The Weekly Airdrop: 0x106

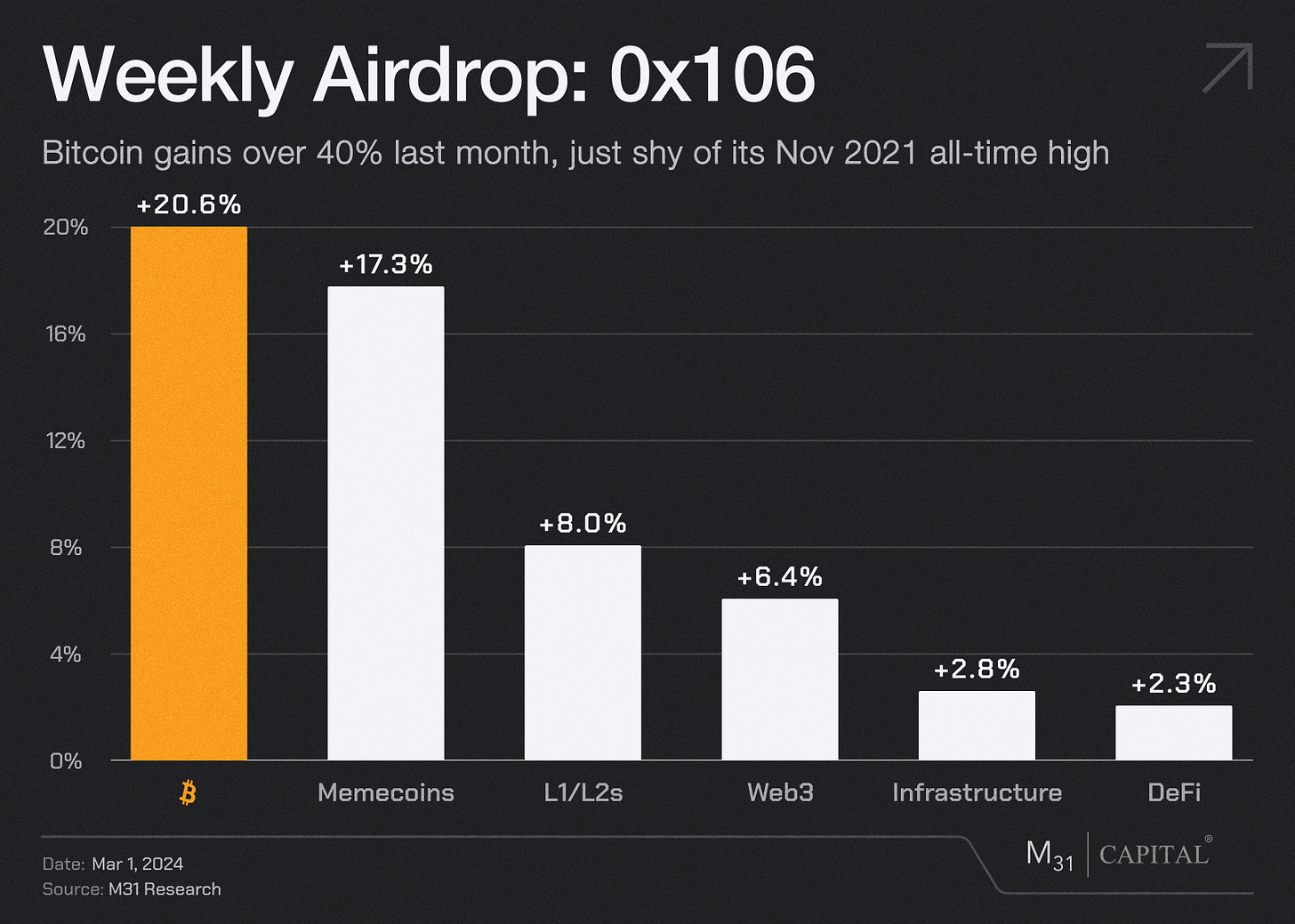

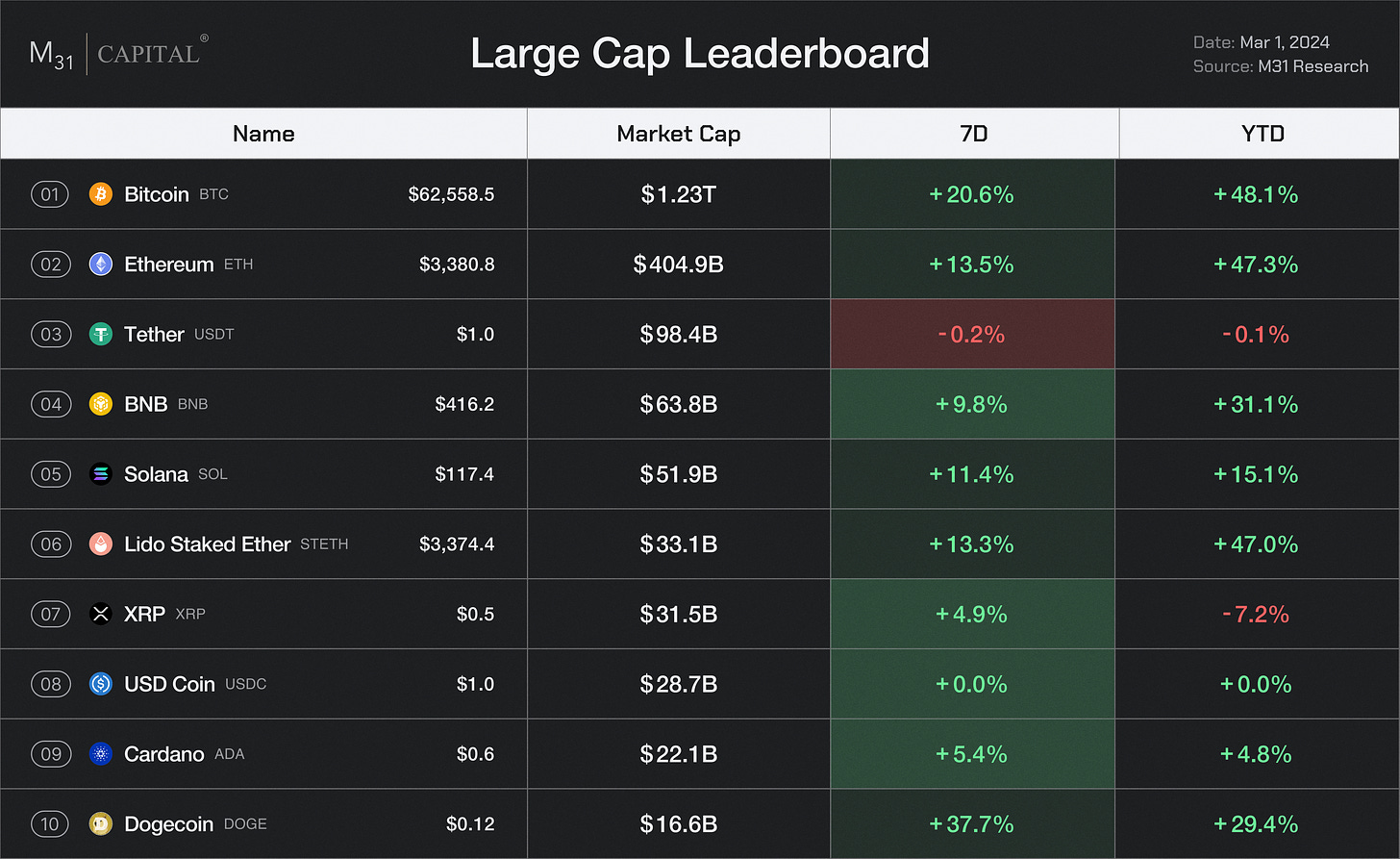

March 1, 2024 // Strong ETF inflows send BTC (+20.6%) near its ATH, ETH (+13.5%) driven by several upcoming catalysts, Arweave adds support for high-powered compute

Bitcoin continued to rally this week, pushing past $63,000 on Thursday. Annualized funding rates for BTC contracts hit 85% on top exchanges, even going past 100% on Binance, signaling a possible overheating of the market. Also, BlackRock's Bitcoin ETF (IBIT) surpassed $1 billion in trading volume Thursday for the fourth consecutive day.

Ethereum ($3,400) gained 13.5% this week, as investors focus on a handful of catalysts including a potential spot ETH ETF, the upcoming Dencun upgrade, and the introduction of restaking platforms such as EigenLayer. As ETH rises in price and the amount held in centralized exchanges falls, there is speculation of a possible alt-season. According to a Bitfinex report, since the beginning of January, centralized exchanges have recorded net outflows exceeding 800,000 ETH, valued at approximately $2.4 billion, possibly creating a supply crunch.

Axelar (AXL): +51.7%

Ripple is teaming up with the Axelar Foundation to make it easier for the XRP Ledger (XRPL) blockchain to work with real-world assets. Through this partnership, developers will be able to use Axelar's technology to connect and interact with smart contracts across more than 55 different blockchains. This will help developers create and run decentralized apps on XRPL. Binance also recently listed AXL on its exchange, further fueling the token’s rally.

Uniswap (UNI): +59.9%

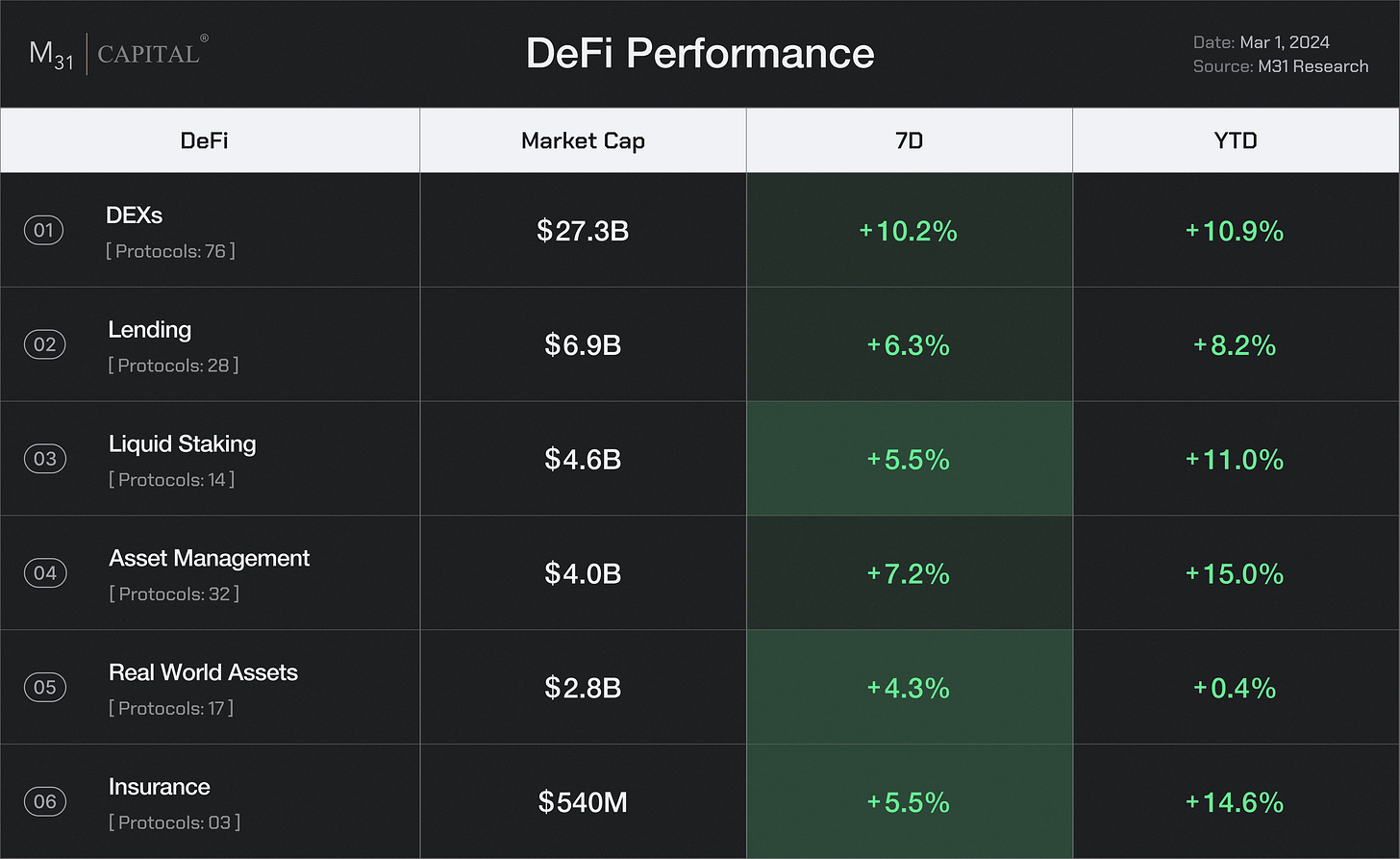

Uniswap has introduced three new features: an Uniswap Extension, the ability to place limit orders, and a new section for data and insights. The limit order feature and the data & insights section were launched yesterday. Additionally, last Friday, a proposal was made to sharing protocol profits with UNI stakers & delegators.

Pepe (PEPE): +153.0%

Memecoins are back on the menu with Pepe (PEPE), Floki (FLOKI), and Dogwifhat (WIF) having significant rallies this week. Memecoins continue to be an existential part and driver in the digital asset ecosystem.

Arweave (AR): +112.7%

Arweave’s native token surged in reaction to the launch of Arweave AO this week, a compute abstraction layer built on top of the Arweave data storage network. The technology will enable high transaction capacity and EVM compatibility and will focus on big data storage support, AI, and social media use-cases.

Theta Network (THETA): +58.4%

THETA had a strong week, driven by the excitement over Theta EdgeCloud Phase 1, a network for GPU-enabled Edge Computing, coupled with the continued strong AI narrative across the crypto market.

JasmyCoin (JASMY): +34.1%

Japanese government approved a bill this week that will allow VC firms and investment funds to own crypto, boosting the token of the Japanese IoT data network, Jasmy.

THE NEWSROOM

BlackRock’s IBIT spot bitcoin ETF crosses $10 billion in AUM

Bank of America, Wells Fargo to Offer Spot Bitcoin ETFs to Clients: Bloomberg

Trading Platform Robinhood, Layer-2 Arbitrum Team Up To Offer Swaps To Users

Gemini to return $1.8bn of crypto lost in Genesis collapse in ‘win for customers’

About M31 Capital

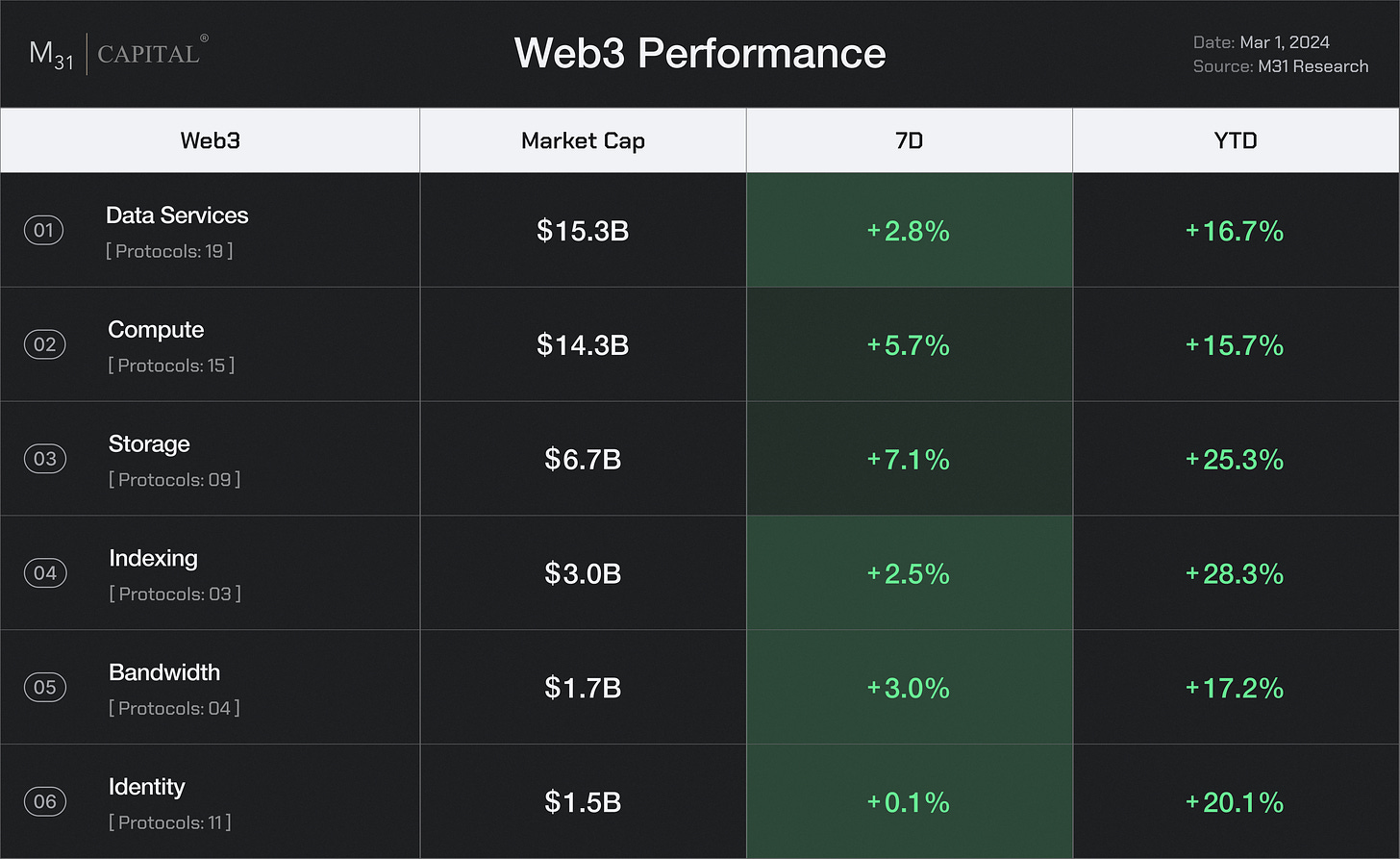

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies that support individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital