The Weekly Airdrop: 0x70

Jun 23, 2023 // Overall market (+15.1%): Major institutions file Bitcoin ETF applications and back a new CEX; U.S. House commits to stablecoin legislation; Ethereum considers raising validator balance

MARKET UPDATE

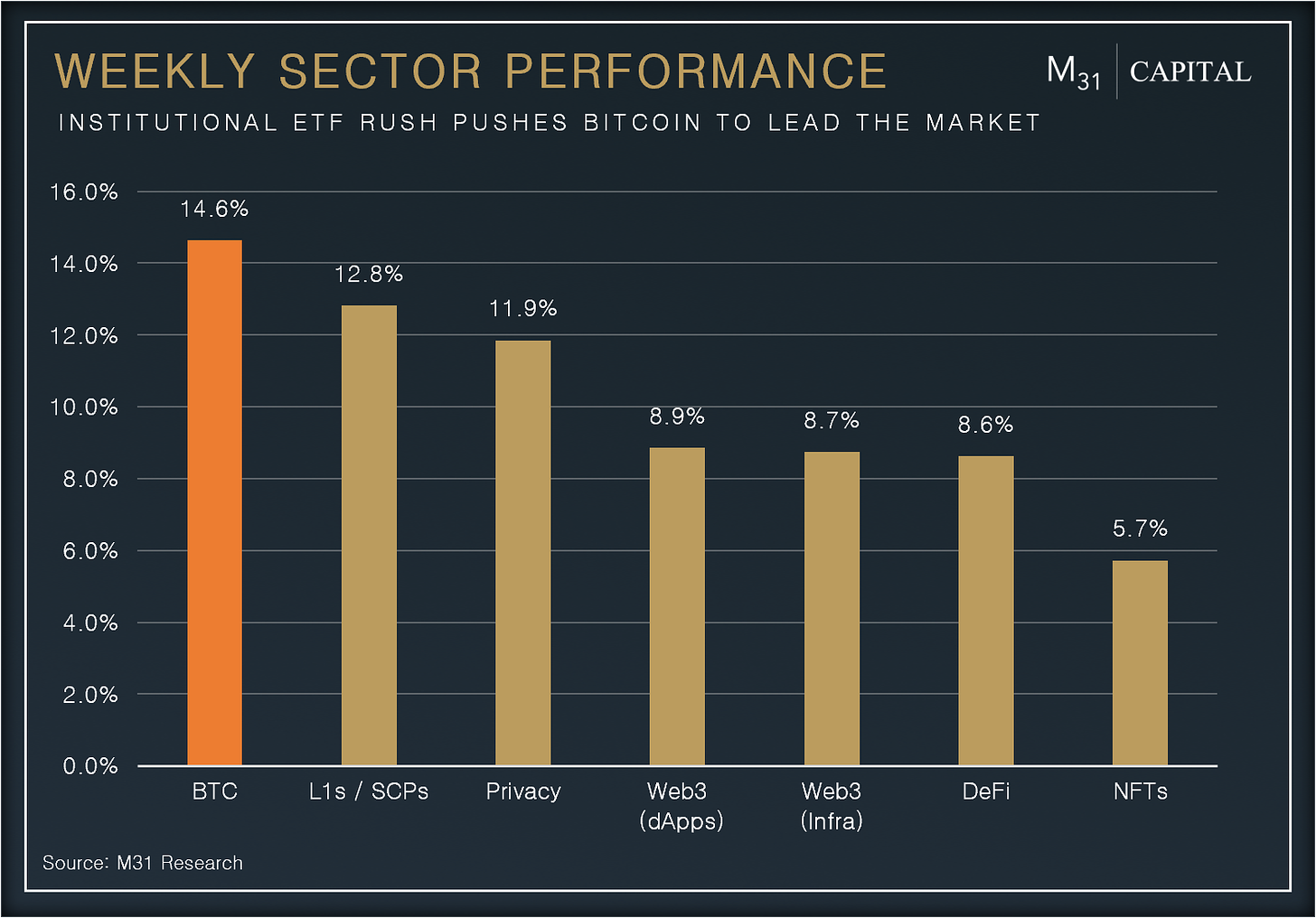

The market surged this week (+15.1%) as institutional demand for Bitcoin intensified with Blackrock's ETF application, followed by WisdomTree, Invesco, Valkyrie Funds, and Bitwise. Although the approval of a Bitcoin spot ETF remains uncertain, institutions continue to demonstrate their interest in crypto. Deutsche Bank filed for a crypto custody license, and EDX Markets, a new cryptocurrency exchange backed by Citadel Securities, Fidelity Investments, and Charles Schwab, launched this week. As a result of these recent developments, Bitcoin’s price outperformed the market and BTC dominance is showing incredible strength, setting a two-year high of 51.8%. Meanwhile, concerns surrounding Binance and Tether subsided.

Crypto regulation will likely be a focal point this summer, as the U.S. House committee prepares to vote on crypto and stablecoins legislation in July. Amid the regulatory landscape, Ethereum core developers are currently deliberating on a proposal to increase the maximum validator balance from 32 ETH to 2,048 ETH per validator. If implemented, this change is expected to drive the growth of LSDs’ market share.

DEFI OVERVIEW

Onchain Activity

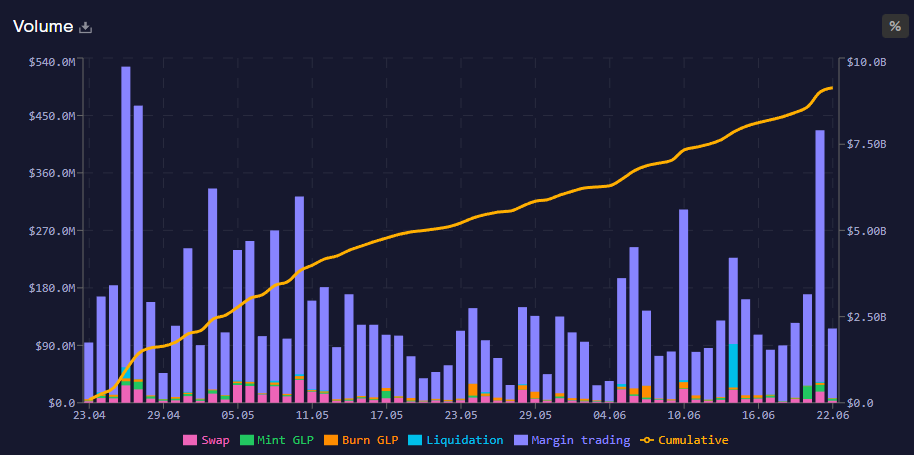

GMX has made a strong comeback and reclaimed its leading position in the Derivatives market. On Wednesday, trade volume reached a two-month high of $426m, reflecting a significant 139% w/w growth to a total volume of $1.3bn and $3.7m in fees generated. The increase in trading activity indicates the return of speculative interest in the market.

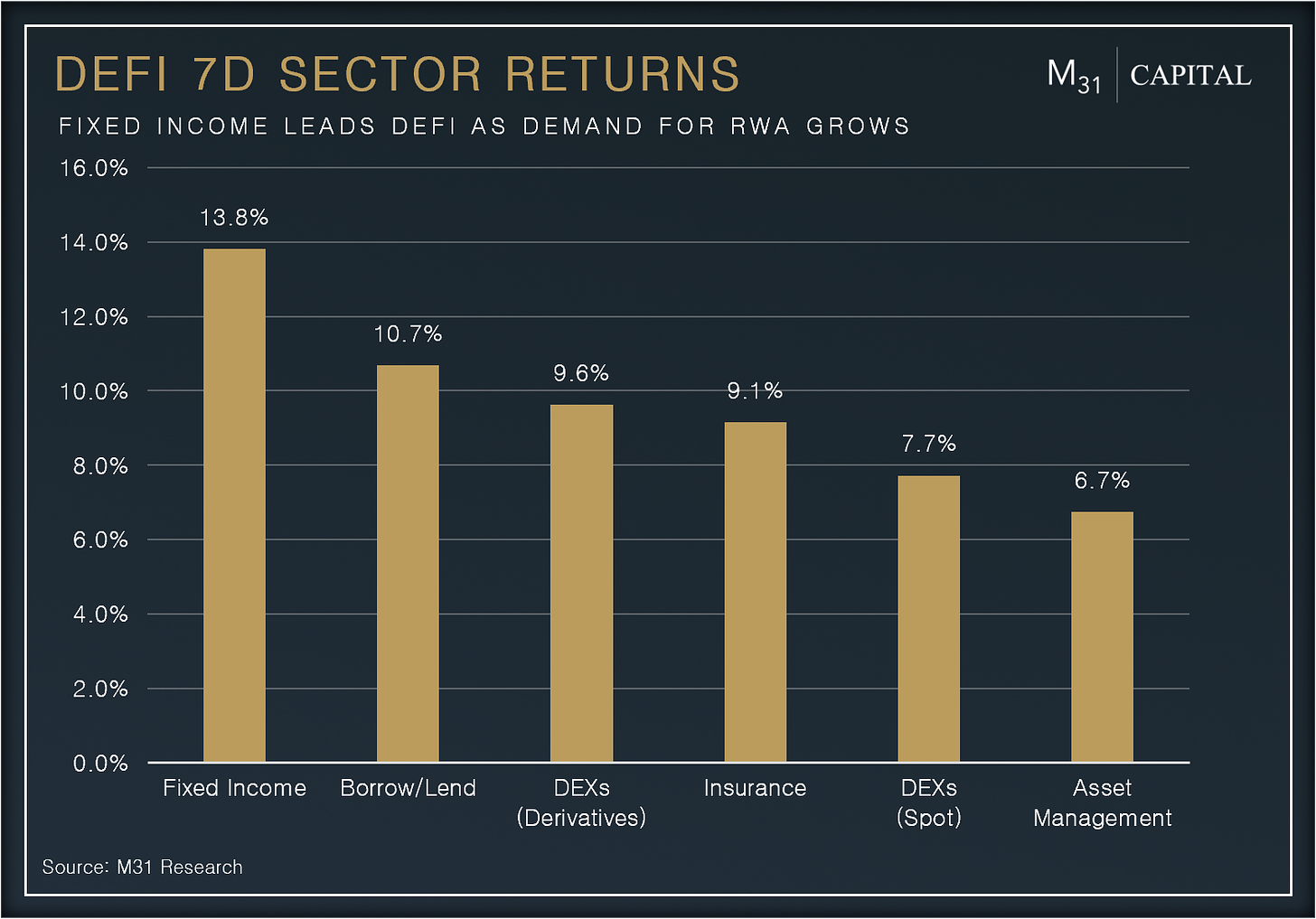

The new tokenized version of DAI, sDAI (Savings DAI), is now live and accessible through Spark Protocol. Powered by the DSR and utilizing the ERC-4626 token standard, sDAI offers improved integrations and gas efficiency, enhancing the user experience. With the recent DSR increase to 3.49%, sDAI provides DAI holders with a higher yield and native streaming benefits for those who opt in.

Offchain Activity

The Whitelist Stargate for V3 Portals proposal is live on the AAVE governance forum. If approved, Stargate integration would enable Aave users to borrow unbacked tokens on different chains using their existing collateral, enhancing cross-chain fund utilization.

Osmosis, the largest decentralized exchange in the Cosmos ecosystem, unveils OSMO 2.0. This update cuts token inflation by 50% and introduces a fee-sharing model in LP pools, which will create a more sustainable emissions model and optimize liquidity distribution to balance growth and stability

WEB3 OVERVIEW

Onchain Activity

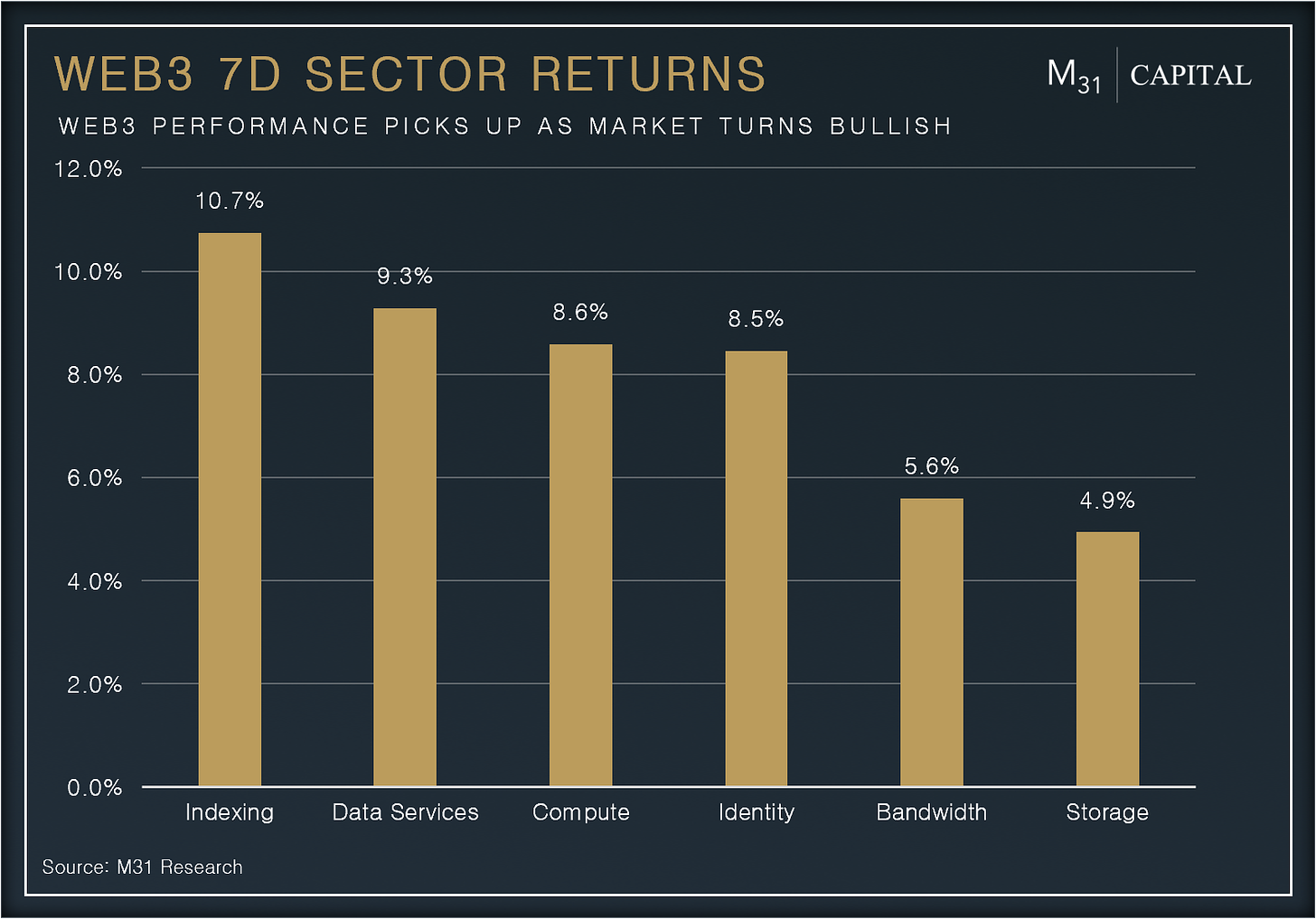

Pocket Network announced the wPOKT launch on Ethereum, enabling POKT to be interoperable with best-in-class DeFi, DAO tooling, and infrastructure while also improving its liquidity and accessibility. Additionally, another Burn Gateway occurred resulting in total ~$1.6m POKT burned (~0.1% of supply)

The Akash GPU Testnet has begun onboarding GPU Providers following a successful launch on Wednesday. According to the protocol, they have received hundreds of applications to participate in Testnet and earn a share of the $100k rewards pool

Offchain Activity

Offchain Labs has released new tooling that simplifies the process of building custom Arbitrum Orbit chains. This development is expected to facilitate the expansion of the Arbitrum ecosystem by making it easier for developers to create and build out their own chains

Etherscan has unveiled Code Reader, a tool that utilizes OpenAI’s API to help users retrieve and interpret source code for specific contract addresses. Polygon has launched Polygon Copilot, an AI interface also powered by ChatGPT-4 to provide guidance, analytics, and insights to users and developers of all levels

AEVO: CEX-LIKE OPTIONS TRADING

Decentralized Perpetual DEXs are increasingly gaining traction across DeFi. However, there is still a significant gap in the adoption of decentralized options trading platforms. The global options market demonstrates remarkable potential, closely trailing the futures market. In 2022 alone, an impressive 29.2bn options contracts were traded, approaching the volume of 54bn futures contracts.

At present, the cryptocurrency options market is primarily dominated by centralized exchanges. In May, the combined monthly volume of BTC and ETH options was $32bn, with Deribit leading the way by capturing approximately 80% of the market share.

AEVO Brings a CEX Experience

AEVO is a comprehensive order book options trading platform built on a custom optimistic rollup to enable gasless orders and fast matching. Developed by the Ribbon Finance team, AEVO aims to address the limitations of their previous offering, DeFi Option Vaults (DOVs), by providing a more flexible and robust experience for serious traders. AEVO offers advantages such as a robust margining system with portfolio margin, support for altcoin options through their OTC Desk, multiple strikes and expiries, deep liquidity, instant onboarding, and the ability to deposit USDC from any EVM chain.

Performance Update:

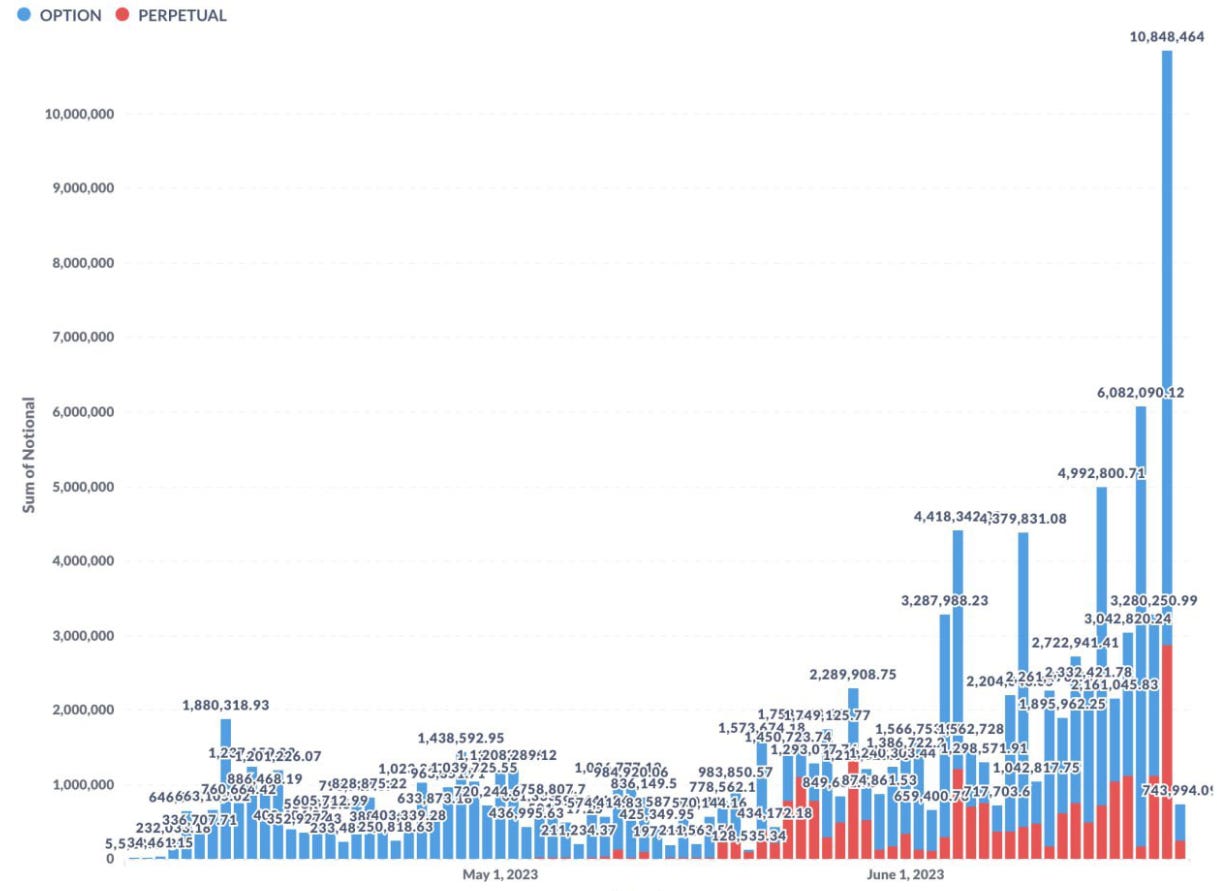

Daily Trade Volume: Reached an ATH of $10 million

Total Open Interest: Hit $8.7 million

With its current fee structure of 0.05% and the volume it has been generating, AEVO has the potential to achieve an annualized revenue of $1.8m.

Future Developments:

Integration with Ribbon: Aevo will be integrated with Ribbon, serving as the venue where Ribbon's options contracts settle bringing more liquidity to the platform

Writing (shorting) Options: Currently, users can only buy options on Aevo. The ability to sell options allows to create wider range of strategies

Expansion of Asset Offerings: While the order book currently supports options trading for BTC and ETH, there are plans to introduce more assets in the future.

AEVO Token Launch: The launch of the AEVO token is under consideration but not yet confirmed.

Decentralized options trading is still in its early stages of development. In the traditional market, options are widely used for controlling portfolio risks, capitalizing on market volatility, and hedging portfolios without reducing exposure to assets. Aevo has already gained significant traction for both its OTC and DLOB desks. With further development, it has the potential to emerge as a top decentralized platform for options trading, offering users exposure to a wide range of strategies and competing with centralized exchanges to gain market share.

THE NEWSROOM

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies that support individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital