The Weekly Airdrop: 0x101

Jan 26, 2024 // GBTC selling pressure eases, ETH ETF delayed until March as expected, Coinbase expected to win case against SEC

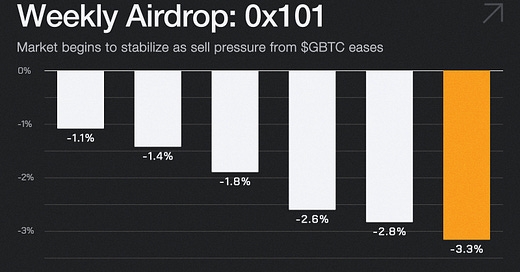

$BTC (-3.3%) finally stabilized mid-week, as the persistent sell pressure from $GBTC outflows finally eased. Selling had primarily been driven by Grayscale’s market leading management fee (1.5%), FTX estate liquidations, and profit taking from the popular discount arbitrage trade. Grayscale’s ETF saw $429 million in outflows on Jan 24, but outflows dropped to $394 million on Jan 25, its second-lowest outflow day on record.

The post-ETF selloff could create an attractive entry point for BTC bulls - crypto analyst Justin Verrengia recently reported that the governments of Saudi Arabia and Qatar are rumored to be planning a joint purchase of around 1M BTC ($40bn), which could be announced as early as next week. This move, if confirmed, could mark one of the most significant endorsements of digital currency by national governments to date.

Manta Network (MANTA): +18.2%

Manta network’s native token is now live and trading on numerous centralized exchanges. Manta network is a ZK application platform that utilizes Celestia DA and Polygon zkEVM to deliver fast speeds and low cost transactions for DeFi and Web3 apps.

Ethereum (ETH) : (-10.2%)

Ethereum client software Nethermind was hit by a critical bug on Sunday, taking about 8% of the network offline. The incident was not a major problem but it brings up the conversation about client diversity and what the implications would be if a provider such as Geth were to encounter a similar issue given that it accounts for 85% of ethereum validators.

ClayStack: TBD

ClayStack’s liquid staking platform has entered the restaking space using Eigenlayer. ClayStack plans to accept native ETH, stETH, and rETH deposits. They are currently running a points program for their upcoming airdrop which should help attract deposits and TVL.

Bittensor (TAO): +31.1%

OSS Capital committed $25M to invest exclusively in the Bittensor ecosystem. The capital will be allocated across open-source grants, startups, validator initiation, subnet creation + scaling, staking across the community, accumulating and holding $TAO in size over very long timeframes (10+ years) and more.

Aleph.im (ALEPH): +112.2%

On January 26, Aleph.im announced the launch of Twentysix Cloud, its highly anticipated marketplace for business and developer decentralized cloud solutions. In partnerships with Avalanche and Superfluid, the platform will offer a pay-as-you-go model, enabling users to pay for exactly the amount of computing or storage resources they consume, by the millisecond.

Polygon (MATIC): (-3.1%)

Polygon Labs announced the launch of the aggregation layer, or AggLayer, a decentralized protocol that aggregates ZK proofs from all connected chains and ensures safety for near-instant (atomic) cross-chain transactions. The team claims it will offer the sovereignty and scale of modular architectures, with the unified liquidity and UX of a monolithic system.

THE NEWSROOM

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies that support individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital