The Weekly Airdrop: 0x65

May 19, 2023 // Overall market (+2.5%): RNDR rallies in anticipation of WWDC, Tether to buy BTC with realized profits, Ledger faces public backlash, and we dive into Rollup Profitability

MARKET UPDATE

The cryptocurrency market didn’t make too many waves this week (+2.5%), as it continues to slowly move along while fundamental metrics continue to grow.

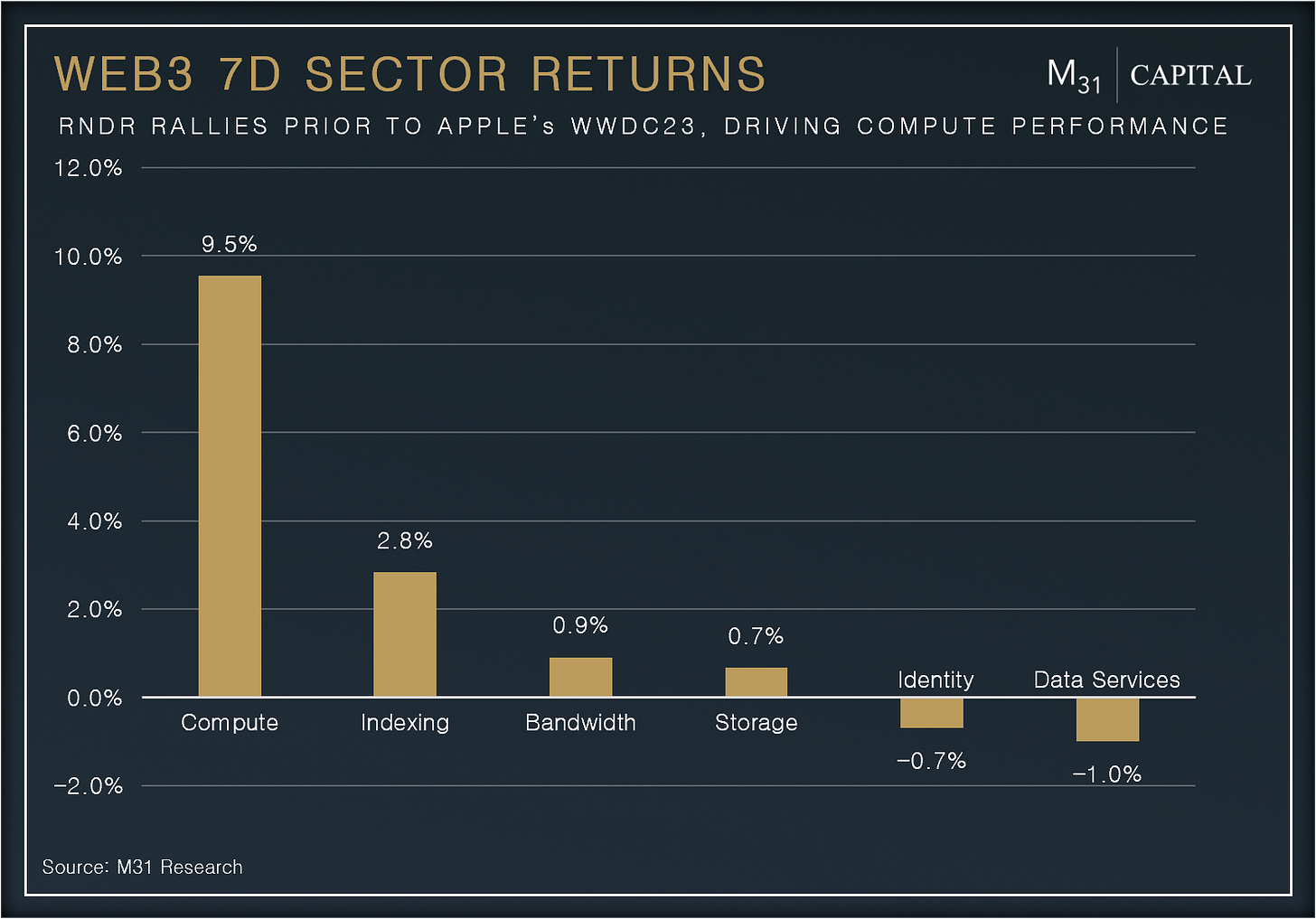

RNDR (+33.6%) was a notable outperformer this week, likely driven by the fact that Apple’s WWDC is approaching, where we expect to see increased integrations with Octane and the Render Network for Apple’s AR/VR mixed reality headsets.

Tether announced that they would begin buying BTC monthly, with 15% of their generated profits. Based on current deposits, we can estimate that Tether will earn ~$3.2bn in annual revenue, which would mean ~$480m in BTC buy pressure from Tether in the next 12 months.

Bitcoin network congestion caused by speculation around BRC-20 tokens cooled off as inscriptions growth slowed down.

Hardware wallet provider, Ledger, introduced a social recovery option for users, which could compromise security by splitting and potentially sending the pieces of private keys to third parties, prompting widespread scrutiny of hardware wallets.

DEFI OVERVIEW

Onchain Activity

Synthetix TVL +18.3% w/w to $422.7m and daily trade volume reached $157.4m, +34.2% m/m after a proposal to add PEPE, SUI, and BLUR perps

Lido V2 went live this week, enabling withdrawals of staked ETH and validator rewards. Lido saw ~450.7k ETH withdrawn almost immediately after bankrupt lender Celsius sent 428k stETH to the withdrawal queue. What’s encouraging is cumulative staked ETH keeps growing, and Lido continues to be the dominant LSD provider with a TVL of ~6.3m ETH

Offchain Activity

A proposal for a staking module and buyback program for LDO is live on Lido’s governance forum. The proposal aims to add much-needed utility to the LDO token by sharing 20-50% of protocol revenue with LDO holders, weekly, through a buyback and distribution mechanism

Optimism’s Bedrock upgrade date is set for June 6th. Deposits and withdrawals on the network will be paused for the upgrade period, and transactions won’t be accepted by the sequencer during that period

WEB3 OVERVIEW

Onchain Activity

The inaugural POKT burn was completed, with 606.8k POKT ($23.6k) burned, marking the beginning of a long-term deflationary process for the POKT token, boosting value accrual

Solana’s DAUs +50.3% m/m, hitting 516.1k, after their state compression implementation (which compresses on-chain data for low-cost storage and execution) sent NFT activity vertical

Compressed NFTs have 4.1m mints in the last 2 months

Offchain Activity

Filecoin introduced Lassie, a retrieval client for Filecoin and IPFS, which addresses their main problem - data retrieval complexity. Lassie finds and fetches content over the fastest retrieval protocols available

Apple approved the Axie Infinity crypto game on the App Store, driving mobile adoption of P2E gaming

Rollup Profitability

Rollups have proven to effectively scale Ethereum, providing users with the security of the base layer, the same applications that are available on the L1, as well as cheaper and faster transactions. It is no surprise that rollups now have ~3.78x the daily users of Ethereum. Rollups capture value by collecting transaction fees from these users who utilize applications on the network.

The Rollup Business Model

The rollup business model is simple. Rollup sequencers incur costs as gas fees it pays Ethereum to settle transactions, and pay for data availability. The sequencer then accrues all of the transaction fees that the users pay to transact or use the chain, plus any MEV that can be generated. This is the income of the rollup.

The difference between the two is the profit, which is a good measure of economic activity, and the ecosystem depth of a rollup network. Currently, these profits accrue to whoever is operating the sequencer, who then decides what to do with them.

Profit = L2 Transaction Fees + MEV – L1 Calldata Costs

Rollups have earned over 10,500 ETH in profit over the last year, with H1 2023 profits already +69.3% vs H1 2022

Arbitrum generates the most amount of ETH of all the rollups, at 33,457 ETH (~$60.2m) annualized, which is 3.4x its closest competitor (Optimism)

In H1 2023 so far, Arbitrum and Optimism have maintained an average profit margin of 41.6% and 24.7% respectively, and one can expect these margins to increase to 70-90% post EIP-4844

The Impact of EIP-4844

EIP-4844, or protodanksharding, is expected to substantially reduce the cost of rollup transactions. Currently, rollups store data on Ethereum as “calldata”, which is expensive and scales with the size of a transaction batch. With EIP-4844, this will be replaced by “blobs” instead, enabling rollups to reduce L1 costs by orders of magnitudes. Post EIP-4844, we expect L2 fees to decrease by a factor of 10x at least. This will not only make rollups cheaper to use, but will also significantly increase their profit margins.

Conclusion

The profitability of rollups serves as a key indicator that underscores the economic robustness of their architecture. By providing faster, cost-effective transactions, rollups have demonstrated their inherent value to the Ethereum ecosystem as well as users. With the promising improvements anticipated from EIP-4844, we foresee an increase in rollup profitability, which will likely make them even more appealing to users.

This value accrual is not just confined to the ecosystem or the DAO, but also paves the way for potential future benefits to tokenholders.

THE NEWSROOM

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies that support individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital