The Monthly Airdrop: November 2024

October Market (+5.4%) // Prediction market activity skyrockets as election nears, Stripe acquires Bridge to enable stablecoin payment rails, Chainlink expands cross-chain ecosystem

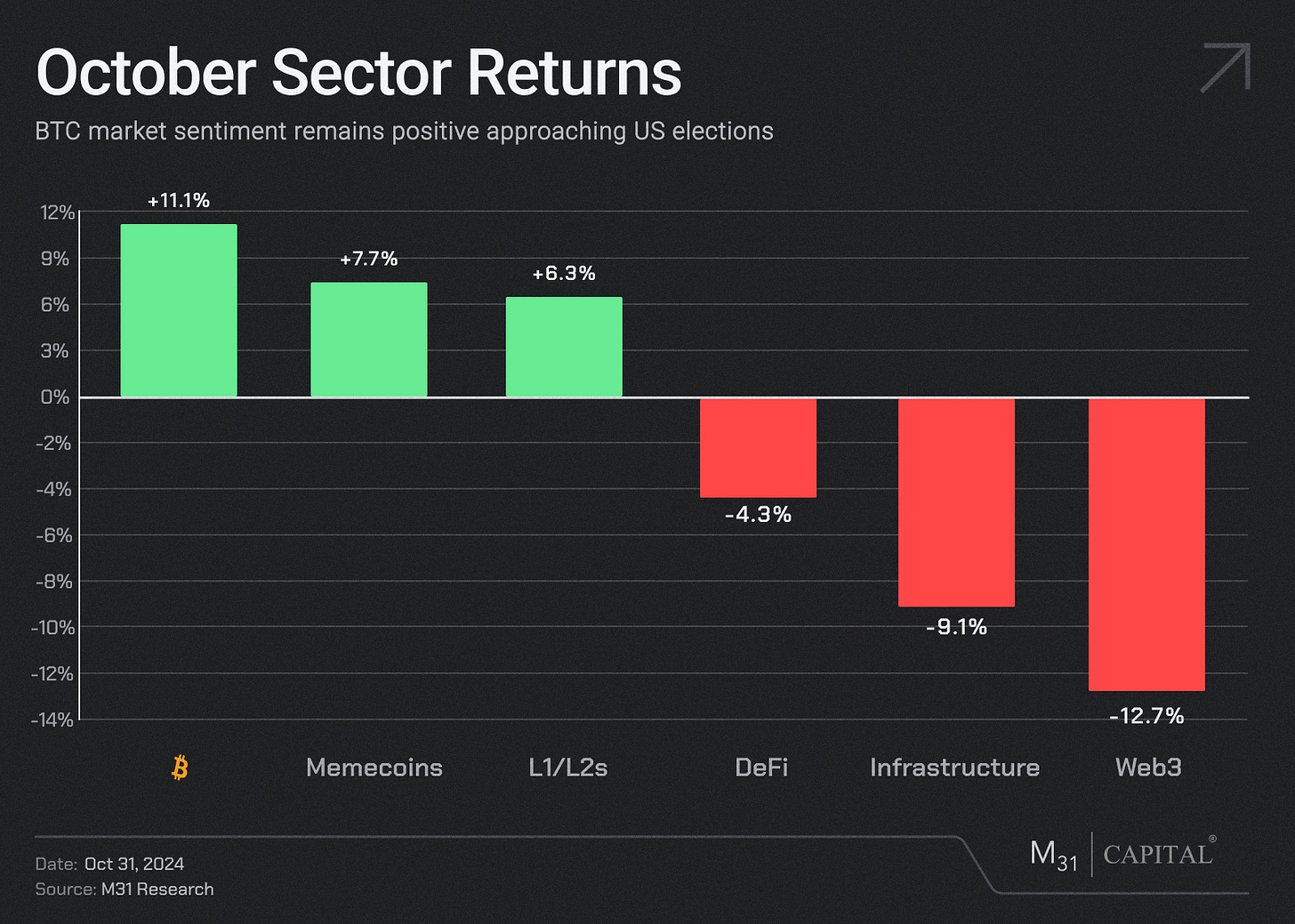

Bitcoin (BTC): Bitcoin surged past $73,000 with $5.4 billion in ETF inflows fueled by anticipation around the U.S. presidential election, with markets favoring a potential pro-crypto stance from Donald Trump. Michael Saylor announced plans for Microstrategy to raise $42bn over the next three years, which will all be used to buy Bitcoin.

Ethereum (ETH): BTC outperformed ETH significantly throughout October, as the ETH to BTC market cap ratio dropped to its lowest point in over three years and is down over 8% since the start of 2024. Institutional interest has shown a clear preference for Bitcoin ETFs, as Ethereum ETFs had just $55.4M in inflows throughout October.

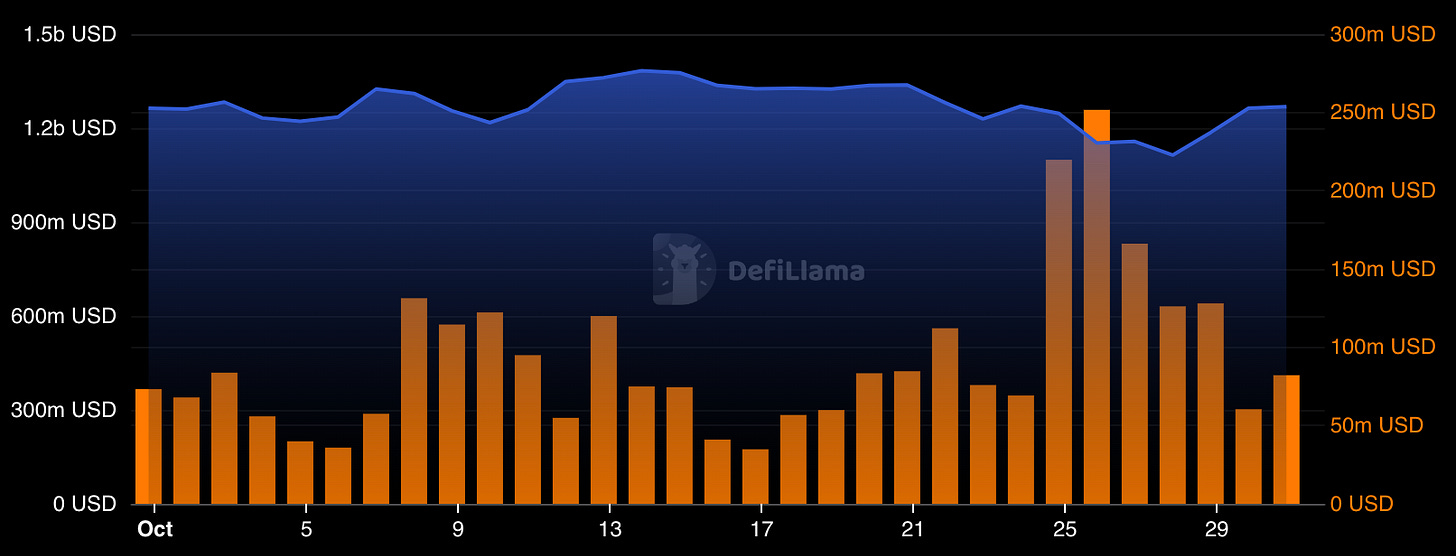

Market Focus: October’s highlight was the dominance of prediction markets, as Polymarket reported over $2 billion in volume in October — a 320% increase from September. This spike was driven by high-profile events, including an HBO documentary's controversial claim identifying Satoshi Nakamoto, and substantial betting volume on the U.S. presidential race, where traders increasingly favored Donald Trump. Dogecoin surged over 40%, driven by Elon Musk’s appearances with President Trump.

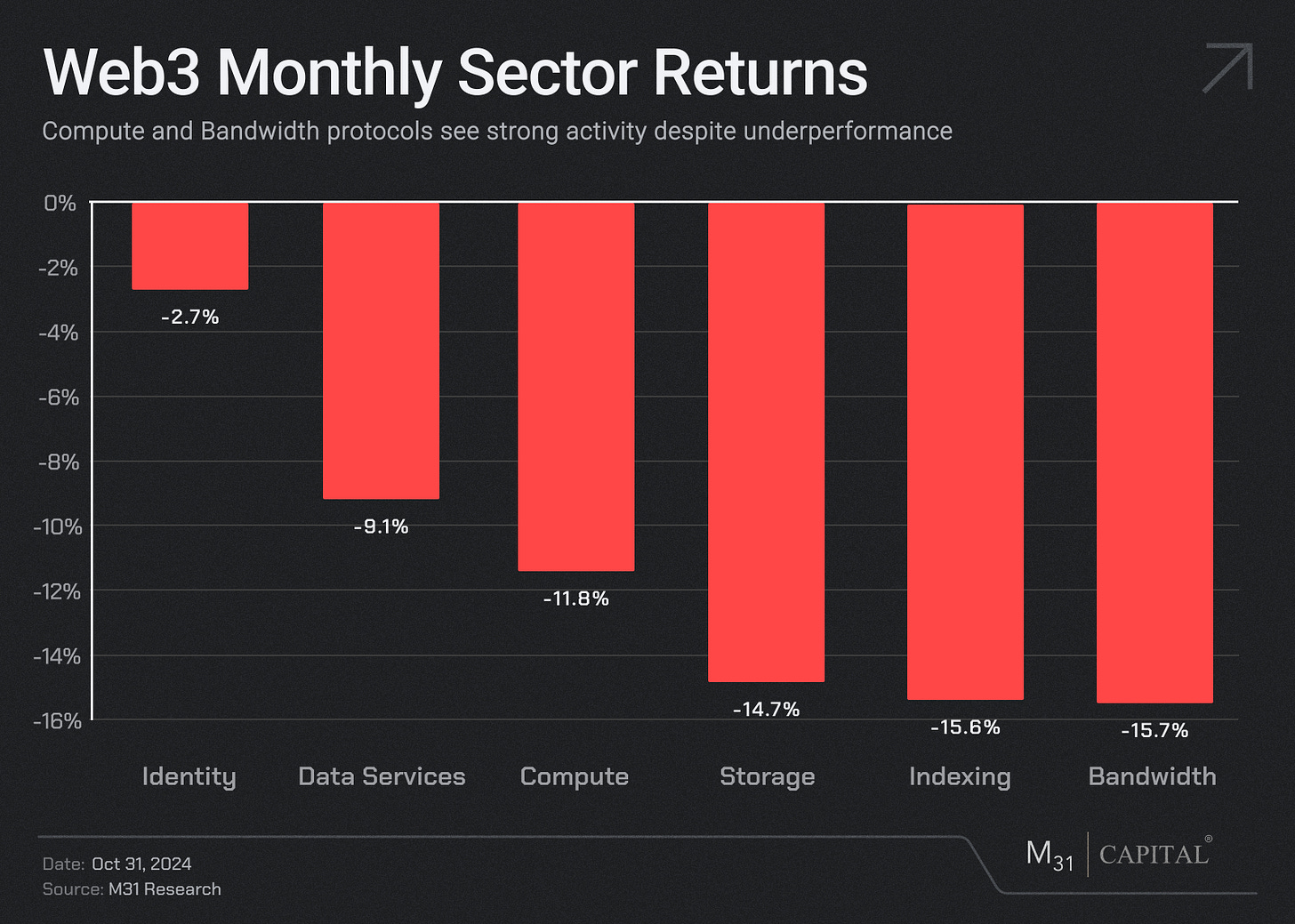

Web3: Web3 and infrastructure projects saw their highest VC investment volume since April, marked by Blockstream’s $210 million raise to expand its Bitcoin ecosystem and Glow Labs' $30 million funding to support blockchain-based clean energy solutions. Meanwhile, Stripe acquired Bridge for $1.1Bn to integrate blockchain with traditional payments infrastructure, signaling a growing institutional focus to incorporate stablecoin utility.

DeFi: October saw significant momentum in real-world asset (RWA) tokenization, with major financial institutions like Lazard and DBS exploring blockchain solutions to tokenize funds. Solana’s restaking functionality went live, further boosting network security and staking efficiency. Additionally, Solana’s DEX activity surged past Ethereum's, fueled by strong interest in AI and meme tokens.

Solana (SOL): +10.4%

Solana’s TVL increased by over $500M in October, with leading dApps such as Jupiter launching mobile apps on the App Store to onboard new retail users.

Stripe integrated new payment rails for Solana stablecoins, which allows merchants to accept stablecoin payments on the Solana blockchain while receiving fiat in return.

Both Nansen and Arkham added support for advanced Solana on-chain analytics, allowing users to visualize and track addresses and transactions on-chain.

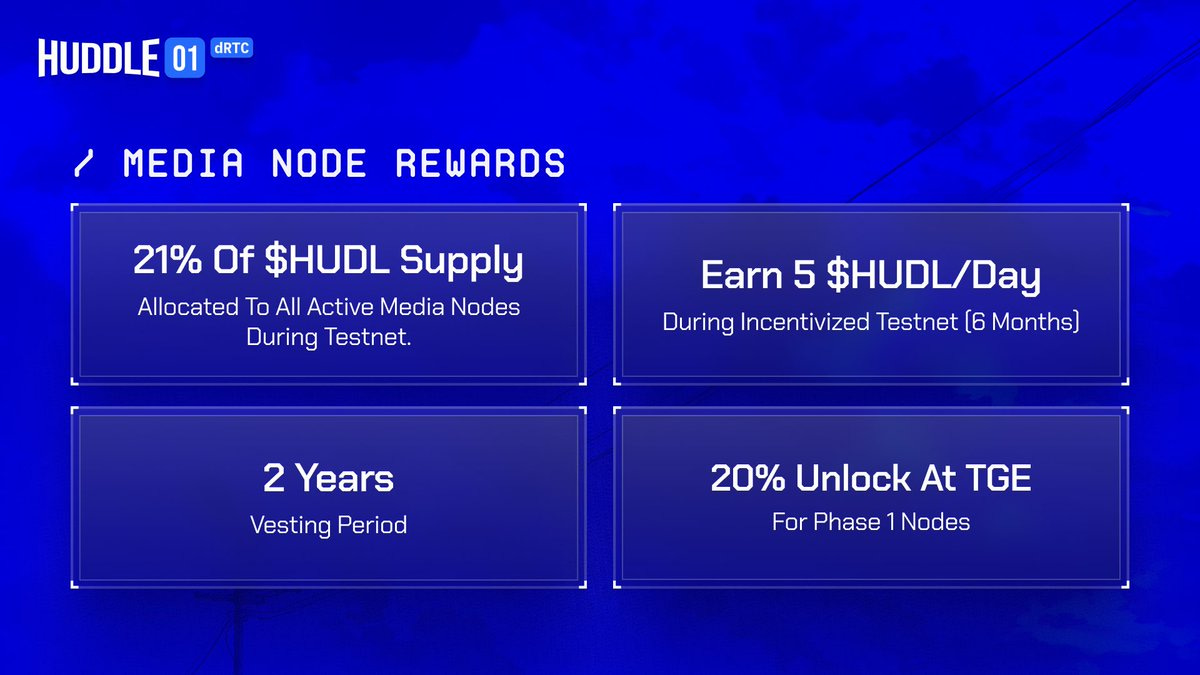

Huddle01: (N/A)

Huddle01 officially opened the whitelist for their media node sale, attracting early node operators to bootstrap the supply side for their dRTC network.

Huddle01 partnered with Aethir to offer guaranteed whitelist access to Aethir node operators, along with NodeOps and Easeflow partnerships to simplify the deployment of media nodes.

Sui (SUI): +11.1%

Coinbase added send and receive support for native USDC on Sui, as the USDC supply on Sui approaches the $100M mark.

Sui averaged over 1M daily active addresses throughout October, as leading DEXes and DEX aggregators continue to see increased revenues.

Sui launched an incubator hub in Dubai for developers and founders to host hackathons on-site and implement novel solutions on-chain.

Chainlink (LINK): (-3.4%)

Chainlink announced several new partnerships with major financial entities, including the Australia and New Zealand Banking Group, to enhance tokenized RWA adoption utilizing the Chainlink Digital Assets Sandbox.

Chainlink’s CCIP integrated data streams onto several new chains including Solana, Soneium, Scroll, Hedera, Linea and Ronin.

Chainlink introduced the Chainlink Runtime Environment, a flexible and serverless platform that allows developers to build, test, and deploy custom integrations on-chain and off-chain.

Space and Time: (N/A)

Space and Time introduced the SxT chain, which aims to streamline DeFi transactions and enable faster data processing within the ecosystem leveraging their ZK-proven data streams.

Cenit Finance joined the Space and Time product suite to launch “Space and Tokens,” which allows developers to leverage Space and Time’s data solutions to build, test and improve their token economies.

Space and Time launched a contributor bounty program, inviting and rewarding developers who engage with its ecosystem and collaborate on initiatives to advance its ZK coprocessor.

Akash (AKT): (-15.3%)

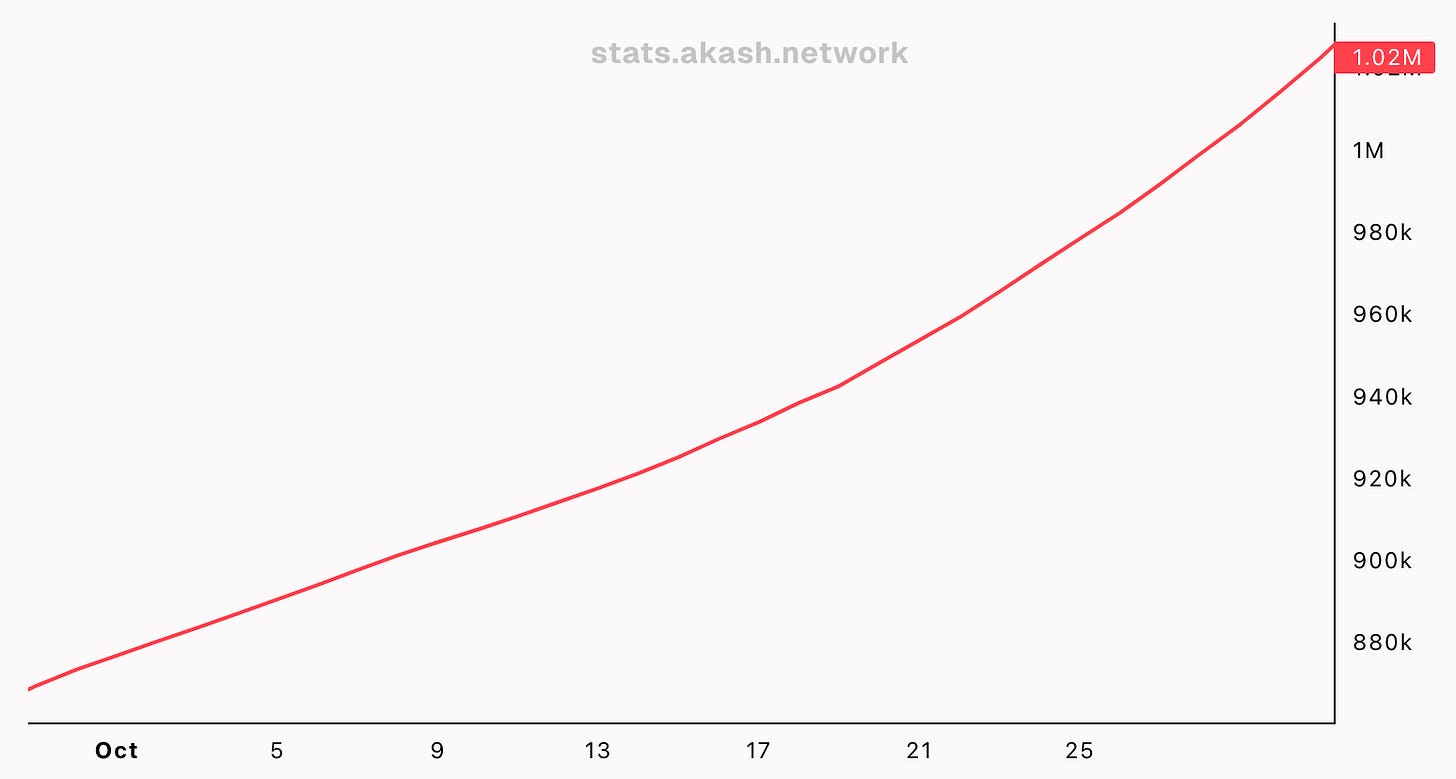

Akash surpassed over $1M in total network spend, including both AKT and USDC payments, with over $500k spent over the last 4 months.

Akash achieved new ATHs in both daily network fees and GPU utilization, with the highest GPU utilization out of any decentralized compute network.

Leading research authority SemiAnalysis recognized Akash as a leading aggregator of compute resources, alongside other DePIN projects such as Aethir and Cudo.

Uniswap (UNI): +3.0%

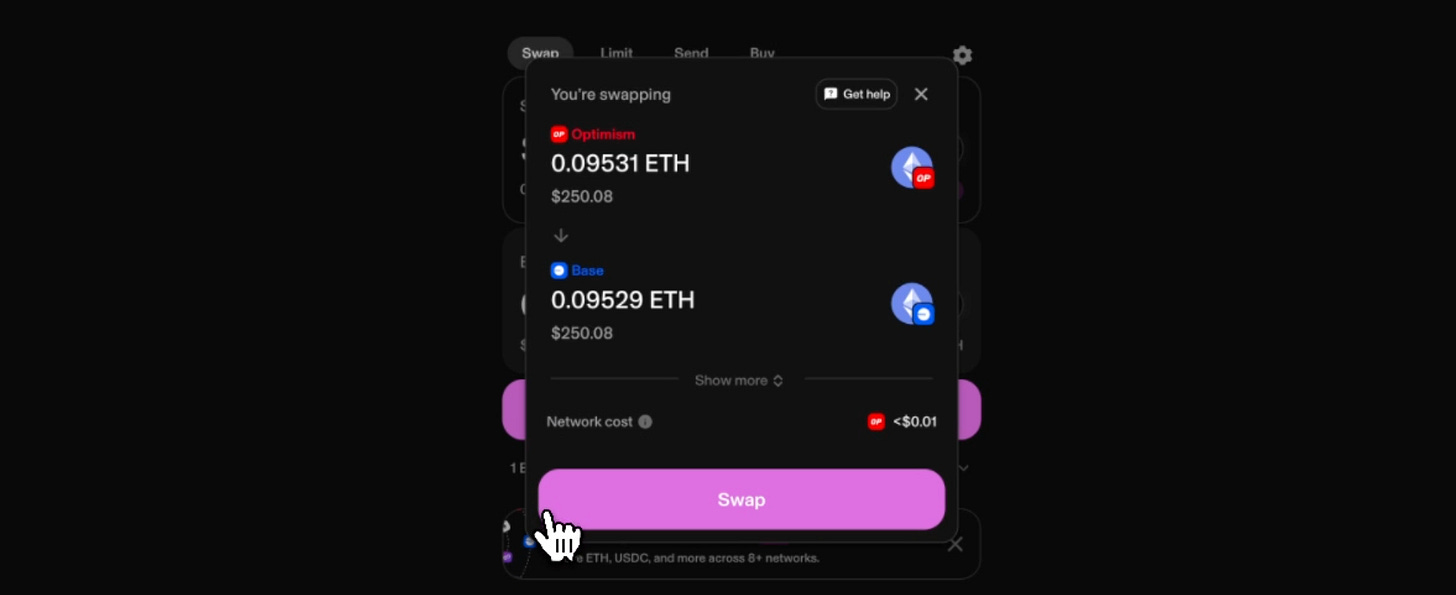

Uniswap Labs introduced Unichain, a L2 network built on Optimism in collaboration with Flashbots. The L2 aims to make transactions faster and cheaper while improving liquidity and reducing value lost to MEV.

Uniswap rolled out permissionless bridging across nine networks, including Ethereum, Base, Polygon, and Arbitrum. This permissionless bridging is powered by Across Protocol, and has been directly integrated with Uniswap’s dApp and wallet interface.

Maple Finance (MPL): +13.6%

Maple announced the launch of its Syrup token on November 13, with a portion of fee revenues from Maple’s lending operations dedicated to buying back Syrup. Early Syrup stakers will receive fixed staking yields as part of a 90-day emissions program.

Maple integrated SyrupUSDC with Pendle, expanding yield opportunities and allowing Pendle users to earn a 3X boost in Drips rewards.

Maple added support for collateralized Bitcoin assets like Coinbase’s cbBTC and Lombard’s LBTC, increasing its offerings for institutional lending.

Jito (JTO): (-0.2%)

Jito achieved a record $78.9 million in monthly fees for October, doubling its previous record from May.

Jito DAO proposed the adoption of the TipRouter Non-Custodial Network, which would allow JTO governance token holders to receive 3% of all MEV tips collected by the protocol.

Jito Restaking went live in October, with a $25M deposit cap that reached full capacity in under 5 hours.

Injective (INJ): (-16.7%)

Agora’s native AUSD and Paxos yield-bearing wUSDL stablecoins were launched on Injective in October, providing new DeFi capabilities in the Injective ecosystem.

21Shares launched the Injective Staking ETP on European exchanges, providing institutional investors with exposure to INJ and staking rewards .

Aave (AAVE): (-8.4%)

Grayscale launched the Grayscale Aave trust, providing U.S. institutional investors with direct exposure to the AAVE governance token.

Aave’s v3.2 upgrade introduced Liquid eMode and customizable risk management options, with the goal of improving capital efficiency across the protocol.

October Highlights

Stripe Acquires Stablecoin Platform Bridge for $1.1 Billion in Crypto's Largest Acquisition

Kraken Unveils New Ethereum L2 Built on Optimism’s Superchain

Michael Saylor's MicroStrategy Plans to Raise $42B to Buy More Bitcoin Over Next 3 Years

World (formerly Worldcoin) Unveils New Layer-2 Network 'World Chain'

The Man Named as Bitcoin's Creator in an HBO Documentary Has Gone Into Hiding

VC Roundup: Capital Flows into Emerging AI-Blockchain Sector

Dogecoin Price Pumps After Elon Musk Shares D.O.G.E. Plans at Massive Trump Rally

Upcoming Events

The M31 Capital team will be speaking at and attending a number of upcoming conferences and events. Please reach out if you are interested in connecting, or better yet - meet us there:

Singapore: Salt iConnections Asia (11/11-11/13)

Abu Dhabi: Apex Invest Abu Dhabi (11/18-11/19)

Florida: Marcus Evans Investor Summit (12/9-12/11)

Abu Dhabi: Bitcoin Mena (12/9-12/10)

Doha: World Summit AI (12/11-12/12)

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies supporting individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital