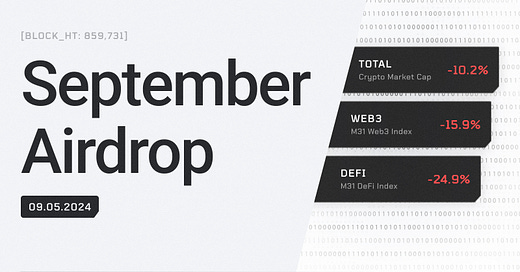

The Monthly Airdrop: September 2024

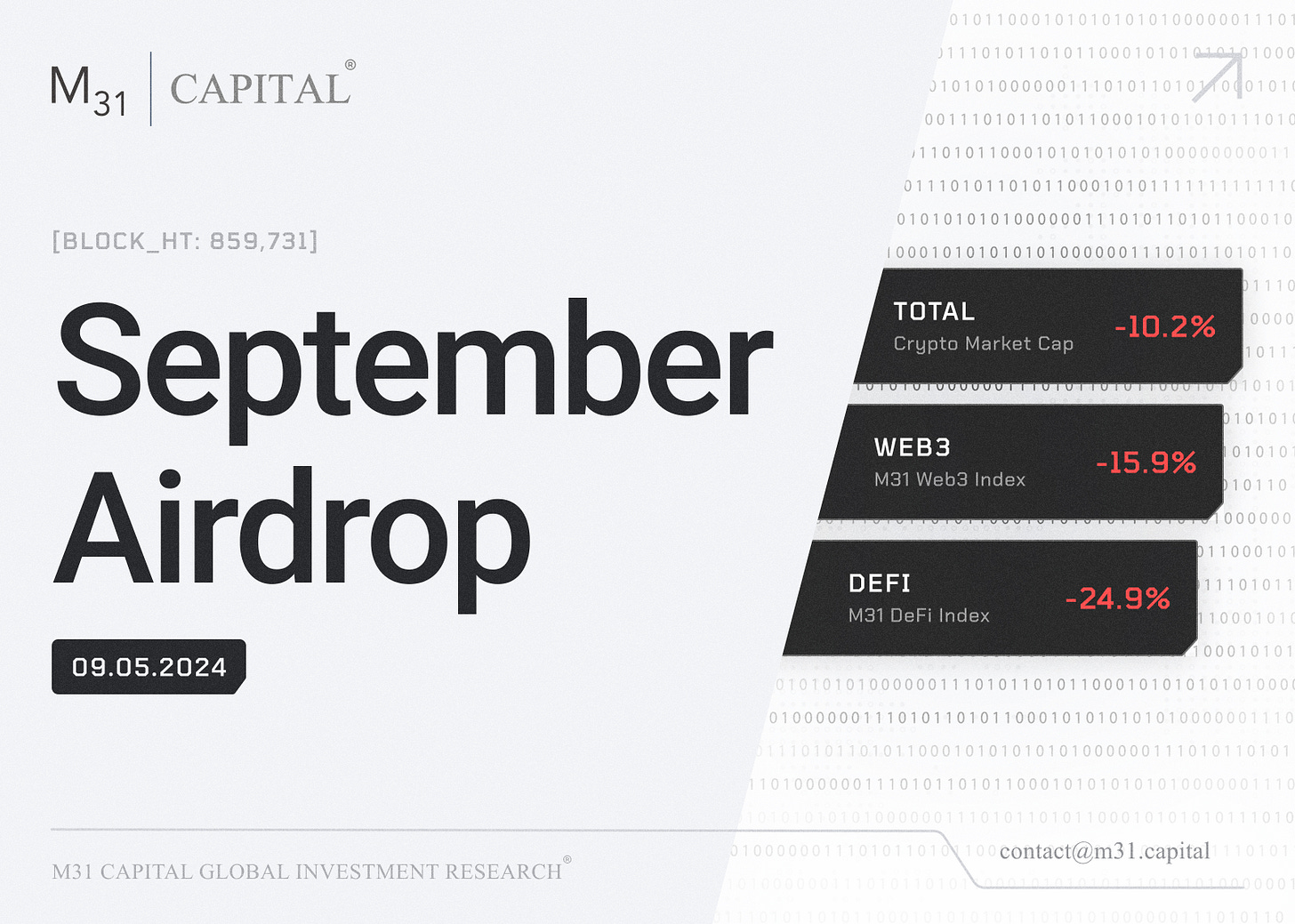

August Market (-10.2%) // BOJ raised rates by 0.25%; FUD looms over Mt. Gox and U.S. Government BTC sell-off; and pro-crypto agendas regained the political spotlight

Bitcoin (BTC): Following August's macroeconomic volatility, BTC closed the month at $59k. BTC ETFs experienced a net outflow of $92.2M, and miner earnings declined 10%.

Ethereum (ETH): ETH dropped over 20%, with monthly transaction volume across Ethereum (L1s and L2s) falling to $27M, a low not observed since May 2020. The ETH ETF had $6.2M in inflows during its first full month but experienced a two-week outflow streak.

Market Focus: The Bank of Japan raised interest rates by 0.25%, significantly appreciating the Yen. Concerns also surfaced over the potential unloading of billions of dollars worth of BTC by Mt. Gox and the U.S. government. In politics, Former President Trump vowed to make the U.S. the "crypto capital," promoting his "The Defiant Ones" project and #BeDefiant campaign, which prompted Kamala Harris to temporarily adopt a pro-crypto stance.

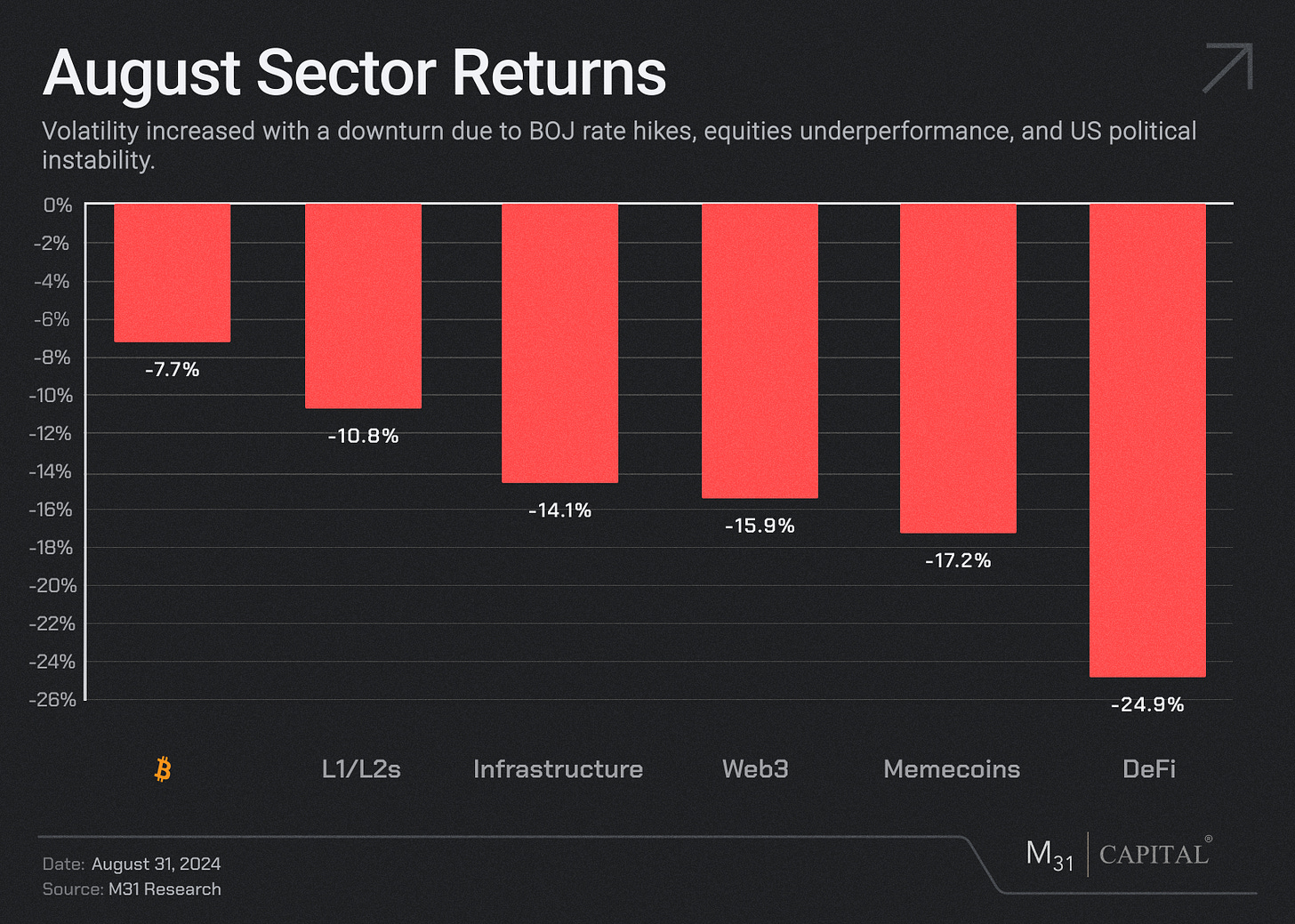

Web3: Web3 growth was mixed, but notable highlights included increased wireless network adoption and DePIN partnerships. Helium saw usage growth throughout August and introduced several Service Provider customization upgrades. DIMO announced its formal integration with Tesla, bolstering its credibility and simplifying the user experience.

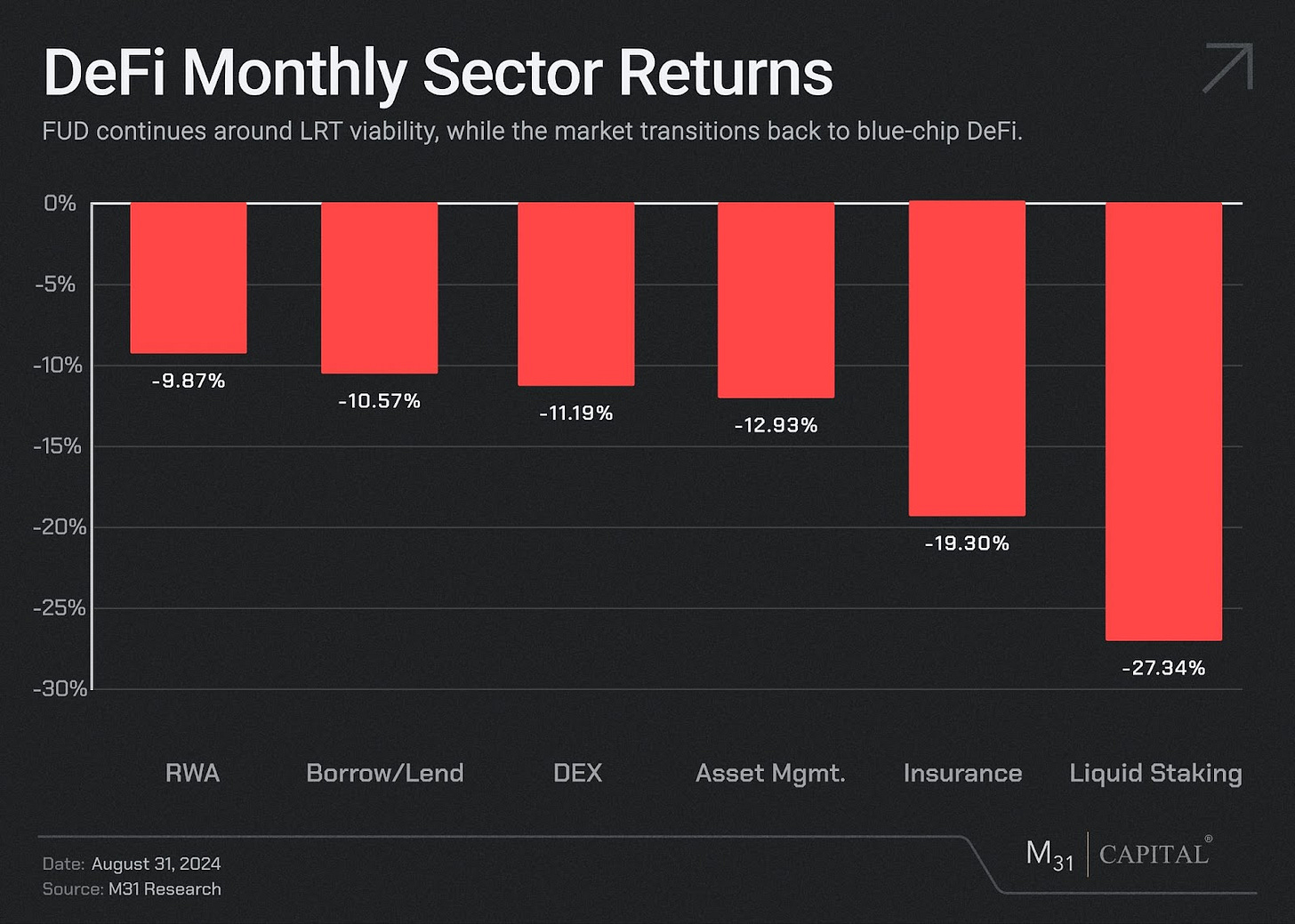

DeFi: DeFi monthly fees and total revenue fell by 24.4% and 19.7%, respectively, from July. Previously heralded LRT projects have flattening APRs or are going out of business. DeFi mindshare is returning to bluechips like Lido, which generated over $76M in fee revenue in August, followed by Uniswap and PancakeSwap.

Helium (HNT): +34.2%

Helium surged by over 30% in the last 30 days following its partnership announcements with leading telecoms and carrier offload programs, which significantly improve service quality, reduce overhead, and burn HNT tokens.

HIP130 and HIP131 proposals also received strong community support for service provider customization and flexibility benefits.

Toncoin (TON): (-19.5%)

Telegram CEO Pavel Durov was arrested in France, and the TON network experienced over 12 hours of downtime following the DOGS memecoin launch. However, TON officials have since confirmed that the network is fully operational again.

TON announced upcoming DeFi integrations with Injective and Pyth Network allowing users to bridge INJ tokens across the TON network and use Pyth’s real-time data streaming.

TON reached a new DAU ATH of 1.1M users, although fee revenue decreased over 12% MoM.

Akash (AKT): (-12.9%)

Akash had a record-breaking quarter, with over 27k leases (+44% QoQ) and revenue rising to $176k (+8% QoQ). This was fueled by major AI projects using Akash instances, such as Prime Intellect, Brev Dev, Ask Venice, and Solve Care.

CPU capacity on Akash increased 15% in August, while active leases remained consistent around 30%.

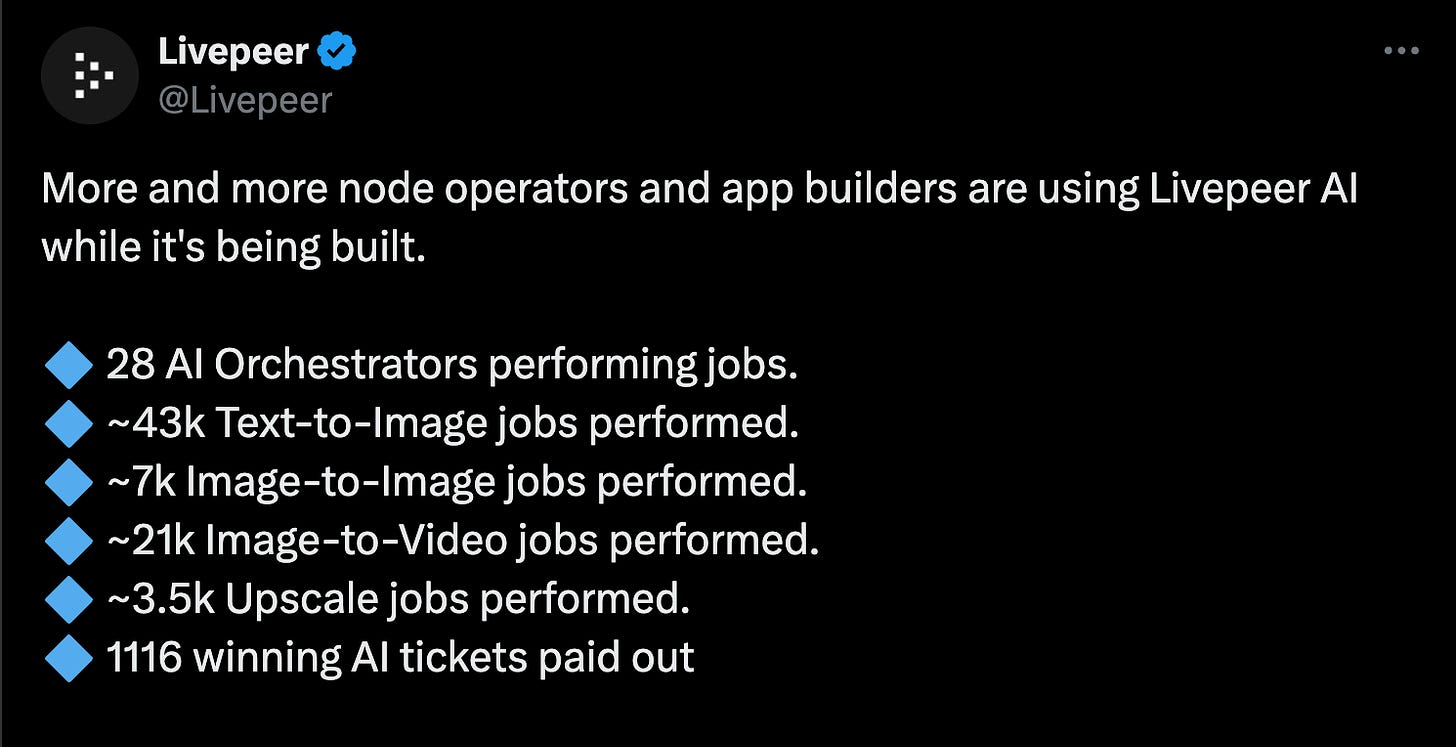

Livepeer (LPT): (-12.0%)

Livepeer introduced speech-to-text and stable diffusion, boosting its AI video processing capabilities and elevating network usage.

The team also hosted an AI Video hackathon, which introduced developers to Livepeer’s AI toolkit and drew retail attention through social media.

Arweave (AR): (-19.8%)

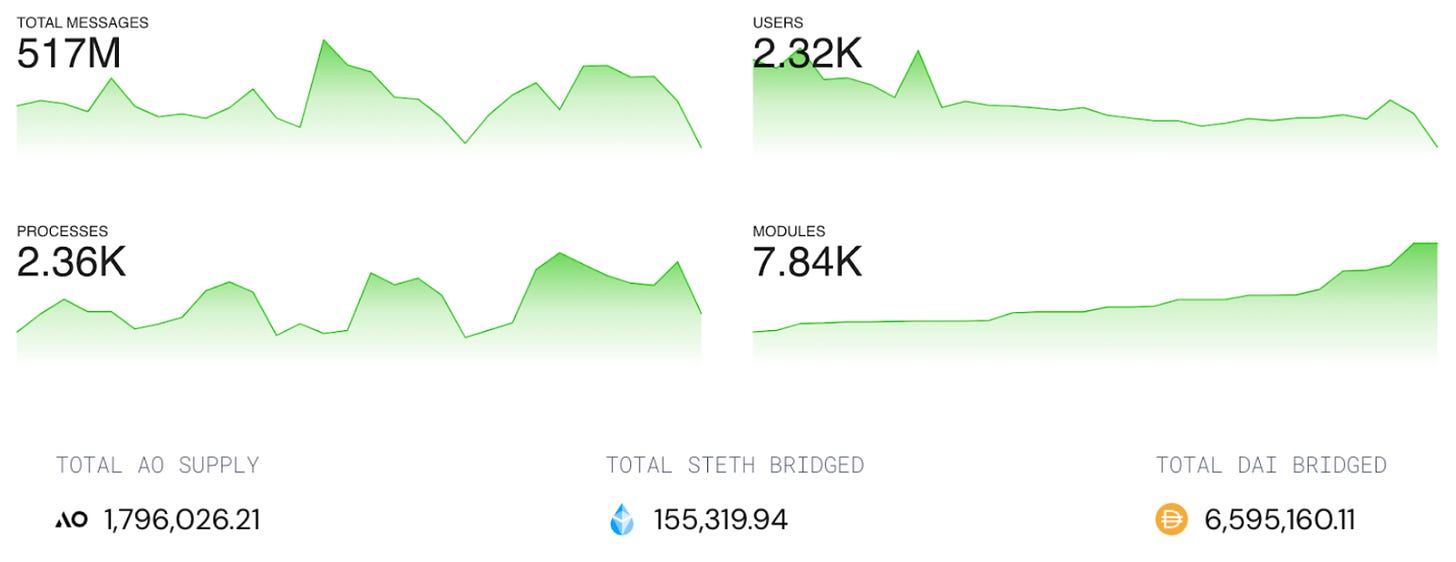

The Arweave community continued building its rich application layer, including ArFleet, a temporary storage solution; AnyoneFDN, a network with privacy-preserving onion routing; liteseed_xyz, a decentralized data upload service for Arweave; and 0rbitco, a decentralized Oracle network that connects online data to AO.

AO opened USDC and DAI bridging this month, surpassing 5M DAI and 150k stETH (equivalent to $365M) in bridged assets.

Marlin (POND): (-4.5%)

Marlin strengthened its partnerships with top projects like Swell, Aztec, Three Protocol, and NetmindAI, positioning itself as a leading multi-proof supplier in Web3.

Marlin also gained retail attention through Verida’s technical litepaper, which promoted Marlin's role in the future of self-sovereign, confidential AI.

DIMO (DIMO): +1.3%

DIMO introduced direct integration with Tesla, enabling drivers to earn up to $15/month for connecting their cars.

DIMO also sponsored an ETHOnline mobility hackathon to encourage the development of new mobility applications following their upgrade of the Developer Console, APIs, and SDK launch.

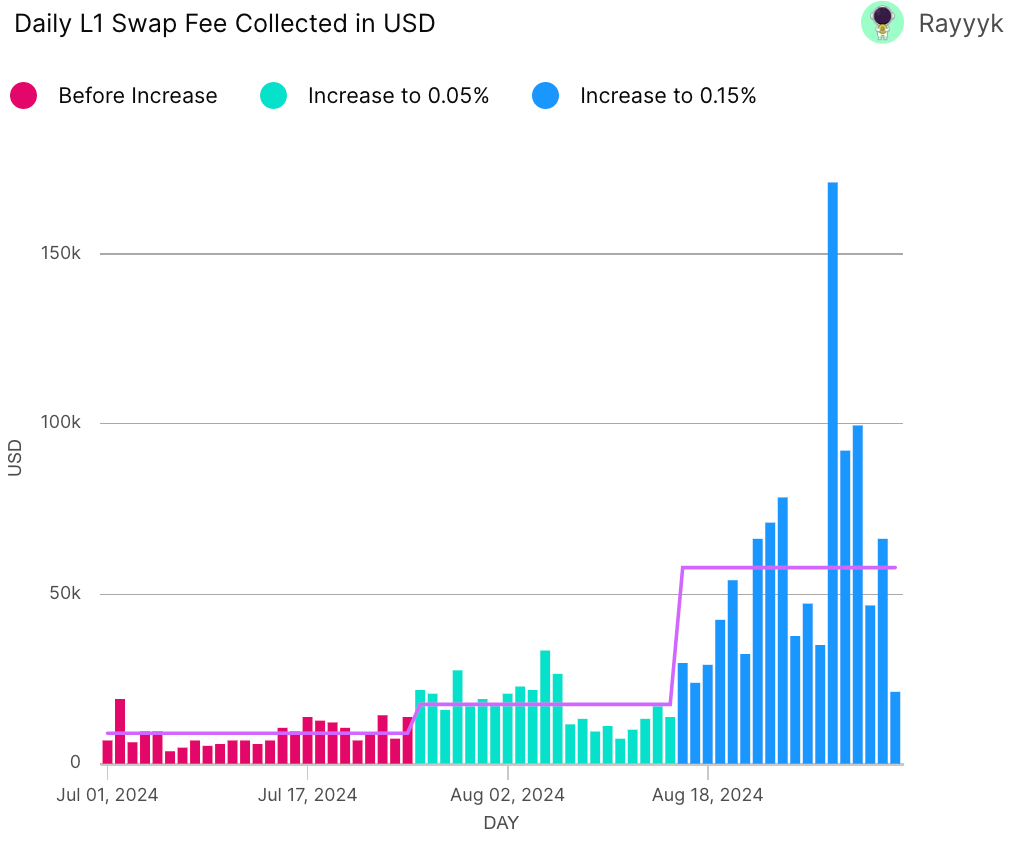

THORchain (RUNE): (-2.3%)

THORchain’s fee increase led to a 5x rise in L1 swap fees, and fees collected surpassed block rewards for the first time in 2024.

THORchain also announced its integration with OKX, which enables native cross-chain swaps between EVM, Bitcoin, and more through OKX's DEX and wallet services.

Sky (MKR): (-36.1%)

MakerDAO has rebranded as Sky and is gradually converting DAI to the USDS stablecoin. This move, which allowed Sky to freeze USDS at its discretion, sparked immediate community backlash.

Sky and Aave announced their partnership for the Sky Aave Force, integrating USDS into Aave V3 and further interconnecting these leading DeFi protocols.

Net revenues dropped by around 30%. Stability fees, their primary revenue source, fell by over 30%, while liquidation fees surged more than 2.5x.

Aave (AAVE): + 11.2%

Aave passed their proposal to launch V3 on zkSync with Chainlink as the price feed provider. Using ZK-proofs and the Elastic Chain ecosystem opens up new private DeFi use cases and onboards fresh liquidity to both protocols.

BGD Labs reported a potential exploit in Aave's peripheral contracts, prompting the Aave Labs team to disable all functions involving their swap features.

Maple Finance (MPL): +4.7%

In August, Maple's TVL increased by 25%, direct loans surged by 105%, and active LPs grew by 65%

Maple also announced MIP-010, formalizing Syrup.fi, their institutional yield platform, and launching the stakeable SYRUP token.

August Highlights

Donald Trump and Bitcoin: From 'Not a Fan' to Crypto Candidate

Ethereum ETFs Take in $5 Million, Breaking 2-Week Withdrawal Streak

BlackRock's ETFs surpass Grayscale's in assets, crowning new crypto fund king: Arkham

El Salvador's Bukele Says Bitcoin Strategy a 'Net Positive,' but Adoption Lags

Goldman Sachs Joins Morgan Stanley in Holding Bitcoin ETFs as Institutional Interest Grows: 13F Wrap

U.S. Moves $600M of Silk Road Bitcoin to Coinbase Prime, but Not Necessarily to Sell

Upcoming Events

The M31 Capital team will be speaking at and attending a number of upcoming conferences and events. Please reach out if you are interested in connecting, or better yet - meet us there:

South Korea: Korean Blockchain Week (9/1-9/7)

Dubai: Dubai AI and Web3 Festival (9/11-9/12)

Singapore: TOKEN 2049 (9/18-9/19)

Beverly Hills: U.S. Private Wealth Summit (9/18-9/20)

Beverly Hills: M31 Ventures Private Investor Dinner (9/19)

Singapore: Solana Breakpoint (9/19-9/21)

Singapore: Network State Conference (9/22)

New York: Messari Mainnet (9/30-10/2)

New York: LionHack 2024 (10/4-10/6)

Las Vegas: Apex Invest (10/9-10/10)

Salt Lake City: Permissionless III (10/9-10/11)

Dubai: World Blockchain Summit (10/10-10/11)

Dubai: GITEX Global (10/14-10/18)

San Francisco: CoinAlts Fund Symposium 2024 (10/16)

Riyadh: FII 8th Edition Conference (10/29-10/31)

New York: The Bridge Conference (11/6)

Singapore: Salt iConnections Asia (11/11-11/13)

Abu Dhabi: Apex Invest Abu Dhabi (11/18-11/19)

Florida: Marcus Evans Investor Summit (12/9-12/11)

Abu Dhabi: Bitcoin Mena (12/9-12/10)

Doha: World Summit AI (12/11-12/12)

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies supporting individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital