The Weekly Airdrop: 0x74

July 21, 2023 // Overall market (-1.4%): Binance cuts expenses; Celsius selling altcoins; Lending protocols TVL hit 1y high; L2 activity and TVL grows; Chainlink CCIP live

MARKET UPDATE

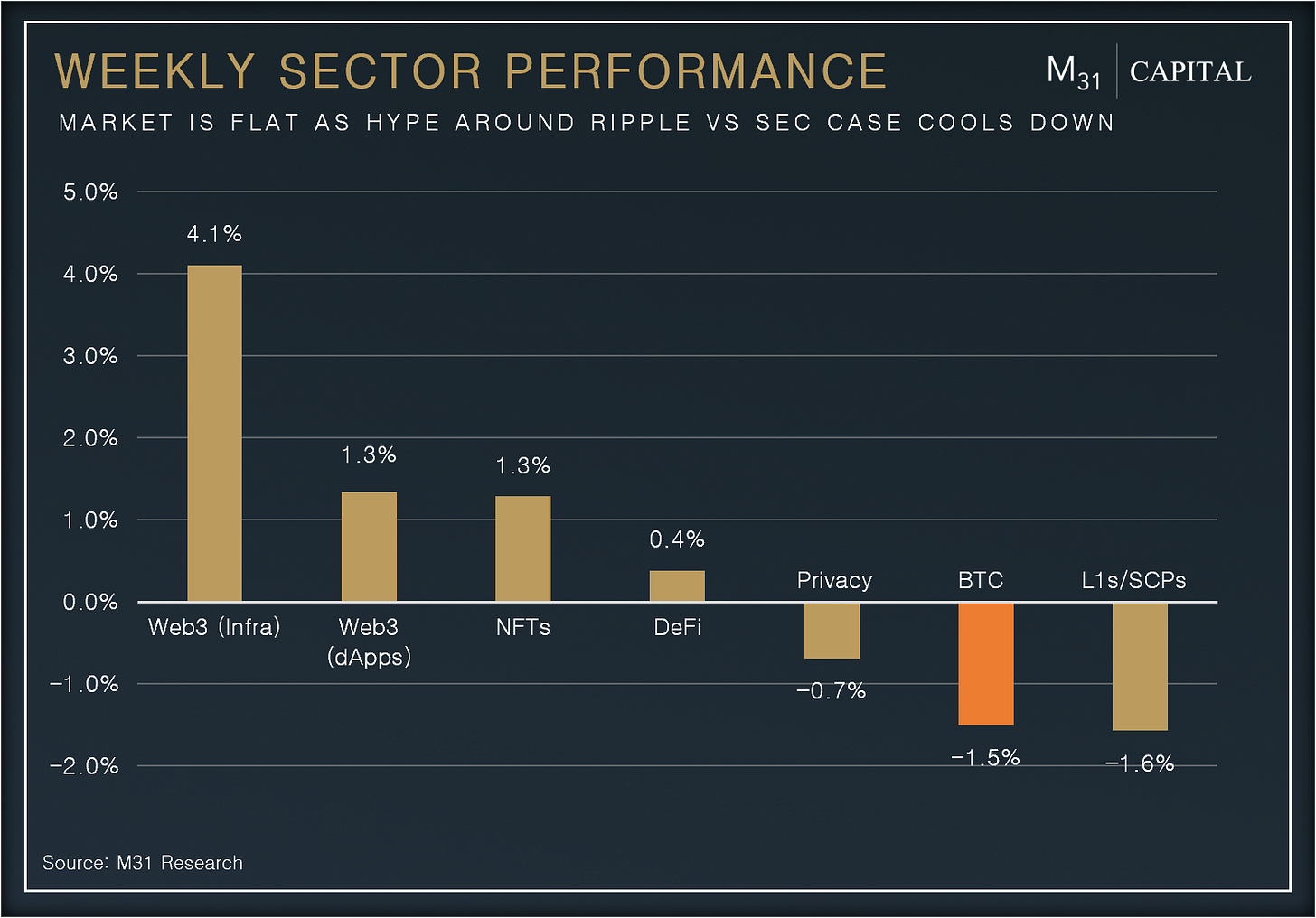

The overall market pulled back (-1.4%) after the XRP led rally lost steam. BTC remains in a tight range after a failed breakout post the XRP pump but Web3 as a whole has outperformed the market, led mainly by LINK(+17.9%) after they launched their much awaited cross-chain interoperability protocol.

Tensions around Binance have resurfaced as the exchange announces cost-cutting measures. Decreased trust in centralized exchanges has been evident as 4.5% of all stablecoins on exchanges were pulled out, reducing CEX stablecoin supply to ~21bn. We expect volatility to return to the market next week, as we approach the FOMC meeting on Jul 26th, potentially signalling the end of the FED rate hike cycle. Celsius also began unloading ~$59 million in of LINK, MATIC, SNX AAVE and other altcoins after they were sent to a FalconX address.

DEFI OVERVIEW

Onchain Activity

Protocol native stablecoins have been actively growing across DeFi. Aave launched GHO, an overcollateralized stablecoin backed by collateral deposits in the Aave protocol. The supply is currently capped at 100m GHO, with fixed borrow rates at 1.5%, making it much more attractive to borrow vs USDC or DAI. AAVE stakers are able to borrow GHO at a discounted rate as well, adding further utility to the token

Synthetix stands out among the top 20 protocols with a positive TVL inflow of +11.2% w/w, reaching $552.1m, making it the second-largest derivatives protocol by TVL ($582m) after GMX. The protocol also recorded weekly trade volume of $0.7bn, +59.0% w/w, after new asset listings, including YFI and MKR

Offchain Activity

Uniswap presented UniswapX, a new permissionless, open source (GPL), auction-based protocol for trading across AMMs & other liquidity sources. The platform offers gas-free cross-chain and native swaps together with MEV protection.

Synthetix's sUSD has unlocked cross-chain interop capabilities through the integration of Chainlink’s Cross-Chain Interoperability Protocol (CCIP) into Synthetix V3. Initially, sUSD can be transferred between Ethereum and Optimism, and the protocol has the flexibility to extend these transfers to other EVM compatible chains upon approval from the Synthetix Spartan council

WEB3 OVERVIEW

Onchain Activity

Helium daily network usage (in $) surged over the past 30 days to $1.5k, +370% m/m, which resulted in revenue increase +85% m/m to $3.7k per day. IoT activity is expected to continue growing as WeatherXM, QNECTD, and KitchenOS choose Helium to power their IoT solutions

Layer 2 growth and usage continues, with L2 transaction activity now ~3.2x of Ethereum. The last week marked the launch of Linea, Base and Mantle. L2 TVL increased +6.4% m/m to~ $9.9bn

Offchain Activity

Solana's introduction of Solang, a Solidity compiler, empowers developers to write smart contracts with support for SPL tokens and the ability to call and build Solana smart contracts. This paves the way for advanced DeFi products and overall TVL growth, capitalizing on Solana's growing DeFi activity.

Telegram has taken a significant step towards boosting mobile crypto adoption by enabling the integration of crypto payments into its bots. This new system allows users to pay for goods and services using USDT, BTC, and TON. The platform has experienced a surge in development with the emergence of various trading and airdrop farming bots.

Protocol Highlight: Chainlink

Chainlink has been a stalwart of critical infrastructure in crypto, with their oracles powering most of the DeFi and Web3 applications we, as well as the ecosystem, use today. Earlier this week, they added another critical piece of infrastructure to their service offerings; cross chain messaging.

Chainlink’s Cross-Chain Interoperability Protocol (CCIP) provides a single simple interface through which dApps and web3 entrepreneurs can securely meet all their cross-chain needs, including token transfers and arbitrary messaging.

What makes it valuable:

Active Risk Management: A secondary network of nodes that verifies the behaviour of the primary CCIP networks can stop risky transactions (if needed) which increases security

Off-Chain Reporting (OCR): aggregates data off-chain from multiple nodes into a single report, reducing network congestion, gas costs, and increasing scalability, for secure and cost-effective data feeds

Battle-Tested: CCIP’s oracle and relayer functions are combined and handled by Chainlink’s DONs(Decentralized Oracle Network) which have been battle-tested and have successfully secured the network for a long time

CCIP features:

ARM as Additional security level to monitor, detect and react on malicious activity across CCIP clients

Rate Limits - CCIP supports configurable rate limits on the amount of tokens able to be transferred cross-chain within a given time period. This additional protection means, even in the worst case scenario, CCIP token pools are protected against being completely drained

Support of multi asset payments including native gas tokens and LINK with further conversion into LINK, which creates additional demand for LINK.

CCIP will enable staking of LINK tokens for part of the revenue

Value accrual:

CCPI generated $26.2k in revenue across 4 networks since the launch facilitating 3k transactions. If CCPI manage to capture at least 50% of activity which Layer0 produces right now, ~470k in daily transactions, that will result in ~$800m of fees generated, which will be distributed across CCPI nodes and part of this will flow to LINK stakers, cheating demand for CCPI nodes, which means higher security and increased demand for LINK.

THE NEWSROOM

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies that support individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital