The Weekly Airdrop: 0x68

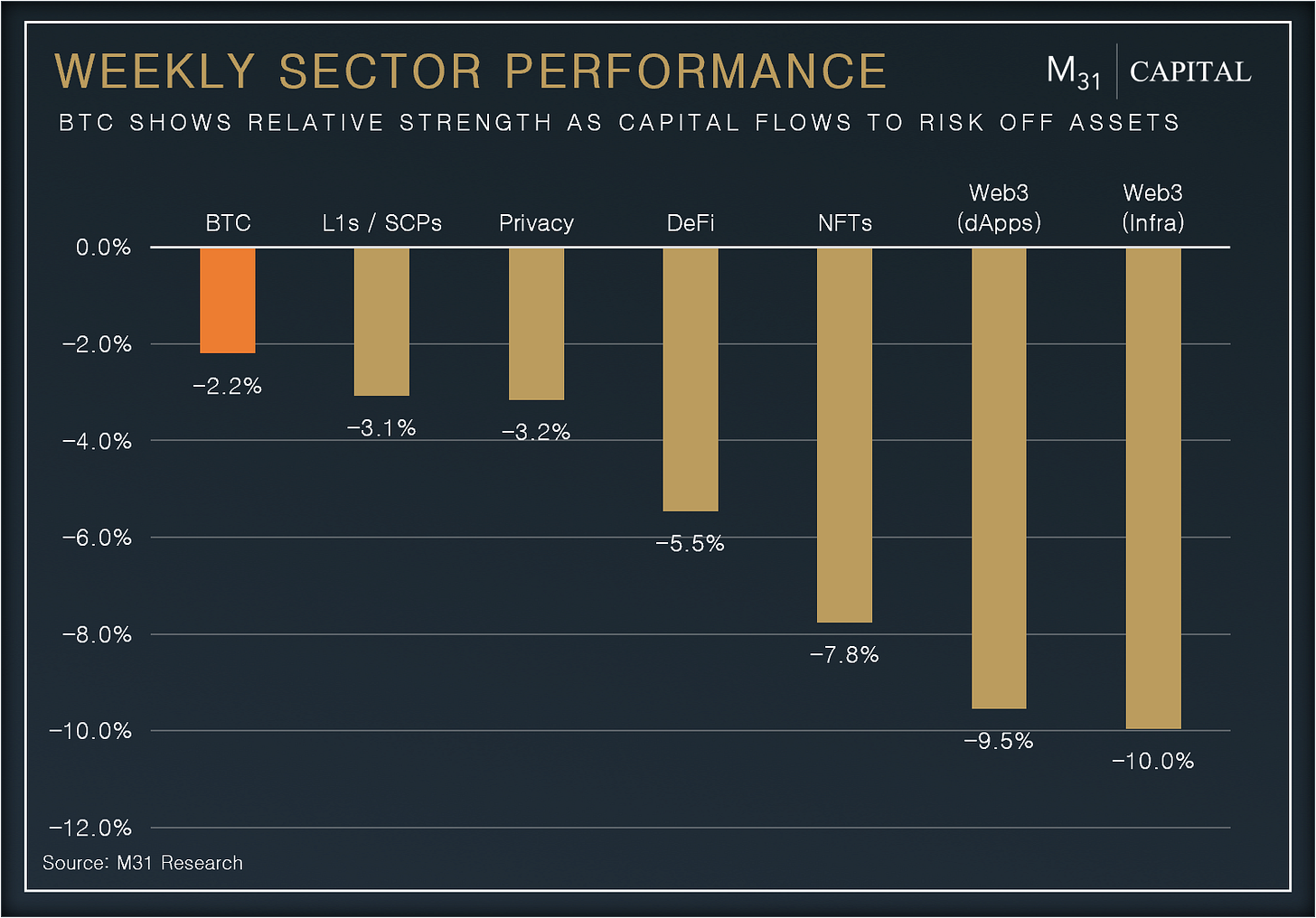

Jun 9, 2023 // Overall market (-3.4%): SEC sues Binance, CZ, and Coinbase sparking market turbulence; Tether invests $1bn in El Salvador; CEX reserves continue to shrink

MARKET UPDATE

Amidst a regulatory wave, the market plummeted (-3.4%) following the SEC's lawsuit against Binance and its CEO, Changpeng Zhao, for multiple securities violations. Coinbase also faced allegations of breaking US securities laws. The SEC extended its claims to include 67 assets, including BNB, Solana, Cardano, Polygon, Algorand, Filecoin, and Cosmos, as securities. As a result, centralized exchanges (CEXs) witnessed $3.62bn in 7-day withdrawals and over $320m in liquidations.

Despite facing pressure, both CEXs expressed their preparedness to defend themselves in court. However, as the crypto crackdown persists and promotes the adoption of decentralized DEXs and Derivatives platforms, the overall market liquidity is diminishing, leading to an extended period of stagnation and increased volatility. Stablecoin reserves on exchanges are declining at a rate not seen since late March, indicating decreasing buying pressure and bearish movement.

In the midst of these developments, Tether made an announcement regarding its partnership with El Salvador. They plan to invest $1bn in a renewable energy initiative, signaling their commitment to sustainability and environmental efforts.

DEFI OVERVIEW

Onchain Activity

An additional wave of tokens from the initial ARB airdrop allocation has been distributed to DAOs within the Arbitrum ecosystem. A total of 4m ARB tokens, equivalent to approximately $4.5m, were allocated and distributed

The crvUSD LLAMMA liquidation mechanism demonstrated its resilience to market volatility. During the events on June 6th, when ETH dropped by 4% within a 10-minutes, participants in soft liquidation incurred a loss of nearly 0.5%. However, the stablecoin peg remained strong, and no further losses were incurred

Offchain Activity

The AAVE GHO Mainnet Launch proposal is currently active on the governance forum. Upon approval of this proposal, the stablecoin will offer a $100m borrowing cap and generate revenue for DAO

Defactor Labs, a DeFi lending platform, tokenizes $100m worth of Bonds using the ERC-3643 token standard. These bonds, tokenized on the Polygon network, will be utilized to provide lending services to small and medium-sized enterprises (SMEs) by leveraging real-world assets, including receivables, as collateral

WEB3 OVERVIEW

Onchain Activity

The migration of OP Mainnet to Bedrock has been completed, reducing gas costs by an impressive ~56%. This successful upgrade has enabled Coinbase, the second core contributor to the OP Stack, to start making significant contributions to the codebase bringing Base to mainnet soon

Following the launch of its Blend feature, Blur has established its dominance in NFTfi. Users have enthusiastically embraced Blend to earn rewards points, which will eventually be converted into BLUR tokens. Weekly activity has surged to a peak of approximately $139m, with the latest week settling at $71m and capturing a remarkable 94.5% market share of NFT lending

Offchain Activity

Akash has made an announcement stating the completion of the code for the initial phase of AKT 2.0, which will be integrated into the upcoming Mainnet 6 upgrade. A notable highlight of AKT 2.0 is the introduction of Stable Payments, which will initially support axelarUSDC and later incorporate additional currencies for enhanced functionality.

Polygon introduces "Everything Music" an on-chain music platform powered by Merkle, offering users access to a wide array of music products, artists, communities, and more. Additionally, Polygon collaborates with IntegralReality and Ubisoft to bring Assassin's Creed to the Polygon network as NFTs

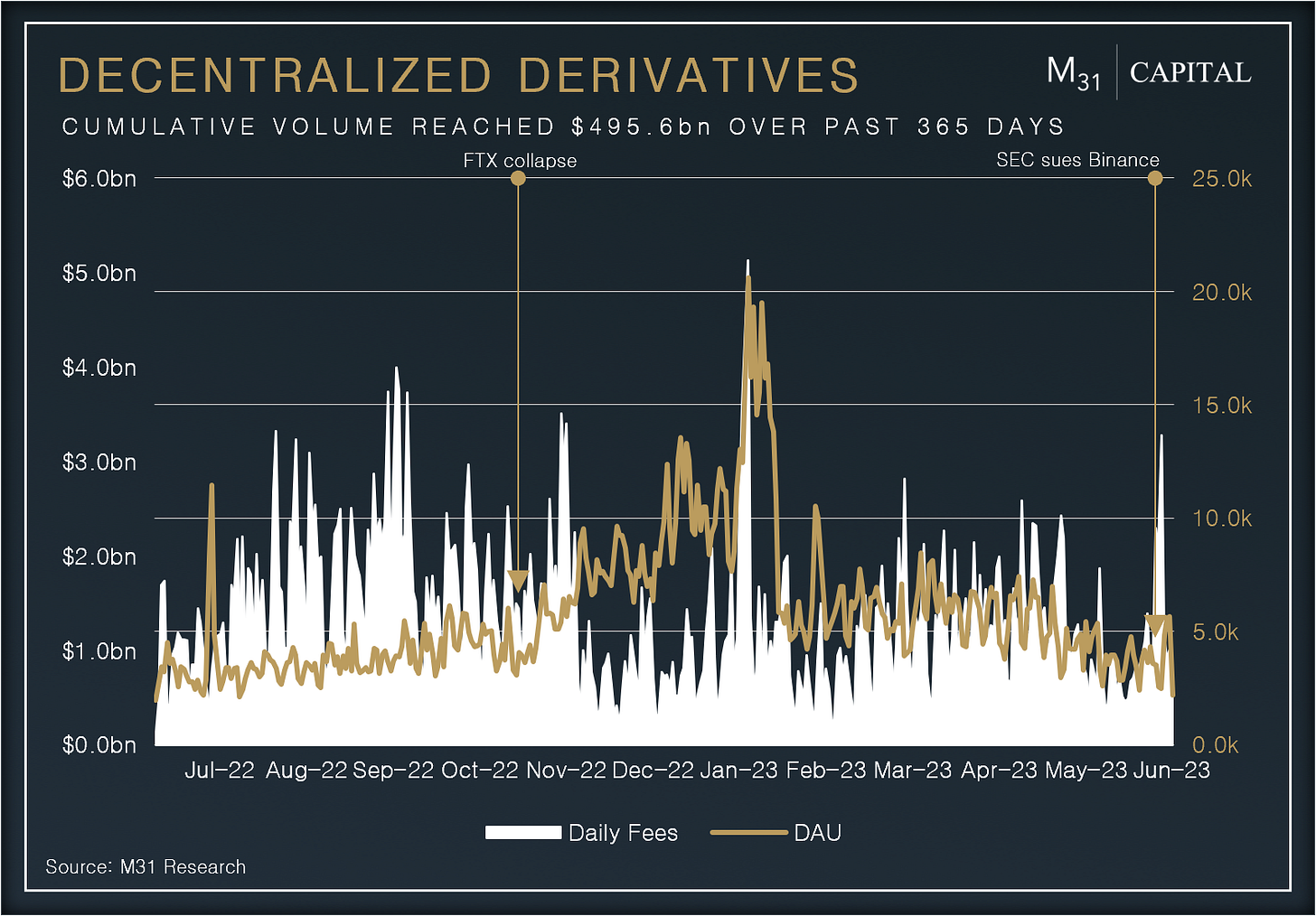

PATH TOWARDS DECENTRALIZATION: DERIVATIVES

FTX collapse drove the adoption of decentralized derivatives platforms, emphasizing self-custody. SEC case against Binance is accelerating this decentralization trend, boosting trade volume and DAU of Derivatives DEXs. Despite these liquidity wipeouts, derivatives trade volume remained strong at $1.0bn daily, with 3% y/y growth

There are different types of derivatives seen in the crypto markets:

Futures: Agreement on token price at a future date. Buyer buys, seller sells upon expiration.

Perpetuals: No expiration, open positions indefinitely. Value derived from asset, pegged through funding rate mechanism.

Options: Right to buy/sell tokens at "strike price" by specified date. Associated fees involved.

Synthetic assets: Digital representations of assets, replicate value and characteristics but not directly backed.

Notable Protocols:

dYdX (DYDX): DLOB platform powered by StarkEx zk technology. DYDX is dominating the market with trade volume reached $342.5bn YTD

GMX (GMX): Peer-to-Pool perpetual exchange on Arbitrum and Avalanche. The protocol's key component is the GLP pool, which acts as a liquidity source. GMX has an impressive $929.2m in TVL and has generated $148.7m in fees and $44.6m in revenue over the last year.

Synthetix (SNX): a liquidity backbone on Ethereum and Optimism that enables the creation of synthetic tokens, representing assets like stocks, crypto, and commodities. Synthetix’s TVL has increased +65.3% YTD, currently at $410m.

Developments:

Injective (INJ) is an L1 blockchain designed to support L2 derivatives markets, enabling a range of revenue-generating trading actions, and enabling users to profit from many different liquidity mining incentives.

Level Finance (LVL) is a perpetuals exchange launched on BNB chain that recently migrated to Arbitrum, resulting in $1.03bn of volume over the last week, even higher than GMX at $765.3m on Arbitrum

AEVO (AEVO) is building out onchain options derivatives, aiming to be a strong Deribit competitor by offering 100+ more contracts, partnering with top trading firms for deep liquidity, and supporting multi-chain deposits

With more onchain developments, robust trading suites, and users migrating away from centralized exchanges, decentralized derivatives are likely to continue their upward trajectory and gain even more traction in the market. As users increasingly recognize the advantages of self-custody and the benefits of participating in a more secure and transparent trading environment, the growth of decentralized derivatives protocols is expected to accelerate, ultimately reshaping the landscape of derivatives trading.

THE NEWSROOM

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies that support individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital