The Monthly Airdrop: October 2024

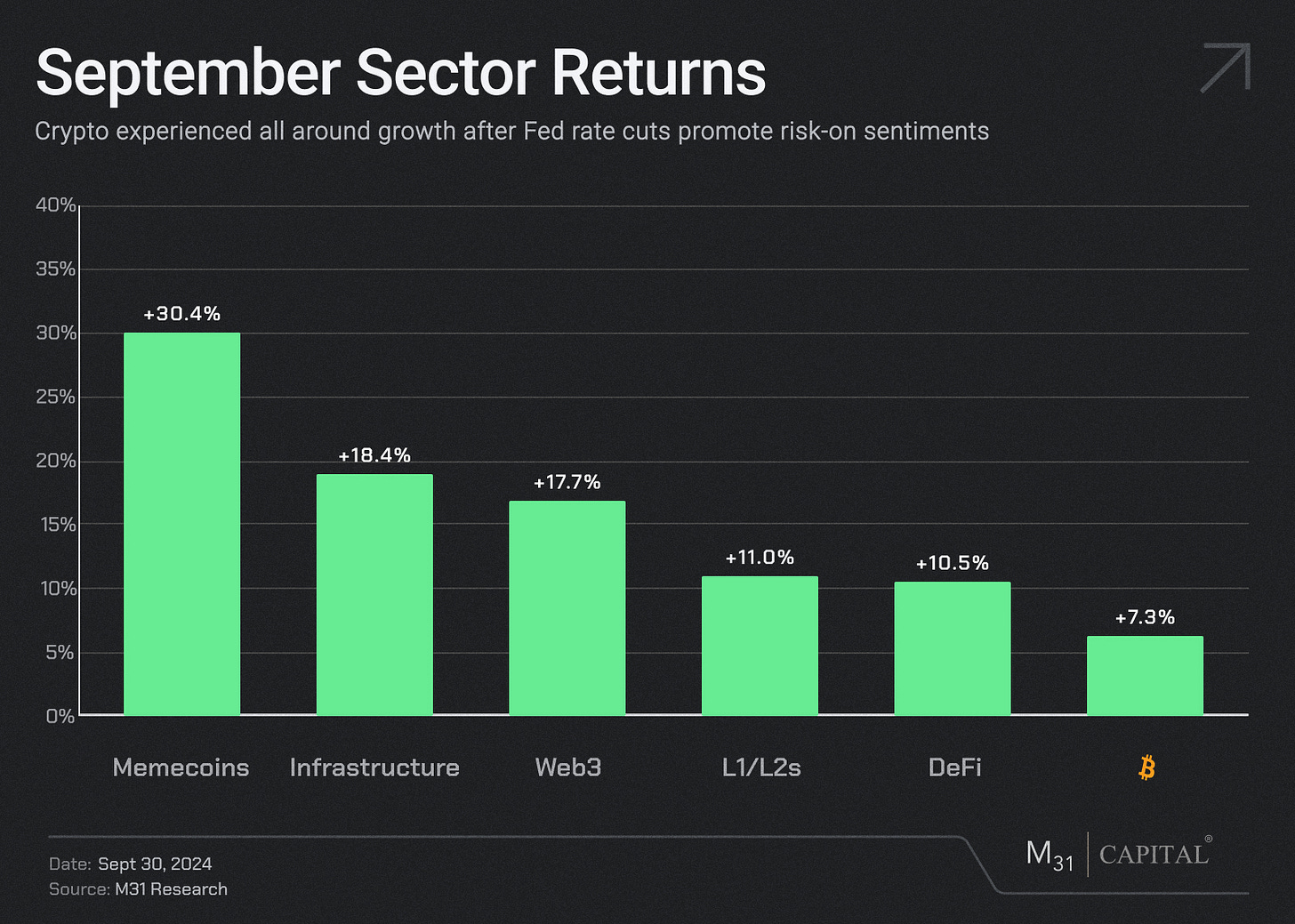

September Market (+10.8%) // Fed cuts rates by 50 bps, Singapore's TOKEN2049 and Solana Breakpoint conclude, AI narratives resurge amidst conference frenzy

Bitcoin (BTC): Bitcoin's September performance was its best in over a decade, driven by rate cuts, the SEC's approval of Bitcoin ETF Options, and the release of Coinbase’s Wrapped Bitcoin (cbBTC).

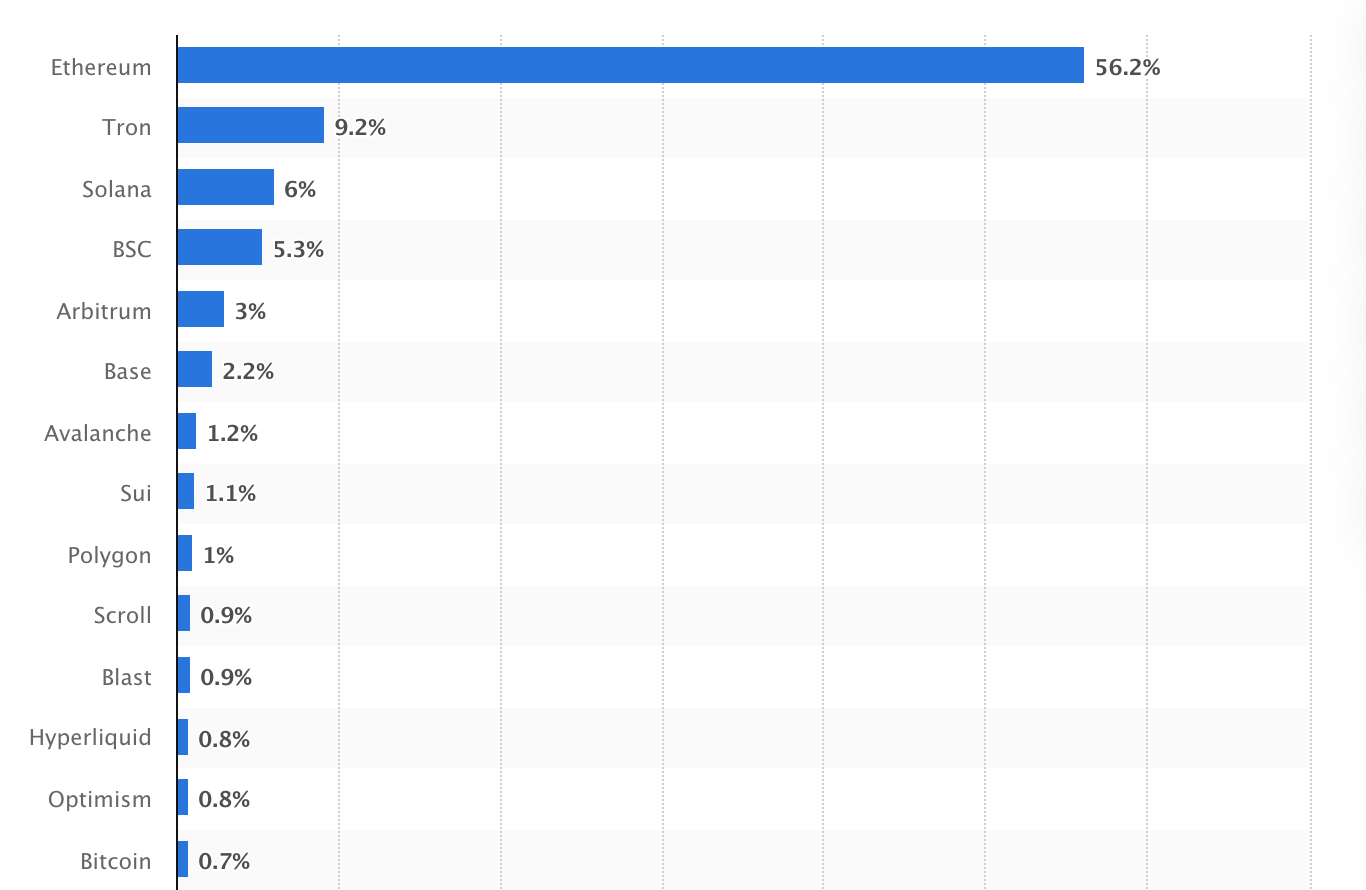

Ethereum (ETH): ETH temporarily rebounded from August, but still trailed BTC over the month. In other news, EigenLayer progressed with Commit-Boost, an open-source project meant to enhance communication between validators and third-party protocols.

Market Focus: September’s highlight was the Fed’s 50 bps rate cut announced on September 19th. Internationally, the Chinese market saw positive movement this past week (SSE Index up 20.4% over the last five days) due to government stimulus and relaxed real estate restrictions. Polymarket continues to garner mainstream attention, as Vice President Kamala Harris claimed a slight lead over Former President Donald Trump following the presidential debate.

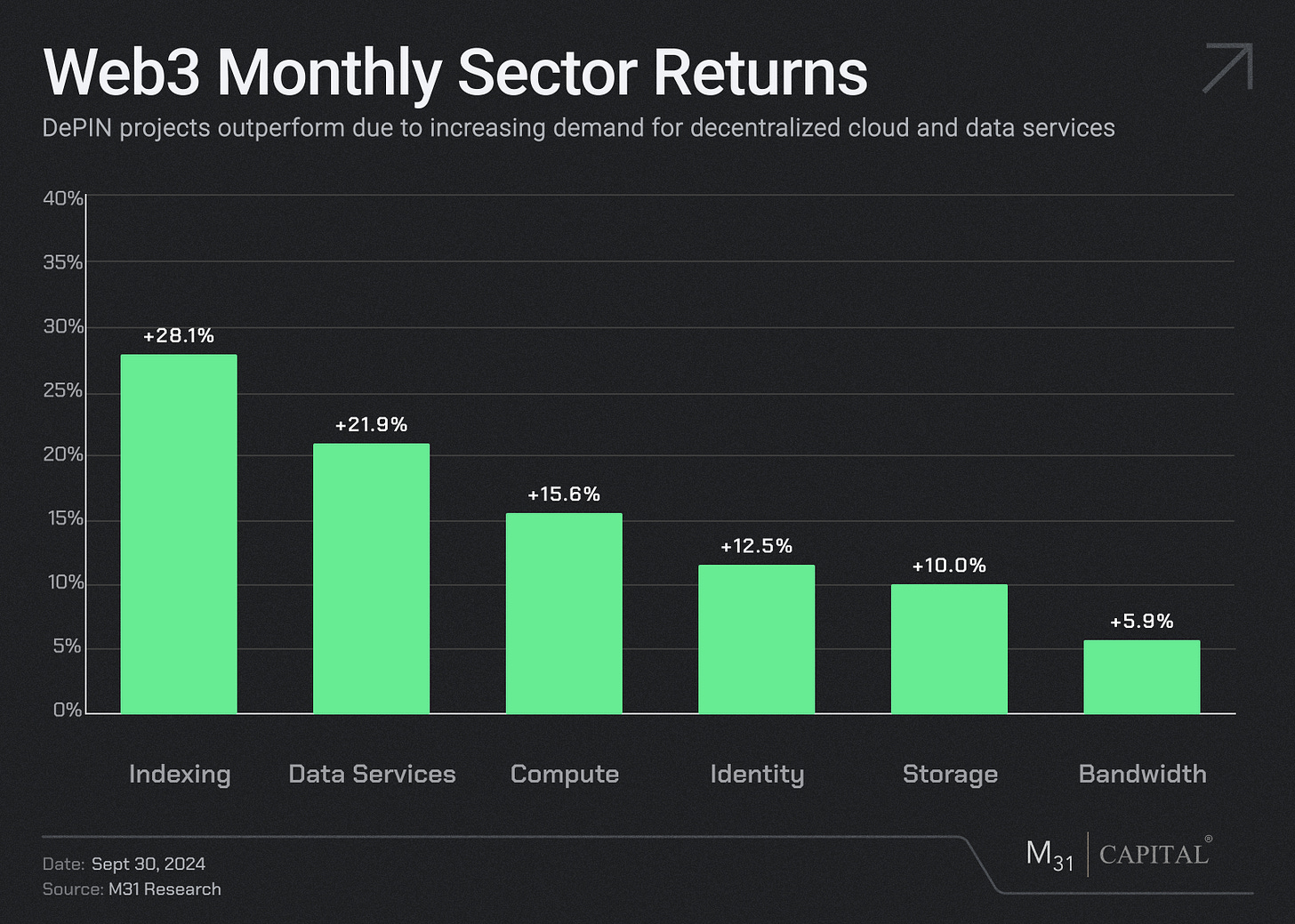

Web3: AI tokens experienced serious gains, with Bittensor (+104.4%) soaring as AI narratives regained mindshare. Sui (+122.7%) surged in mindshare and adoption as the highly performant L1 surpassed Solana in TPS and daily transactions. Compute and DePIN projects also posted strong results, as Fluence (+37.3%) and Render (+28.6%) benefitted from rising Web3 cloud demand.

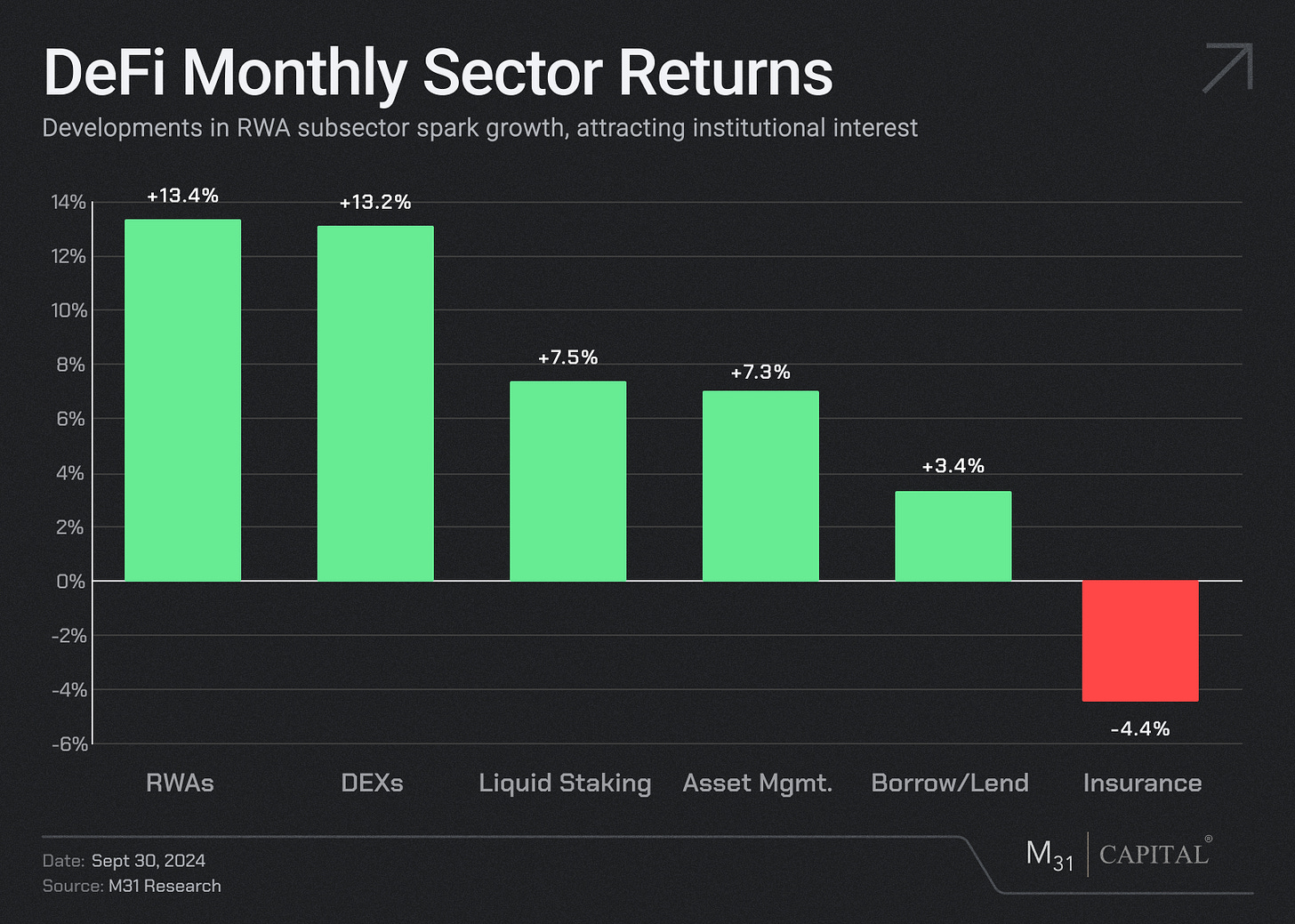

DeFi: Injective (+32.7%) and THORChain (+28.9%) capitalized on September's bullish DeFi momentum driven by growing interest in cross-chain applications. THORChain notably integrated Bitcoin Taproot and announced support for the Rujira merge.

Solana (SOL): +12.8%

Breakpoint introduced new Solana DePIN and AI projects, along with partnerships from Franklin Templeton and Société Générale. Solana’s ecosystem TVL experienced significant growth driven by LSTs, DEXes, and staking protocols.

ZK Compression and the Firedancer launched on mainnet, helping scale applications through validity proofs and state compression while also increasing validator efficiency.

Sui (SUI): +122.7%

Sui surged past $1 billion in TVL, driven by significant growth in the lending and liquid staking sectors. Sui is now the 8th largest blockchain by TVL.

Sui integrated with USDC and now supports Cross-Chain Transfer Protocol (CCTP). This milestone allows transfers between Sui and other major blockchain ecosystems such as Ethereum, Solana, and Arbitrum.

Render (RENDER): +28.6%

Render integrated with Dropbox and AWS S3 storage, enabling interaction with data from major Web2 cloud providers.

Render announced support for Maxon One’s Redshift - the industry-standard renderer - and C4D files for photorealistic art generation.

Render is now the largest project on Solana. After last August’s token migration (RNDR to RENDER), over 60% of the circulating supply has moved from Ethereum to Solana.

Celestia (TIA): +23.1%

The Lemongrass hardfork update went live on September 18. It introduced minimum gas fees, IBC multi-hops, enhanced cross-chain functionality, and the deactivation of Blobstreams.

Celestia Foundation announced a $100M funding round led by Bain Capital Crypto, bringing total project funding to $155M.

Ethena (ENA): +55.0%

Ethena announced an integration with Ethereal Exchange, which will allow USDe to manage on-chain positions and offer 15% of future Ethereal governance tokens to ENA holders.

Increased trading volumes (+574% MoM) suggest that investors recognize ENA’s potential as a stablecoin-based DeFi player, and its growth signals confidence in the protocol’s direction.

Sei (SEI): +62.0%

Sei’s TVL passed $600M, driven by its V2 protocol launch, a wave of new strategic partnerships, and community-driven initiatives.

DAUs, active contracts, and active addresses reached all-time highs in September.

Injective Protocol (INJ): +32.7%

Injective introduced a tokenized index for BlackRock’s BUIDL Fund.

Injective joined the Tokenized Asset Coalition (RWA) alongside leading platforms like Coinbase and Circle.

Injective surpassed 950 million on-chain transactions in September, including major boosts in derivative and DEX volume.

THORChain (RUNE): +28.9%

Kujira and THORChain announced their Rujira Alliance, a new application layer pairing THORChain’s cross-chain liquidity and Kujira’s rich DeFi app suite.

THORChain’s September hardfork included a Cosmos SDK upgrade, Bitcoin Taproot support, and Node Synchronization improvements to reduce node data size by over 1 TB.

THORChain integrated with Radix, unlocking $42 million in liquidity and providing access to over 530,000 unique users.

Maple Finance (MPL): +7.1%

This month, Syrup announced a series of partnerships, including Ether.Fi for liquid staking and Veda for yield diversification.

OKX and Binance Web3 wallets integrated with Syrup, granting USDC and USDT holders exposure to Syrup’s high-yield products and boosted Drip rewards.

September Highlights

Crypto legislation unlikely to gain traction before the end of the year

Binance executive: US election will not have much impact on global crypto regulations

Bloomberg Embraces Polymarket Prediction Market Data for Election Insights

Crypto Billionaire Zhao Vows More Tech Investment After Leaving US Custody

Bitcoin’s Bearish September May Be Its Best Since 2013 Ahead of Bullish October

Upcoming Events

The M31 Capital team will be speaking at and attending a number of upcoming conferences and events. Please reach out if you are interested in connecting, or better yet - meet us there:

Las Vegas: Apex Invest (10/9-10/10)

Salt Lake City: Permissionless III (10/9-10/11)

Dubai: World Blockchain Summit (10/10-10/11)

Dubai: GITEX Global (10/14-10/18)

San Francisco: CoinAlts Fund Symposium 2024 (10/16)

Riyadh: FII 8th Edition Conference (10/29-10/31)

New York: The Bridge Conference (11/6)

Singapore: Salt iConnections Asia (11/11-11/13)

Abu Dhabi: Apex Invest Abu Dhabi (11/18-11/19)

Florida: Marcus Evans Investor Summit (12/9-12/11)

Abu Dhabi: Bitcoin Mena (12/9-12/10)

Doha: World Summit AI (12/11-12/12)

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies supporting individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital