The Weekly Airdrop: 0x67

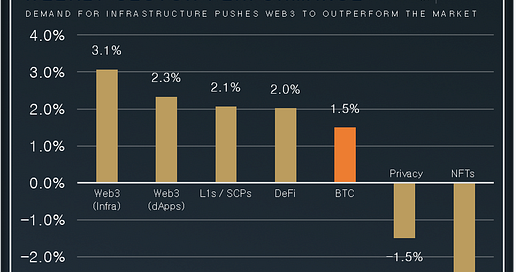

Jun 2, 2023 // Overall market (+3.2%): Stablecoin supply hits 2021 levels; Major crypto exchanges expand in Hong Kong; China releases a Web3 whitepaper & token unlocks this week totalled ~$850m

MARKET UPDATE

The overall market rises (+3.2%) despite stablecoin supply reaching its lowest levels since September 2021 (which suggests a potential decrease in new buying pressure and capital allocation across the cryptocurrency market). The increased likelihood of a 25bp rate hike by the FED and tensions surrounding the debt ceiling added further uncertainty to the market.

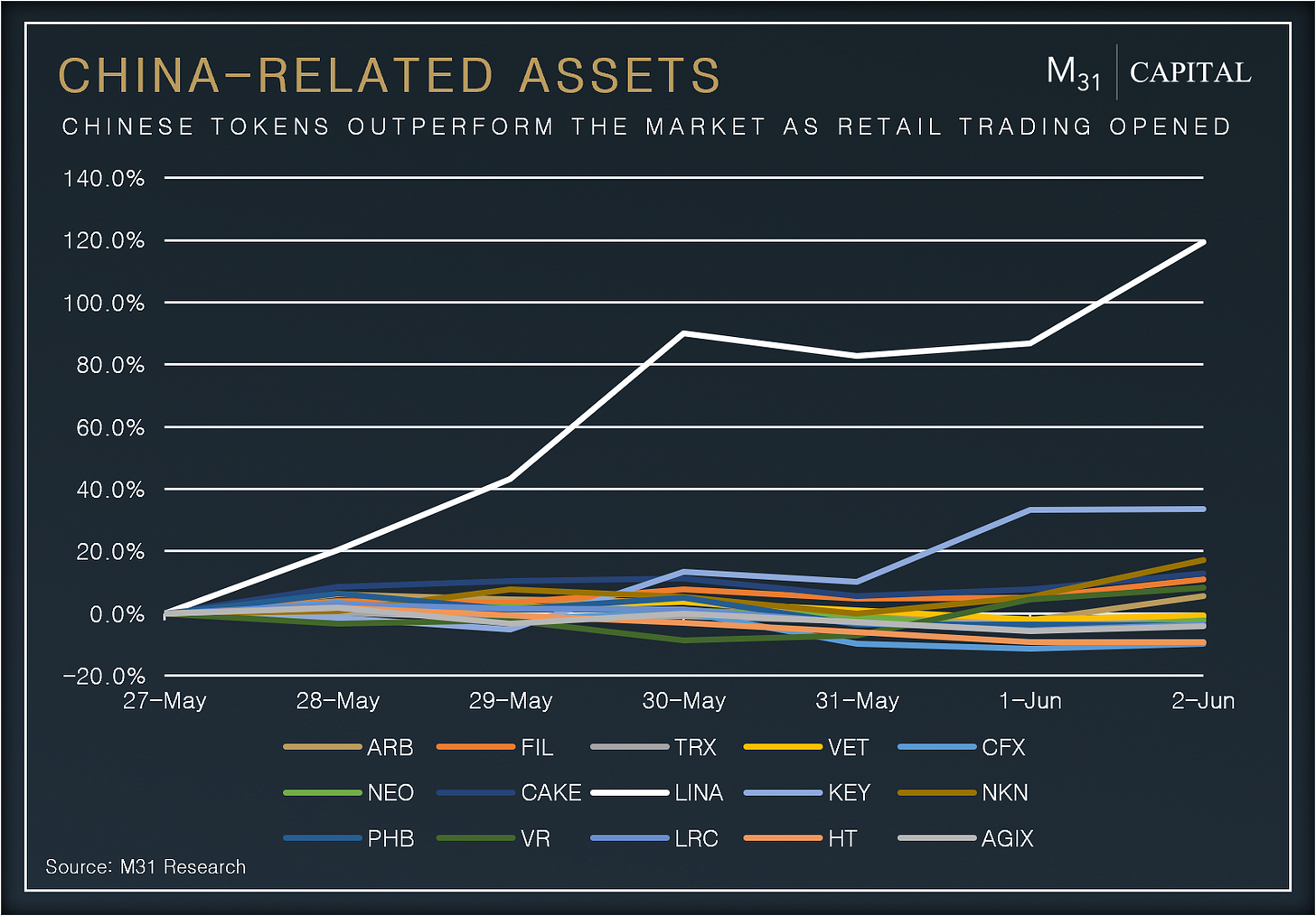

Several cryptocurrency exchanges, including OKX, Huobi, and CoinEx, are expanding their operations to Hong Kong in light of retail trading opening up. Hong Kong-based company First Digital is introducing a new stablecoin, FDUSD, that will be pegged to the U.S. dollar but regulated in Asia. Meanwhile, Beijing has released a white paper for web3 development to establish the city as a global hub of digital economy innovation. Retail trading in Hong Kong opened on Jun 1st, pushing up the prices of China-related tokens.

The week also saw significant token unlocks, totaling ~$850m. The majority of these unlocks belonged to Optimism (9% of supply, ~$600m) and 1inch Network (16.7% of supply, ~$100m). As a result, these assets significantly underperformed the overall market.

DEFI OVERVIEW

Onchain Activity

Level Finance has emerged as a leading derivatives trading platform in terms of volume, surpassing GMX. With a weekly trade volume of ~$1bn, the protocol has generated $1.1m in fees

Solana is experiencing a notable surge in DeFi activity, with a +211.4% increase in weekly DEX volume, reaching $760m. This success is primarily driven by Raydium, which saw a remarkable +399% w/w increase in trade volume. This resurgence of DeFi on Solana marks a significant comeback after being overshadowed by the collapse of FTX

Offchain Activity

Celestia rollups will integrate native USDC, in collaboration with Noble as the Cosmos ecosystem's native USDC issuer. This solution solves liquidity issues for applications, empowering developers to bootstrap sovereign rollups effectively

ETH continues to pour into staking, resulting in an entry queue of 89k validators with a waiting time of 44 days. This influx is expected to add 2.8m ETH to staking, increasing the staked supply by 11.1%

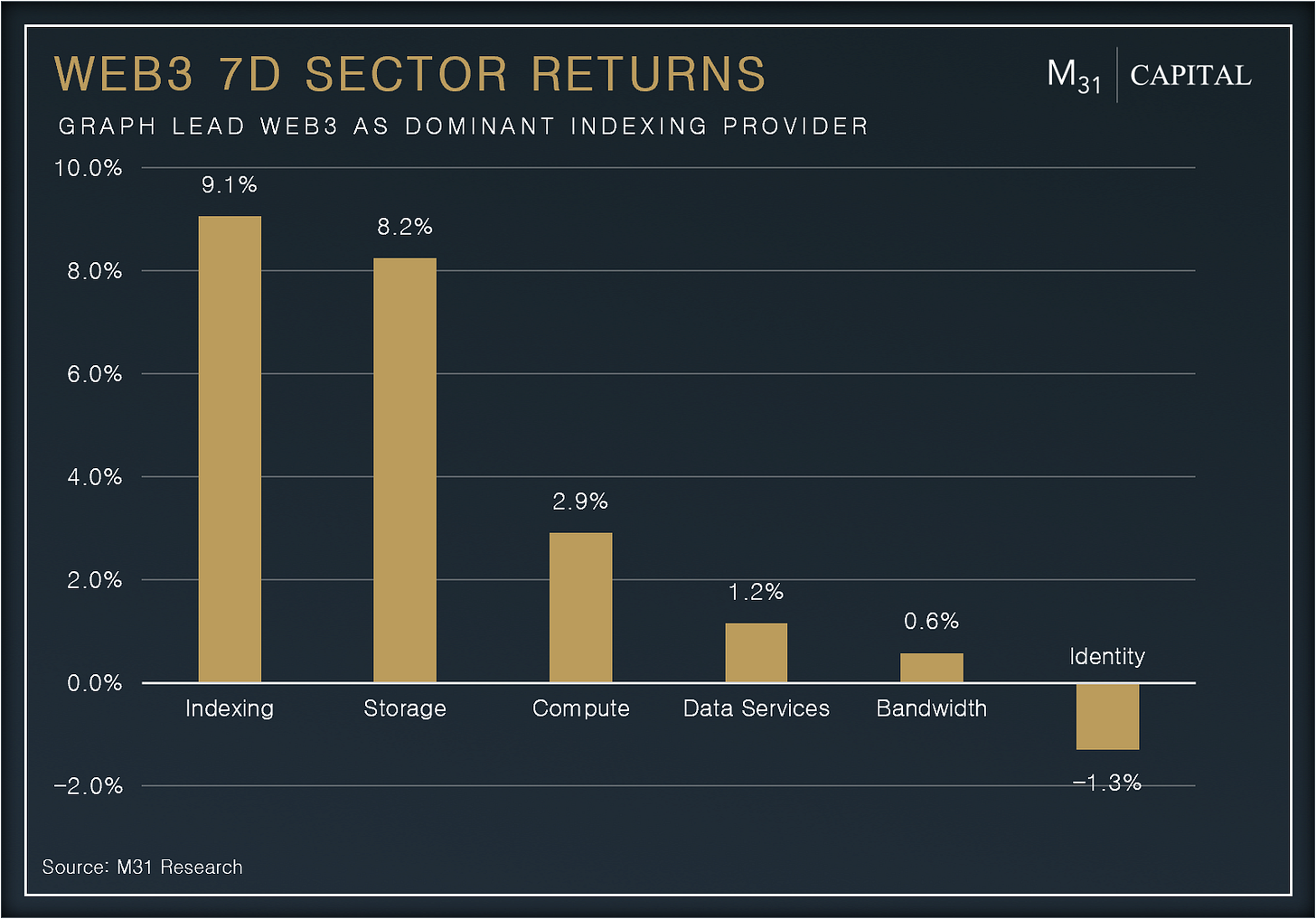

WEB3 OVERVIEW

Onchain Activity

Akash is rapidly approaching the launch of its GPUs market, which will unlock a multitude of opportunities for utilizing decentralized AI & ML technology. While the GPUs market is still on the horizon, the vCPUs market has already witnessed a notable increase of +10.6%, with 916 vCPUs leased

Avalanche has achieved a significant milestone by surpassing 1m monthly active users (MAU). The growth can be attributed to the recent introduction of AvaCloud, a no-code platform developed by Ava Labs, which enables the launch of customized blockchains, or subnets, on the Avalanche network

Offchain Activity

Render updated its whitepaper and roadmap, aiming to facilitate the increasing demand for computational power in AI applications by enabling developers to utilize GPUs for tasks such as NeRF rendering and generative AI. The next important step in the roadmap is the implementation of BME

Stable Diffusion is live on Akash GPUs testnet. It's a crucial tool as it optimizes AI applications running on GPUs, improving rendering processes and enhancing overall performance by ensuring faster and more reliable computations and maximizing GPUs utilization for developers

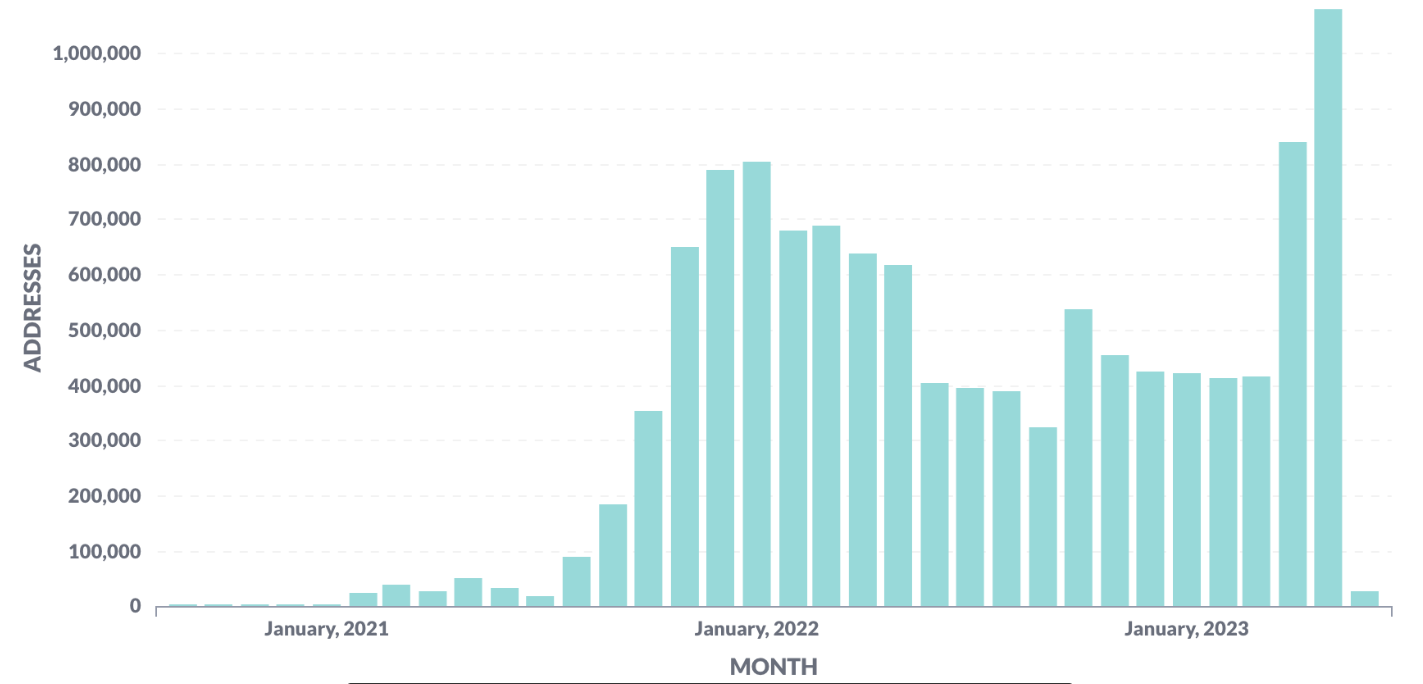

LSDFi: MORE THAN JUST STAKING

Ethereum’s Liquid Staking Derivatives (LSD) market is growing rapidly with 21.5m ETH staked, which represents 37.1% of all total ETH staked.

After the Shapella upgrade, which enabled ETH withdrawals, the amount of staked ETH has surged by 18.7%, with 3.4m ETH staked in under two months. The robust growth of the LSD market is driven by the unique advantage staked derivatives provide participants: the ability to earn staking yield by securing the core Ethereum protocol while earning additional yield by maintaining liquidity across DeFi.

LSDFi protocols leverage staked assets to offer attractive yields, leading to a significant increase in TVL in recent weeks.

TVL in LSDFi protocols has reached ~$385.8m, +294.2% since Shapella

Notable Protocols:

Lybra Finance: Provides users with interest-bearing stablecoin eUSD, backed by stETH (and other LSDs in the future). As eUSD is overcollateralized, it’s able to provide borrowers with a sustainable yield at ~8%. Lybra’s TVL reached $203.6m in the last week

Pendle Finance: a yield-trading protocol. It provides the ability to speculate on yield, leverage it, or hedge the yield at a fixed rate by splitting the underlying yield-bearing asset into principal and yield components, which can be further traded on Pendle’s AMM. Protocol’s TVL increased by +530% YTD to $81.9m

Instadapp: iETH vault leverages stETH against ETH to earn higher interest rates. Instadapp Lite Vault currently holds $63m. The v2 ETH vaults adopt a multi-protocol approach, leveraging stETH on AAVE, Morpho-AAVE, and Compound

LSDFi Developments:

Tokemak v2: Introduced Liquidity Management Pools (LMPs) with the first addressable market being liquidity for ETH liquid staking tokens (LSTs). Tokemak functions as a meta-protocol, operating above Maverick and Swell, to effectively manage the liquidity

Parallax Finance: Parallax simplifies the process of investing in LSDs by allowing users to invest in one structured product, boosting yield by auto-compounding additional yield with platform revenue and the PLX token

Prisma Finance: Prisma introduced acUSD, fully collateralized by liquid staking tokens. The stablecoin will be incentivized on Curve and Convex where users can receive trading fees, CRV, CVX, and PRISMA on top of their Ethereum staking reward

The LSD market has witnessed a remarkable surge in growth, accompanied by active advancements in LSDFi protocols. This trend heralds the arrival of the LSDFi summer. Presently, the total value locked (TVL) of LSDFi protocols stands at $385.8m, constituting only 2.6% of the entire LSD market. Consequently, we anticipate a substantial proliferation of LSDFi protocols, given the vast potential for expansion.

THE NEWSROOM

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies that support individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital