In This Issue:

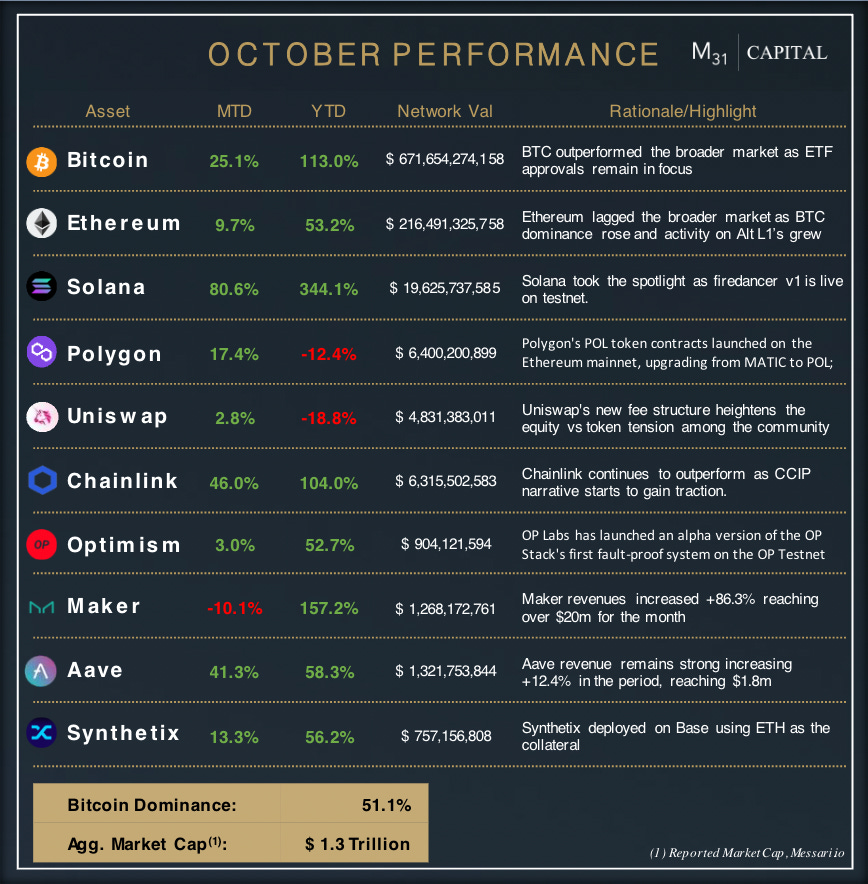

Market: BTC +25.1% ends October at new yearly highs on ETF approval optimism

Narrative: Geopolitical instability, front running ETF approvals, and low liquidity create a perfect storm for a flight to quality and a tailwind for BTC

Highlight: Celestia’s mainnet goes live bringing data availability across chains

Market Action

Uptober did not disappoint investors in the crypto space and marked the 9th time in 11 years that the period has seen positive gains for BTC. There were a few significant catalysts leading up to the positive price performance we have seen in the past 31 days.

We have just recently seen a shift in capital flows into digital assets that has been in a sustained outflow for the better part of this year. This comes from a variety of factors but most importantly a renewed focus on BTC as a flight to quality in a time of fiscal and geopolitical uncertainty in tandem with a flurry of ETF final deadlines just around the corner in 2024.

In the week ending October 27th, we saw $326m in new flows into digital asset products, marking the 5th consecutive week of inflows. This concentrated focus on BTC is indicative of a healthy rally and likely the beginning of a much larger crypto bull run as we head towards the halving in April.

Web3

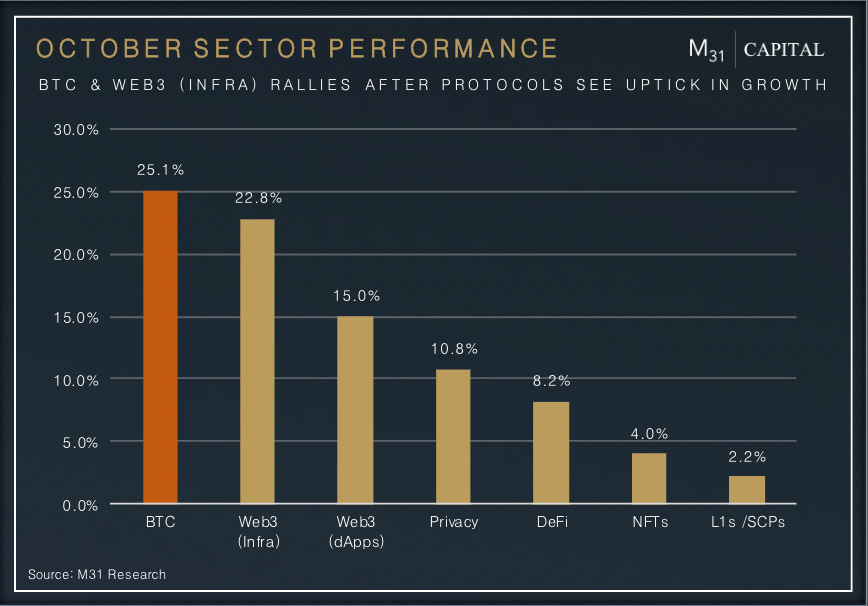

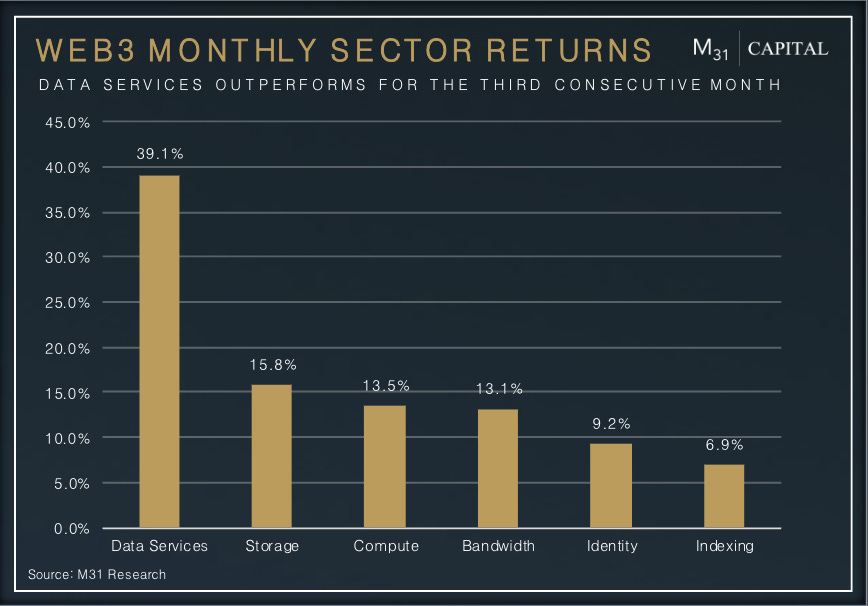

A quick look at the chart below, and it is very clear what drove Web3 (Infra) performance in October.

Data services +39.1% was a significant outperformer among all the Web3 sectors, driven by LINK +49.3% after investors begin waking up to CCIP’s multiple partnerships and integrations, Chainlink’s critical infrastructure, and favorable LINK tokenomics as well. This sparked rallies among many smaller market cap tokens in the data services sector, including TRB (+119.7%).

The Graph +24.83% surged with smoother transition plans to its Network. Core developer Edge & Node introduced an upgrade indexer on Arbitrum for easy new chain bootstrapping and subgraph upgrades, providing immediate query servicing post-publication. This feature allows free subgraph publishing with minimal query fees. Through a phased approach, The Graph aims to extend support, ease upgrades, introduce a 60-day upgrade window, and retire hosted service endpoints, streamlining user migration to its Network

The Helium +8.25% community marked the release of Helium Wallet App v2.3.0, bringing new features including an explorer by Relay Wireless for large-scale deployers. Concurrently, the Helium Foundation Membership Program was launched to drive network growth and decentralized wireless expansion, highlighted by a grant program and mobile mining rewards for Helium 5G Hotspot owners. These advancements, alongside a +23% WoW and +27% MoM increase in Helium's demand-side protocol fee, reflect the network's growing value and appeal to users and investors

The Render Network +44.9% community recently concluded a vote on proposal RNP-005, which passed overwhelmingly with 99.79% approval. The proposal aims to onboard Beam as its second open compute client focused on machine learning workloads. Beam offers a cloud platform designed to accelerate AI development without the need for managing infrastructure. Beam clusters will gain access to Render Network's extensive global GPU supply optimized for parallelized AI computations

Arweave has seen considerable growth recently, with its value surging by +47.3% and onchain transaction increasing by +23.4% to reach 124 million in the past month. This rise in interest and activity is reflected in the various projects within the Arweave’s ecosystem including ardrive and ar.io. Additionally, the ongoing Permahack — a two-week online hackathon aimed at exploring the capabilities of Arweave’s permaweb — further underscores the growing demand for Arweave’s services

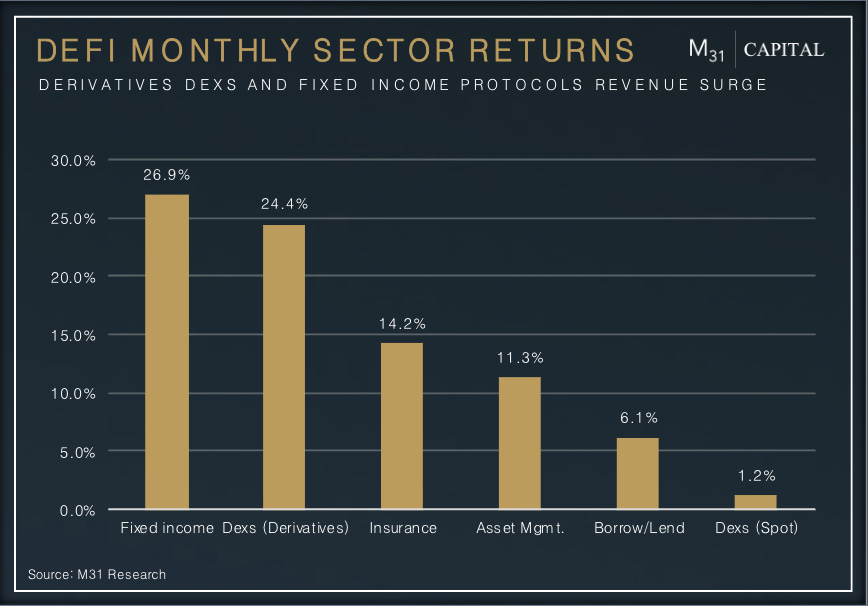

DeFi

DeFi activity picked up significantly in the month of October and as we saw volatility return, and trading activity come back to life after majors spent weeks in tight ranges with distant catalysts that had weighed on volumes and activity for months.

As speculation returned so did volumes and fees across popular perp Dexs. Most notably we saw dYdX volumes consistently hold above $1b and surpass $2b on a handful of days. We also saw strong performance coming from spot Dexs coming off of a particularly weak September. The majority of the spot purchases were likely stablecoins coming off the sidelines which drove overall DeFi TVL to $41.9b by month end, up +8.8% from the start of the month. Another notable trend in the month is what seems to have potentially been a stablecoin market cap bottom. After outflows and redemptions of USDC for almost a full year, there are now more stables being minted and capital being injected into the DeFi space with ~$800m more minted than redeemed in October.

Thorchain was a major benefactor of increased onchain activity and increasing swaps done through Metamask, with TVL increasing +34.7% M/M and RUNE price increasing +46.9% during the period

Dopex has passed important milestones with the rDPX v2 audit complete and scheduled launch mid-month, this will enable bonding of Eth and rDPX for rtETH(synthetic ETH) which will earn a staking yield while retaining rDPX exposure with put protection, DPX surged +47.6% as a result of this

GMX fees surged +137.8% in October, reaching $5.8m for the period, with GMX rising +17.6% as their V2 platform continues to gain traction surpassing $1b in weekly volume

dYdX volumes consistently surpassed the $1b mark increasing +51.7% M/M, driving up fee revenue for V3 as their own V4 standalone app chain went live which will enable significantly higher throughput and improved UX, dYdX surged +16.7% in October

October Highlights

Partner Highlights

Render Network upgraded its core infrastructure from Ethereum to Solana

Google Cloud adding BigQuery support for Solana

Enters the modular era, Celestia is live on mainnet

dYdX has launched its layer-1 blockchain, dYdX Chain

Protocol Highlight:

Celestia

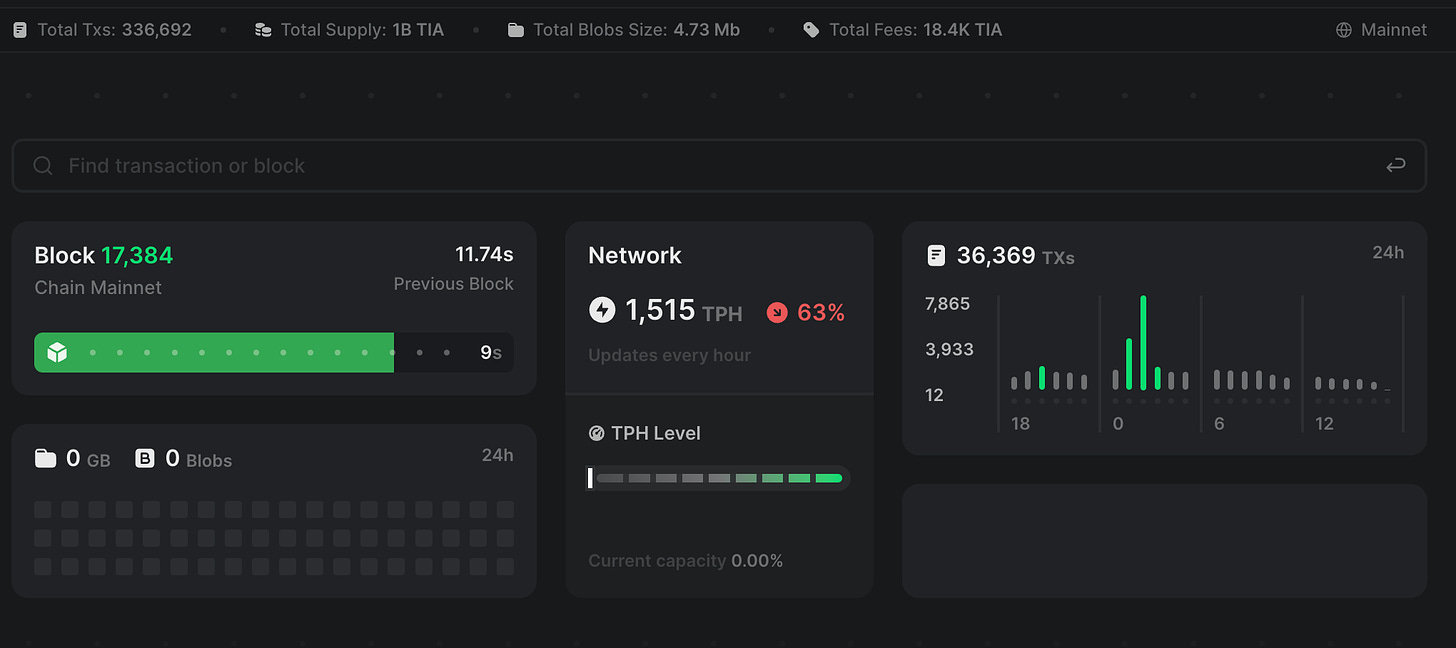

Celestia marked a key milestone with its mainnet launch on Oct 31, initiating a modular era and rewarding early adopters with $TIA token airdrops. Post-launch, the network recorded 336,692 transactions, generated 4.73 megabytes of blob size, and accrued 18,400 TIA fees, reflecting a growing adoption.

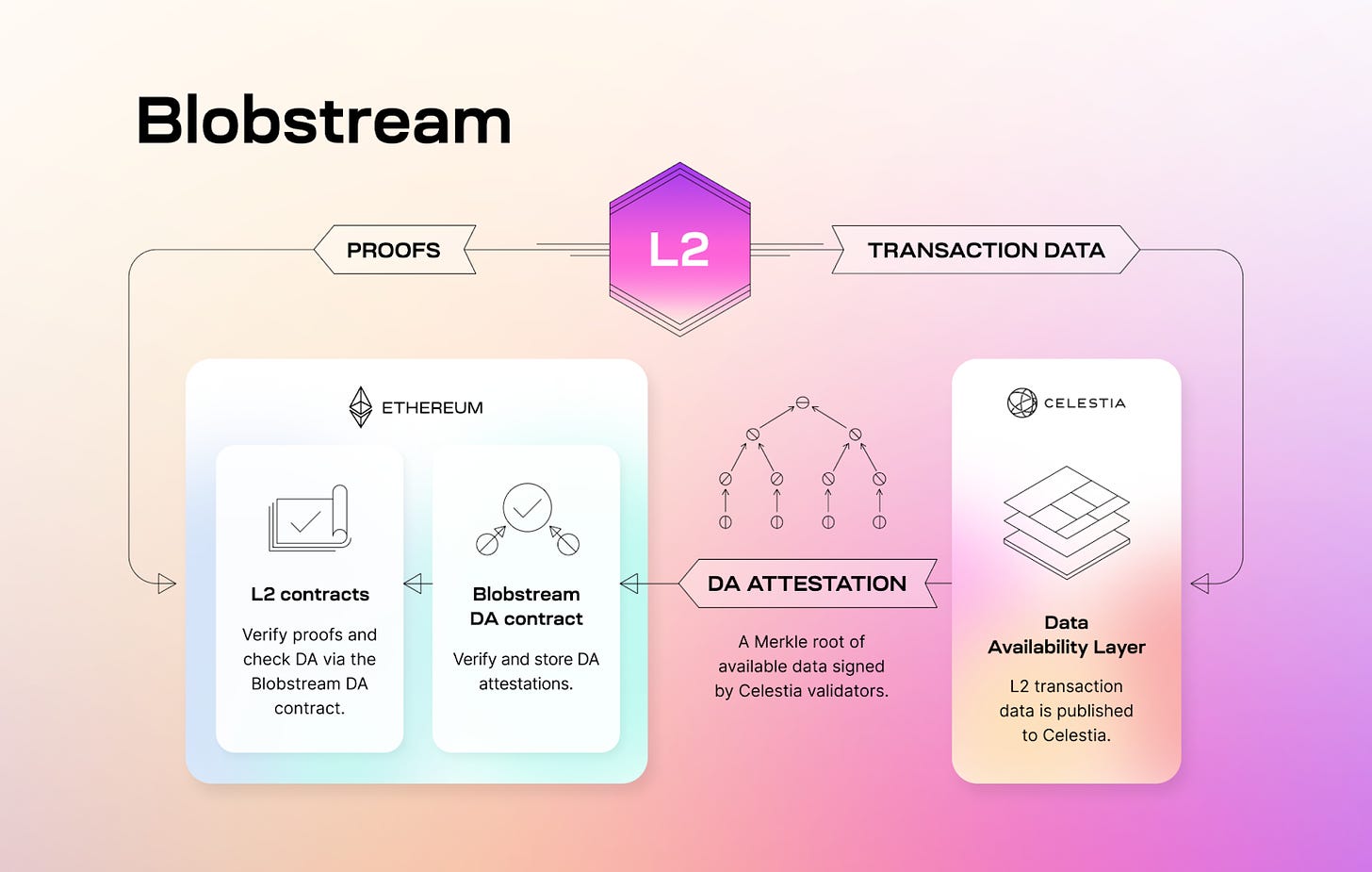

Enhancing Ethereum's ecosystem, Celestia Labs introduced Blobstream, a technology bridging Celestia's modular data availability layer to Ethereum for simplified Layer-2 solution development. Blobstream, supported by Data Availability Sampling (DAS), facilitates user contributions to data availability for rollups, augmenting network security as Celestia scales.

On a parallel front, Succinct Labs has rolled out Blobstream X, a progressive zero-knowledge implementation, to speed up data root commitment streaming for Ethereum L2s. Currently live on the testnet (Goerli), Blobstream X brings a suite of advantages:

Reduced Overhead: Blobstream X, using zero-knowledge proofs to verify Celestia’s validator EdDSA signatures on Ethereum, cuts down infrastructure needs and special-case logic tied to ECDSA, aligning with Celestia's high-throughput, verifiable data availability goal.

Optimized Contract Updates: Employing a request/response model, Blobstream X enables quicker on-chain commitment updates, advancing from the prior ~100 minute interval to on-demand updates.

Gas Savings: Significant gas savings are achieved as Blobstream’s ZK proofs can be aggregated with other ZK proofs.

Expanded ZK-proving Scope: Blobstream X broadens the ZK-proving horizon beyond consensus to additional block validity rules or Celestia's state machine, reducing trust reliance on Celestia’s validator set.

Upcoming Events

The M31 Capital team will be speaking at and attending a number of upcoming conferences and events. Please reach out if you are interested in connecting, or better yet - meet us there:

London: Digital Asset Week (11/14-11/15)

Virtual: AngelList Confidential 2023 (11/8-11/10)

Dubai: COP28 UAR (11/30-12/12)

West Palm: Family Office Investor Summit (12/4-12/6)

Tulum: SPARK (12/4-12/7)

Riyadh: Digital Acceleration & Transformation Expo (12/11-12/12)

Dubai: iFX Expo (1/16-1/18)

Miami: Quantum Miami (1/24-1/26)

Dubai: Satoshi Roundtable X (2/1-2/6)

Hong Kong: Web3 Festival 2024 (4/6-4/9)

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies supporting individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital