September Performance

In This Issue:

Market: BTC (+3.91%) ends September in the green for the third time ever and the first time in six years

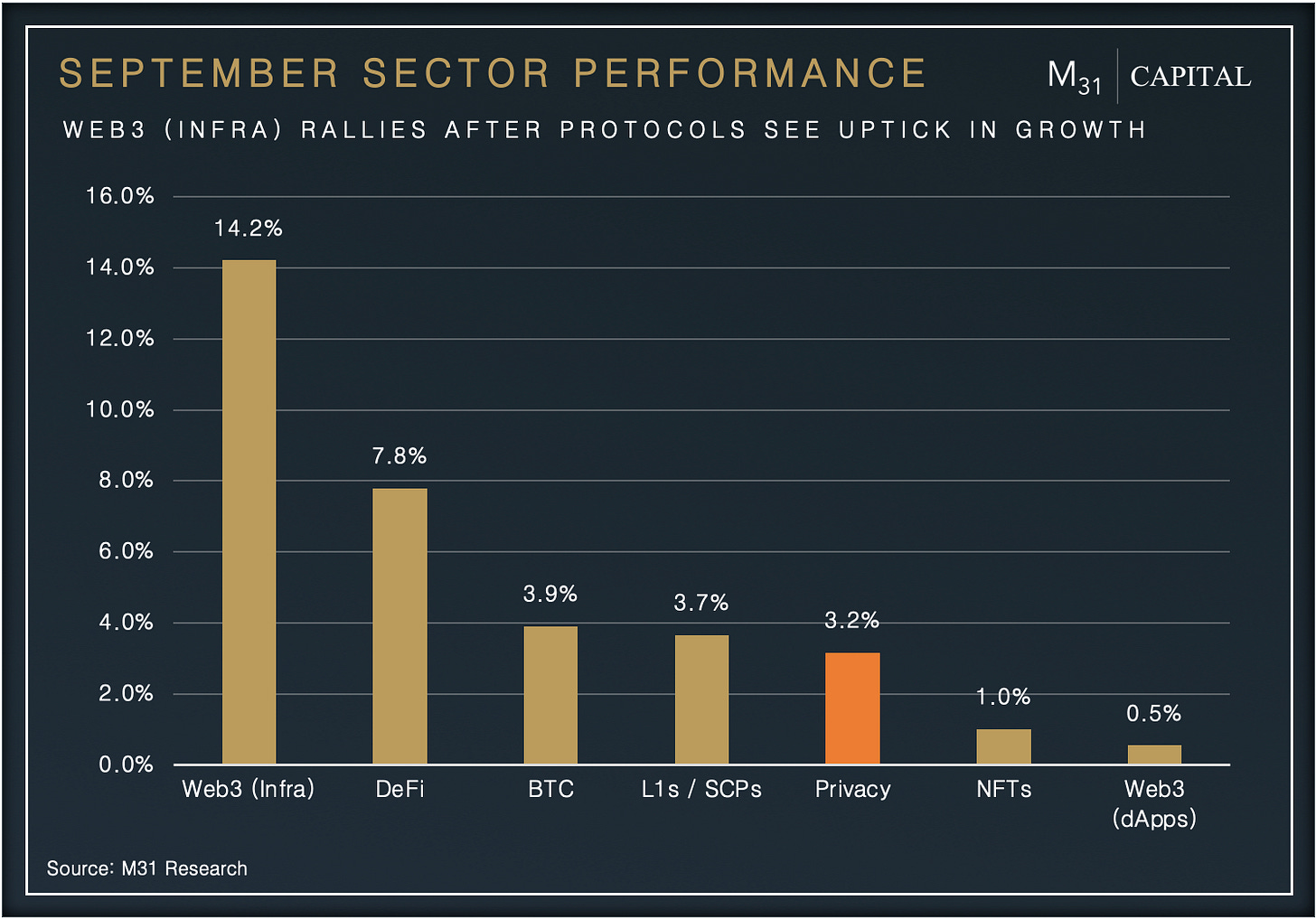

Narrative: September provides much needed relief as Web3, DeFi see strong performance

Highlight: Pocket Network goes the modular route, and will deploy as an L2, using Celestia DA

Market Action

September is a marked month on most people’s “crypto calendars” as traders and investors non eagerly anticipate an eventual red month for BTC, and as a result, most other crypto assets.

After six consecutive years in the red, BTC ended September 2023, +3.91%. Is this time different?

Despite crypto markets gaining modestly during the month of September, BTC price has largely been range bound between $25.6K and $26.8K up until the very end of the period. This muted activity is likely a result of a waiting game on the regulatory front with respect to BTC and ETH ETF’s. Trading volumes across spot and derivatives had inched lower during the month as outflows from digital asset products remained.

We have seen a flurry of new ETF filings for spot and futures based ETH products, but it would stand to reason the futures filings are more strategic as they may pave the path for an eventual spot ETH ETF, following a similar path to BTC currently.

Web3

A quick look at the chart below, and it is very clear what drove Web3 (Infra) performance in September.

Data services (+41.1%) was a significant outperformer among all the Web3 sectors, driven by LINK (+37.7%) after investors begin waking up to CCIP’s multiple partnerships and integrations, Chainlink’s critical infrastructure, and favorable LINK tokenomics as well. This sparked rallies among many smaller market cap tokens in the data services sector, including TRB (+249.9%).

The Graph (+0.2%) has seen a surge in fees generated over the last 30D, +181.1% to $82,750, while price hasn’t seemed to follow suit. This is yet another example of overall market conditions pulling a blanket on fundamentally growing protocols

DePIN networks have been leading the charge in Web3, when it comes to showcasing a strong growth in fundamentals. Onchain monthly revenues crossed $120k for back to back months in July and August, +179.9% from the beginning of the year, as DeWi protocols like WiFi Map and Geodnet begin to scale

Render Network‘s strong relationship with Apple continues, after Apple revealed that the iPhone 15 will be the first iPhone to feature hardware-accelerated ray tracing on the A17 Pro chipset. What this means is that iPhones will be able to be used as light nodes on the Render Network, and leverage OctaneX

Solana had some big partnerships, with Visa announcing they will use the chain as a settlement layer for USDC payments with its millions of merchants. This is a big deal as it further cements the notion of crypto payment rails as the cheapest and most efficient in the world

DeFi

After a lackluster couple summer months, DeFi assets saw significant gains in both price and protocol activity in September. During the period we saw some large overhanging risks come to a close surrounding CRV backed loans which provides stability to the broader DeFi ecosystem liquidity through CRV emissions.

Curve rallied (+28.8%) after Founder Egorov closed out his Aave V2 loans and significantly improved the health factors of the loans he has against CRV across other DeFi platforms

FOLD (+138.8%) rallied on the back of mevETH launch, an LST that will provide high yields on staked ETH using non predatory MEV strategies. FOLD will accrue value on all protocol fees, and will be used to bid for access to Manifold’s SecureRPC API

Maple Finance launched their cash management solution on Solana. This product, aimed at DAO treasuries has seen $10M in deposits initially, will provide RWA exposure to Treasury Bills on Solana, in addition to the pool already on Ethereum, with over $100M in TVL. MPL has performed well following the successful launch (+17.5%) in Sept

RUNE (+28.4%) has been a major outperformer this month, primarily driven by news that Metamask enabled cross chain native BTC swaps, which will use THORchain in the backend to facilitate trades. This will increase volumes on THORchain as it gets exposure to Metamask’s 21M users

dYdX volumes have nearly doubled in Sept and have eclipsed $1B in 24 hour volumes across their perpetual swaps multiple days this month increasing fees +27.2% MoM. Despite major pairs largely remaining unchanged, volatility early in the week drew in more traders

September Highlights

Partner Highlights

Coinbase Integrates Lightning Network Payments

Coinbase Launches offshore Derivatives Exchange

Circle launches native USDC on Polkadot

Protocol Highlight:

Pocket Network (POKT)

Pocket Network recently announced that it would be transitioning from a standalone L1, to a Sovereign rollup (L2) that uses Celestia as a DA layer, ushering in two trends we see growing more and more - L1s transitioning to rollups, and Celestia as a widely used DA layer.

Pocket Network is a critical component of the Web3 stack, in our opinion, as it provides much needed decentralized access to the open internet, de-risking from the centralized node service providers like Infura. It has been pivotal since launch, consistently servicing over 30B relays almost every single month over the last year. The network has proved out serious reliability, and market fit.

Key Takeaway: The Modular Era is Upon Us

Pocket Network recently announced that they will be moving their core network from its current standalone L1 state to a sovereign rollup, deployed using Rollkit. This rollup will use Celestia for data availability and consensus. This transition will drive increased utility to Pocket Network through:

Speed and Flexibility - Protocol upgrades can be shipped faster, protocol rules can be updated without the need for a hard fork, thanks to Celestia

Security - Each application on Celestia gets its own sovereign execution space (the rollup) while inheriting the security of Celestia’s consensus, which leverages a shared security model.

Focus on Core Product Development - outsourcing the DA and Consensus functions allow Pocket network to focus on boosting performance, reliability and cost

Mainnet is expected to go live, Q2 2024.

Upcoming Events

The M31 Capital team will be speaking at and attending a number of upcoming conferences and events. Please reach out if you are interested in connecting, or better yet - meet us there:

Riyadh: Future Forum (10/4-10/5)

Luxembourg: Blockchain Week 2023 (10/9-10/13)

Dubai: Blockchain Dubai Exhibition & Summit (10/12-10/13)

New York City: New York Tech Week 2023 (10/16-10/20)

Barcelona: European Blockchain Convention (10/24-10/26)

Riyadh: Future Investment Initiative (FII) (10/25-10/27)

Dubai: AIM Summit (10/30-10/31)

Dubai: World Blockchain Summit Dubai (11/1-11/2)

Athens: Decentralized (11/1-11/3)

London: Digital Asset Week (11/14-11/15)

Virtual: AngelList Confidential 2023 (11/8-11/10)

Dubai: COP28 UAR (11/30-12/12)

Tulum: SPARK (12/4-12/7)

Riyadh: Digital Acceleration & Transformation Expo (12/11-12/12)

Miami: Quantum Miami (1/24-1/26)

Dubai: Satoshi Roundtable X (2/1-2/6)

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies supporting individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital