The Weekly Airdrop: 0x102

Feb 2, 2024 // BTC ETF outflows reverse, JUP airdrops $700m to users, Avalanche releases plans to scale with HyperChains

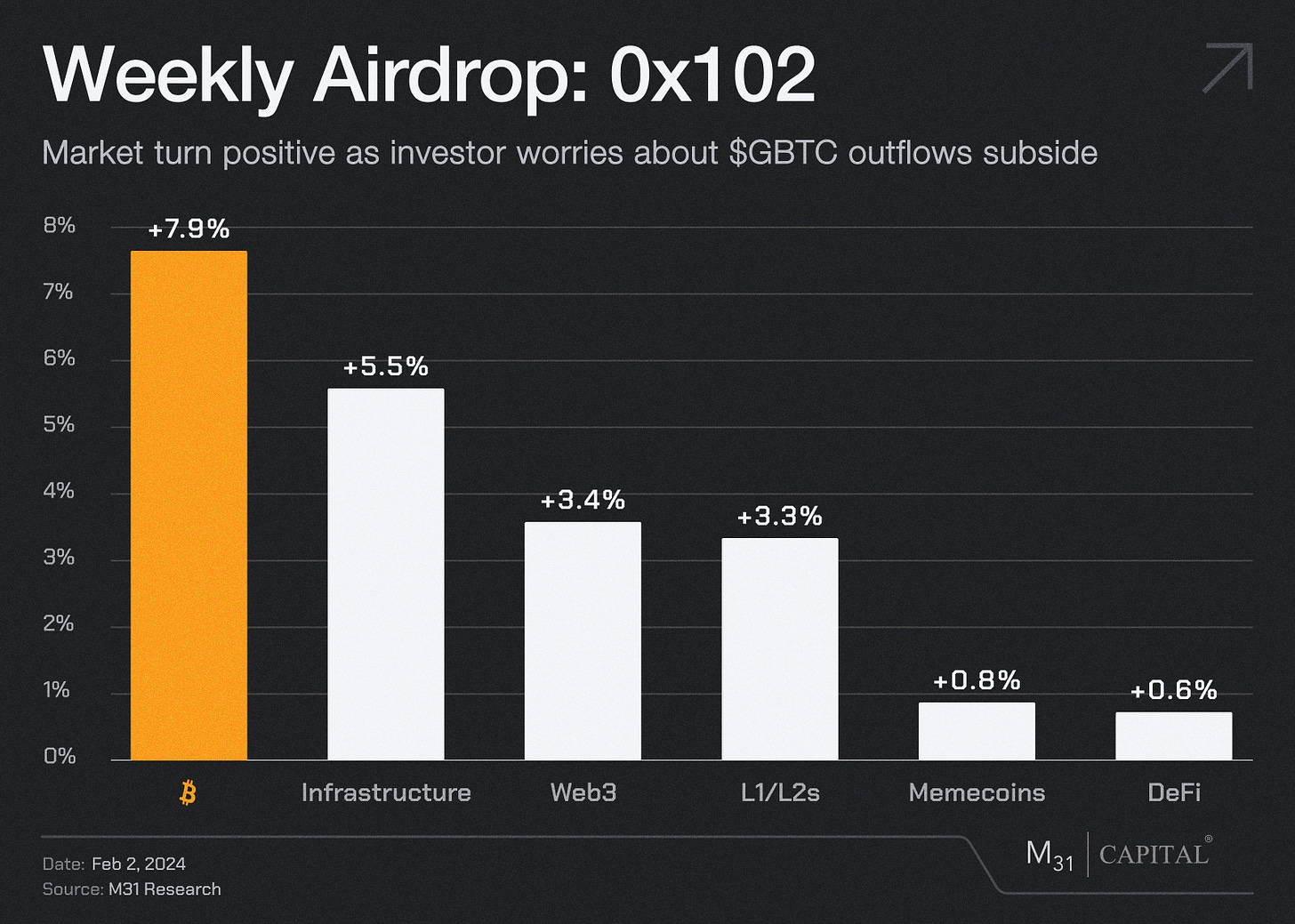

$BTC +7.9% ETF flows reversed this week and enjoyed sustained inflows of $634.5m for the past five trading sessions. However, the response from BTC comes as Celsius distributions have offset the positive flows.

The Celsius bankruptcy finally closed this week with $3bn in crypto to be distributed to creditors through Coinbase and Paypal. This marks the end of a long reorganization process in which creditors will be receiving shares in the newly formed mining company, and a mix of cash and crypto per the terms of the deal signed off on by creditors 18 months ago.

This week the highly anticipated $680m JUP airdrop took place, with initial trading kicking off at ~$0.76, giving the trading platform a FDV of $7.6bn at the time of launch before trading lower, into the upper 50c range, by the end of the week. Despite the large pullback, this still leaves Jupiter with a valuation similar to Uniswap. The rush to claim tokens put Solana’s network under significant stress, leading to user transaction failures.

Jupiter (JUP): (-22.5%)

The JUP airdrop finally hit wallets this week with over $700m given to users of the platform’s DEX aggregator, perps, and bridge. This week Jupiter has consistently facilitated trading volumes in excess of $500m and exceeding $1bn on Jan 30th.

ZetaChain (ZETA): +132.2%

ZetaChain launched its mainnet this week, driving a significant surge in its native token, ZETA. ZetaChain is an EVM-Cosmos compatible layer one that allows for communication across chains including non-smart contract chains such as Bitcoin. This omnichain platform enables users to interact with multiple chains all from one location.

Abracadabra Finance (MIM): (-1.0%)

Abracadabra Finance was hacked this week resulting in a loss of $6.4m. The hack was a result of a rounding issue in the smart contracts which allowed the attacker to borrow large amounts of their stablecoin MIM without proper collateral requirements. At the time of the attack MIM de-pegged to $0.71 before recovering and almost regaining its $1 peg.

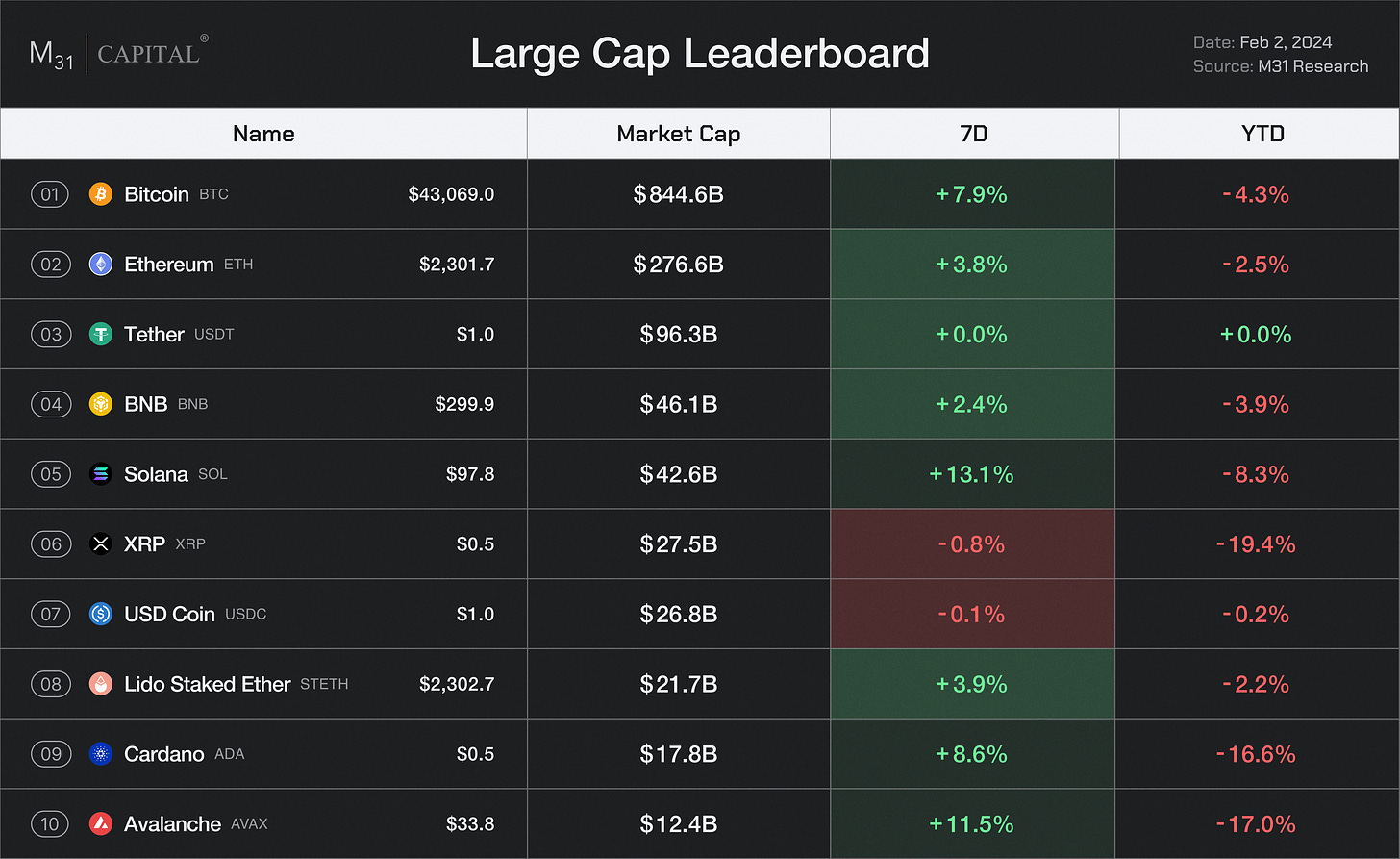

Avalanche (AVAX): +11.5%

Ava Labs released the outline for its scaling solution, Vryx, as it aspires to scale the Avalanche blockchain to 100k TPS. The scaling approach will first be enabled on the HyperSDK testnet, which is targeted for the middle of Q2. HyperSDK is the framework for building high-performance blockchains that have virtual machines, enabling them to offer smart contracts. Vryx will be used to support such blockchains built using the HyperSDK — known as HyperChains — which should trickle down to the main blockchain platform over time.

Marlin (POND): +33.4%

On Jan 26th Marlin announced a partnership with PublicAI, a train-to-earn platform that incentivizes a global workforce to build a large-scale decentralized AI training network. Marlin will provide verifiable computing, featuring TEE and ZK-based coprocessors, to delegate decentralized cloud workloads for the PublicAI marketplace.

Cudos (CUDOS): +24.9%

Cudos, the decentralized cloud infrastructure provider, released its 2024 roadmap this week, outlining its plans to add MetaMask support, multi-chain computing, additional Cosmos and EVM-based currencies for payment, support for AI templates, improved cross-chain communications (in partnership with Axelar), and additional smart contract functionality.

THE NEWSROOM

FTX Expects to Fully Repay Customers but Won't Restart Defunct Crypto Exchange

Tether Reports Record $2.85B Profit as Biggest Stablecoin Nears $100B Market Cap

Real-World Asset Firm Superstate Launches First Fund Tokenizing U.S. Treasuries

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies that support individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital