The Monthly Airdrop: May 2025

April Market (+10.6%) // Crypto outperforms as equities see sharp selloff, Stablecoin market cap reaches new ATH, Paul Atkins replaces Gensler as SEC chair

Bitcoin (BTC): April saw Bitcoin outperform the market, closing above $94k after ETF momentum reversed mid-month. MicroStrategy surpassed 550,000 in BTC holdings, announcing over 25,000 in BTC acquisitions during the month of April. Net ETF inflows for the month surpassed $2.9Bn despite $800M outflows over the first 8 trading days.

Ethereum (ETH): The Ethereum Pectra upgrade is confirmed to go live on May 7th, which will double the capacity for blobs boosting scalability for Layer 2 rollups. Vitalik Buterin proposed a radical change from EVM to RISC-V to slash onchain execution costs. Ethereum closed the month trading around $1800, with $66M in net ETF inflows driven by BlackRock’s ETHA fund.

Market Focus: Crypto ally Paul Atkins was appointed to SEC Chair, replacing Gary Gensler. Stablecoins saw positive developments, as Circle filed for a U.S. IPO and announced a global payments network for financial institutions. Ripple’s $1.25Bn acquisition of prime broker Hidden Road enables deeper RLUSD integration in the TradFi ecosystem. On a macro scale, volatility driven by tariff escalations drove Gold prices to new ATHs, as global equities experienced a sharp selloff.

Web3: VC activity continues to hold strong, with a clear focus on decentralized AI investments; Nous Research raised $50M in a Series A to develop human-centric decentralized AI models on Solana. Eliza Labs launched an AI agent platform with open tooling for developers and community-first token distribution. Meanwhile, the SEC dropped their lawsuit against Helium for alleged securities violations.

DeFi: April saw the global stablecoin market cap reached an ATH above $237Bn. Coinbase expanded their partnership with PayPal, as the SEC dropped their 15-month investigation into PYUSD. RWA blockchain Mantra saw its native OM token crash over 90% amidst market maker controversy and low liquidity. The DTCC announced they were creating an AppChain for tokenized collateral management.

SQD.AI (SQD): +43.5%

SQD continues to outperform the market as their decentralized data layer scales, serving millions of queries per day and adding support for Soneium and Nexera.

Through a new partnership with io.net, SQD can support more complex data workloads using io.net’s decentralized compute resources.

Virtuals Protocol (VIRTUAL): +167.2%

Virtuals outperformed the market significantly in April, with the Genesis launch on Base enabling fair token distribution to AI agent contributors based on usage.

The first-ever Virtuals Hackathon saw over 100 submissions, as autonomous wellness agent Solace took the top spot.

Binance and Binance US listed VIRTUAL in April, renewing market interest and deepening liquidity after pulling back from January highs.

DIMO Network (DIMO): +10.5%

DIMO partnered with OpenMind AGI to build secure machine-to-machine data exchange, starting with vehicle information from DIMO’s network.

The DIMO LTE R1 hardware device now enables passive AI based diagnostics, such as deciphering check engine lights without any user input.

The new DIMO Build console offers a streamlined user interface, with an integrated suite of tools for developers to fully decentralize their applications.

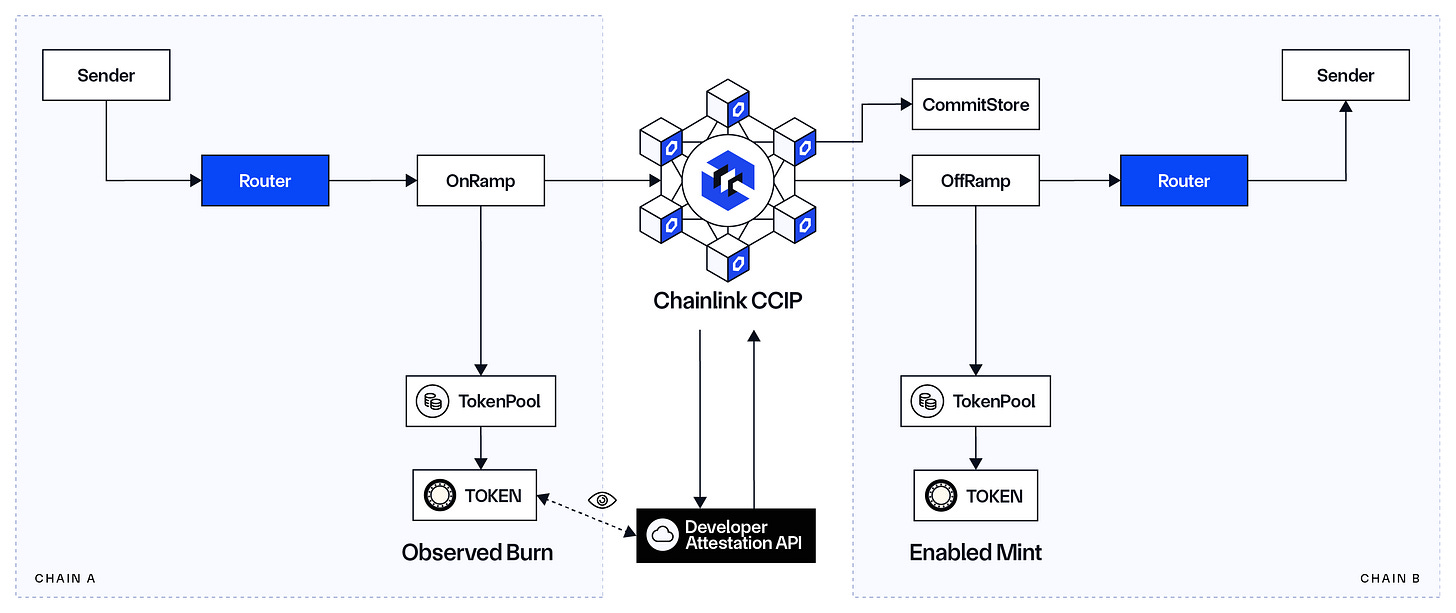

Chainlink (LINK): +5.8%

Chainlink launched the CCIP Token Developer Attestation feature, providing developers with more control on how their cross-chain tokens move between chains.

Ronin Network successfully migrated over $450M worth of assets from their legacy bridge infrastructure to Chainlink CCIP.

The LINK token became available on PayPal and Venmo, expanding mainstream accessibility for US users.

Bless Network: (N/A)

The Bless Network surpassed 5 million active nodes in April, integrating with ElizaOS to enable the single-click deployment of onchain decentralized AI agents.

Bless testnet now supports external API calls, allowing AI agents to interact with live data feeds in real time.

Euler Finance (EUL): +39.0%

Euler achieved several milestones in April, recording new ATHs in active loans while surpassing $1Bn deposits on Ethereum and $200M deposits on Avalanche.

The new Vault Swap feature allows lenders to seamlessly reposition their collateral without manual withdrawals.

Maple Finance (SYRUP): +34.2%

Maple Finance saw new ATHs in both TVL and protocol revenue, with a heavy focus on expanding BTC yield through delegation to CoreDAO.

The MPL-SYRUP token system phased out in April, as Maple governance was fully consolidated under the SYRUP token.

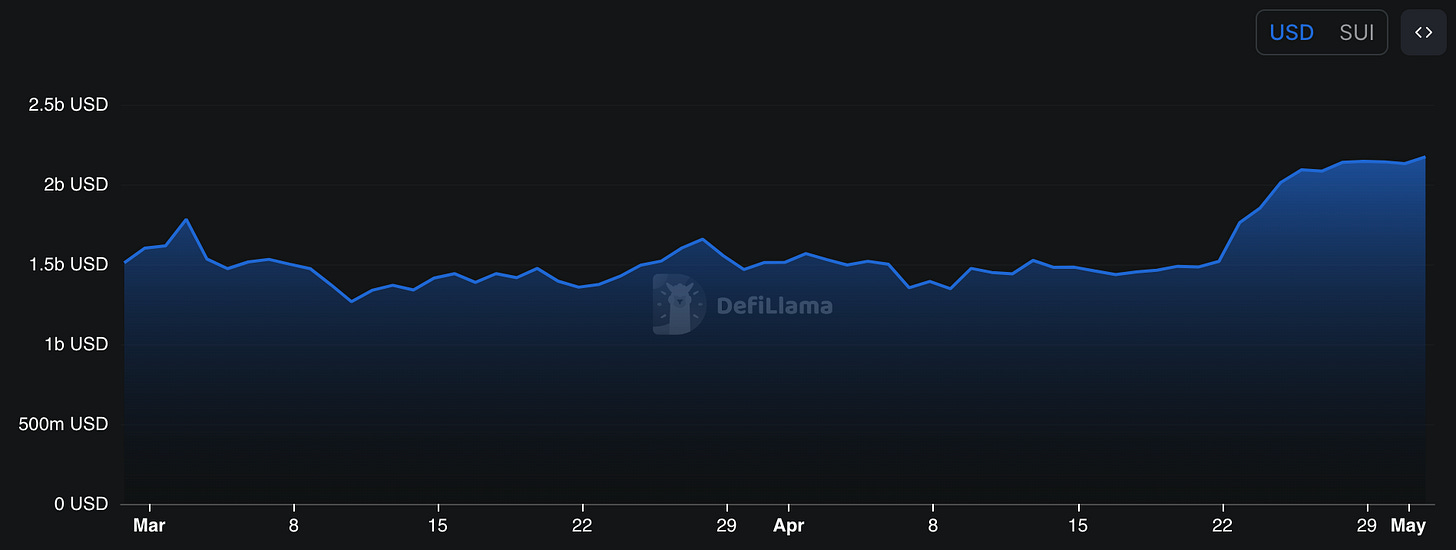

Sui (SUI): 43.5%

BTCfi on Sui saw significant adoption in April, as over 10% of TVL on Sui is now composed of BTC-backed assets.

Partnerships with xPortal and xMoney enabled the launch of a virtual Sui Mastercard, allowing users across Europe to spend their crypto for everyday purchases via Apple Pay.

USDC on Sui surpassed a $500M market cap, supporting their rapidly growing DeFi ecosystem.

Ethena (ENA): -7.2%

Ethena’s USDe became the first stablecoin with weekly institutional-grade Proof of Reserves validated by multiple third-party attestors, including Chainlink and Chaos Labs.

New ecosystem partners include TON, Plasma, and Re, expanding USDe and sUSDe reach to over 1 billion users.

Aave (AAVE): +3.1%

Aave DAO voted to activate the Buy and Distribute program, approving a specific allowance to the Aave Finance Committee to initiate AAVE buybacks.

A new proposal aims to deploy Aave V3 on the Aptos mainnet, which would mark a significant milestone as the first non-EVM deployment.

Ripple’s RLUSD was added to Aave V3 on Ethereum with an initial supply cap of $50M.

April Highlights

Paul Atkins, Nominated by Trump, Has Been Sworn In as SEC Chair

Mantra Token Crashes 90% in One Hour, Team Blames 'Reckless Liquidations'

Ripple Acquires Crypto-Friendly Prime Broker Hidden Road for $1.25B

Theo Raises $20M to Bring Hedge Fund Strategies to Retail Crypto Traders

Galaxy Research Proposes New Voting System to Reduce Solana Inflation

Vitalik Buterin Suggests Replacing EVM with RISC-V to Scale Ethereum

Ripple Pitched Buying Circle for $5 Billion But Offer Was Rejected

Trump to Host Gala for Top 220 $TRUMP Memecoin Holders at D.C. Golf Club

North Korean Hackers Created Fake US Companies to Target Crypto Developers

Upcoming Events

The M31 Capital team will be speaking at and attending a number of upcoming conferences and events. Please reach out if you are interested in connecting, or better yet - meet us there:

Washington DC: SelectUSA Investment Summit (5/11-5/14)

Toronto: Consensus 2025 (5/14-5/16)

Doha: Qatar Economic Forum (5/20-22)

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies supporting individual sovereignty.

Website: https://www.m31.capital/