The Weekly Airdrop: 0x66

May 26, 2023 // Overall market (-1.4%): Hong Kong prepares to reopen crypto activity, Synthetix flips GMX, and CEX volumes hit their lowest levels since 2020

MARKET UPDATE

The overall market remains range-bound (-1.4%) with liquidity progressively tightening after Huobi ceased services in Malaysia and Hotbit withdrew from the market. China-related tokens experienced a surge as traders anticipated Hong Kong's retail inflows into cryptocurrencies on June 1st. Momentum across AR/VR projects persisted leading up to the WWDC conference.

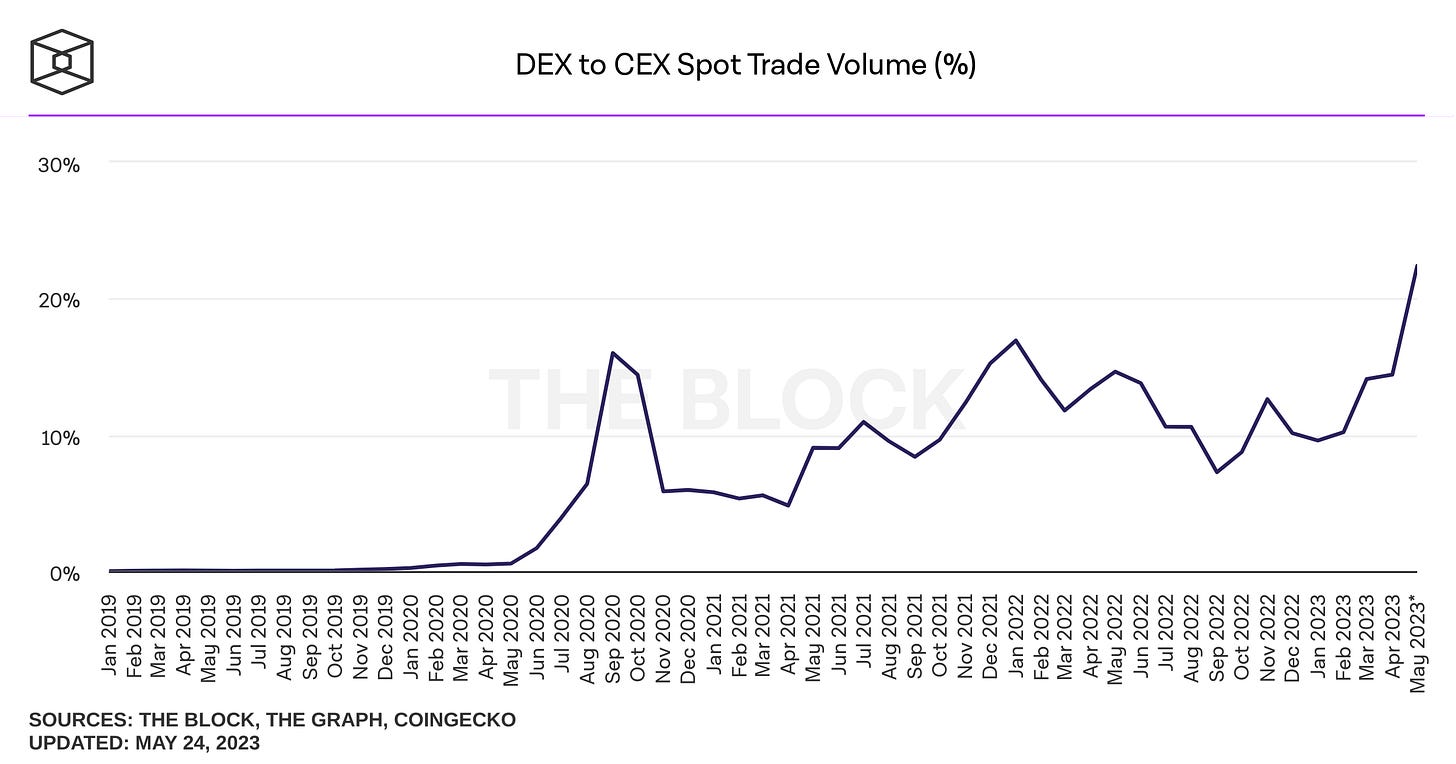

CEX volume is currently at its lowest levels since 2020, accompanied by remarkably low liquidity, as market makers Jane Street and Jump withdraw. Exchanges such as Binance.US, Bittrex, Huobi, and Hotbit are winding down their operations, while Coinbase intensifies its legal actions with the SEC. In the meantime, the DEX to CEX trade volume ratio reached a new all-time high of approximately 20% this month, reflecting the sustained interest in memecoin trading.

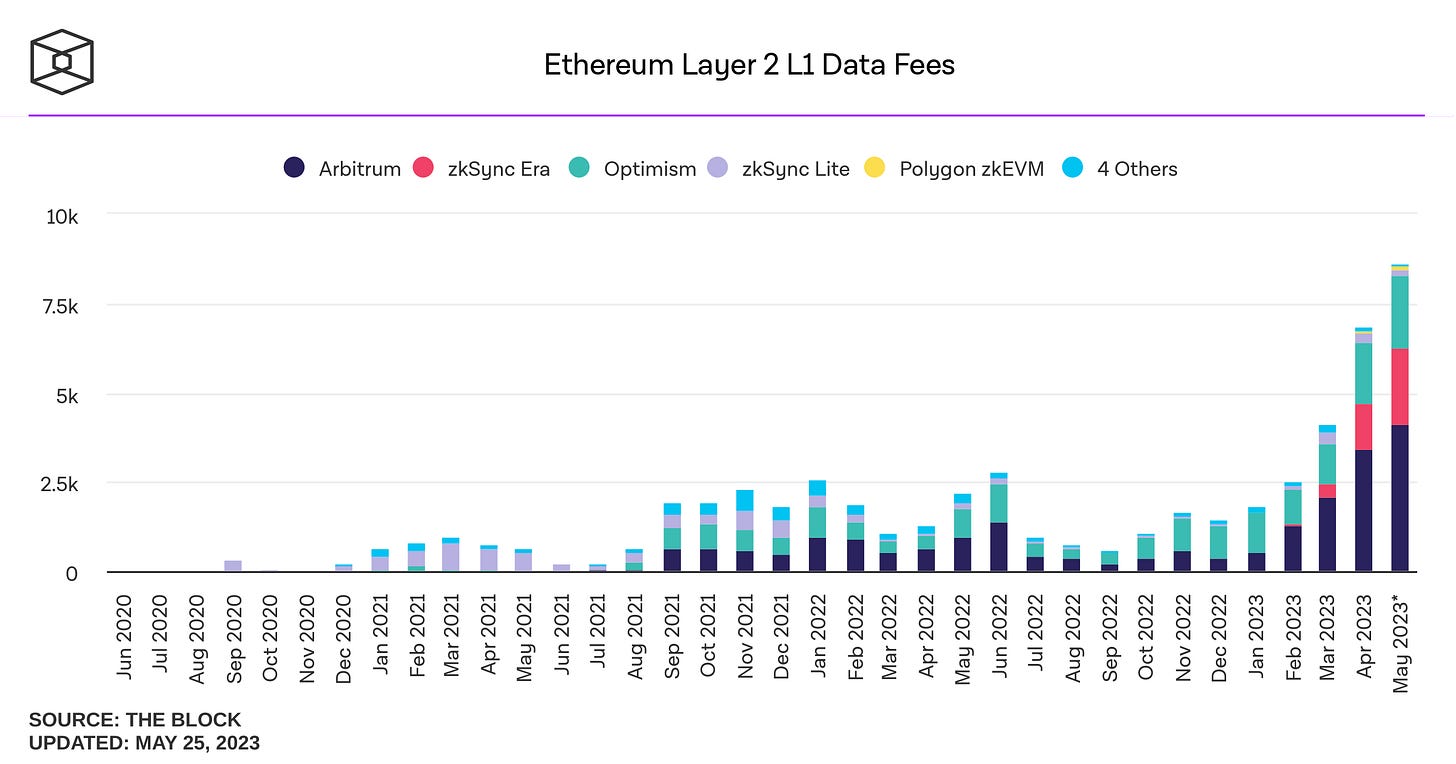

L2s are steadily gaining traction and fueling demand for Ethereum’s data availability. zkSync Era flipped Ethereum in DAUs, and fees paid by rollups to settle on Ethereum have already hit an ATH of 8,600 ETH this month.

DEFI OVERVIEW

Onchain Activity

Synthetix ($866m) flipped GMX ($322m) in trade volume this week, while crossing the $10bn mark for all time trade volume. The fact that Synthetix has markets for more assets (40 assets) than GMX, coupled with OP incentives for traders worth ~$500k /week, has helped it hit this milestone. As a result, GLP yields have hit an all time low of 1.56%

frxETH supply increased +11.0% w/w, to a total of 226.0k. Frax currently offers the highest yield for ETH (~5.29%), thanks to its substantial CVX voting power, which allows the protocol to significantly enhance emissions towards its frxETH-ETH Curve Pool

Offchain Activity

More protocols are entering the lending and borrowing space for art-based NFTs following the successful launch of “Blend” on Blur, including Binance launching “NFT Loans” on their marketplace

Synthetix unveiled a compelling vision for the protocol's future, with proposed changes encompassing trading incentives, an SNX passive staking pool, SNX split and buyback, and more

WEB3 OVERVIEW

Onchain Activity

Stargate is emerging as the dominant force in cross-chain transfers, as DAU count reached an ATH of 62.6k with a substantial total transferred volume of $10bn. Powered by L0 crosschain messaging, this protocol leverages omnichain liquidity for seamless transfers while mitigating the associated risks of wrapped token arrangement

Audius solidifies its position as a prominent Web3 music platform, maintaining a consistent count of approximately 4m monthly users for the 4th consecutive month. In addition, the platform has recorded an impressive 285.5m API calls this month, highlighting its robust usage and engagement

Offchain Activity

The Solana Foundation has integrated a ChatGPT plugin developed by Solana Labs, allowing users to purchase NFTs, transfer tokens, inspect transactions, and fetch data for public addresses through the AI model

Light Protocol announces v3, bringing a zkLayer to Solana, enabling cheap, fast, and private program execution such as hidden payments, encrypted order books, or onchain games with private states

DePIN: Empowering Connections

Decentralized Physical Infrastructure Networks (DePIN) signify the imminent evolution of the crypto landscape. By harnessing blockchain technology, DePIN establishes trustless decentralized physical networks, empowering individuals to contribute, earn rewards, and effectively address crucial concerns such as connecting underserved regions, reducing cellular and internet expenses, and optimizing idle hardware.

DePIN can be categorized into two groups:

Projects facilitating network contribution and rewards through specialized physical devices:

Sensor Networks: Hivemapper, Dimo, FOAM

Energy Networks: Arkreen

Geospatial Data Networks: GEODNET, PlanetWatch, WeatherXM

Projects enabling the monetization of unused hardware resources:

DePIN promotes AI advancement

Cryptocurrency taps into collective knowledge to build better, cheaper, and community-driven products. In AI, centralized platforms like AWS dominate despite their higher costs which hinder progress and favor specific companies. Training one large AI model costs ~$30m, and by 2030, extensive datasets could cost $100-500m. Centralization limits model evolution and ensures biased outcomes.

DePIN projects make technology more accessible for users by offering cost-effective solutions like Filecoin storage at $0.19/tb per month, it surpasses centralized cloud providers by 99.1% in efficiency. Operating in an open-source environment, DePIN protocols accelerate progress and innovation. Initiatives like Gensyn's computational market aim to decrease the cost for AI training. Open-source environment drive collaborative and inclusive technology development.

DePIN protocol revenue is $44.7m over the past 12m: Filecoin dominates 98.9%

Despite the tough market conditions, the development of DePIN protocols continues to see significant results:

Helium Mobile reached 3,807 active hotspots and IOT - 451,808 as of now

Hivemapper covered 1.6m of unique miles across 600 regions

THE NEWSROOM

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies that support individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital