August Performance

In This Issue:

Market: Market pulls back sharply (-10.7%) after ETF delays

Narrative: Protocol fundamentals are being overlooked, leaving big opportunities

Highlight: ENS revenue & user activity has been growing fast recently

Market Action

August was a particularly rough month on planet crypto as a BTC ETF delay plus market illiquidity caused prices to slide into month end with few exceptions.

The month was fraught with ups and downs for digital assets, regulators, and hopeful ETF providers. We experienced one of the largest liquidation events since the collapse of Three Arrows Capital in early 2022, while later in the month a D.C. Court of appeals ruled that it was unjust for the SEC to reject Grayscale’s Trust conversion application sending BTC price soaring +10% before a full retrace in the days to follow.

However, this landmark decision effectively guarantees we will get a spot BTC ETF and likely in just a few months.

We also saw a passing flurry of onchain activity as blockchain users tested out new products like social platform, Friend.Tech.

Web3

After a strong July, Web3 assets were down (-16.6%) in August, as the entire market felt the waves of cascading liquidations and declining BTC price. However, there were outliers, namely AKT (+63.2%) & LPT (+72.3%). Akash Network launched their GPU Marketplace and Livepeer clocked extremely strong usage in August as BASE adopted the network for its livestreams.

Many Web3 assets showed strong progress in fundamentals and overall network development in August despite prices reflecting the opposite.

Livepeer DAUs surged +1,755.5% in August, generating a yearly high of $36.3k in monthly revenue (+29.1% MoM), led by daily livestreams of Base’s “Onchain Summer”

Akash ended the month +63.2% after successfully completing the upgrade to Mainnet 6', adding Nvidia GPUs to its decentralized compute market. Akash now provides GPUs on demand at 1/5th the cost of AWS and other competitors

Base saw ~15.8M transactions in August, putting it on par with both Arbitrum and Optimism. This was driven by usage of social app friend.tech that resulted in 2,300 ETH in fees for the month

DeFi

August was a particularly rough month for the DeFi sector in terms of asset prices as we have seen a sustained flow of capital out of the space as off chain risk-free yields have remained elevated. DEXs saw significant activity during the volatile periods of this month, but we’ve seen a large divergence in performance between competitors dYdX and GMX.

DAI supply surged to $5.2bn (+8.01% MoM) thanks to Spark Protocol’s 5% Dai Saving Rate (DSR), sustained through MakerDAO’s $55m annualized revenues

Unibot saw $165.7m in trading volume in August, with bot fees accounting for 35% of total revenue. The user base continues to be sticky with ~2k daily active users, ~87% of whom are returning users

THORChain daily volume hit a high of $101.2m after the protocol launched a new lending product. This propelled a +20.6% TVL increase to ~$175.7m and a +57.2% monthly RUNE price rally

zkSync TVL ($143.1m) and transaction activity (200k-300k daily) skyrocketed over the last few months (driven by airdrop farmers). Since April, zksync has outperformed both Arbitrum and Optimism in terms of pure profit earned. Over the last 30 days, zkSync earned $7.5m, up +17.9% over the previous month

August Highlights

Partner Highlights

Osmosis to bring fee abstraction to Cosmos, and Akash

Akash partners with Together, a company that provides GPU-as-a-service solutions

Protocol Highlight:

Ethereum Name Service (ENS)

Currently, ENS’ annualized revenue stands at $24.2m, which is significantly higher than most Web3 and DeFi projects. ENS is also sitting on a treasury worth $564m, while its market cap is just $194m.

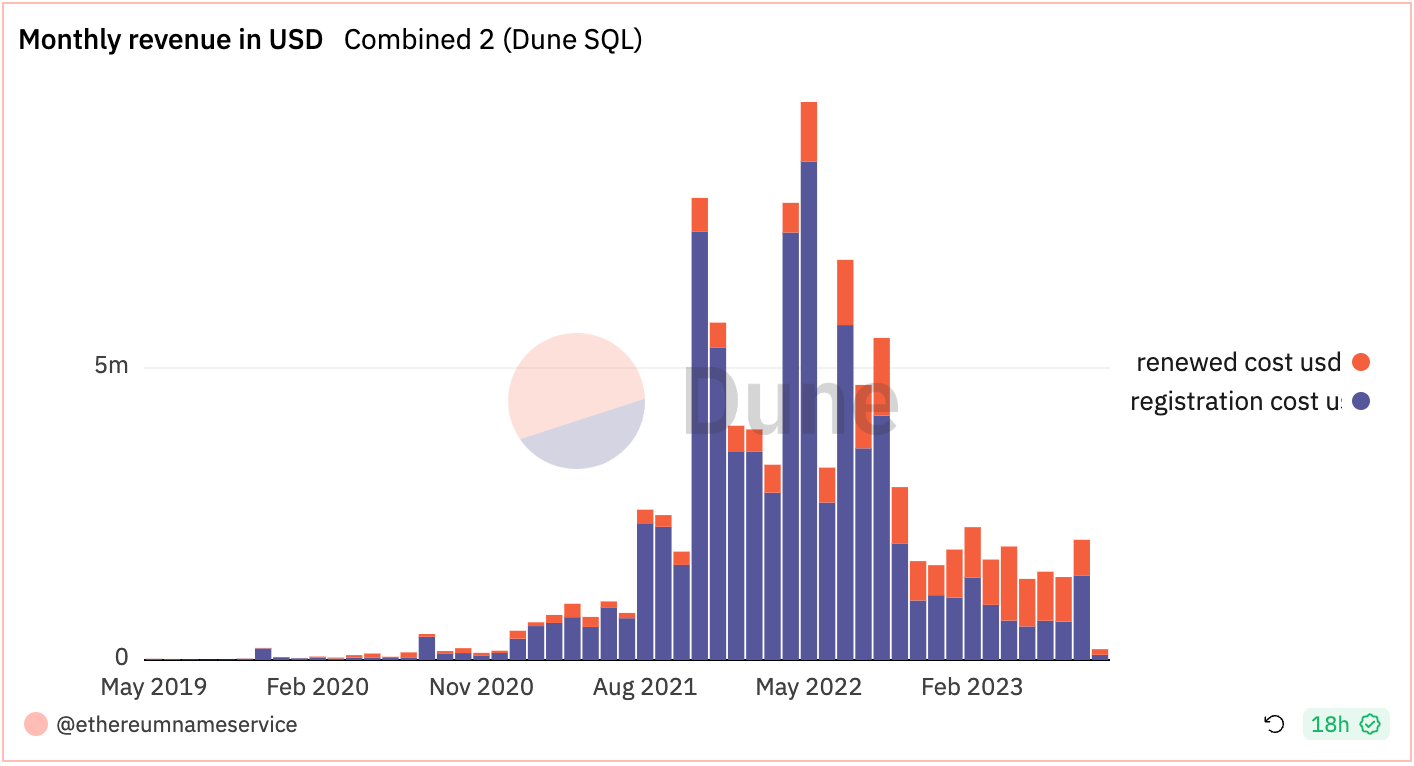

ENS monthly revenue surged by +42.1% in August, marking a 5-month peak, earning a total of $2.1m across registration and renewal fees. There was a significant increase in new name registrations, which soared to 43k in August, +39.6% MoM.

Despite the broader market pullback last year, ENS continuously earned $1.3-$1.5m in fees each month, with renewals contributing over 50%, indicating sticky recurring revenue.

Another growth lever for the protocol, as well as the driver of the current rise in registrations (and subsequently revenues), has been the integration of ENS with DNS. This integration makes it possible to use Web3 usernames the primary naming service for the internet, widely increasing the TAM available for ENS to capture.

Takeaway: Price-Fundamentals Mismatch

There is a clear gap between price and fundamentals when it comes to ENS. Token price was down (-18.2%) in August and (-30%) this year. All while the protocol continues to generate recurring revenue month over month from happy customers.

Integrations with DNS and others like Lens Protocol broaden the TAM for ENS and gives the project strong levers to accelerate growth.

Ultimately, price will follow.

Upcoming Events

The M31 Capital team will be speaking at and attending a number of upcoming conferences and events. Please reach out if you are interested in connecting, or better yet - meet us there:

Copenhagen: Nordic Blockchain Conference (9/7-9/8)

Austin: Permissionless (9/11-9/13)

Singapore: Token 2049 (9/13-9/14)

Dallas: Marcus Evans PWM Summit (9/18-9/20)

Dubai: Crypto Expo Dubai 2023 (9/20-9/21)

Cologne: W3.vision (9/20-9/21)

Riyadh: Future Forum (10/4-10/5)

Luxembourg: Blockchain Week 2023 (10/9-10/13)

Dubai: Blockchain Dubai Exhibition & Summit (10/12-10/13)

Barcelona: European Blockchain Convention (10/24-10/26)

Riyadh: Future Investment Initiative (FII) (10/25-10/27)

Dubai: AIM Summit (10/30-10/31)

Athens: Decentralized (11/1-11/3)

London: Digital Asset Week (11/14-11/15)

Miami: Quantum Miami (1/24-1/26)

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies supporting individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital