The Weekly Airdrop: 0x63

May 5, 2023 // Overall market (-0.9%), U.S. banking turmoil continues while memecoins pump, Curve launches its stablecoin crvUSD, and Stripe launches a fiat to-crypto on ramp

MARKET UPDATE

The markets remained quiet this week as BTC traded within a narrow range of $27.3k to $29k after the FED hiked rates another 25bps. Banking troubles in the U.S continue with two more banks, PacWest Bancorp and Western Alliance Bancorp on the brink of failure

Back to crypto.

Memecoins continue to be the flavor of the month. $PEPE is now worth over $1bn. The silver lining to the irrationality of this market is that memecoin activity going vertical in April and continuing to do so has heavily contributed to an increase in ETH burned (ETH has been deflationary every single day since March 27th) with ~46,000 ETH ($91.8m) burned over the past week alone.

At this rate, ETH will deflate at ~0.77% per year.

Amidst ongoing uncertainty with crypto regulation in the U.S. - exchange giants Coinbase and Gemini have found other opportunities offshore. Coinbase recently launched an offshore derivatives exchange. Adding to the domestic uncertainty, President Biden unveiled a proposal to increase the BTC mining tax to 30% of mining energy costs.

However, as U.S. regulation tightens its grip on the burgeoning industry, the flame of cryptocurrency adoption burns bright in other countries. Recently, Bhutan announced that it had been mining BTC since the token was valued at $5k and has now joined forces with Jihan Wu's Bitdeer to establish a $500m fund to support cryptocurrency mining operations in the country.

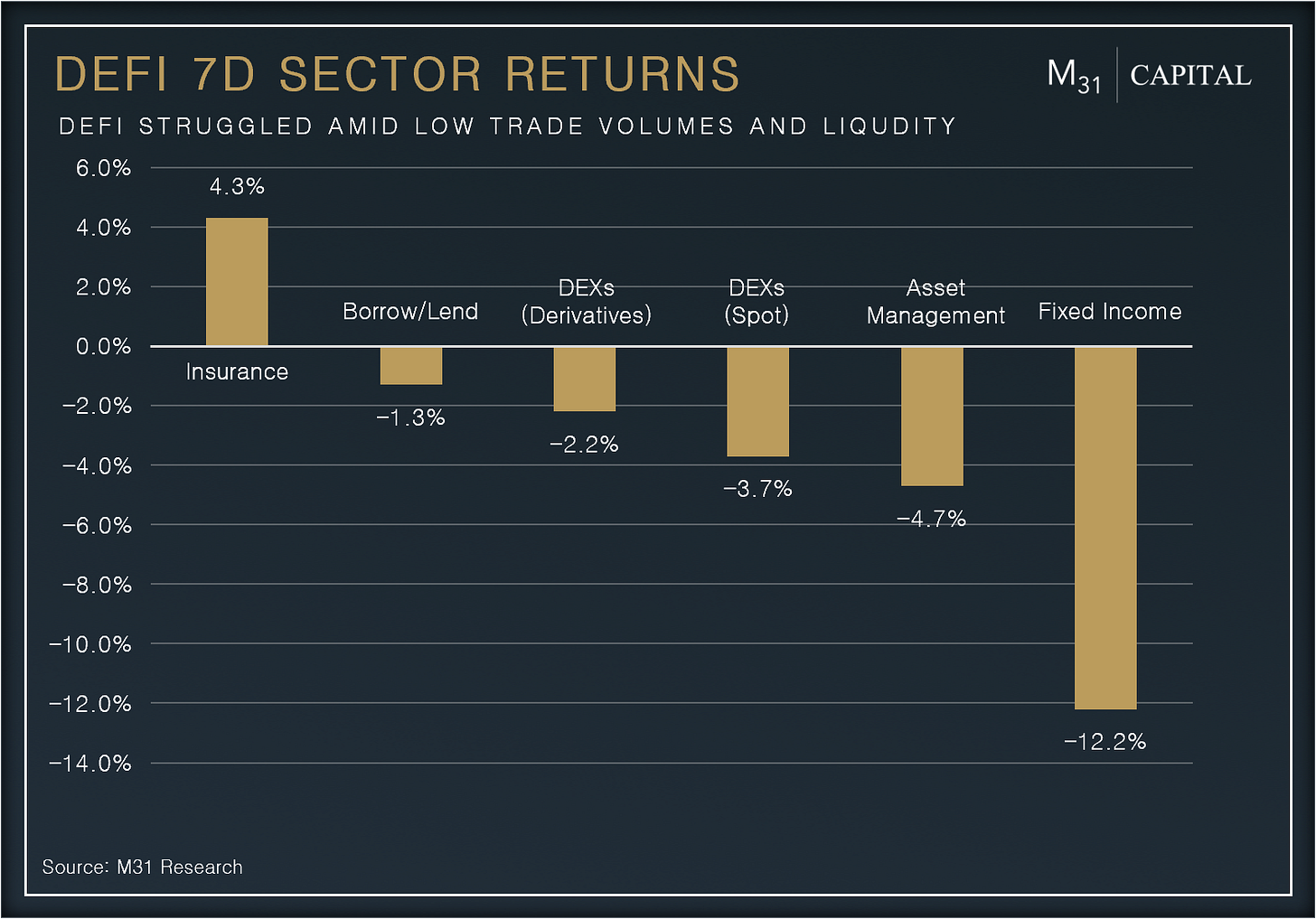

DEFI OVERVIEW

Onchain Activity

Curve launched crvUSD, a CDP stablecoin pegged to the U.S. Dollar. The stablecoin is backed by collateral from Curve liquidity pools. The peg stability is controlled by cutting-edge algorithm called Lending-Liquidating AMM (LLAMMA)

Arbitrum remains the leading L2, with TVL +7.9% w/w to $2.4bn as Chronos, a DEX on the L2 attracted ~$250m in TVL, +6395.2% w/w. This was likely driven by their CHR token emissions beginning to drip for liquidity providers on May 4th

Offchain Activity

Blur introduced Blend, a peer-to-peer perpetual lending protocol for NFTs that unlocks greater liquidity and features for NFT traders

Axelar's GMP now links Cosmos and EVM chains, enabling secure cross-chain movement of any payload, including function calls and logic. Sommelier vaults and Stride’s stAtom are expanding to Arbitrum, following the Cosmos to EVM movement

WEB3 OVERVIEW

Onchain Activity

Render shows consistent growth in Q1 23, with 2.1m frames rendered, +2.1% q/q as the network made significant improvements to key features for scaling, including native Cinema4D and multi-render support, more robust ORBX exporting tools, and development on a new AI-assisted rendering suite

Bitcoin Ordinals inscriptions surpasses 3m, generating $8m+ in fees. Monday saw 372k unique inscriptions due to the new BRC-20 token standard allowing users to issue transferable tokens directly through the network

Offchain Activity

LayerZero announced Essence, which allows anyone to create a validator (oracle and relayer) in less than an hour. Besides that, the interoperability protocol integrated with zkSynk ERA and Polygon zkEVM

Stripe launches hosted crypto onramp for expanded access, offering both embedded and hosted options to 2m+ customers

POCKET NETWORK (POKT)

Pocket Network (POKT) is a multi-chain relay protocol that is poised to transform decentralized connectivity by serving as the TCP/IP of Web3 node infrastructure. Through incentivizing RPC nodes, POKT promotes the provision of node services, leading to the development of a resilient and robust network for Web3 applications.

When a DApp sends an API request to the Pocket Network via the Pocket Portal, the request is directed to a Pocket Node. The Pocket Node then verifies and manages the request by interacting with the specified blockchain network, and provides the requested data or transaction result back to the DApp.

By staking POKT tokens as collateral, anyone can operate as a Pocket Node, demonstrating their commitment to providing secure and reliable infrastructure services. Node operators earn POKT tokens as rewards for successfully handling API requests, which are distributed based on the amount of stake each node operator holds

Recent Developments

Pocket Network recently introduced a much needed proposal to bring value accrual to the token: PIP-29: Burn Gateway

Fees will be collected from gateway operators and will burned

Gateway Fee Per Relay will specify how much USD-equivalent POKT the gateway operators owe for every relay they send through the network

Gateway Fee is initially set to be $0.0085 per 10k relays

Fee Collection & Burning process will be coordinated by the Pocket Network Foundation, which is controlled by the DAO

At current number of ~1.3bn daily relays, we estimate that around ~$30k POKT will be burned on a monthly basis. As POKT continues to add more chains, and the number of daily relays increasing, the gross revenue could even reach $1m per month, putting POKT in the same fee earning tier as Solana and ENS

Growth metrics:

Supported blockchains reached impressive 51 reward-generating RelayChains

Daily relay count reached 1.1bn, +38.1% y/y

POKT staked supply reached 973.9m POKT, 63.3%

THE NEWSROOM

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies that support individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital