The Weekly Airdrop: 0x57

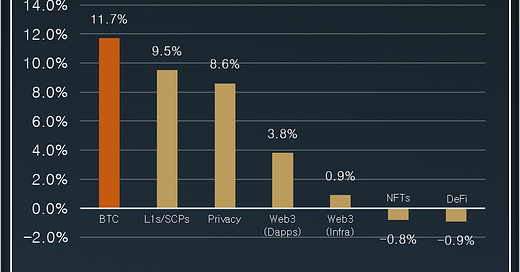

March 24, 2023 // Overall Market +7.6% while the Fed simultaneously hikes rates 25bps and reverses ~70% of last year's QT

MARKET UPDATE

The overall market (+7.6%) continued its rally and BTC (+11.7%) saw increased inflows & adopters (non-zero addresses reached ATH of 45.1m) thanks to the Fed printing another $100bn to provide more capital to banks in duress

L1s/SCPs (+9.5%) was the top performing sector again led by STX (+22.4%) and FTM (+14.0%) as Stacks 2.1 went live, providing support with native Taproot and Segwit addresses

Onchain Activity

Arbitrum launched their ARB token on Thursday, leading to massive activity on the L2: +2m daily transactions, +950k DAUs, & ~$1.8m in 24h fees

Tether issued an additional $1bn USDT on the Tron network with a total of $4bn USDT issued in the past 7 days, increasing the dominance to 59.0%

Offchain Activity

The Federal Reserve increased rates another 25bps, emphasizing their commitment to achieving 2% inflation and securing the banking system

Coinbase, Sushiswap, and Justin Sun are the latest entities to face regulatory pressure from the SEC in the ongoing scrutiny of the crypto industry

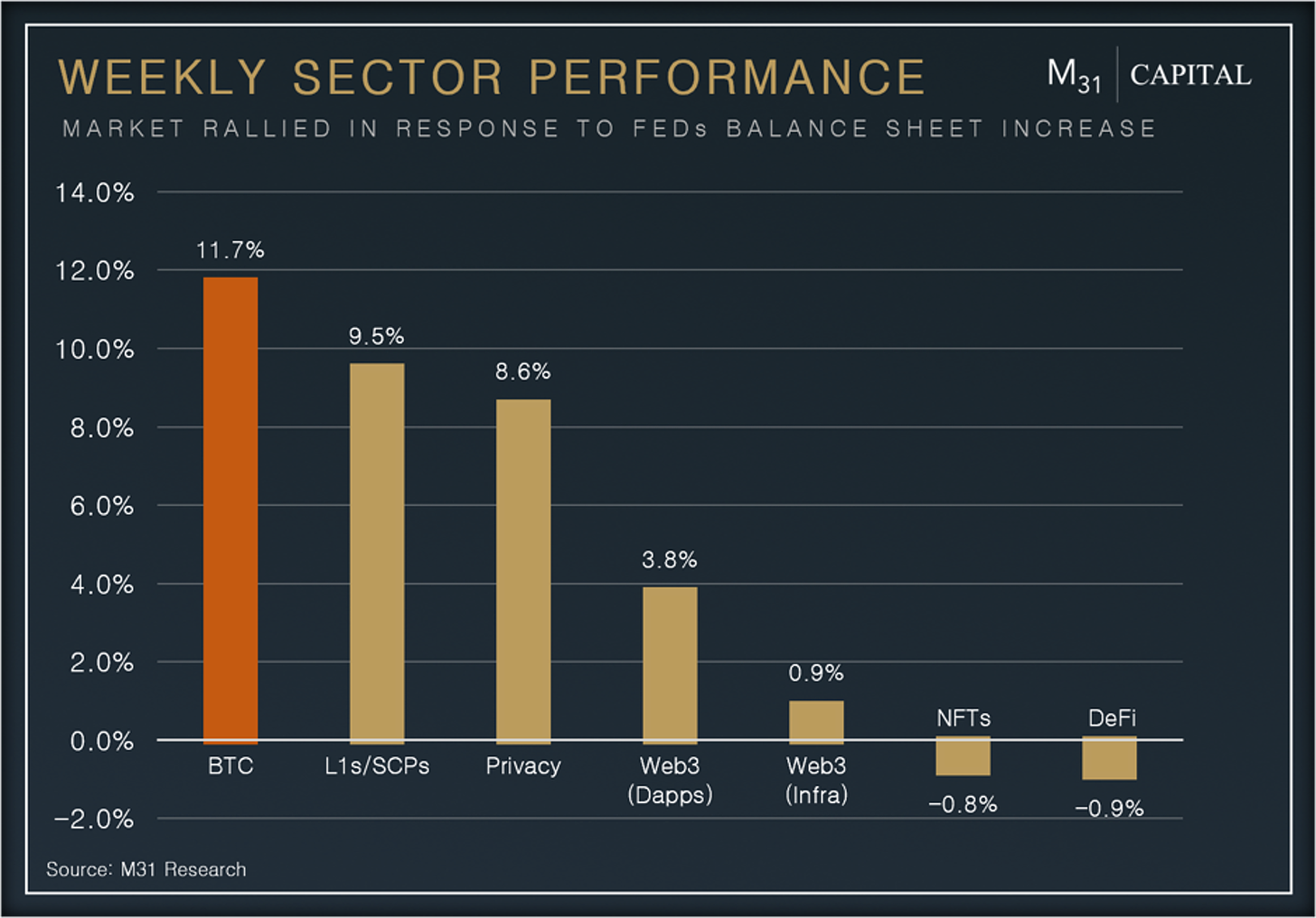

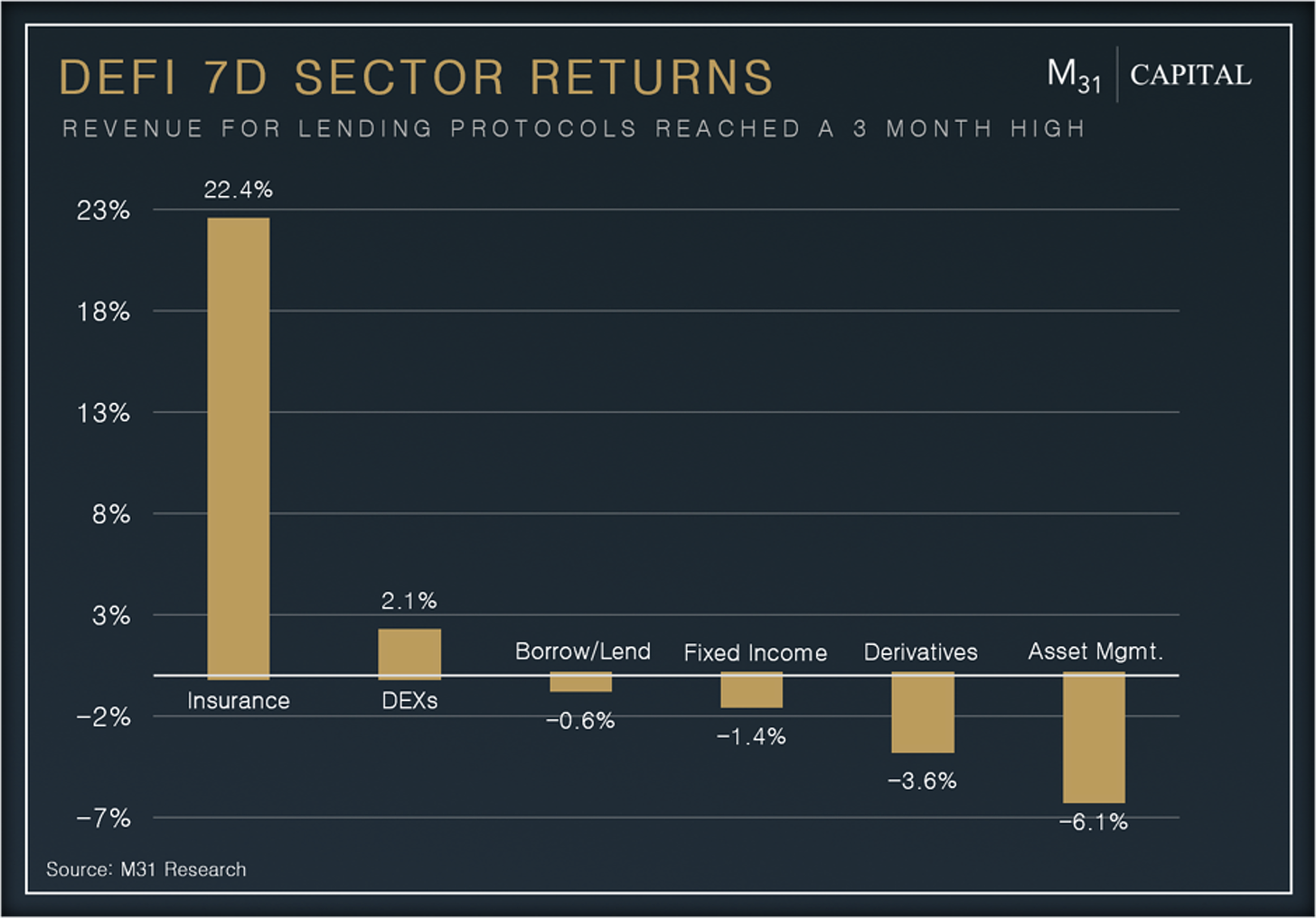

DEFI OVERVIEW

Performance:

Lending protocols achieved remarkable growth with a revenue of $29.5m, +247.0% m/m. The rising demand for capital led to ~$13bn in borrow volume across lending protocols, in March so far

DEXs (+2.1%) led by JOE (+101.9%) saw TVL increase +18.7% after the DEX benefitted from its Arbitrum deployment, processing $310m in trade volume

Key Highlights:

Uniswap processed ~$1.8bn in trade volume on Arbitrum over the last week, as users looked to trade the ARB token after launch. The DEX earned ~$2m in fees over the last 24 hours

Radiant Capital is dominating crosschain borrow/lend with TVL up +71.2% m/m & monthly revenue of $500k, the highest level since Sep 2022

WEB3 OVERVIEW

Performance:

Data Services (+8.0%) was the best performing sector led by LINK (+9.7%) and BAND (+4.9%) as Chainlink posted product updates for Q1 23 covering details of CCIP development progress

LPT (+18.3%): Xeenon, a Web3 streaming platform launched a new creator revenue sharing model on Livepeer, providing creators with revenues paid in ETH

Key Highlights:

Akash Network vCPUs leased increased +44.8% w/w, as demand for decentralized compute power continues to increase

Arweave looks at becoming a cross-chain dApp hub as WeaveDB, partnered with LitProtocol & integrated Lens Protocol

PROTOCOL HIGHLIGHT

Liquity (LQTY) is a decentralized borrowing protocol that allows users to take out interest-free loans using ETH as collateral. These loans are paid out in LUSD, a USD pegged stablecoin backed entirely by ETH.

How It Works:

Collateral Ratio: Users can borrow against ETH at a minimum collateral ratio of 110%, which improves capital efficiency and allows for up to 11x leverage

LUSD Peg: The ability to redeem LUSD for ETH at face value and the collateral ratio set a floor and ceiling price through arbitrage opportunities

Chicken Bonds: Bonding mechanism that provides users with an opportunity to earn boosted yield while the protocol gains protocol-owned-liquidity

Interest-free Borrowing: LUSD can be borrowed interest-free; users only pay one-time borrowing and redemption fees that are paid to LQTY stakers

Immutable: Liquity is governance-free with immutable code, meaning that no one can ever alter the protocol in any way

Network Metrics:

LUSD supply has increased 47.2% YTD while TVL is up 68.5% YTD

A total of $30.9m in revenue generated and $4.5bn in LUSD borrowed

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies that support individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital

Bitcoin holding strong after a week of adverse regulatory news and macroeconomic events