The Weekly Airdrop: 0x56

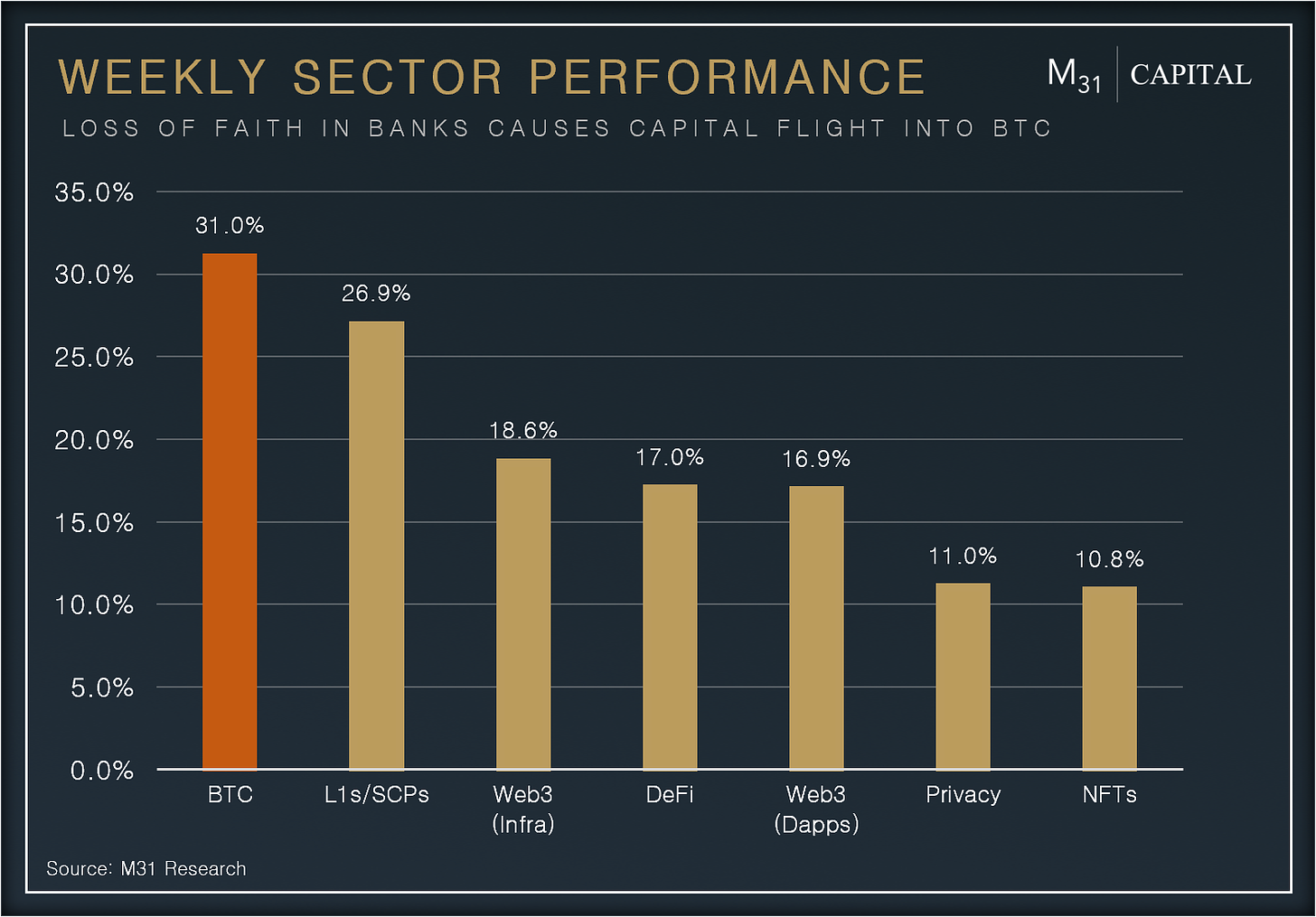

March 17, 2023 // Overall Market +21.5% as users fled to Bitcoin safety while banks around the world experienced bank runs, collapse, and panic

MARKET UPDATE

Overall market (+21.5%): The Silicon Valley Bank run and USDC depeg caused extreme momentary panic over the weekend, but BTC (+31.0%) led the market as the top asset became literally safer than dollars in the bank

L1s/SCPs (+26.9%) was the top performing sector, led by STX (+18.7%) as the Bitcoin L2 continues to generate excitement, with major upgrades coming later this year

Onchain Activity

Daily active addresses on Arbitrum hit an ATH of 112.9k, as users flocked to the chain after the ARB token airdrop was announced

Arbitrum announced their native token, $ARB, with a total supply of 10B tokens, 11.62% of which will be airdropped to users of the chain on the 23rd of March

Offchain Activity

CPI data was published, with inflation meeting expectations at 6.0% y/y

The BoJ disclosed its first Tokyo equity market intervention since December 2022, with a purchase of $5.2bn (€4.86bn) worth of ETFs on Monday evening

DEFI OVERVIEW

Performance:

Derivatives (+29.0%) was led by GMX (+25.8) and SNX (+25.3) after daily revenue on Synthetix reached $427k, its highest level since Aug 2022

Insurance (+22.7%) led by NXM (+24.8%) after V2 update went live which brings more tools and use cases for protocol, turning it to risk infrastructure layer

Key Highlights:

DeFi proved resilient once again amid the harshest regulatory attack yet. Daily DEX volume hit an ATH of $25bn on Saturday. The DEX/CEX ratio is +144.5% m/m

Lido continues to dominate the liquid staking category, adding +23.3% in TVL over the last week, while earning $10.1m in fees, +47.1% w/w

WEB3 OVERVIEW

Performance:

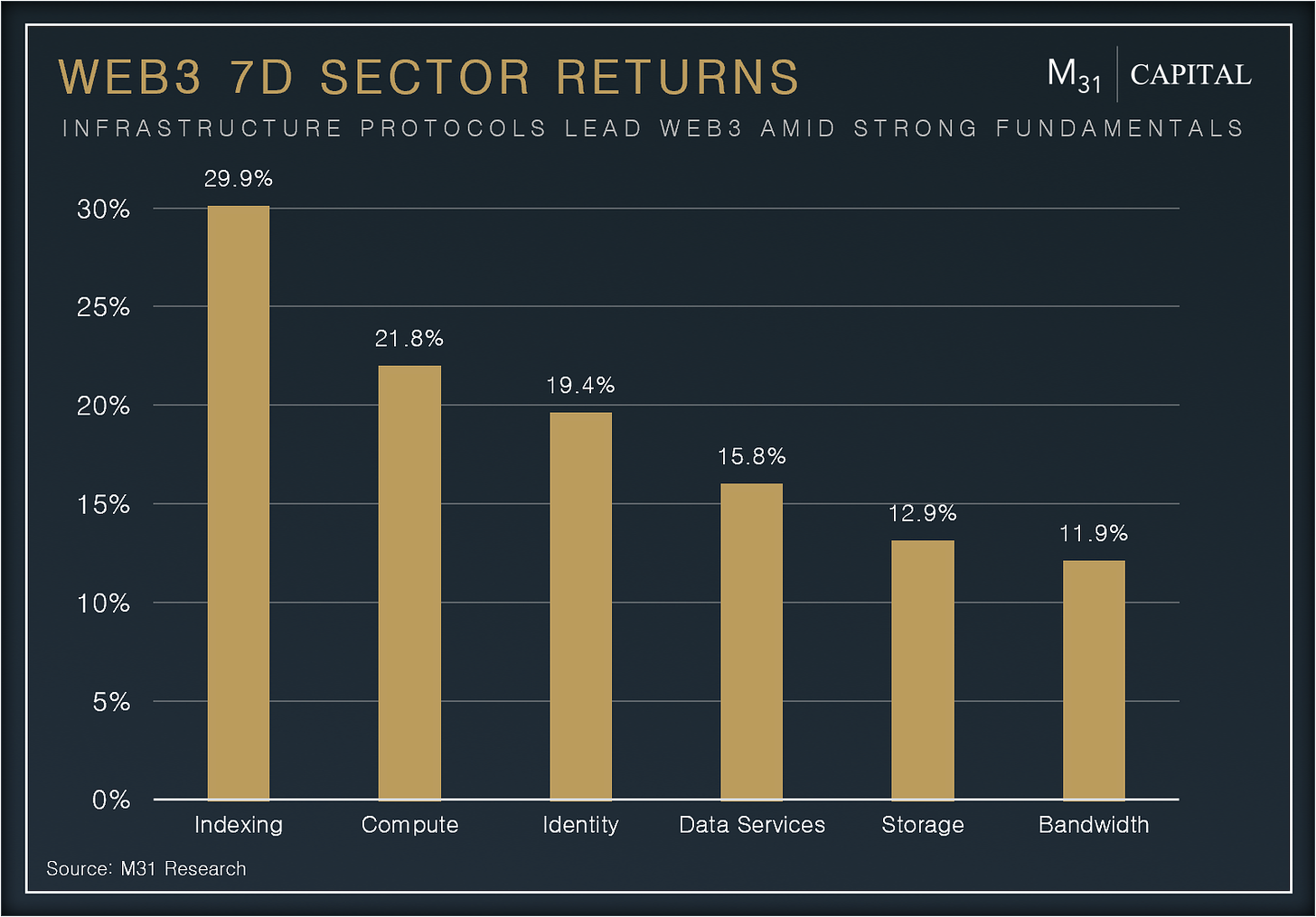

Indexing (+29.9%) was the best performing sector, (after pulling back the most last week), led by GRT (+32.2%), after the protocol showed a +42.9% increase in fees over the last 30 days

Compute (+21.8%) was another top performing sector, led by a strong performance of RNDR (+36.9%) as the network continues to offer massive advantages to users

Key Highlights:

Livepeer partnered with Filecoin's FVM to enable cost-effective video content archiving, opening up new use cases for web3 video. Fees on the network are up +21.5% over the last 30d

Filecoin makes new highs in daily data stored with 5,300 TiB of data, and expected to continue growing due to FVM launch and ecosystem growth

PROTOCOL HIGHLIGHT: Bitcoin (BTC)

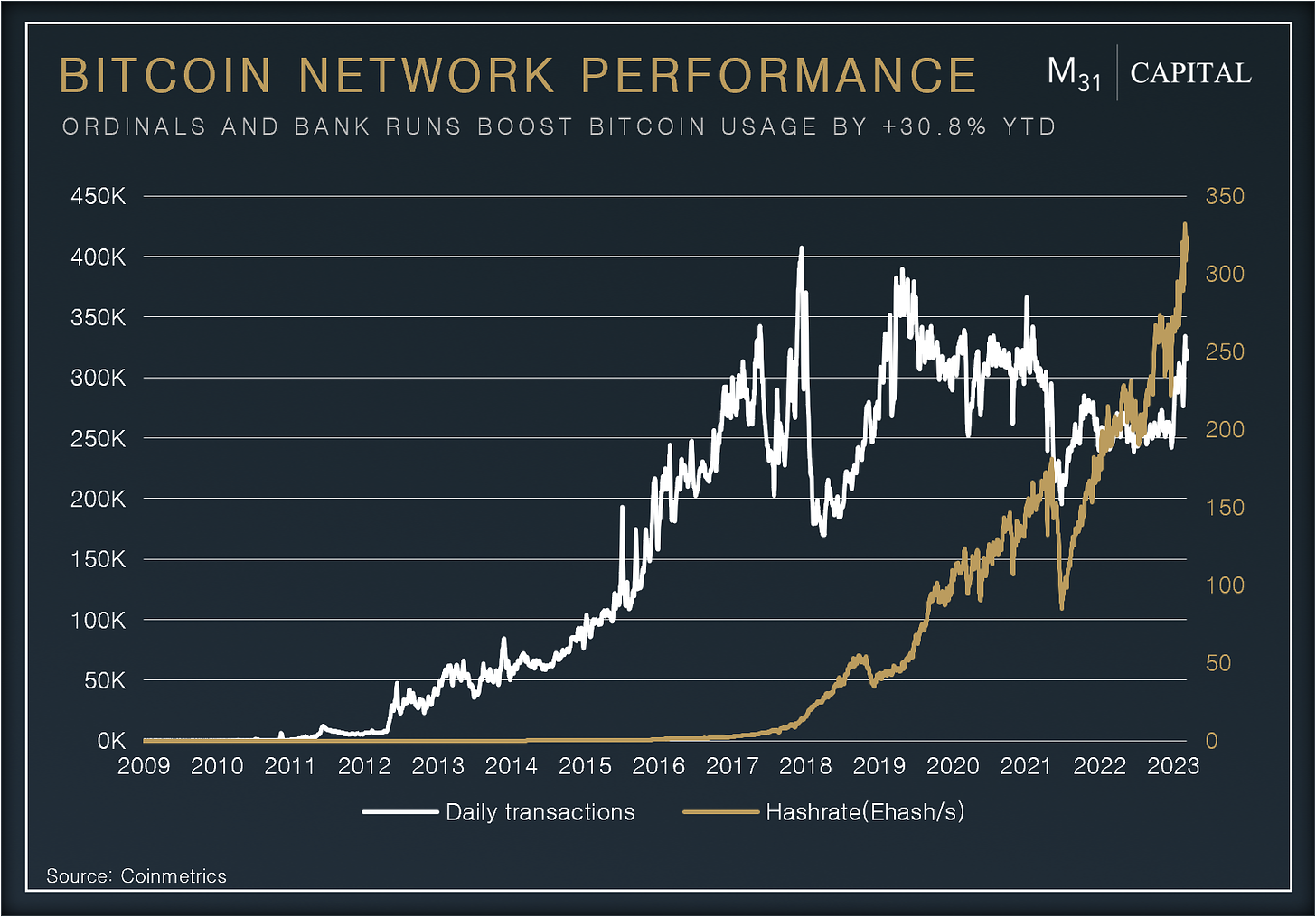

Despite the shifting narratives surrounding Bitcoin during its various cycles, its resilience has been consistently demonstrated, withstanding multiple black swan events. In light of the recent banking crisis, capital is quickly moving into BTC.

Bitcoin Updates:

Bitcoin NFTs: Ordinals allow arbitrary data to be inscribed on an individual satoshi (sat), effectively creating on-chain, Bitcoin NFTs

Bitcoin DeFi: Stacks Nakamoto upgrade tightens its connection to base layer brings sBTC - trustless, non-custodial Bitcoin peg-out derivative

Bitcoin Social Media: Nostr is a decentralized social media platform with a monetization structure utilizing Lightning Network

Bitcoin Stablecoin: Lightning Labs is working on LBTC, a BTC stablecoin

Bitcoin Metrics:

Bitcoin Dominance: +8.6% YTD to 45.7%

BTC/ETH Ratio: +8.0% YTD to 14.9%, after a 10 month downtrend

More Hodlers: BTC that hasn’t been moved in 2+ years hit an ATH of 52%

Transaction Activity: +29.5% y/y to 322.3k daily transactions

Lightning Network Capacity: +54.8% YTD to $130.4m

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies that support individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital