The Weekly Airdrop: 0x71

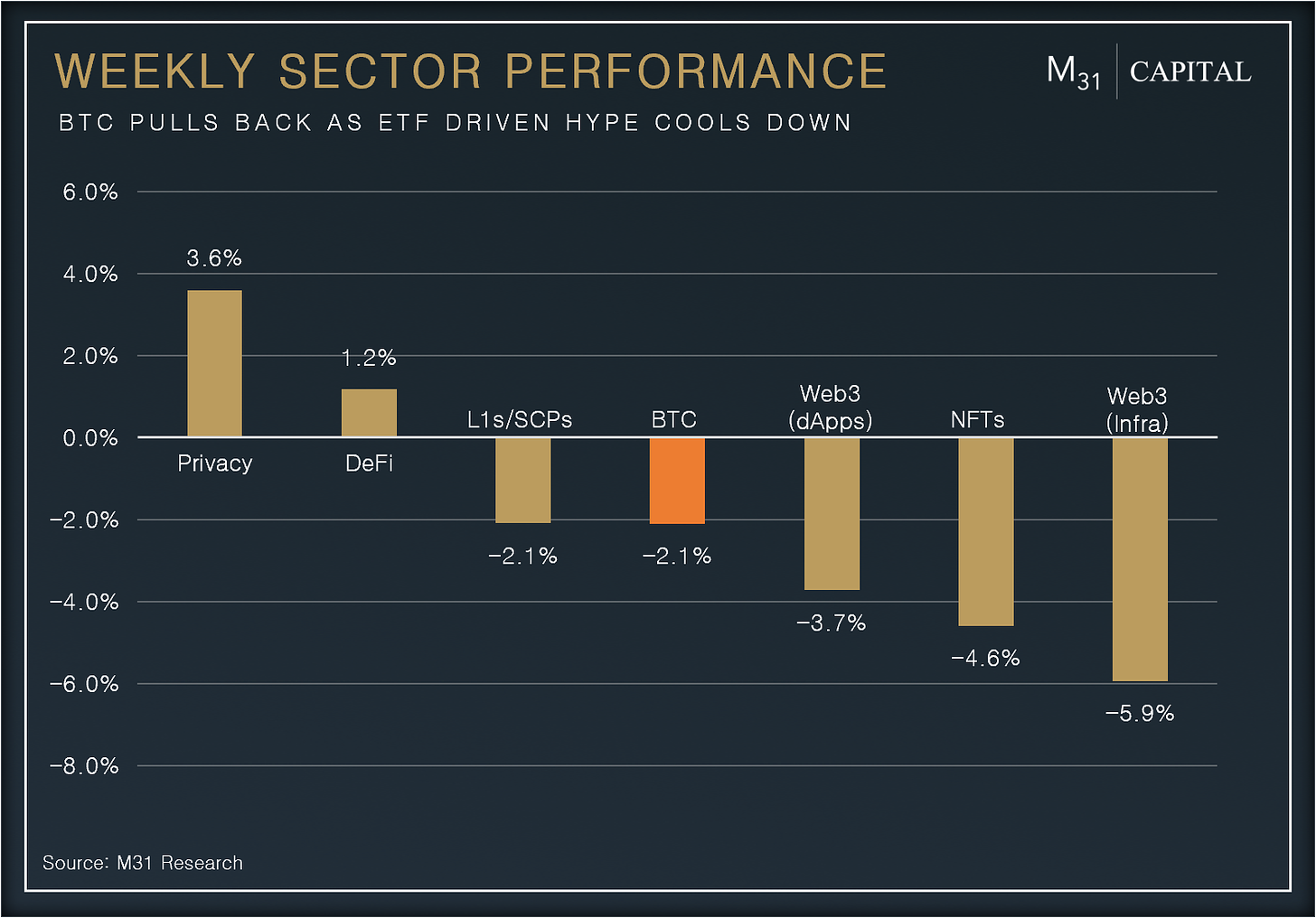

Jun 30, 2023 // Overall market (-1.1%): SEC approves the first Bitcoin Futures ETF; Fidelity joins the race for a spot ETF; seasoned DeFi protocols gain momentum and we take a look at RWA onchain

MARKET UPDATE

The overall market witnessed a cooldown this week (-1.1%), after last week’s BTC led surge, driven by spot BTC ETF applications. A contributing factor might be Robinhood shutting its crypto trading desk and liquidating assets, along with Celsius’ planned altcoin selloff.

the SEC greenlit the first Bitcoin Futures ETF by Volatility Shares but remains cautious regarding a spot ETF, which Fidelity is eager to reapply for. Meanwhile, Japan’s Financial Services Authority and Singapore’s Monetary Authority are collaborating on Project Guardian, eyeing tokenization and DeFi innovation. Tokens like Compound, Aave, Uniswap, and Synthetix are also gaining traction despite the market’s lateral movement.

Bitcoin has taken center stage this month and the market is reflecting it with dominance reaching another ATH of over 52%. Despite the market volatility and upcoming halving in 2024, miners are relentlessly pursuing more Bitcoin network hashrate, pushing up the 30-day moving average to 376 EH/s.

DEFI OVERVIEW

Onchain Activity

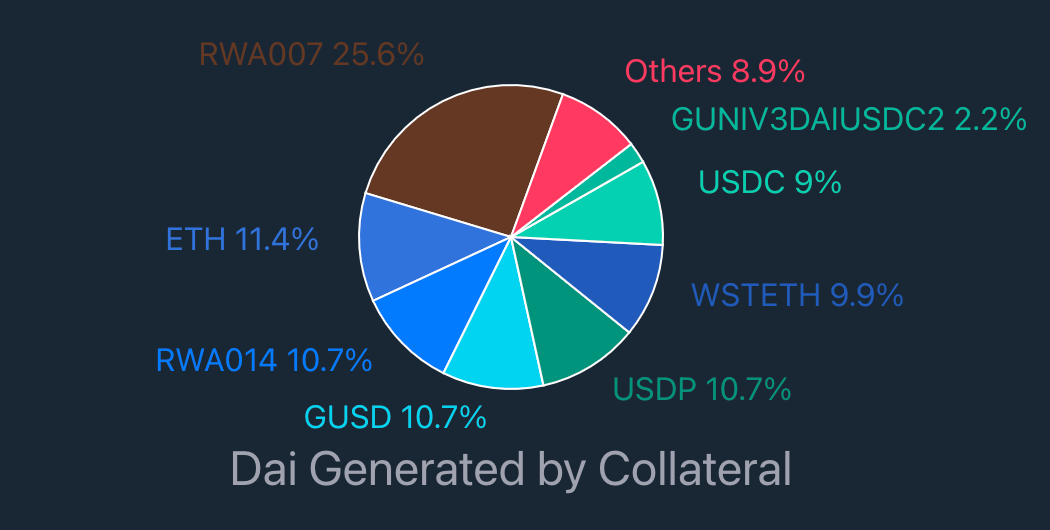

In response to the DAI depeg in March from USDC losing value, MakerDAO has reduced its exposure to the centralized stablecoin by 81.5% in favor of real-world assets (RWAs), adding $700m worth of US bonds to its DAI treasury backing

Vela Exchange, a CEX-like onchain perpetual derivatives trading platform, has officially launched to the public, seeing $5.5b in volume during open beta. Since the launch, TVL has risen by 270% to $18.8m

Offchain Activity

Maple Finance prepares to launch Maple Direct, which aims to be a trusted direct lending desk that establishes a new industry standard for professional lending/borrowing opportunities, addressing the growing institutional demand to utilize transparent blockchain infrastructure

Yearn Finance has a proposal live on their forum that will activate veYFI rewards with oYFI Guages, meaning the governance rewards will be boosted for vote-locked holders who also are also vault depositors, deepening the governance flywheel and helping to maximize the protocol’s autonomy

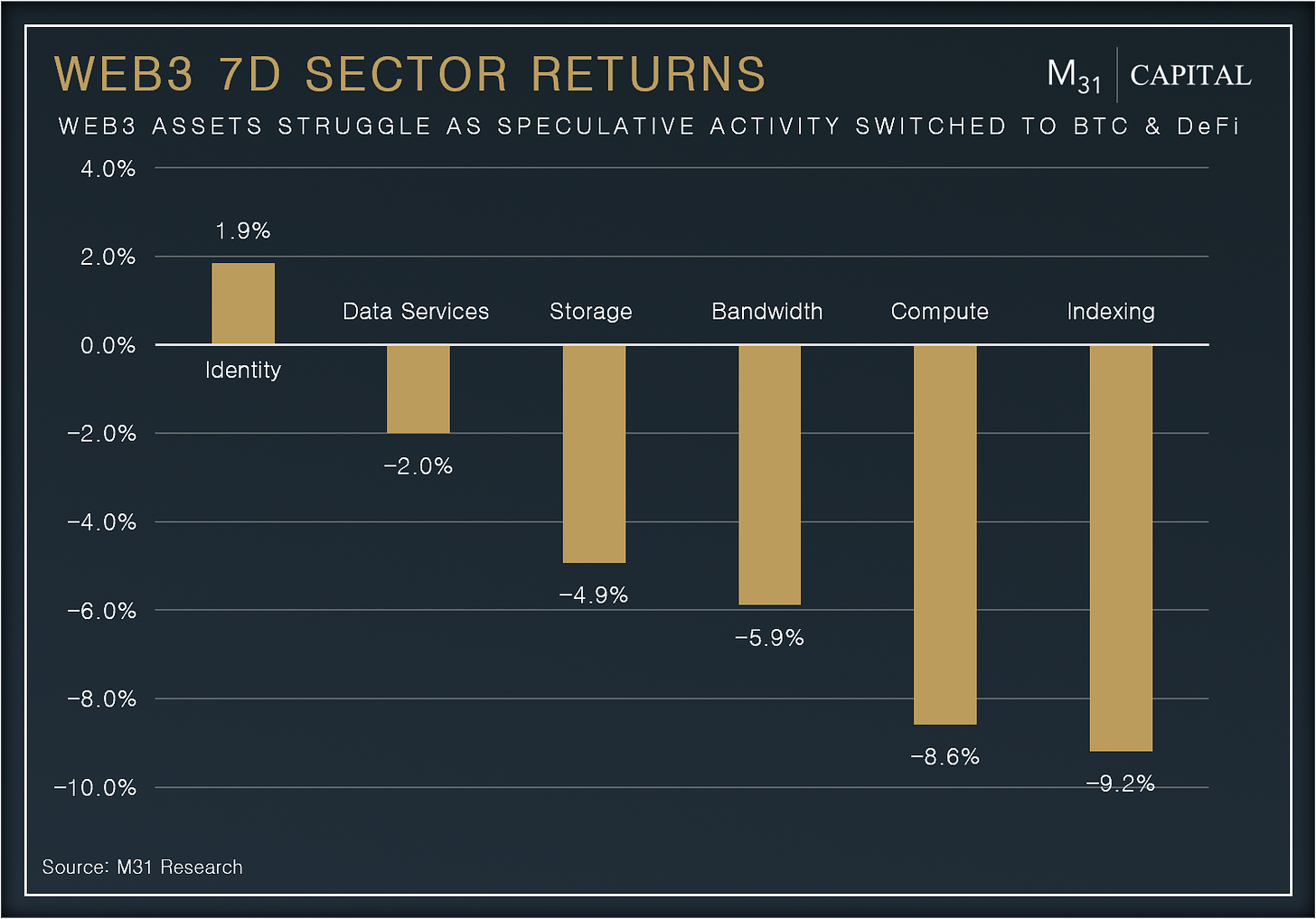

WEB3 OVERVIEW

Onchain Activity

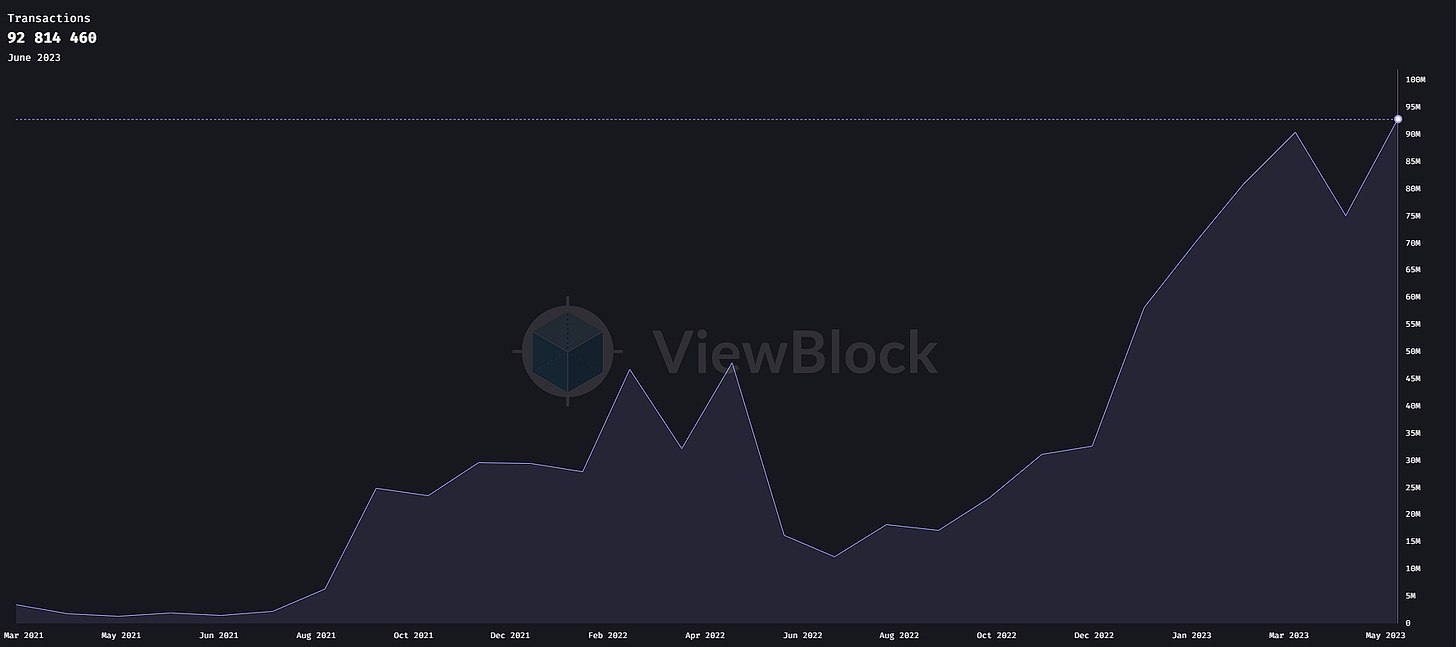

Arweave has unveiled its U token, a programmable asset that can be obtained by burning AR tokens for data storage on the Permaweb. U token utility includes facilitating the monetization of stored content, seamless integration with dApps due to its programmability, and its potential use for trading or providing liquidity on Permaswap. Following the launch, monthly transactions reached new ATH of 92.8m, +23.7% m/m

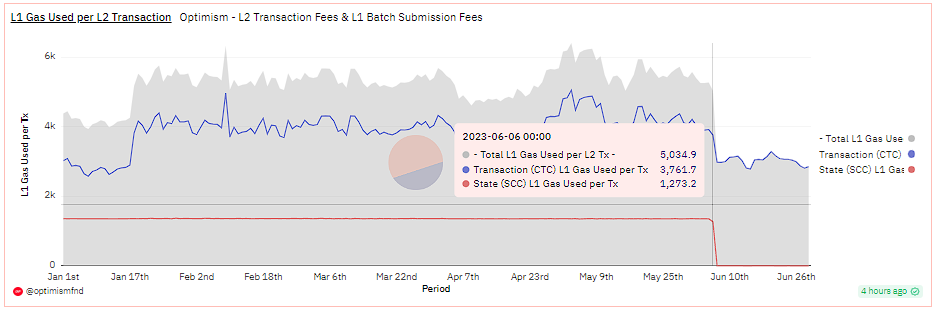

Since the Bedrock upgrade on June 6, which implemented batch compression for transaction data on Optimism (making it much cheaper for Optimism to post data onto Ethereum, increasing profit), its daily transactions have increased by +82% to 500k, with daily gas fees reducing by 67% to $50k.

Offchain Activity

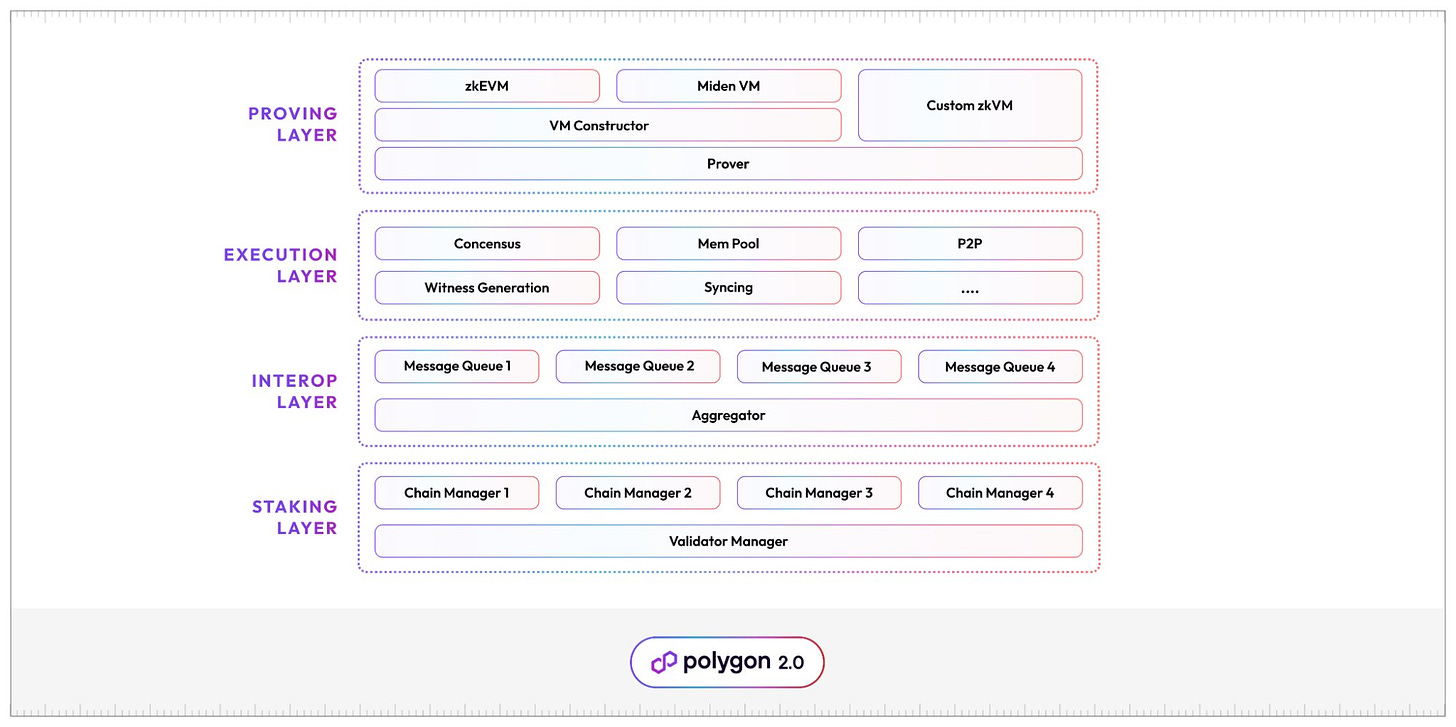

Polygon put forth the architecture for Polygon 2.0, which aims to combine all the ecosystem chains into a supernetwork, and provide users with unified liquidity and unlimited scalability. It will consist of four protocol layers (proving, execution, interop, staking), with the polygon token playing a key role in the staking layer

zkSync introduced ZK Stack, which is their set of tools and frameworks that will enable sovereign, zk-powered, hyperchains (modular chains). This will push zkSync from being a standalone L2, to a network of Superchains, which will have tailored customization, composability, asynchronous connectivity, and the ability to use a native token as the base token

The State of RWA (Real World Assets) Onchain

Real World Assets (RWAs) are traditional assets tokenized and brought onchain. This sector emerged alongside DeFi and continues to evolve, offering users the opportunity to access investments in real estate, government treasuries, commodities, and more. By tokenizing these assets and bringing them onchain, users can enjoy benefits such as low margin, around-the-clock market access, and instant global product availability, all on top of the transparency and security that blockchains provide.

According to the Bank for International Settlements, the TAM for tokenization of RWAs is ~$5tn

Lending

Most RWA protocols today, essentially look to bring offchain “yield” onchain. They do this by lending out depositor stablecoins and crypto assets to entities and organisations outside of crypto, to generate enhance yield.

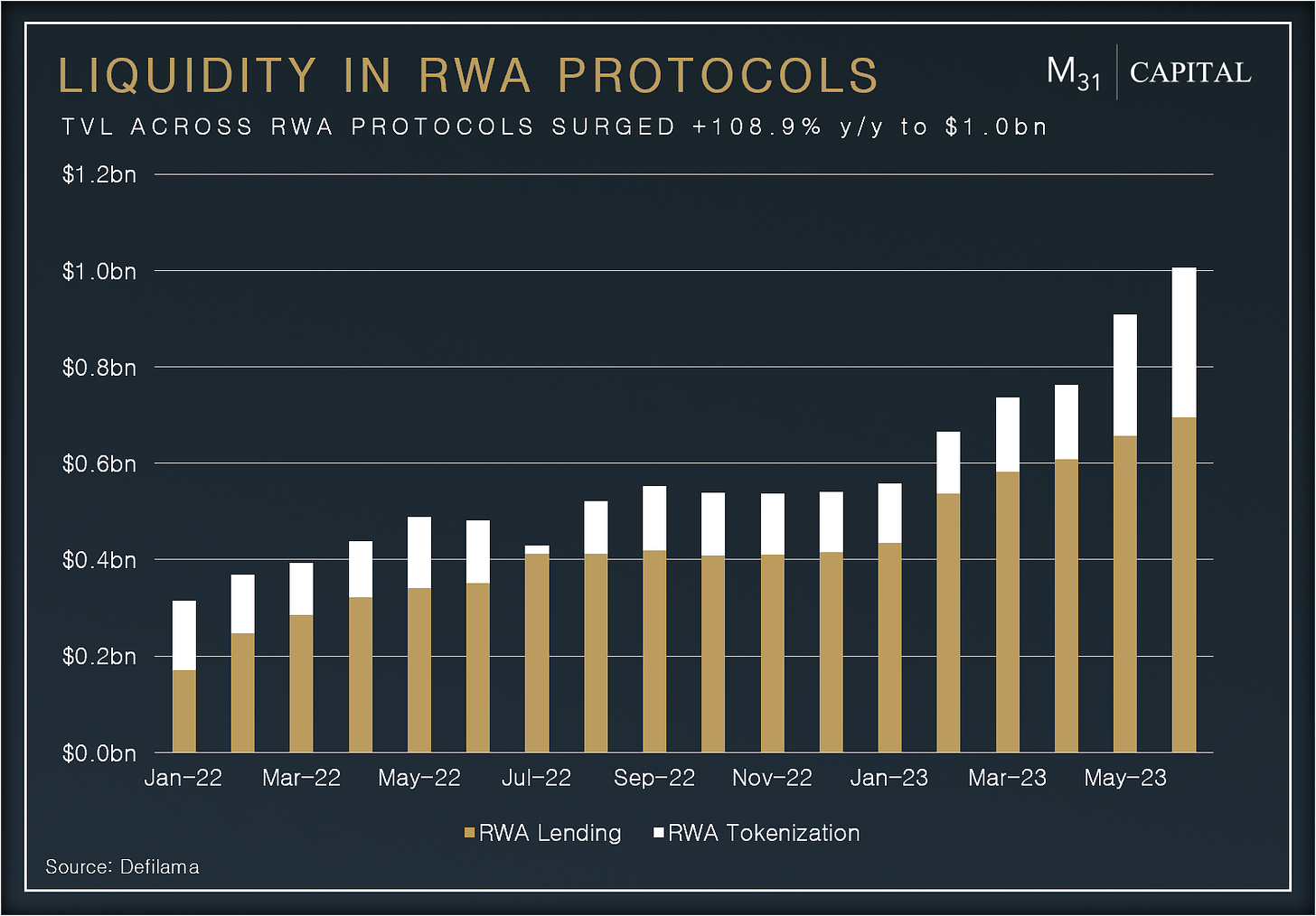

Lending makes up ~70% of all the TVL (~$700m) in RWA protocols, while tokenized assets make up ~30% ($300m). Total TVL in RWA protocols is up to $1.01bn, +83.5% YTD

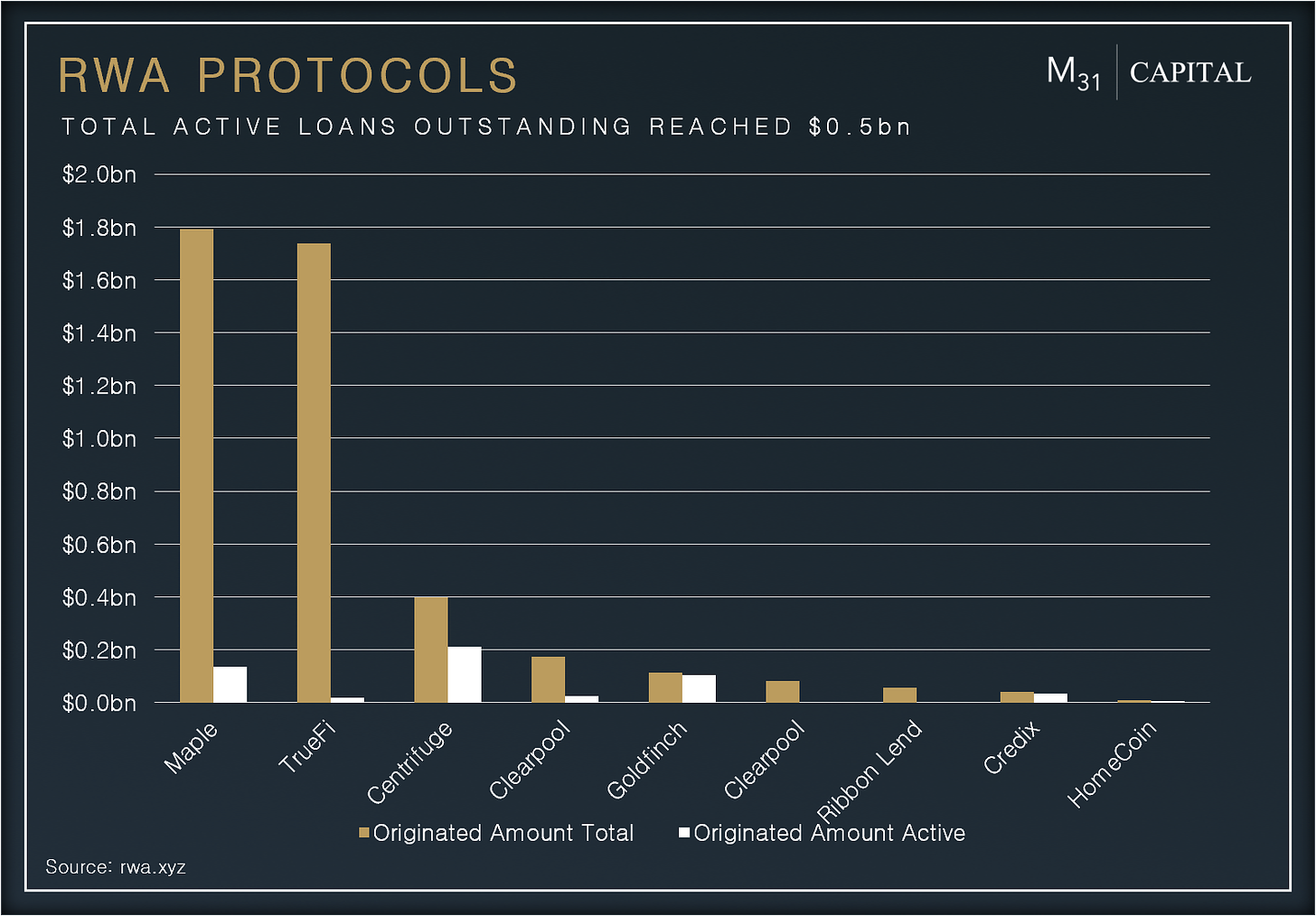

A total of $536.7m in active loans, across 1651 deals. The avg. yield on these loans stands at a solid 10.68%

Centrifuge, Maple and Goldfinch make up the most of the lending component, with over ~$450m in active funded loans, earning their depositors around $42.66m a year (9.46%)

Goldfinch stands out, as it uses onchain liquidity (depositors) to provide capital to small businesses in emerging countries, actually boosting overall global economic output. Goldfinch has generated $11.2m in fees over the last year, from providing this service

Tokenization

While lending has been a core focus of onchain RWA protocols so far, we are seeing strong developments, and a growing trend of more and more assets being tokenized, and brought onchain. We see this as the next phase of RWA, one that can unlock the $5T+ in TAM.

Ondo Finance is the leader, with $130m in TVL. It provides access to institutional-grade financial products and services, allocating capital to funds, treasuries, money markets

Matrixdock offers an STBT (Short-term Treasury Bill Token), providing exposure to U.S. Treasury securities. TVL has increased +18.6% m/m to $83m

RealT enables fractional investments in real estate and access to the cash flows associated with the property. ReaT reached $80m in TVL with 353 properties tokenized

TVL in these protocols has grown +156.4% YTD to ~$310m

THE NEWSROOM

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies that support individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital