The Weekly Airdrop: 0x62

April 28, 2023 // Overall market (+1.7%), BTC volatility picks up, the banking crisis continues, Coinbase sues the SEC, and Lens launches a new appchain

MARKET UPDATE

Market sentiment has been swinging wildly, in line with price almost every single day this week, with investors flipping from ultra-bullish to bearish, then back to bullish and ultra-bearish again. It was liquidation season, with $312m in longs and $483m in shorts liquidated. $1.5bn in total OI was wiped out though the overall market ended the week +1.7%.

The spotlight on the banking crisis intensified as First Republic Bank faces insolvency and the U.S. mulls another bailout. Like clockwork, BTC jumped +3.7% on the news.

Q1 GDP came in lower than expected, further raising concerns about the possibility of a recession.

In crypto, BTC wallets that had been dormant for decades activated within the same week, with some moving out BTC, causing concern that old cold wallets were being hacked. Jump acted hastily on inaccurate information, selling BTC and causing a short term 10% nosedive in BTC price.

When the news turned out to be false, the market reversed. Welcome to crypto.

DEFI OVERVIEW

Onchain Activity

Total ETH staked reached a new ATH of over 18.7m after ~510k ETH were deposited last week, the largest weekly inflow since Mar 2022, driving TVL in liquid staking protocols ($18.1bn) higher than DEX TVL

Synthetix monthly revenue +52.5% m/m to $5.0m as activity on the platform was boosted by OP trading rewards (300k OP weekly will be awarded to traders of perps), with over 3.3k active users of the network over the last week

Offchain Activity

Circle’s Cross-Chain Transfer Protocol (CCTP) is now live on Ethereum and Avalanche, allowing USDC to flow natively across supported chains and eliminating the risks of the traditional “lock and mint” approach to bridging

Optimism introduced the Superchain Token List to streamline token bridging between Ethereum and OP Chains, including the OP mainnet and Base. The list will simplify the process of bridging tokens within the OP ecosystem

WEB3 OVERVIEW

Onchain Activity

Daily Bitcoin Ordinals inscriptions reached a new ATH of 193k largely driven by the trading of BRC-20 tokens, which are fungible tokens built with ordinals on the Bitcoin blockchain

Filecoin’s FVM is gaining significant traction, with ~738 unique contracts deployed and over 100k transactions processed. This has enabled the development of many new use cases, including perpetual storage, DataDAOs & decentralized computing apps

Offchain Activity

Lens Protocol launched a closed beta for Bonsai, an app chain built on Polygon designed to hyperscale Web3 social for users. The app chain will use Arweave as a data availability layer

Pocket Network has proposed that gateway operators pay a fee per relay served by the protocol, a fee that will be burned by the DAO, reducing inflationary pressure, and adding a value accrual lever to the POKT token

SHARED SEQUENCER NETWORKS

It is an exciting time for modularity maximalists.

Arbitrum is doing over 1M transactions a day (surpassing Ethereum), Optimistic rollups are generating over $150m in annualized fees, a16z and Coinbase are launching rollups using the OP Stack, and Infrastructure projects like Celestia, Astria, Espresso, Fuel, and Eclipse are driving further rollup innovation. EIP-4844 will reduce the cost of publishing data to Ethereum, making rollups even more profitable and scalable.

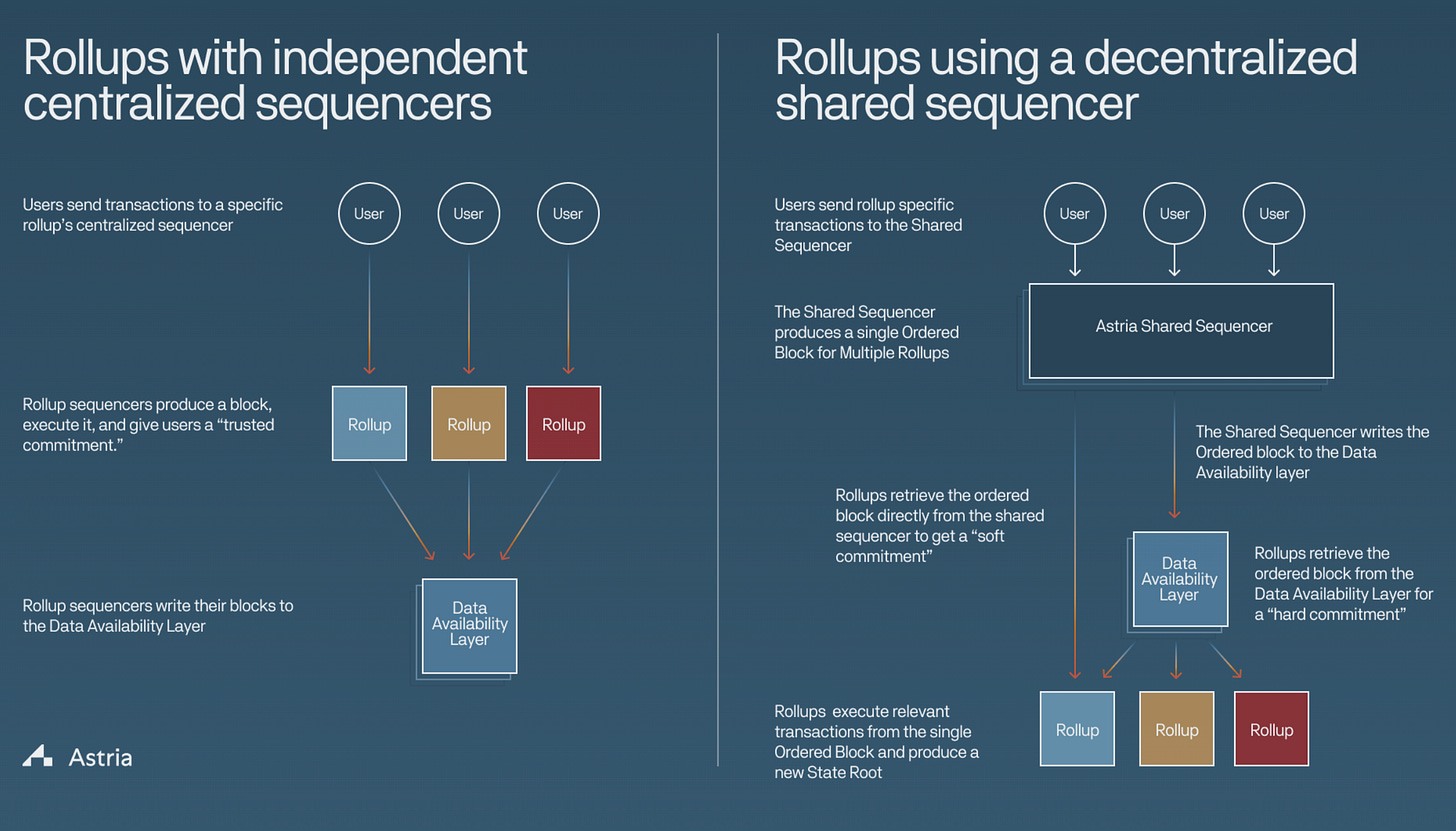

How rollups work (note: oversimplification): a sequencer orders transactions, builds the L2 blocks, and submits these blocks to the base blockchain. As a result, MEV ($) accrues to these sequencers.

Currently, the largest rollups run centralized sequencers, which poses a massive risk to censorship resistance, rollup liveness, and security. To mitigate this risk, sequencing needs to be outsourced to a decentralized network of shared sequencers.

Benefits

Rollups can focus more on their primary use case and can achieve decentralization and security out of the box

Massive explosion in new use cases with atomic cross-rollup transactions that is only possible with rollups using shared sequencer networks

Improved security by reducing the reliance on a single point of failure

Drawbacks

Higher latency compared to traditional sequencers, as there is additional overhead involved in processing and coordinating transactions

Potentially lowers the revenue for rollups (previously captured by it’s own sequencer)

Who’s Building Cool Stuff?

Astria is a middleware blockchain with its own decentralized sequencer set, accepts transactions from multiple rollups & uses Celestia as a DA layer

Espresso is a middleware blockchain that utilizes the HotShot PoS BFT consensus mechanism, draws security using Eigen Layer & incorporates its own DA layer

THE NEWSROOM

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies that support individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital