The Weekly Airdrop: 0x100

Jan 19, 2024 // Tether adds $380m in BTC to balance sheet, dYdX tops Uniswap as largest Dex by volume, GBTC outflows surpass $1.1b

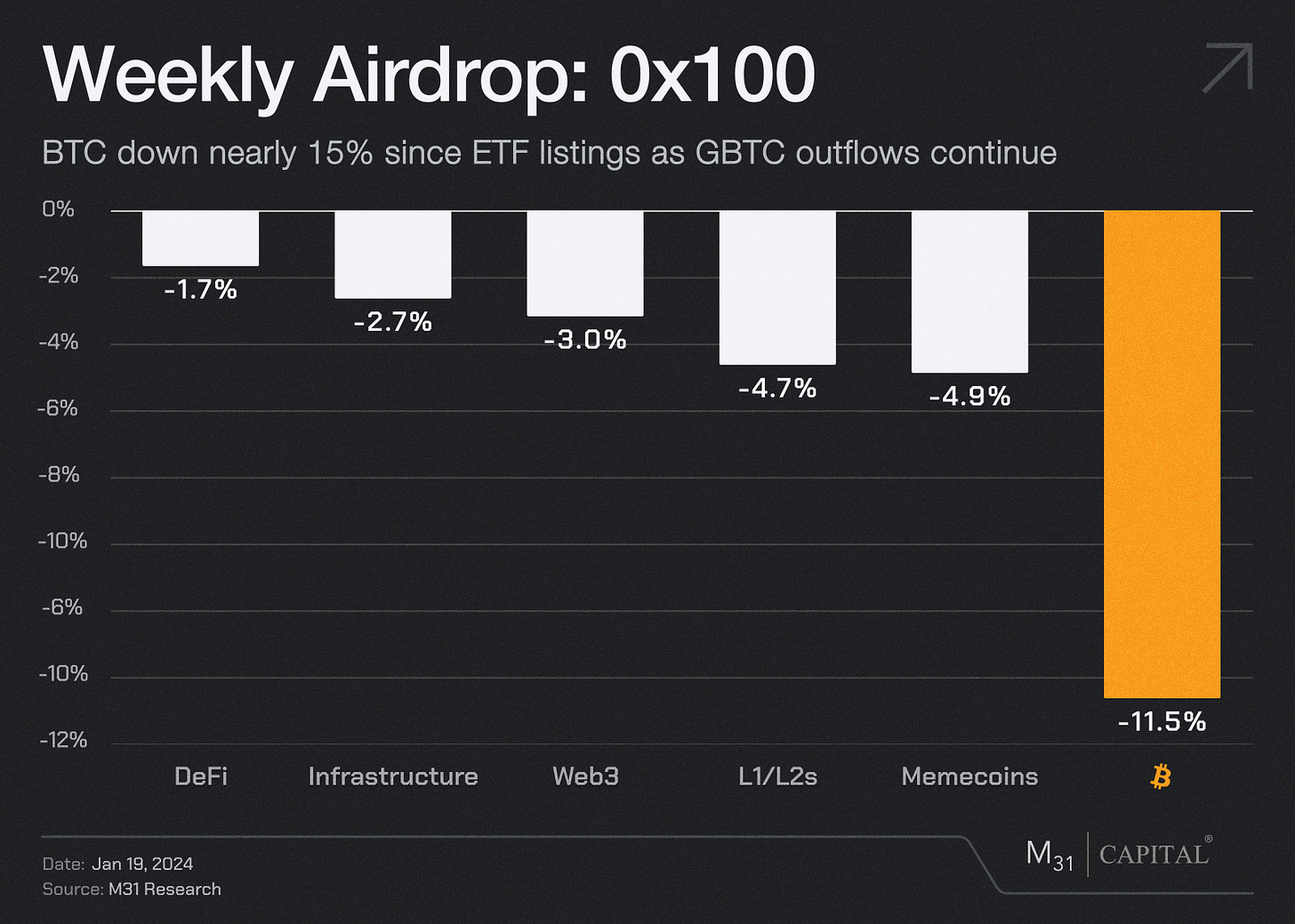

Following the rally early last week leading into ETF approval, BTC has struggled to find its footing and retreated (-11.5%) this week, likely a result of the continued heavy GBTC selling pressure. GBTC charges a 2.5% fee vs. an average 0.3% fee for the recently launched ETFs. Interestingly, Grayscale’s GBTC has seen outflows of ~25,000 BTC which is almost exactly the amount of inflows to Blackrock’s ETF (IBIT) over the same period.

The selloff can also be attributed to profit taking (i.e. “sell the news”), as BTC is still up 43.7% over the past 3 months and 95.8% over the past year. The rest of the market has mostly followed suit, with large caps ETH & SOL down (-4.7%) and (-7.9%), respectively. The market at large will likely be in limbo until GBTC outflow expectations improve.

dYdX (DYDX): +3.2%

dYdX v4 has finally eclipsed the 24hr volume of Uniswap v3 by $150m. dYdX had a combined trading volume of over $1.3b across the Ethereum and Cosmos based platforms as we saw volatility pick up to the downside this week.

Frax Finance (FXS): (-5.6%)

Frax founder Sam Kazemian confirmed the first week of February as the expected launch date of Fractal, the DeFi powerhouse’s very own L2. It is expected to be supported by a rush of TVL and utilize frxETH as the gas token, providing yield for simply holding the token needed to transact on chain.

Rocketpool (RPL): (-11.8%)

Popular ETH staking protocol Rocketpool was the victim of a hack in which their X(twitter) account was hacked and the link in their profile was redirecting users to a fake site. RPL extended its losses on news of the hack despite no core protocol functions being compromised.

Huddle01 (TBD): TBD

Huddle01 published their 2024 Roadmap which outlined the transition to a fully permissionless network operated by a community of Huddle01 Node Operators. This includes the launch of physical hardware nodes that anyone in the community can run. After Mainnet launch in Q3 (estimated), the Huddle01 token launch will allow individuals to earn rewards for running a node. The 2024 Roadmap also unveiled Layer01, Huddle’s infrastructure layer for more generalized dRTC use cases, including DeFi and more.

Livepeer (LPT): (-6.5%)

On a recent community call, Livepeer discussed adding support for AI video generation capabilities for its global GPU network to meet the growing demand for AI video generation. This would increase revenue for Livepeer transcoders and position LPT as a core name within the rapidly-growing Web3xAI ecosystem.

The Graph (GRT): (-11.9%)

A proposal was introduced for the next phase of The Graph’s develpment called “Graph Horizon”. Key features of Graph Horizon include an immutable generalized staking contract, increased economic security through measurable and increased stake representation, a fully permissionless indexing method, decentralized arbitrators, and reduced governance intervention.

Chainlink (LINK): +6.0%

Earlier this week, Chainlink and Circle announced an integration between Chainlink’s Croschain Interoperability Protocol (CCIP) and Circle’s Crosschain Transfer Protocol (CCTP) which will allow the secure transfer of USDC across different blockchains. Web3 developers can now build crosschain applications that unlock new use cases for USDC.

THE NEWSROOM

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies that support individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital