The Weekly Airdrop: 0x69

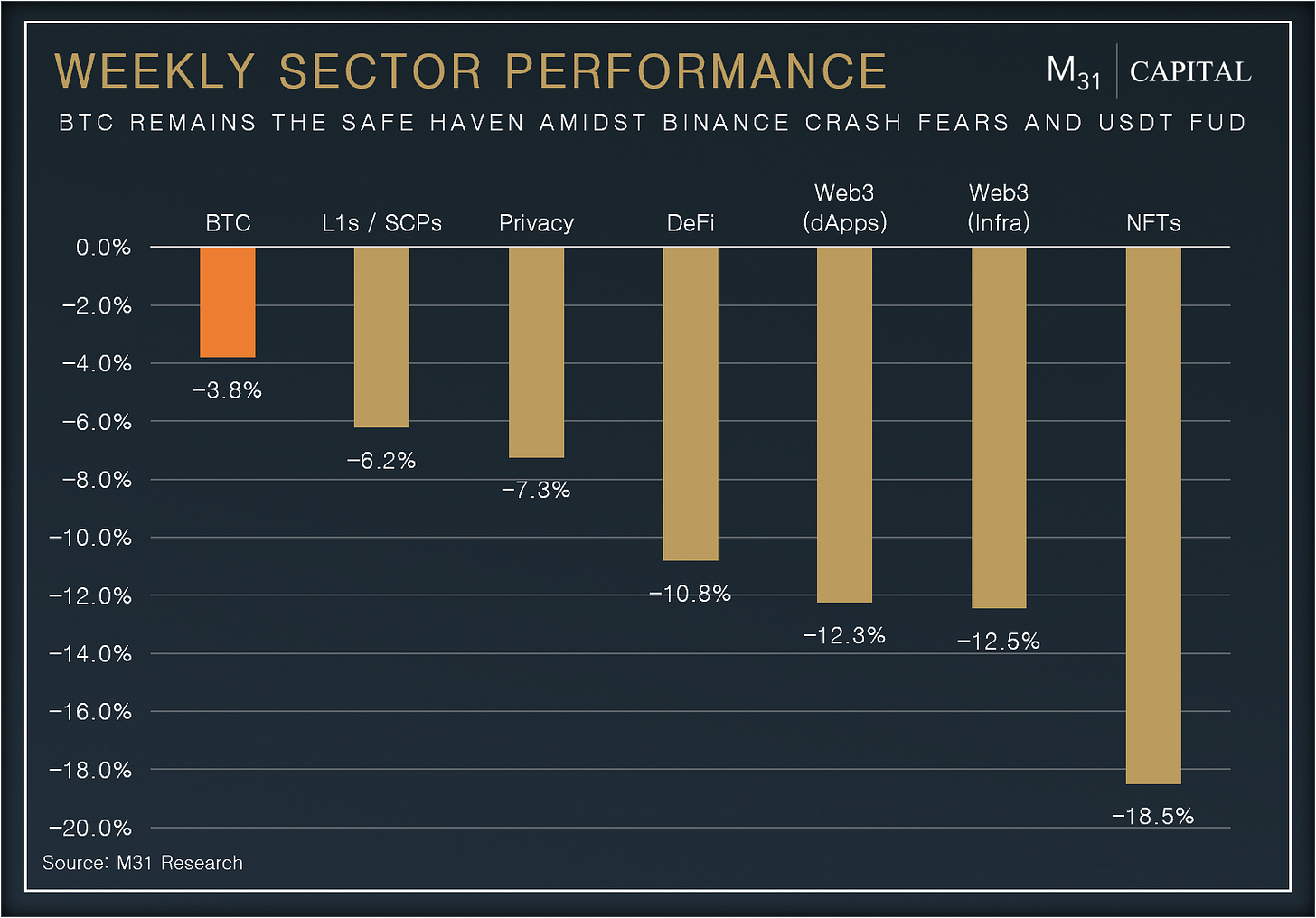

Jun 16, 2023 // Overall market (-7.8%): Robinhood to delist major tokens amid SEC crackdown, Celsius to convert alts to BTC/ETH, and Court seeks compromise on Binance.US operations

MARKET UPDATE

The market experienced a significant drop (-7.8%) following a week of bearish news, particularly the SEC's lawsuit against Binance. Despite the judge declining to immediately freeze Binance.US funds, CPI data reporting below expectations, and the Fed temporarily pausing rate hikes, any bullish effect was nullified by the increase in the terminal rate for 2023 to 5.6%. With low liquidity, Robinhood and Celsius planning to dump their altcoin holdings, and uncertainty surrounding the Binance case, this downward trend is expected to persist in the coming weeks.

Crypto.com discontinues its U.S. institutional business, citing regulatory uncertainty. Meanwhile, the House of Republicans seeks to remove Gary Gensler, reflecting concerns over the SEC's guidance on crypto regulation. In contrast, Blackrock's filing for a spot Bitcoin ETF signals institutional interest. Additionally, the European Union launches the European Digital Infrastructure Consortium (EDIC) to bolster blockchain infrastructure in Europe. These events underscore the dynamic nature of cryptocurrency regulations and the varying approaches taken by different regions.

Despite challenging macroeconomic and regulatory conditions, the adoption of ETH staking remains strong, witnessing a monthly increase of 5.5% in ETH staked, reaching a total of 22.9m (19.0% of total supply).

DEFI OVERVIEW

Onchain Activity

LSDfi is continuing to experience significant growth as it sets new ATHs in TVL, drawing in $399.3m worth of liquid-staked derivatives. Lybra Finance is leading the pack, attracting $164.7m, with an increase of +1001.4% in the last month

Curve’s stablecoin, crvUSD, is seeing significant borrow demand as support for wrapped Lido-staked ETH (wstETH) is live, and Conic Finance unveils a crvUSD-based omnipool, which has seen $28.2m TVL with a current APR of 13.6%

Offchain Activity

EigenLayer, a restaking primitive on ETH that bootstraps security for middleware, launched the first phase on Mainnet to onboard restakers. TVL in the stETH, rETH, and cbETH pools hit the initial usage limit of 3.2k ETH each on the first day

Uniswap releases its vision for the v4 upgrade, which aims to experiment with on-chain limit orders, a TWAMM, dynamic fees, auto-compounding for LP positions, MEV distribution back to LPs, customized onchain oracles, and depositing of out-of-range liquidity into lending protocols for extra yield accrual

WEB3 OVERVIEW

Onchain Activity

Filecoin's storage utilization remains strong with an 8.9% m/m increase in average daily active storage deals, reaching 5,151 TiB in June. The network capacity grows by 2.2% to 21.4 PiB, attracting new participants despite the SEC's security classification

Akash has launched an incentivized testnet for the GPUs market, paving the way for its upcoming mainnet launch. This will enable Akash to tap into the growing AI market by offering affordable resources for AI model training using powerful NVIDIA GPUs

Offchain Activity

Polygon introduces Polygon 2.0, which is a set of upgrades that reimagines its protocol architecture, tokenomics, and governance with the goal to offer unlimited scalability and unified liquidity via ZK tech as an ultimate Value Layer. TVL in Polygon zkEVM is up 37.4% in the last week, hitting a new ATH of $25.7m

The Graph, an indexing and query layer, is completing the final phase of its settlement layer migration, enabling dApps to publish, curate, and upgrade subgraphs (open APIs) at a ~25x lower cost, and retrieve the data faster. While 863 subgraphs have been published on Ethereum since its launch in 2020, 180 subgraphs have already been published via Arbitrum in 2023

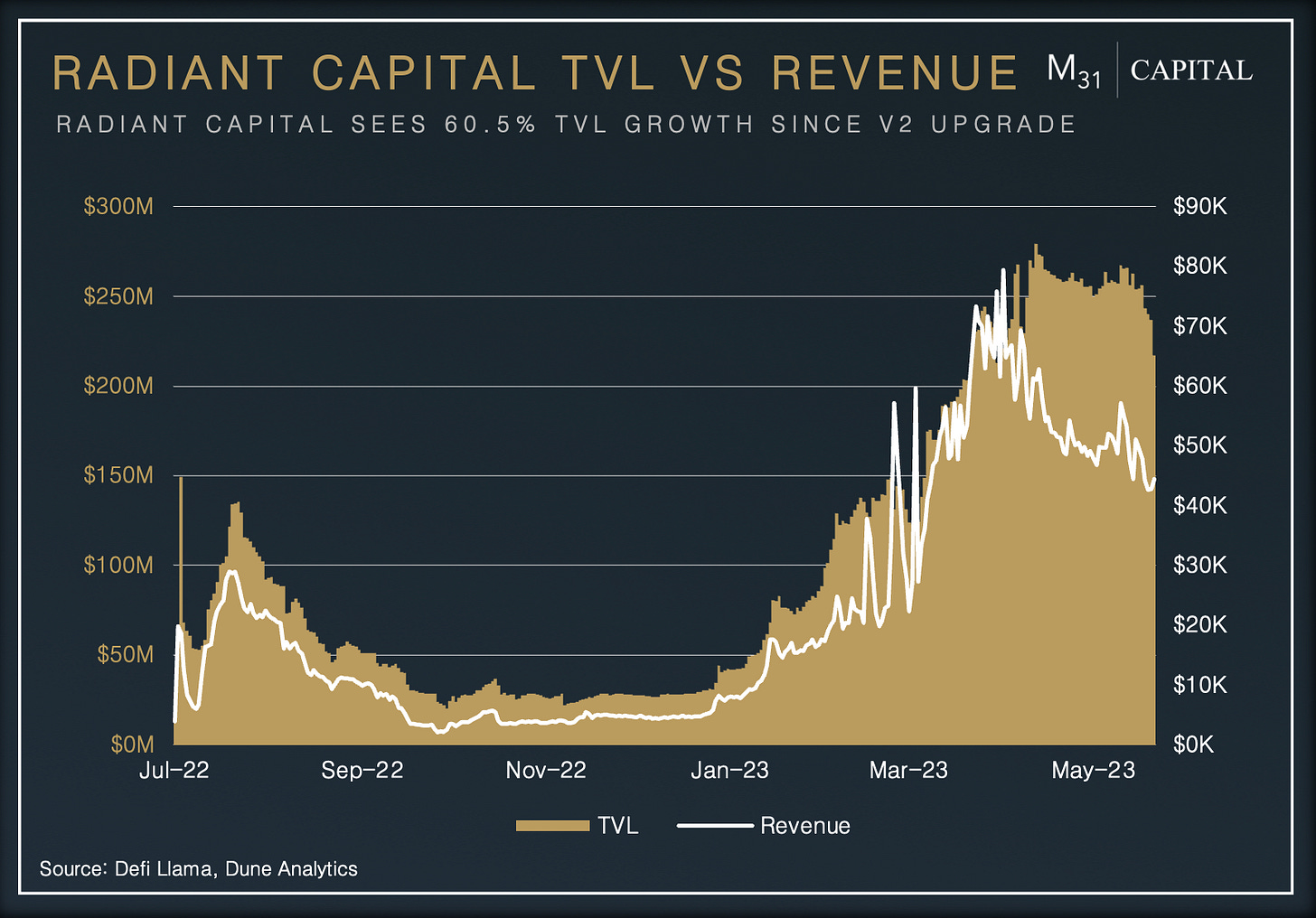

Radiant Capital (RDNT)

Radiant Capital (RDNT) is a cross-chain money market protocol taking the lending market by storm while addressing some of the barriers to token growth in DeFi. With its Layer Zero Omnichain Fungible Token (OFT-20) implementation, Radiant Capital provides a one-stop shop for users to lend collateral, borrow assets across chains, and automate lend-borrow loops up to 5x for higher APRs. The protocol currently supports Arbitrum and BNB Chain with 13 available assets, generating revenue from borrowing interest, early exit penalties, and liquidations.

RDNT has seen significant growth in 2023, largely attributable to the adoption of dynamic liquidity provision (dLP) in its v2 upgrade. The dLP flywheel effectively tackles a major challenge in DeFi, specifically the prevalence of mercenary (transient) capital, by directly incentivizing value accumulation within the protocol through enhanced yield. By prioritizing stable and committed liquidity, it fosters a healthier ecosystem that promotes long-term value creation.

Recent Developments:

Radiant Capital recently launched its v2 upgrade in March, introducing many enhancements.

Value Accrual: Users must maintain a minimum 5% threshold in locked dynamic liquidity against their lent assets to be eligible for RDNT emissions

Rebalancing Fees: Allocating liquidity to the RDNT token generates higher rewards than lending capital, with 60% of fees distributed to LP lockers, 25% to lenders, and 15% to the DAO (v1 had a 50:50 locking/lending ratio)

Flexible Liquidity: Linearly scaled emission schedule gives early exits 10-75% of emissions depending on the remaining vesting time (90 days total)

Decentralizing Actions: “Bounties”, akin to a “liquidation bot”, are placed on expired LP locks, incentivizing eligible users to claim the fees accrued on ineligible positions which benefits both themselves and the protocol

DAO Governance: RDNT holders can vote on new assets to be added to the Radiant money market, while a risk committee determines the appropriate collateral and borrowing parameters

Growth metrics:

DAU has steadily climbed in 2023 from 170 to 1.9k, a growth rate of 1015.3%

Radiant has $215.4m in TVL, +690.3% YTD, and generated $4.4m in revenue YTD

RDNT price increased 512.2% YTD to gain a $66.0m market cap

THE NEWSROOM

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies that support individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital