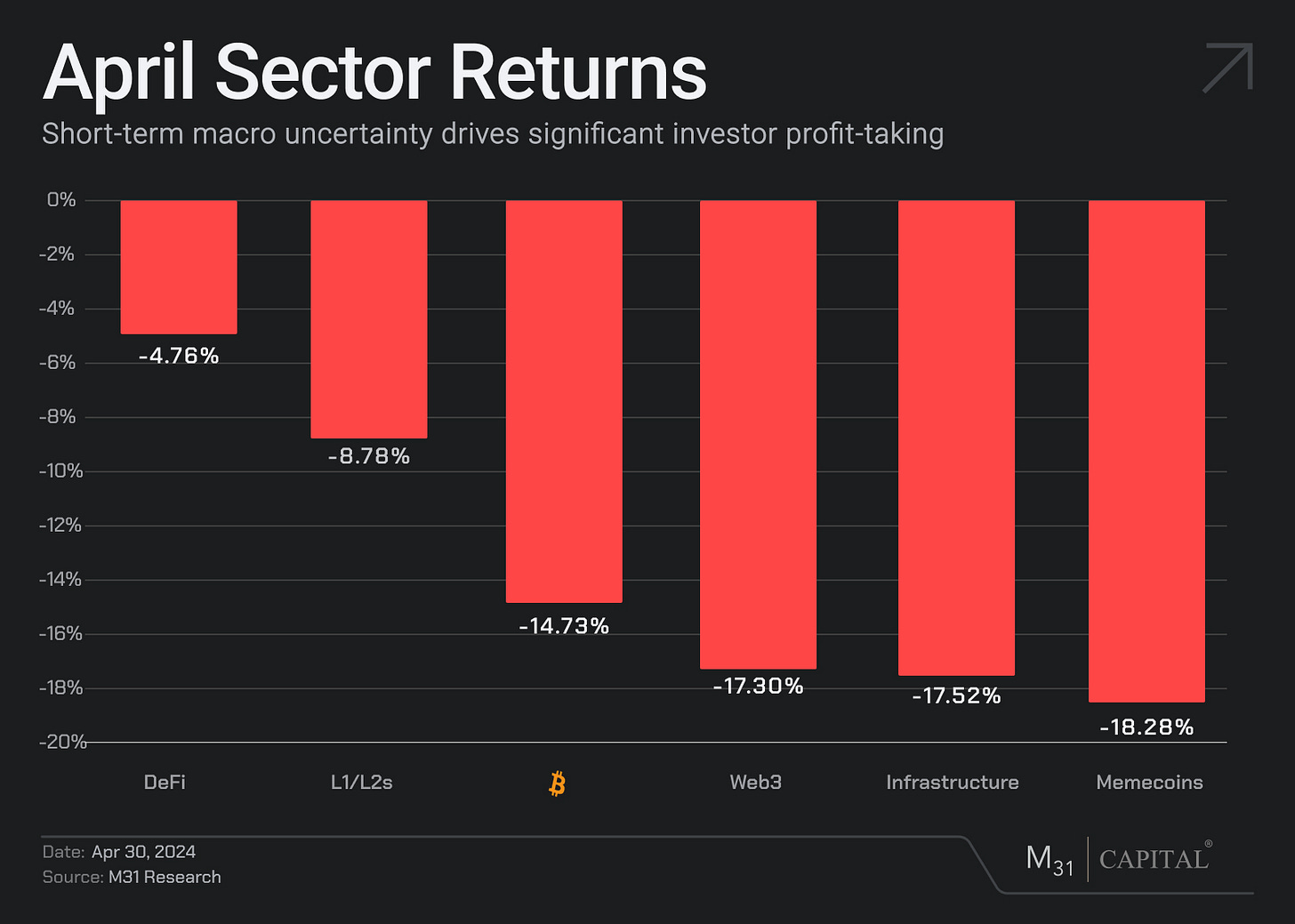

Web3: Bitcoin volatility, in combination with precarious macro fundamentals such as slowing GDP growth and persistent CPI inflation, led to considerable FUD in Web3 in April. However, relative stability in infrastructure projects like Arweave illustrate budding product market fit and real use cases, especially as AI demand surges.

DeFi: TVL on dApp’s fell $10 billion in April according to DeFiLlama (-7% MoM). This was lead by Avalanche, with 31.5% of the funds leaving the chain. Furthermore, Institutional investors are showing significant interest in RWAs. Securitize, a RWA tokenization firm, raised $47 million in a funding round led by BlackRock whose $BUIDL is now the largest tokenized treasury fund with over 30% market share.

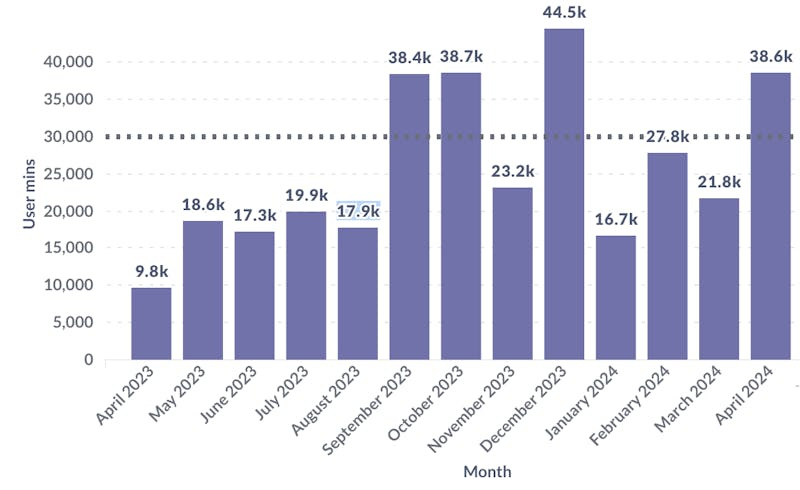

Huddle01: (N/A)

Huddle01 recently introduced significant mobile app, dashboard, and SDK improvements that bolster both user and developer experiences. These changes and - a shift to dTRC Protocol - marked important milestones that generated massive platform growth. In April, Huddle announced 38.6k minutes, surpassing its monthly goal of 30k.

Aleph.im (ALEPH): +16.32%

This month, Aleph released their Web3 hosting marketplace called Twentysix Cloud. Now, developers can host any full-stack application that uses Next.js and access indexing and compute services. TwentySix Cloud also leverages Avalanche’s ecosystem for streaming payments to increase the reliability and flexibility of Aleph.im’s decentralized cloud infrastructure.

Arweave (AR): +3.87%

Arweave maintained its momentum from March after investing in Carv - a data layer that helps AI and gaming companies monetize - and receiving a $35M pledge for a newly launched accelerator that will focus on the budding AO Computer ecosystem. Coupled with consistent data uploads, these events convey increased innovation on Arweave’s permanent storage solution, even in the face of greater market headwinds.

Synternet (NOIA): +8.55%

Syntropy has now rebranded to Synternet, reflecting its ambitious interoperability goals as a universal data streaming infrastructure provider. This new update includes an Ethereum-Cosmos token bridge and bolsters developer, publisher, and consumer support.

Ondo Finance (ONDO): (-3.11%)

RWA tokenization firm Securitize announced a $47 million round led by BlackRock on Wednesday. This comes after the BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) surpassed the Franklin Templeton's OnChain U.S. Government Money Fund (FOBXX) in market cap, becoming the largest tokenized treasury fund with >30% market share. However, on-chain data shows only 13 addresses currently hold BUIDL tokens. One of those, DeFi platform Ondo Finance, recently shifted $95M of backing assets from OUSG token to BUIDL.

Tether (USDT): +0.00%

Tether Holdings, issuer of the world’s largest stablecoin USDT, announced a record net profit of $4.52 billion for Q1 2024. The company disclosed a net equity of $11.37 billion as of March 31, up from $7.01 billion at the end of 2023. This increase includes ~$1 billion from operations, primarily from U.S. Treasury holdings, and $3.52 billion from market gains in Bitcoin and gold. Tether issued $12.5 billion in USDT in the quarter, with its total market cap surpassing $110 billion. Additionally, the company reported a $1 billion increase in excess reserves, totaling nearly $6.3 billion, to back its stablecoin offerings. On Monday, Tether reported a $200 million investment in Neurotech, taking a majority stake in the U.S. brain implant company.

Pump.fun: (N/A)

On April 24, Pump.fun generated $521,150 in revenue, marking its second most profitable day ever. The platform enables users to easily create a memecoin by just providing a name, ticker, and a JPG image for a fee of under $2, without needing to supply initial liquidity. Pump.fun also mitigates the risk of rug pulls by ensuring that no tokens launched have a pre-sale or allocations for team members. Instead, these tokens are immediately available for trading on a bonding curve, allowing for buying and selling. Once a token attains a certain market cap, a predetermined amount of liquidity is added to a native decentralized exchange (DEX) and then burned. For instance, in the Solana ecosystem, reaching a $69,000 market cap triggers a $12,000 liquidity deposit into Raydium.

April Highlights

Ethereum Restaking Protocol EigenLayer Reveals Token and Airdrop Plans

BlackRock’s BUIDL becomes the world’s largest tokenized treasury fund

Worldcoin, Sam Altman's Crypto Project, Is Building a Layer-2 Chain

Upcoming Events

The M31 Capital team will be speaking at and attending a number of upcoming conferences and events. Please reach out if you are interested in connecting, or better yet - meet us there:

Dubai: HFM Middle East Summit (5/14-5/15)

New York: SALT iConnections NY 2024 (5/20-5/21)

Austin: Consensus 2024 (5/29-5/31)

Dubai: M31 Academy (6/1-8/15)

Virtual: Gaining the Edge-Global Capital Intro (6/17-6/28)

New York: US Emerging Manager Summit (6/6)

Brussels: EthCC (7/8-7/11)

Wyoming: Wyoming Blockchain Symposium (8/19-8/22)

Singapore: TOKEN 2049 (9/18-9/19)

Singapore: Breakpoint (9/19-9/21)

Las Vegas: Apex Invest Las Vegas (10/9-10/10)

Salt Lake City: Permissionless III (10/9-10/11)

San Francisco: CoinAlts Fund Symposium 2024 (10/16)

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies supporting individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital