The Weekly Airdrop: 0x104

Feb 16, 2024 // Bitcoin ETFs continue to take share from Gold, Chainlink partners with Telefonica to end SIM-swap hacks, Citi completes successful RWA tests on Avalanche

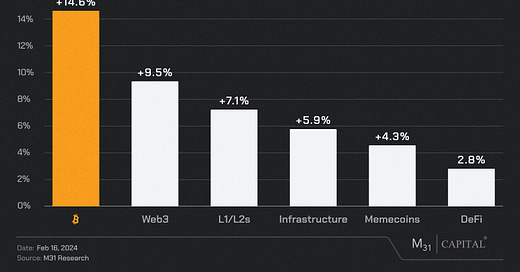

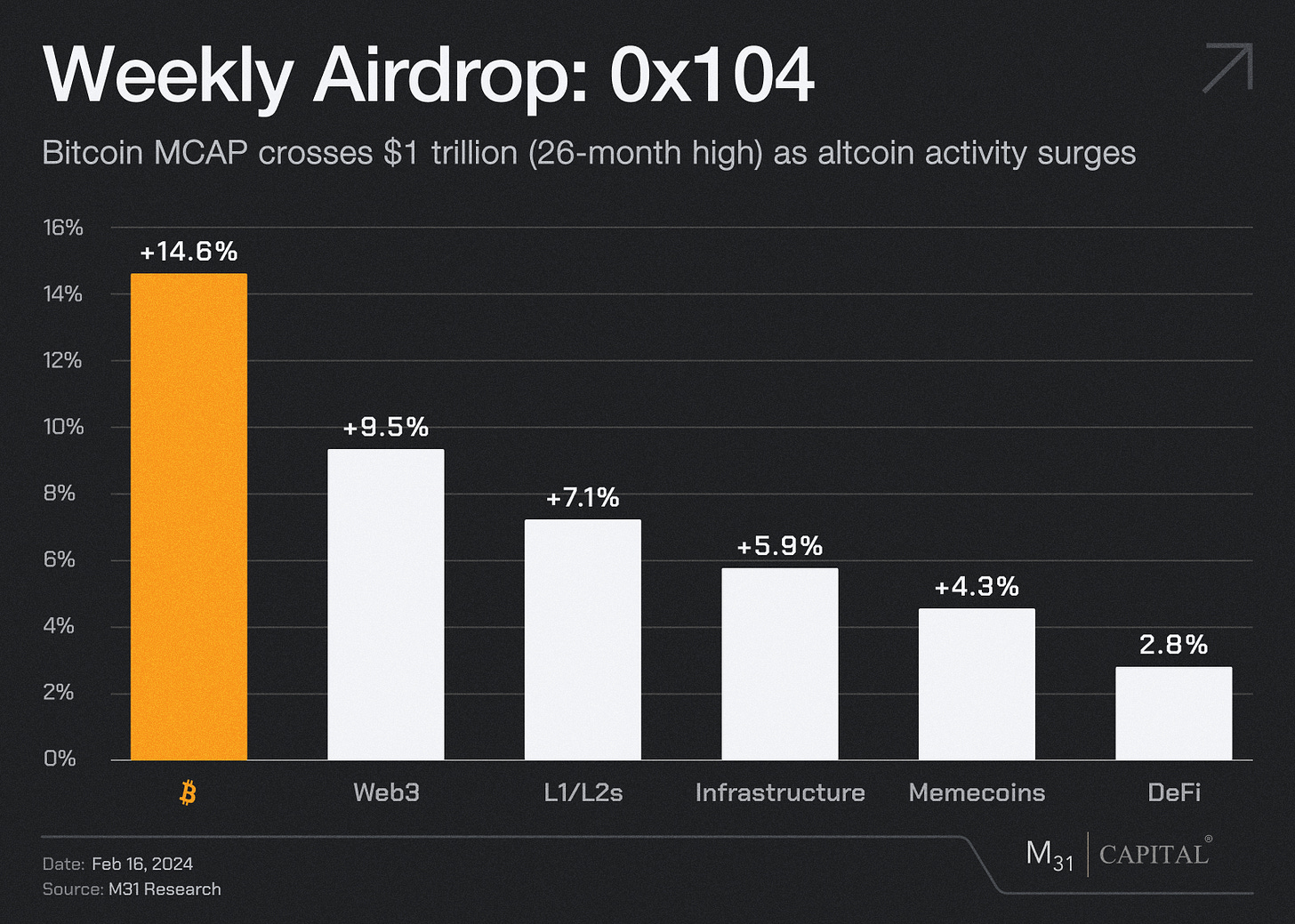

Bitcoin has now rallied nearly 15% since the launch of the various spot Bitcoin ETFs on Jan 10th. The rally has sustained despite increases in both the U.S. Dollar Index (DXY) and 10-year U.S. Treasury Yields, both which are often negatively correlated with Bitcoin's price. Bitcoin ETFs have net inflows of ~$5 billion, whereas gold has net outflows of ~$3 billion in the same period.

ETH has continued to perform alongside Bitcoin, pushing past its $2,500 resistance. As of Thursday, Franklin Templeton, BlackRock, Fidelity, Ark and 21Shares, Grayscale, VanEck, Invesco and Galaxy, and Hashdex have all submitted applications for ETH spot ETFs. TVL on Ethereum has surged 14% over the past week, hovering around $110 billion. Protocols like EigenLayer are responsible for driving a massive inflow to the Ethereum network as restaking starts to become a stronger narrative.

Spark (TBD): NA

Maker has forked Aave and launched its own lending protocol called Spark with airdrop "pre-farming" rewards.

dYdX (DYDX): +11.2%

The dYdX Foundation secured a $30 million allocation from the dYdX Chain Community Treasury. This money will be used to extend the foundation’s operational capacity by an additional three years, facilitating the execution of the project’s strategic roadmap. The protocol’s TVL has increased 55% over the past week.

Sei (SEI): +41.9%

Sei has upgraded their Devnet with Ethereum Compatibility, allowing developers to deploy code compatible with the Ethereum Virtual Machine (EVM) on the Sei blockchain.

Chainlink (LINK): +6.9%

Chainlink Labs has teamed up with Telefonica, a Spain-based multinational telecommunications firm, to facilitate Polygon-based smart contract interactions with its telecom networks. The partnership, announced on Feb 14, will allow Polygon-based smart contracts to query information from Telefonica and its subsidiaries via the Global System for Mobile Communications (GSMA) Open Gateway APIs. Telefonica’s Brazilian subsidiary will be the first telecoms company to commercialize the integration. The company will leverage the GSMA Sim Swap API to protect against fraud, particularly SIM-swaps and similar “takeover attacks.”

Pocket Network (POKT): +7.5%

Pocket Network announced its third Network Gateway this week, Liquify, which processes >500M RPC requests a day. Its impressive client list includes DFK, Fuse network, Dymension and Thorchain, and the network is 100% on bare metal with a 99.9995% success rate and low-latency.

Avalanche (AVAX): +17.4%

Citibank published a report this week outlining how it leveraged the Avalanche network to test how the combination of blockchain infrastructure, tokenization, and smart contract logic can help re-architect capital markets and enhance financial services. The bank tested use cases on Avalanche “Spruce,” an Evergreen testnet Subnet designed for buy- and sell-side institutions to benefit from public blockchain infrastructure and innovation in a permissioned manner. Together with key investment and wealth management clients like Wellington Management, WisdomTree, and ABN AMRO, the firms tested a variety of use cases with a focus on private markets. Citi ultimately concludes that tokenization “unlocks the value in traditional markets to new use-cases and digital distribution channels while enabling greater automation, data, and operating models, such as those facilitated by digital identity and smart contracts.”

THE NEWSROOM

OpenAI Jumps Into Text-to-Video Fray With Sora, Challenging Meta, MidJourney and Pika Labs

$290,000,000 Drained From Crypto Gaming Platform PlayDapp by Hackers After Massive Security Breach

Gold ETFs Witness $2.4 Billion Outflows Amid Bitcoin ETF Surge

Crypto money laundering drops nearly 30% in 2023 as cyber criminals change tactics

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies that support individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital