The Weekly Airdrop: 0x105

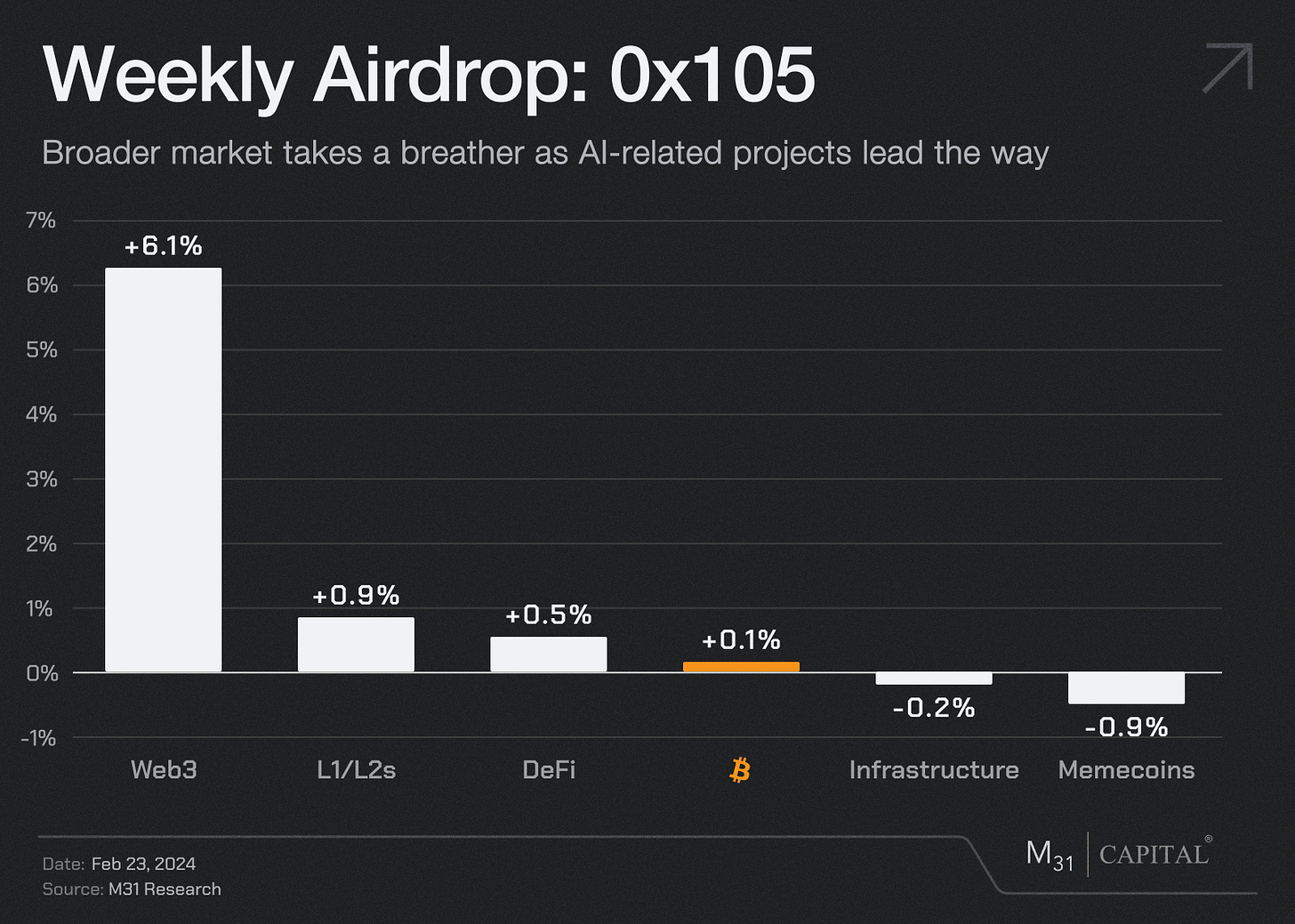

Feb 23, 2024 // Worldcoin more than doubles in price with OpenAI's Sora release, US Etheruem ETFs loom ever closer, StarkNet reverses course on controversial airdrop unlock schedule

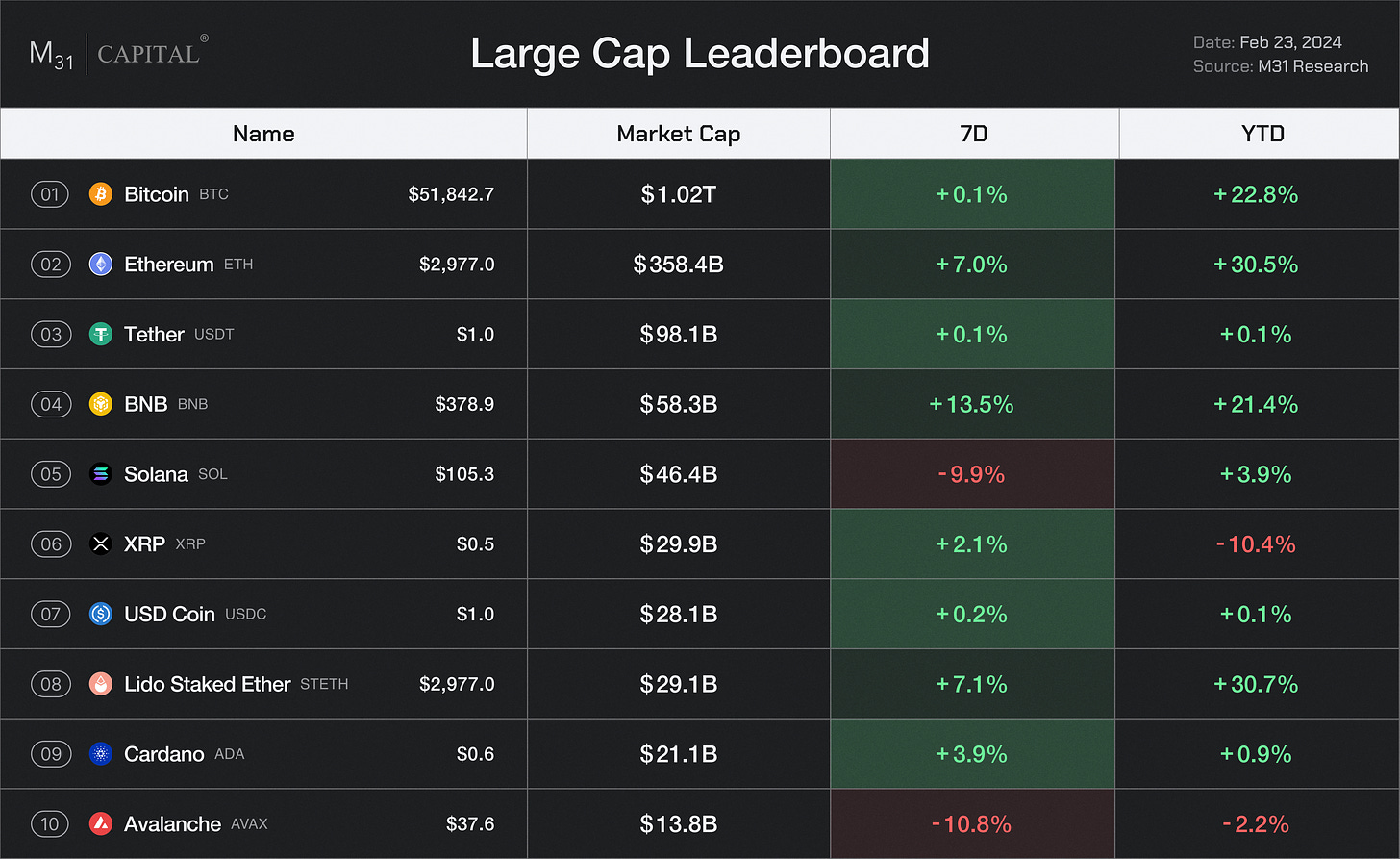

BTC soared past $52,000 this week, but quickly met resistance before reaching $53,000. These price fluctuations have resulted in around $40M worth of BTC liquidations on February 22nd alone.

ETH has mirrored BTC’s ETF price hike with news of a potential US ETH ETF. Furthermore, the upcoming Dencun upgrade and subsequent Proto-Danksharding implementation are additional catalysts for ETH’s upward price trajectory. This upgrade promotes throughput and scalability on Ethereum and puts the network one step closer to full Danksharding.

EigenLayer: NA

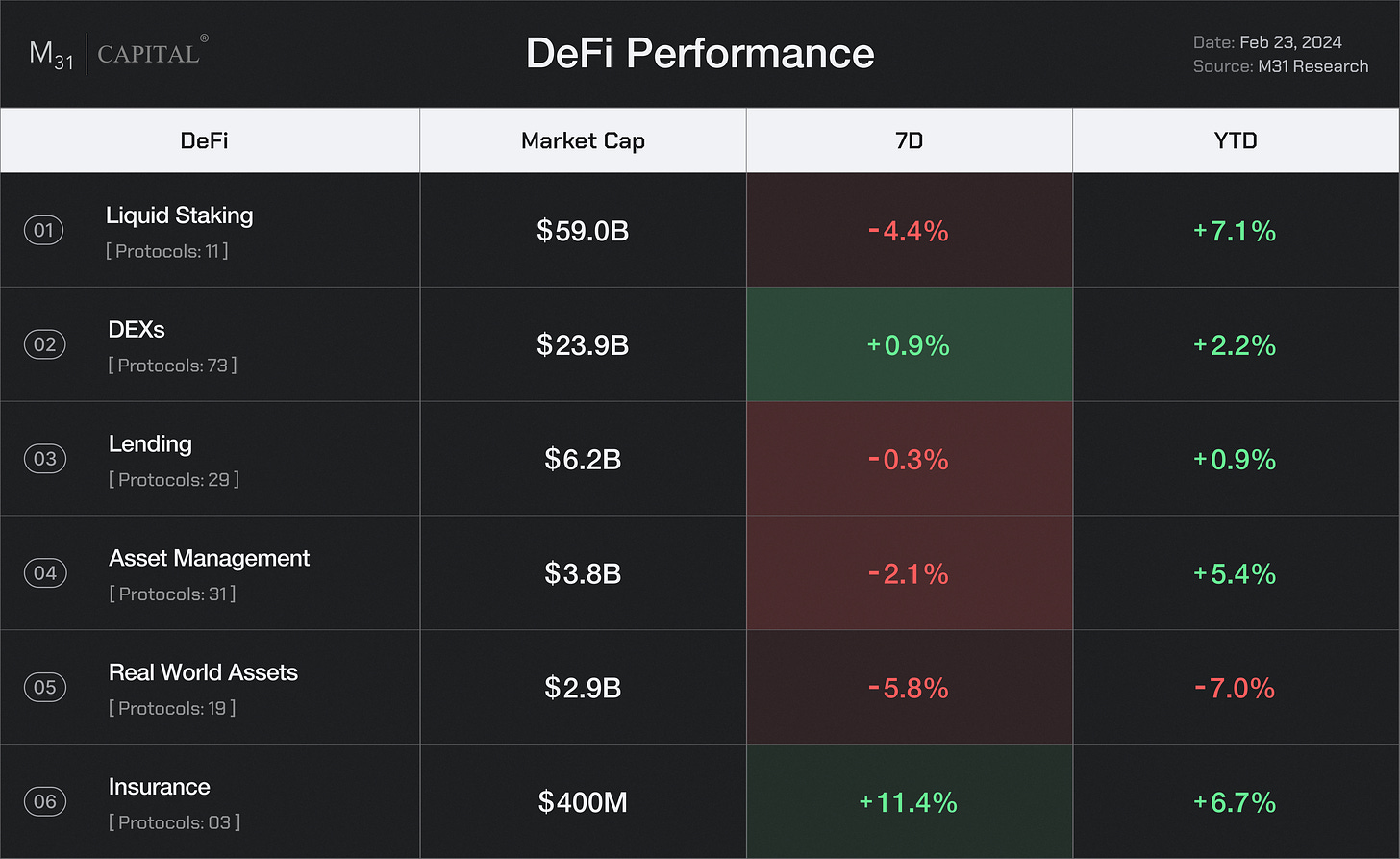

a16z announced a $100M funding round for restaking protocol EigenLayer on Feb. 22. EigenLayer surpassed JustLend on Feb. 15 and is now the fourth largest DeFi protocol with TVL at 7.9b, up 347% MoM.

Euler (EUL): +29.4%

Euler Finance introduced Euler v2, a more flexible DeFi lending platform with considerable bounce back from last year’s exploit. V2 introduces modular features like the Euler Vault Kit and Ethereum Vault Connector for enhanced customization. Users can also now create collateralized debt positions and synthetic assets.

Starknet (STRK): (-36.6%)

StarkNet Foundation amended STRK’s unlock schedule after the token dropped 53% from its Feb. 20 top of $4.41 amid concerns about investors unloading tokens on Starknet users. 64M of the 10B STKR tokens will be unlocked monthly from Apr. 15 until Mar. 15, 2024. The schedule then sees 127M STRK unlocked each month until March 2027. STRK is up 10% after the announcement.

Worldcoin (WLD): +79.4%

Worldcoin's WLD token rose 163% this week as the project's wallet application reached 1 million daily users. Additionally, OpenAI introduced Sora, a text-to-video generator, and announced plans to raise $7 trillion for semiconductor chip development. Given Sam Altman’s involvement in both AI companies, Worldcoin’s price followed the positive sentiment although there are still concerns around WLD’s emission schedule.

Render (RNDR): +39.8%

Render’s token also benefitted from OpenAI’s Sora release this week, coupled with the increasing demand for Nvidia’s H100 - and soon B100 - chips.

The Graph (GRT): +37.7%

The “Google of Web3” has released their new roadmap for data enabled services and optimized indexer performance. Over the last few months, consistent increases in subgraph counts have boosted revenue for network participants.

THE NEWSROOM

Pudgy Penguins Have Sold $10 Million Worth of Toys—Now Walmart Wants More

Market Analyst Jim Bianco Unveils Reasons Behind Grayscale’s Outflows & Negative ETF Sentiment

Coinbase International Exchange Tops $1B Daily Volume While Bitcoin ETF Volumes Surge

Pixels Trading Volume Hits $1.2 Billion as Ethereum Gaming Token Tops Major Coins

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies that support individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital