The Weekly Airdrop: 0x72

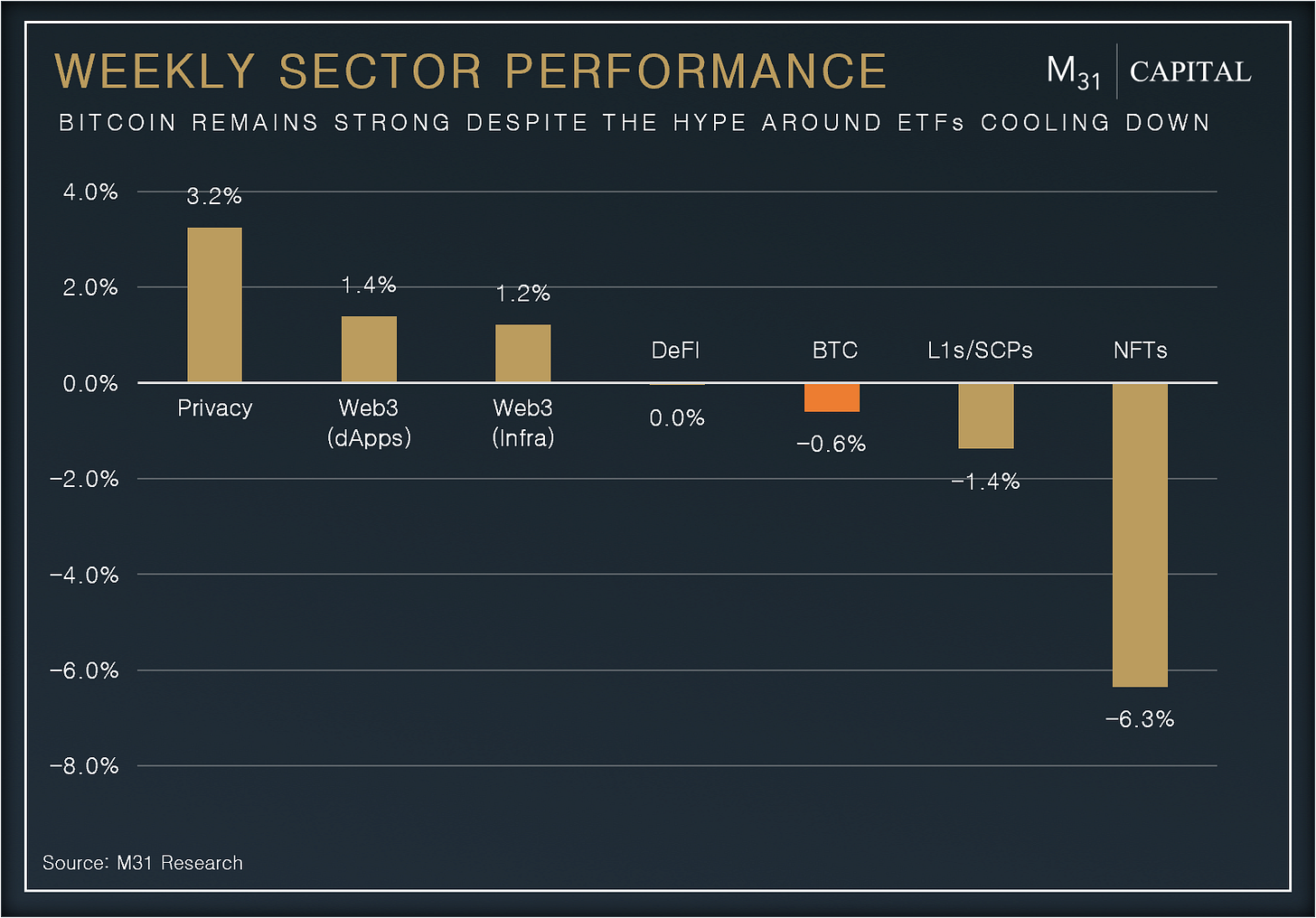

July 7, 2023 // Overall market (+1.9%): BTC stays in tight range; blue-chip DeFi tokens outperform; institutions calling for tokenization; Lightning unveiled tools designed for AI development

MARKET UPDATE

The overall market (+1.9%) while BTC remained range-bound between $29.5k and $31.5k for the second consecutive week, as all the institutions re-filed their spot BTC ETF applications after the SEC claimed the filings were “inadequate”.

DeFi tokens continued their rally. There has been a notable increase in weekly inflows into crypto asset management products, with ~$125m in net inflows over the last week, marking the second strong week in a row following two months of outflows. This trend continues to indicate a growing interest to deploy liquidity into the crypto markets.

Prominent figures in the financial industry, such as Bob Wigley, the chair of UK Finance, and BlackRock CEO Larry Fink, recognized the potential value of tokenization. They publicly acknowledged its ability to enhance efficiency in capital markets, streamline value chains, and improve cost and accessibility for investors.

Bitcoin has undergone various narratives, including being hailed as digital gold and an inflation hedge, with some narratives proving successful while others faded away. However, with the rapid advancements in AI technology, a new use case for Bitcoin has emerged as a currency for AI. Lightning Labs, the company behind the Bitcoin Lightning Network, has introduced a suite of tools that allow developers in the AI field to seamlessly integrate Bitcoin and Lightning into their applications, opening up new possibilities for the intersection of these technologies.

DEFI OVERVIEW

Onchain Activity

Pendle launched on BNBchain with wBETH and an integration with Thena for ETH-frxETH. This has resulted in TVL increase to a new ATH of ~$128.7m, +7.6% w/wD

AAVE’s active loans increased to ~$2.5bn, its highest level in a year. Stablecoins currently comprise of 50% of the total loans, which is a bullish signal, since it points towards an increase in demand for onchain leverage

Offchain Activity

EigenLayer increasing their restaking capacity for LSTs and native ETH. The caps for rETH, stETH, and cbETH will be increased to 15,000 tokens per LST with no individual deposit limit and will be paused again when deposits reaches 30,000 tokens

1inch tested a new token swap transaction type called “fusion”, and used it to sell 11,000 ETH. The new fusion feature is an auction style mechanism that aims to help market participants buy and sell tokens in a much more efficient way. It uses custom presets to set duration, start and end auction amount

WEB3 OVERVIEW

Onchain Activity

ENS has plans to L2s according to a recent community call. Leading .eth domains provider finished first strong month in terms of registrations and renewals count reaching 76.7k in June, +74.9% m/m after 4 consecutive months of decline

The final phase of the Akash GPU Testnet beginned on July 5th, including AI Model Deployment and GPU Benchmarking. Google’s BERT — a powerful and versatile language model was deployed on an Nvidia V100 GPU via Akash Console. This will bring together providers, SDL builders, benchmarkers, and deployers to prepare the AISupercloud launch at Mainnet 6

Offchain Activity

DeSo month in review and it’s progress towards DeSo 2.0. Protocol announced $1m bounty for building decentralized Reddit

Starknet “Quantum Leap” upgrade scheduled for July 13 which is set to significantly increase throughput and decrease transaction fees. Also, updated Cairo roadmap has been published explaining what to expect next for L2’s native smart contract language

A Quick Look at “DeFi 1.0”

Blue chip DeFi tokens have rallied over the past few days, which was surprising as DeFi tokens seemed to have lost retail and investor interest. However, post the ETF applications, many are looking back towards DeFi as the second wave of tokens that may be attractive to institutions as well. We dig into why.

Antifragile: DeFi 1.0 protocols like DAI, AAVE, and Compound have not only survived since their inception around 2018 but have also expanded their core products

Financial Stability: Protocols have amassed significant treasuries, which have enabled them to maintain operations and fund ongoing developments for the long term

Revenue: Simply put, these protocols make money. This revenue generation reflects the protocol’s ability to leverage opportunities effectively, validates usage and fortifies its financial standing

Protocol Level Developments:

AAVE: improved capital efficiency via eMode with AAVE V3, introduced portals for cross chain operations and isolation mode, will launch a stablecoin (GHO)

Maker: lowered it’s exposure to USDC in favor of RWAs, significantly increasing its revenue

Compound v3: changed their cross asset market into a single borrowing market model

Conclusion:

While DeFi 1.0 tokens may appear mundane compared to the recent frenzy around memecoins like PEPE or AI tokens that have surged despite lacking real-world AI applications for mass adoption, these "dinosaurs" are far from extinct. They continue to outperform many new protocols in terms of Total Value Locked (TVL) and market share, and generate substantial revenue, providing them with the financial buffer to cover operational and developmental costs for years to come.

THE NEWSROOM

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies that support individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital